30 October 2025

Future Metals NL

Quarterly Activities Report for period ending

30 September 2025

Future Metals NL ("Future Metals" or the "Company", ASX | AIM: FME) is pleased to announce its Quarterly Activities and Cashflow Report for the quarter ended 30 September 2025 (the "Quarter").

Highlights

· Appointment of new Managing Director and CEO

o On 29th September, the Board announced the appointment of Mr Keith Bowes as Managing Director and Chief Executive Officer

· Commencement of a Strategic Review of the Company's assets

o The review will deliver a revised strategy that considers the PGM price revival for Panton, the copper potential of the Alice Downs Corridor and the optionality of the nearby Savannah Plant

· Review initiated of Scoping Study for the Panton Nickel PGM Project which will also consider the Mineral Resource Estimates and impact of metal price improvements

o Optimisation opportunities from the 2023 Panton Scoping Study are being assessed in the context of the revised strategy for the Company

· Exploration Activities within the Alice Downs Corridor

o A ground electromagnetic (EM) survey commenced in the southern portion of the Alice Downs Corridor to assist in defining future drill targets

· PGM prices continue to improve with platinum and palladium both up 80% and 60% respectively this year

o The current PGM basket price is at levels well in excess of those used in the 2023 Panton Scoping Study

· Finalisation of the A$4.2 million capital raise (before costs)

Headline

During the quarter, the Company recruited a new Managing Director and initiated a process to refine its strategic direction with a comprehensive review of its asset portfolio and envisaged corporate structure. The exploration potential of the Alice Downs Corridor and the Savannah Plant optionality are key parts of this review. These activities are being undertaken against a backdrop of strengthening platinum group metal ("PGM") prices, renewed interest in critical minerals and an improving market for copper and nickel.

Panton Nickel PGM Project

The Panton Project, located in the East Kimberley region of Western Australia, is the Company's flagship asset and is one of the world's highest‑grade PGM deposits. Panton hosts a high‑grade core zone of approximately 4 million ounces palladium equivalent (PdEq[1]) at 3.3 g/t (including 1.1g/t Pt) within a total resource of 6 million ounces PdEq1 at 2.0g/t (including 0.7g/t Pt). The Scoping Study for the Project, announced to the market in 2023, showed the potential for Panton to be one of the few long-life, globally significant PGM operations producing ~160,000oz pa PdEq1. Importantly the Study only incorporated 26% of the high-grade Reef and Dunite materials and only 10% of the overall MRE.

The Company is in the process of undertaking a review of the 2023 Scoping Study[2] which will identify opportunities for enhancements that will be incorporated into a future updated technical study (Pre-feasibility Study). An infill drill program will also be considered to convert more of the Inferred Resource to Measured and Indicated status, thereby increasing the reported mine life of the project. The revised study will incorporate the larger mineral resource and consider higher commodity prices, potential mine sequencing, processing optimisation, capital and operating cost updates and the optionality around the neighbouring Savannah Plant. The Savannah Plant is located within trucking distance of Panton (see Figure 1) and could provide an opportunity to reduce up‑front capital costs by utilising existing processing infrastructure instead of constructing a greenfield plant.

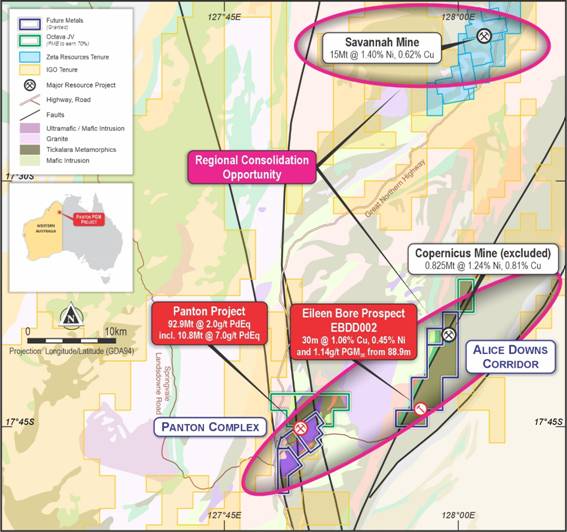

Figure 1: Location of the Eileen Bore Cu-Ni-PGM Project and the Panton PGM Project in proximity to the Savannah Mine

Under the MOU with Zeta Resources[3], the owner of the Savannah Plant, and has agreed to assess the technical, economic, and regulatory aspects of utilising alternate ore sources that may come from Future Metals projects and prospects to feed the Savannah Mine processing plant. Should the assessment yield positive results, the parties will negotiate in good faith for a suitable commercial structure for future operations.

