NEWS RELEASE | 31 October 2025

Quarterly Report September 2025

Summary:

· Conchas Project

During the quarter, Berkeley Energia Limited (Berkeley or Company) announced positive results of a preliminary metallurgical test work program completed on representative samples from the Conchas Project (Conchas or the Project), as part of the Company's Critical Minerals Exploration Initiative in Spain.

· Conchas hosts shallow, thick zones of lithium (Li) and rubidium (Rb) mineralisation, with accessory tin (Sn), caesium (Cs), beryllium (Be), niobium (Nb) and tantalum (Ta) within a muscovitic leucogranite unit

· SLR Consulting Ltd (SLR) was engaged to undertake metallurgical testing on representative samples obtained from three diamond core holes drilled in 2024

· The preliminary metallurgical test work program, designed to assess the potential recovery of Li, Rb, and the other elements of economic interest, comprised head sample characterisation, mineralogical analysis, gravity, flotation and magnetic test work

· Flotation test work results demonstrated that very good recoveries of Li (78% overall recovery) and Rb (63% overall recovery) can be achieved at acceptable grades for -150µm grind size material

· Magnetic separation testing on -300µm +150µm material showed 77% of the Li and 58% of the Rb (stage recoveries) reporting to the magnetic product. This result may present an opportunity for magnetic separation processing of the coarser fraction followed by flotation of the finer material

· Next steps include 3D modelling of the drilling data to refine the geological interpretation of the Li and Rb mineralisation as a precursor to resource estimation, and a second phase of metallurgical test work to optimise the flotation and magnetic separation processes

· Rb is a critical raw material for advanced technology and industrial applications used in key sectors including defence and military, aerospace, communications, medical and renewable energy. The U.S. and Japan have both classified Rb as a Critical Mineral due to its strategic importance and growing demand in high-tech applications.

· International Arbitration against Spain

In May 2024, Berkeley advised that its wholly owned subsidiary, Berkeley Exploration Limited (BEL), had filed a Request for Arbitration (Request) for its investments in Spain through its Spanish subsidiary, Berkeley Minera España SA (BME), initiating arbitration proceedings against the Kingdom of Spain (Spain) before the International Centre for Settlement of Investment Disputes (ICSID).

As part of its Request, BEL alleges that Spain's actions against BME and the Salamanca project (Salamanca Project) have violated multiple provisions of the Energy Charter Treaty (ECT), and that BEL is seeking preliminary compensation in the order of US$1 billion (US$1,000,000,000) for these violations.

During the quarter, the timetable and arbitration rules were established by the Tribunal, with the Company's Statement of Claim due to be filed in early 2026.

Notwithstanding the investment dispute, BEL remains committed to the Salamanca Project and continues to be open to a constructive dialogue with Spain. BEL is ready and open to collaborate with the relevant Spanish authorities to find an amicable resolution to the permitting situation and remains hopeful discussions can take place in the near term.

· Spanish Nuclear Power Industry:

· Nuclear debate continues post blackout in Spain

o Spain is preparing to close its first nuclear power plant in 2027, reigniting a debate over the country's energy future mere months after the April 2025 blackout plunged much of Spain and Portugal into darkness and exposed vulnerabilities in the Iberian grid.

o Nuclear power plants generated ~20% of Spain's total net electricity production in 2024 and became its second largest source of electricity production, according to the country's nuclear industry forum ForoNuclear. The blackout that struck the Iberian Peninsula in April highlights nuclear's role in providing inertia and stability to the electricity system, it said.

o Iberdrola, ENDESA and Naturgy, the owners of the Almaraz nuclear power plant in Extremadura, have informed the Ministry for Ecological Transition of their intention to submit a formal request to extend the operational life of the Extremadura facility beyond 2027.

The formal request, which will be submitted before the end of October, is the first necessary step for the continuity of the facility's operation beyond the planned closure dates to be studied.