This review will also consider any consolidation opportunities that may be present and made suitable by a possible Zeta Resources agreement.

Eileen Bore Prospect

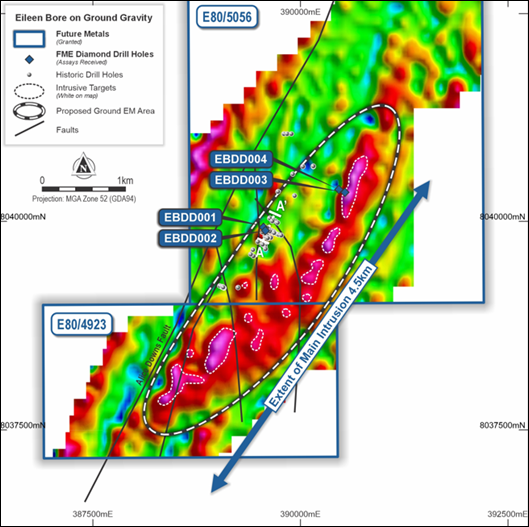

Eileen Bore, located within 20 km of Future Metals' 100%-owned Panton Project, forms part of the Alice Downs Corridor ("ADC") in the highly prospective East Kimberley region of Western Australia. Recent drilling results indicate the presence of broad zones of disseminated and net-textured copper and nickel sulphides across the Eileen Bore Prospect (see Figure 2).

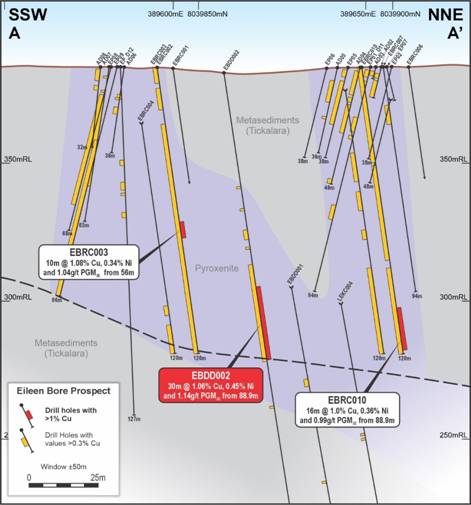

Figure 2: Cross section looking northwest at Eileen Bore. Section line location in Figure 4 and marked as A-A'.

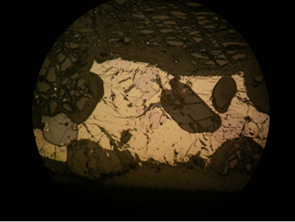

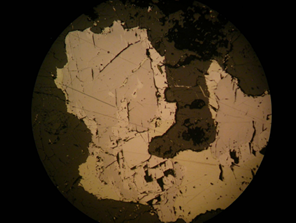

These intrusions host sulphide assemblages including chalcopyrite, pyrrhotite, pentlandite, and pyrite. Petrography of the sulphide assemblage confirmed magmatic chalcopyrite, pyrrhotite and pentlandite. The 300m strike of historic mineralisation is dominated by chalcopyrite and pyrrhotite with lesser pentlandite (Left image of Figure 3). The 4.5km intrusion is dominated by pyrrhotite and subordinate pentlandite and chalcopyrite (Right Image of Figure 3).

Figure 3: Petrography Imaging (Reflected plane-polarised light, Field width 1.8mm) Left Image - EBDD002 from 112.35 -112.5m. Intercumulus magmatic sulphide. Chalcopyrite dominates over pyrrhotite, no pentlandite in this section. Right Image - EBDD003 from 125.4-125.55m. Pyrrhotite and subordinate pentlandite and chalcopyrite.

In 2024, ground gravity surveys and drilling revealed that historical mineralisation at Eileen Bore has been structurally offset approximately 300m north from a significant 4.5 km-long northeast-southwest striking intrusion. This body is now interpreted as the likely source of mineralisation at Eileen Bore. Gravity data also identified numerous internal density variations and north-south trending faults (refer to Figure 4), with hole EBDD003 intersecting 127m of ultramafic including 7.4m @ 0.46% Cu, 0.51% Ni, and 0.3g/t PGM (3E).

Figure 4: Plan view of the planned geophysics program over the Eileen Bore tenements

This intercept, combined with the anomalous Ni-Cu-Pd-Pt-S over 127m, confirms the prospectivity of the main 4.5km long intrusion, which was previously unknown. The historical mineralisation is interpreted to be offset from this main intrusion, and it is interpreted that further zones similar to that intersected in EBDD002, which intersected 30m @1.06% Cu, 0.45% Ni & 1.14g/t PGM(3E) from 88.9m, are key targets.

To refine targeting, a ground electromagnetic ("EM") survey commenced at the end of September, following completion of heritage clearances. Future Metals secured $63,375 in co-funding from the Western Australian Government's Exploration Incentive Scheme ("EIS") Venture 2 to support the Ground EM geophysical programme.

Corporate

The Company released its Annual Report, Corporate Governance Statement and Appendix 4G to the market during the quarter.

The Company completed the search for a new CEO with the appointment of experienced resource executive Mr Keith Bowes as Managing Director. He has been tasked with advancing the Company's flagship Panton PGM Project and developing the opportunities within the ADC.

The Company considers the timing of Keith's appointment opportune, given the combination of tailwinds from improving metal prices, the optionality through the Zeta Resources discussions and the Alice Downs Corridor. These opportunities together place Future Metals in an enviable position in the PGM market. The Company is now targeting a ramp-up of its exploration and development activities at both Eileen Bore and Panton.

The Company has also initiated a process to cancel its admission of its ordinary shares trading on the AIM market of the London Stock Exchange. The Company is of the view that the admission to trading on AIM is not delivering sufficient value to shareholders, having regard to the following factors:

· Conditions which have impacted stock markets generally since its admission to trading on AIM in October 2021 have made it challenging to raise capital in the UK;

· The low levels of liquidity and trading volumes in FME's Shares on AIM;

· The cost of maintaining admission to trading on AIM, including professional fees, listing fees payable and incremental legal, auditing and other fees; and

· The amount of management time and regulatory burden associated with maintaining the Company's admission to trading on AIM, in addition to its ASX listing.

It is the opinion of the Board that the cancellation will not materially nor adversely impact existing Shareholders as they will still be able to trade on the ASX.

It is expected that the Cancellation will occur on 5 November 2025. Full details on the timetable for the Cancellation can be found in the Company's announcement on 7 October 2025.

Improving Metal Price Environment

Since the release of the Panton Scoping Study in late 2023, PGM prices have moved sideways. However, since the end of Q1 this calendar year, there has been significant movement in the platinum and palladium prices, which appear to be following the gold and, more recently, silver trajectories. Platinum has, in fact, been the best-performing precious metal year-to-date, bettering even gold's run this year (see Table 1 below).

With Platinum representing ~50% of PGMs in Panton, the price increase has a significant impact on the price basket developed for the project and will improve the project economics.

Table 1: Performance of metal prices over 2025 to date, prices as of 24 October 2025 (Kitco)

| Metal | Current Price (USD) | Price Performance (Year to Date) |

| Platinum | $1,614/oz | 80% |

| Palladium | $1,441/oz | 60% |

| Rhodium | $8,350/oz | 85% |

| Gold | $4,113/oz | 56% |

| Copper | $10,996/t | 24% |

| Nickel | $15,113/t | 8% |

Financial Commentary

The Company held approximately A$3.5m in cash at the end of the Quarter.

Exploration and project development expenditure during the Quarter amounted to approximately A$323k. Payments for administration and corporate costs amounted to approximately A$335k. Also included in corporate costs were payments to related parties and their associates of A$33k, comprising Director fees and remuneration (including superannuation). The Quarterly Cashflow Report (Appendix 5B) for the period ended 30 September 2025 is included in this announcement and provides an overview of the Company's financial activities.

The Quarterly Cashflow Report (Appendix 5B) is available at the following link : http://www.rns-pdf.londonstockexchange.com/rns/4329F_1-2025-10-30.pdf and on the Company's website Quarterly Reports - Future Metals NL.

For additional information please refer to the ASX/AIM announcements covered in this announcement:

26 September 2025 Annual Report

26 September 2025 Corporate Governance Statement

26 September 2025 Appendix 4G

26 September 2025 Response to ASX Proce and Volume Query

29 September 2025 Appointment of Managing Directors and CEO

29 September 2025 Initial Director's Interest Notice

17 February 2025 Significant Copper-Nickel Discovery at Eileen Bore with 4.5km strike potential

The above announcements are available to view on the Company's website at future-metals.com.au. The Company confirms that it is not aware of any new information or data that materially affects the information included in the relevant original market announcements. The Company confirms that the information and context in which any Competent Person's findings are presented have not been materially modified from the original market announcements.

For further information, please contact:

Future Metals Strand Hanson Limited (Nominated Advisor & UK Broker)

Keith Bowes James Bellman / Rob Patrick

info@future-metals.com.au +44 (0) 20 7409 3494

About Future Metals

Future Metals NL (ASX: FME | AIM:FME) is an Australian-based exploration Company focused on advancing its Panton PGM Project in the eastern Kimberley region of Western Australia.