· Balance Sheet

The Company is in a strong financial position with A$71 million in cash reserves and no debt.

Classification: 2.2 This announcement contains inside information

For further information please contact:

Robert Behets Francisco Bellón

Acting Managing Director Chief Operations Officer

+61 8 9322 6322 +34 923 193 903

Critical Minerals Exploration Initiative

During the quarter, the Company continued to advance its exploration initiative targeting Li, Rb, Sn, Ta, Nb, tungsten (W), and other battery and critical metals, within its existing tenements in western Spain. Further analysis of the mineral and metal endowment across the entire mineral rich province and other prospective regions in Spain is also being undertaken, with a view to identifying additional targets and opportunities.

Conchas Project

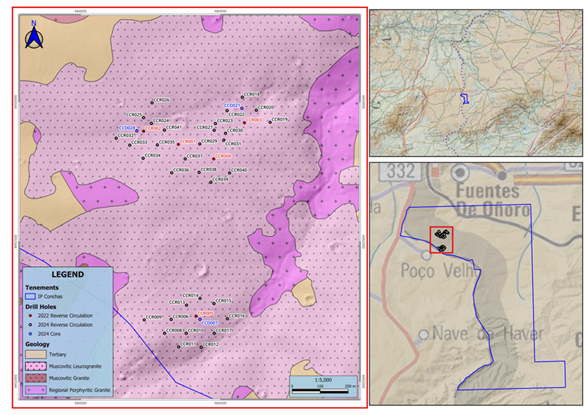

The Investigation Permit (IP) Conchas is located in the very western part of the Salamanca province, close to the Portuguese border (Figure 1). The tenement covers an area of ~31km2 in the western part of the Ciudad Rodrigo Basin and is largely covered by Cenozoic aged sediments. Only the north-western part of the tenement is uncovered and dominated by the Guarda Batholith intrusion. The tenement hosts a number of sites where small-scale historical Sn and W mining was undertaken.

Figure 1: IP Conchas Location Plans and Geology / Drill Hole Location Plan

Berkeley conducted a small drill program comprising five broad spaced reverse circulation (RC) holes for a total of 282m in 2022 to test a Sn-Li soil sampling anomaly. Anomalous results for Li, Sn, Rb, Cs, Nb and Ta obtained from multi-element analysis of drill samples were reported in 2023, demonstrating Conchas' potential for several critical and strategic raw materials included in the European Commission's Critical Raw Materials Act (CRMA). The drill results included 25m @ 0.56% Li2O & 0.22% Rb2O from surface (CCR0002).

A follow-up RC and diamond core drilling program was completed in 2024. The drilling program comprised 33 RC holes for 1,857m drilled on a 100m by 100m grid, with depths ranging from 16m to a maximum of 169m. In addition, three diamond core holes for 230m were drilled to collect samples for metallurgical test work purposes.

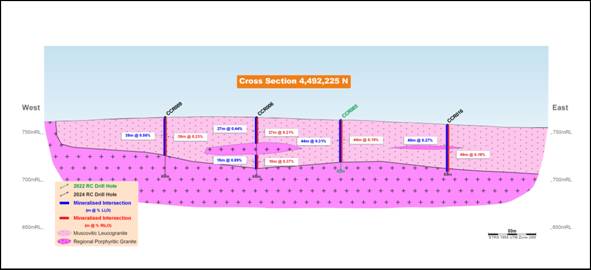

All drill holes intersected muscovitic leucogranite hosted mineralisation with select intercepts including 61m @ 0.50% Li2O & 0.21% Rb2O from surface (CCR0012), 56m @ 0.48% Li2O & 0.21% Rb2O from surface (CCR0025), 27m @ 0.44% Li2O & 0.21% Rb2O from surface and 14m @ 0.95% Li2O & 0.39% Rb2O from 40m (CCR0006) and 18m @ 0.55% Li2O & 0.23% Rb2O from surface (CCR0017).

The multi-element mineralisation is largely associated with a sub-horizontal muscovitic leucogranite unit that locally outcrops at surface. The muscovitic leucogranite has a mapped extent of ~2km (in a NE-SW orientation) by ~1.2km (on average in a NW-SE orientation) (Figure 1) and varies in thickness from 7m to over 170m in the drill holes (Figure 2).

Figure 2: IP Conchas 4,492,225 North Cross Section

Preliminary Metallurgical Test Work Program Results

The Company engaged SLR to undertake metallurgical testing on representative samples obtained from three diamond core holes drilled in the 2024 program at the Conchas Project.

The preliminary metallurgical test work program was designed to assess the potential recovery of Li, Rb and the other elements of economic interest, and comprised:

· Head Sample Characterisation;

· Scanning Electron Microscope (SEM) Mineralogical Analysis;

· Gravity Test Work;

· Flotation Test Work; and

· Magnetic Test Work.

Head Sample Characterisation - Head Assay

A representative sub-sample was submitted to SLR's in-house analytical laboratory for head assay to determine the levels of target elements present in the composite sample. A sub-sample was also submitted to ALS Global for ICP multi-element analysis. The results of the SLR in-house assay and selected elements of the ALS analysis are given below in Table 1.

| Analyte | SLR | ALS | |

| Li | (%) | 0.22 | 0.23 |

| Li2O | (%) | 0.56 | 0.59 |

| Rb | (ppm) | 2,094 | 1,960 |

| Rb2O | (ppm) | 2,291 | 2,144 |

| Ta | (ppm) | 53.1 | 47.5 |

| Nb | (ppm) | 86.0 | 71.8 |

| Be | (ppm) | 76.1 | 76.5 |

| Cs | (ppm) | | 145.5 |

| Sn | (%) | 0.051 | 0.064 |

| Fe | (%) | 0.77 | 0.86 |

Table 1 - Summary of Head Assay Results

Head Sample Characterisation - Particle Size Distribution

A representative sub-sample of the -2mm feed material was subjected to particle size analysis by screen. The sample was wet screened at 53µm, the fractions dried and the +53µm fraction screened to generate mass data by fractions. The results, which determined a D80 particle size of 1,453µm, are summarised below in Figure 3.

Figure 3 - Graph of -2mm Feed Particle Size Distribution

Head Sample Characterisation - Class Size Analysis

A 2kg sample was ground to nominally generate a D80 size of 300µm and sized to generate five fractions for size-by-size analysis and sub-samples for mineralogical investigation. Representative sub-samples of the fractions were pulverised and submitted to SLR in-house laboratory for Li, Rb, Ta, Nb, Be, Sn, Iron (Fe) and Ce assay. Cs assays were subcontracted to ALS Global analytical services. The results are summarised below in Table 2.

| Fraction µm | Weight % | Assay | |||||||||

| Li % | Li2O % | Rb ppm | Ta ppm | Nb ppm | Be ppm | %Sn | %Fe | Ce ppm | Cs ppm | ||

| +300 | 17.5 | 0.27 | 0.57 | 2,148.8 | 56.6 | 72.1 | 60.2 | 0.044 | 0.69 | 0.50 | 152.00 |

| -300+150 | 32.9 | 0.23 | 0.49 | 1,949.5 | 38.3 | 48.1 | 74.9 | 0.038 | 0.43 | 0.80 | 147.50 |

| -150+53 | 27.9 | 0.23 | 0.49 | 1,847.5 | 108.4 | 44.1 | 74.7 | 0.072 | 0.33 | 0.50 | 169.50 |

| -53+11 | 15.2 | 0.18 | 0.40 | 1,638.1 | 152.0 | 176.6 | 66.4 | 0.113 | 0.63 | 1.00 | 136.00 |

| -11 | 6.5 | 0.17 | 0.37 | 1,491.6 | 86.5 | 47.7 | 64.8 | 0.016 | 0.74 | 2.90 | 105.50 |