The 100% owned Panton PGM project is located 60 kilometres north of the town of Halls Creek in the east Kimberley region of Western Australia, a tier one mining jurisdiction. The Project is located on three granted mining licences and situated just 1 kilometre off the Great North Highway, which accesses the Port of Wyndham.

In October 2023, Future Metals announced a substantial upgrade to its Mineral Resource (MRE), with improvements in grade, JORC classification, and the inclusion of a chromite estimate. The total MRE at the Panton PGM-Ni-Cr Project is now 92.9Mt @ 1.5g/t PGM3E, 0.20% Ni, 3.1% Cr203 (2.0g/t PdEq[4]) for contained metal of 4.5Moz PGM3E, 185kt Ni, 2.8Mt Cr203, (6.0Moz PdEq2). The MRE has been reported across three separate units; the Reef, the High-Grade Dunite and the Bulk Dunite (refer ASX|AIM announcement dated 26 October 2023). PGM-Ni mineralisation occurs within a layered, differentiated mafic-ultramafic complex referred to as the Panton intrusive which is a 9km long and 2.7km wide, south-west plunging synclinal intrusion. PGM mineralisation is hosted within a series of stratiform chromite reefs as well as a surrounding zone of mineralised dunite within the ultramafic package.

About Platinum Group Metals (PGMs)

PGMs are a group of six precious metals being Platinum (Pt), palladium (Pd), iridium (Ir), osmium (Os), rhodium (Rh), and ruthenium (Ru). Exceptionally rare, they have similar physical and chemical properties and tend to occur, in varying proportions, together in the same geological deposit. The usefulness of PGMs is determined by their unique and specific shared chemical and physical properties. PGMs have many desirable properties and as such have a wide variety of applications. Most notably, they are used as auto-catalysts (pollution control devices for vehicles), but are also used in jewellery, electronics, hydrogen production / purification and in hydrogen fuel cells. The unique properties of PGMs help convert harmful exhaust pollutant emissions to harmless compounds, improving air quality and thereby enhancing health and wellbeing.

Follow us:

Appendix One | Panton Project JORC-Compliant Mineral Resource Estimate as at 26 October 2023

| Category | Mass (Mt) | Pd (g/t) | Pt (g/t) | Au (g/t) | PGM3E[5] (g/t) | Ni (%) | Cr2O3 (%) | PdEq[6] (g/t) | PGM3E (koz) | Ni (kt) | Cr2O3 (kt) | PdEq (koz) |

| Reef (no cut-off grade has been applied) | ||||||||||||

| Indicated | 4.5 | 2.6 | 2.4 | 0.4 | 5.4 | 0.25 | 14.0 | 6.7 | 778 | 11 | 623 | 957 |

| Inferred | 6.3 | 2.9 | 2.6 | 0.3 | 5.8 | 0.28 | 15.0 | 7.2 | 1,175 | 17 | 946 | 1,450 |

| Sub-Total | 10.8 | 2.8 | 2.5 | 0.4 | 5.6 | 0.27 | 14.6 | 7.0 | 1,954 | 29 | 1,569 | 2,407 |

| High Grade Dunite (underground, below 300mRL, 1.4g/t PdEqcut-off) | ||||||||||||

| Indicated | 5.9 | 0.6 | 0.6 | 0.2 | 1.4 | 0.20 | 2.2 | 1.7 | 259 | 12 | 132 | 334 |

| Inferred | 20.5 | 0.6 | 0.6 | 0.1 | 1.3 | 0.21 | 2.3 | 1.8 | 885 | 43 | 478 | 1,154 |

| Sub-Total | 26.4 | 0.6 | 0.6 | 0.1 | 1.3 | 0.21 | 2.3 | 1.8 | 1,144 | 54 | 610 | 1,488 |

| Reef + High Grade Dunite | ||||||||||||

| Indicated | 10.4 | 1.5 | 1.4 | 0.2 | 3.1 | 0.22 | 7.3 | 3.9 | 1,037 | 23 | 755 | 1,291 |

| Inferred | 26.8 | 1.2 | 1.0 | 0.2 | 2.4 | 0.22 | 5.3 | 3.0 | 2,061 | 60 | 1,424 | 2,604 |

| Sub-Total | 37.2 | 1.3 | 1.1 | 0.2 | 2.6 | 0.22 | 5.9 | 3.3 | 3,098 | 83 | 2,179 | 3,895 |