| Feed | 100.0 | 0.22 | 0.48 | 1,878.8 | 81.4 | 70.7 | 70.3 | 0.058 | 0.50 | 0.83 | 149.93 |

| | | | | | | | | | | | |

| Fraction µm | Weight % | Distribution % | |||||||||

| Li | Li2O | Rb | Ta | Nb | Be | Sn | Fe | Ce | Cs | ||

| +300 | 17.5 | 20.7 | 20.7 | 20.0 | 12.2 | 17.9 | 15.0 | 13.2 | 24.4 | 10.5 | 17.7 |

| -300+150 | 32.9 | 33.4 | 33.4 | 34.2 | 15.5 | 22.4 | 35.1 | 21.2 | 28.3 | 31.7 | 32.4 |

| -150+53 | 27.9 | 28.4 | 28.4 | 27.4 | 37.1 | 17.4 | 29.6 | 34.4 | 18.4 | 16.8 | 31.5 |

| -53+11 | 15.2 | 12.5 | 12.5 | 13.3 | 28.4 | 38.0 | 14.4 | 29.4 | 19.3 | 18.3 | 13.8 |

| -11 | 6.5 | 5.0 | 5.0 | 5.2 | 6.9 | 4.4 | 6.0 | 1.8 | 9.7 | 22.7 | 4.6 |

| Feed | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Table 2 - Results of Class Size Analysis

The results generally show that elemental distributions followed the relative trends observed in the fraction mass distributions, with greater distributions present in the -300 +150µm fractions and the least in the -11µm fines fraction. Li distributions ranged from 33.4% in the -300 +150µm fraction to 5.0% in the -11µm fraction and Rb ranged from 34.2% to 5.2% in the respective fractions.

SEM Mineralogy Analysis

The target mineral phases identified include cassiterite, Nb-Ta oxides, polylithionite and muscovite. Muscovite was the most abundant target phase, maintaining relatively consistent concentrations across all size fractions (Figure 4).

The Li minerals were clustered in the polylithionite group which covers a range of minerals between zinnwaldite and lepidolite depending on the Fe and fluorine (F) contents. Cassiterite and Nb-Ta oxides were both present in trace quantities. The gangue material was primarily composed of plagioclase and quartz, present in nearly equal proportions. Plagioclase content increases in the finer size fractions, whereas quartz becomes less abundant. K-feldspar appears as a minor phase, while other phases, including phosphates, kaolinite, accessory minerals, tourmaline, sulphides, and topaz occur only in trace amounts.

Figure 4 - Mineral Phase Abundance

Gravity Test Work

The four fractions generated for the class size analysis were subjected to gravity release analysis (GRA) by treating each of the fractions separately on the Mozley super panner, generating six products for assay. The products were dried, weighed and representative sub-samples prepared and submitted for Li, Rb, Ta, Nb, Be, Sn and Fe assay.

Cumulative Li recoveries into the combined concentrates and middling product ranged from 28.0% at a grade of 0.16% Li (-53 +11µm) to 65.8% at a grade of 0.24% Li (0.52% Li2O) in the -150 +53µm fraction. Cumulative Rb recoveries into the combined concentrates and middling product ranged from 22.2% at a grade of 2,358ppm Rb (+300µm) to 66.1% at a grade of 2,049ppm Rb (2,242ppm Rb2O) in the -150 +53µm fraction.

The results showed optimum liberation size for the Conchas composite was in the -150 +53µm fraction.

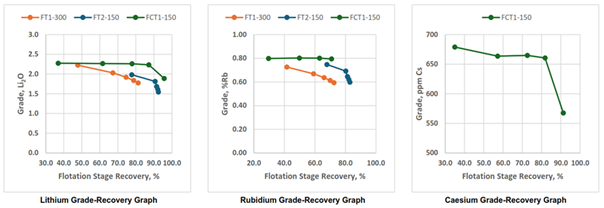

Flotation Test Work

A short programme of flotation testing was performed on the Conchas composite to evaluate potential grades and recoveries at two grind sizes.