| Bulk Dunite (Near surface, above 300mRL, 0.9g/t PdEq cut-off) | ||||||||||||

| Indicated | 30.3 | 0.4 | 0.4 | 0.1 | 0.9 | 0.18 | 1.1 | 1.3 | 850 | 56 | 337 | 1,220 |

| Inferred | 25.3 | 0.3 | 0.3 | 0.1 | 0.7 | 0.18 | 1.3 | 1.1 | 564 | 46 | 329 | 873 |

| Sub-Total | 55.7 | 0.4 | 0.3 | 0.1 | 0.8 | 0.18 | 1.2 | 1.2 | 1,414 | 102 | 666 | 2,094 |

| Total Resource | ||||||||||||

| Indicated | 40.7 | 0.7 | 0.6 | 0.1 | 1.4 | 0.19 | 2.7 | 1.9 | 1,887 | 79 | 1,092 | 2,511 |

| Inferred | 52.1 | 0.8 | 0.7 | 0.1 | 1.6 | 0.20 | 3.4 | 2.1 | 2,625 | 106 | 1,753 | 3,478 |

| Total | 92.9 | 0.7 | 0.7 | 0.1 | 1.5 | 0.20 | 3.1 | 2.0 | 4,512 | 185 | 2,846 | 5,989 |

Mineral Resources

The information in this document that relates to Mineral Resources has been extracted from the ASX announcement titled: "Resource Upgrade Defines Panton Impressive Grade & Scale", 26 October 2023. This announcement is available to view on the Company's website at future-metals.com.au. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the estimates in the original release continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person's findings are presented have not been materially modified from the relevant original market announcement.

Competent Person

The information in this presentation that relates to Mineral Resources is based on, and fairly represents, information compiled by Mr Brian Wolfe, who is a Member of the Australian Institute of Geoscientists. Mr Wolfe is an external consultant to the Company and is a full-time employee of International Resource Solutions Pty Ltd, a specialist geoscience consultancy. Mr Wolfe has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as a competent person as defined in the 2012 Edition of the "Australasian Code for reporting of Exploration Results, Exploration Targets, Mineral Resources and Ore Reserves" (JORC Code). Mr Wolfe consents to the inclusion in this presentation of the matters based upon his information in the form and context in which it appears.

Appendix Two | Exploration and Mining Permits

Exploration & Mining Permits changes during the Quarter

| Project | Location | Tenement | Interest at beginning of Quarter | Interest at end of Quarter |

| Nil | ||||

Farm-In / Farm Out Agreement changes during the Quarter

| Joint Venture | Project | Location | Tenement | Interest at beginning of Quarter | Interest at end of Quarter |

| Octava Minerals Ltd | Panton North | Western Australia | E80/5455 | - | - |

| Octava Minerals Ltd | Palamino | Western Australia | E80/5459 | - | - |

Future Metals may earn up to 70% in the two tenements listed above. Details of the transaction can be found in the announcement 'Farm-In Agreement Over East Kimberley Ni-Cu-PGE Prospects' released on 17 January 2023.

Interests in Mining & Exploration Permits & Joint Ventures at 30 September 2025

| Project | Location | Tenement | Area | Interest at end of Quarter |

| Panton PGM-Ni Project | Western Australia | M80/103 M80/104 M80/105 | 8.6km2 5.7km2 8.3km2 | 100% 100% 100% |

| Panton North (OCT JV) | Western Australia | E80/5455 | 8 BL | - |

| Alice Downs Corridor (OCT JV) | Western Australia | E80/5459 | 2 BL | - |

| Alice Downs Corridor | Western Australia | E80/4922 | 1BL | 100% |

| Alice Downs Corridor | Western Australia | E80/4923 | 2BL | 100% |

| Alice Downs Corridor | Western Australia | E80/5056 | 10BL | 100% |

[1] Refer to Appendix One for PdEq calculations

[2] Refer to ASX Announcement "Panton PGM-Ni-Chromite Project Scoping Study" - 7th December 2023

[3] Refer ASX Announcement "FME Executes Strategic Infrastructure MOU with Zeta Resources" - 10th April 2025

[4] Refer to Appendix One for PdEq calculations

[5] Platinum-Group-Metals 3E refers to platinum, palladium and gold

[6] Reef: PdEq (Palladium Equivalent g/t) = Pd(g/t) + 0.833 x Pt(g/t) + 1.02083 x Au(g/t) + 2.33276 x Ni(%) + 0.07560 x Cr2O3 (%)

Dunite: PdEq (Palladium Equivalent g/t) = Pd(g/t) + 0.833 x Pt(g/t) + 1.322 x Au(g/t) + 2.2118 x Ni(%)

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.