Two rougher tests were conducted at the 300µm (FT1-300) and 150µm (FT2-150) primary grind sizes to identify the better flotation performance, and one cleaner test was then conducted at the better performing grind size to evaluate the effect of kinetic cleaning on grades and recoveries.

The results of the rougher tests confirmed that the finer 150µm grind was the better performing test and was therefore used for cleaner flotation testing (FCT1-150). Cleaner flotation achieved 87.2% Li stage recovery, representing 77.5% overall recovery at a grade of 1.04% Li (2.23% Li2O), 70.9% Rb stage recovery representing 62.7% overall recovery at a grade of 0.79% Rb (0.87% Rb2O), and 78.5% Cs recovery at a grade of 661ppm Cs (Figure 5).

Flotation testing of the Conchas material demonstrated that very good recoveries of target minerals could be achieved at acceptable grades.

Figure 5 - Summary of Flotation Test Work Results for Li, Rb and Cs

Magnetic Test Work

Representative sub-samples of the 300µm and 150µm primary grinds were subjected to magnetic separation testing to evaluate potential grades and recoveries at the two grind sizes.

The 300µm sub-sample was screened at 150µm and the two fractions treated separately. The +150µm fraction was treated on an Eriez Log 1.4-disc separator, the -150µm treated on a Bunting Wet High Intensity Magnetic Separator (WHIMS) 500 jaw magnetic separator and the results combined to generate the overall performances. The 150µm sub-sample was treated on the Bunting WHIMS 500 jaw magnetic separator.

The initial magnetic test intensity was 4,000 Gauss with testing conducted in 1,000 Gauss increments up to 15,000 Gauss.

Magnetic separation testing on the <300µm +150µm material showed 76.6% of the Li and 57.7% of the Rb reporting to the magnetic product grading 2.34% Li2O and 0.73% Rb. This result may present an opportunity for magnetic separation processing of a coarser +150µm fraction followed by flotation of the finer -150µm material.

Magnetic separation on the <300µm +150µm material also showed 43.5% of the Ta and 50.9% of the Nb reported to the combined 4,000, 6,000 and 9,000 Gauss magnetic concentrates grading 1,161ppm Ta and 1,551ppm Nb.

Summary

Metallurgical testing of the Conchas mineralisation tested demonstrated very good recoveries at acceptable grades using flotation and magnetic separation methods.

The recommended next steps, from a metallurgical test work perspective, include more detailed flotation testing to optimise the rougher and cleaner flotation reagent schemes, optimisation of the magnetic separation on the coarse fractions, and mineral content variability testing to understand how variability affects the beneficiation methods.

Geological Modelling

3D modelling of the drilling data is being undertaken to refine the geological interpretation and assess volumes, average grades, and grade distributions for the Li and Rb mineralisation at different cut-offs, as a precursor to resource estimation.

An updated geological model based on all available data, including surface mapping, soil geochemistry and drilling, is also being developed.

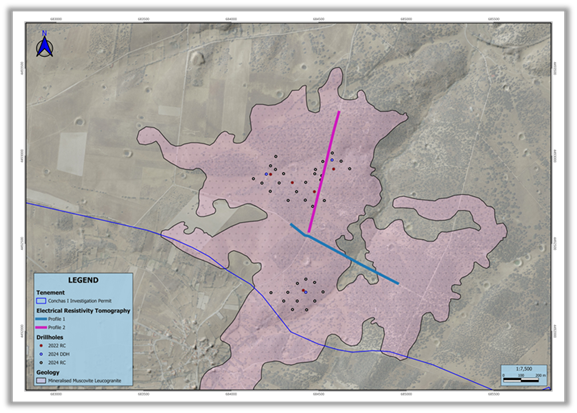

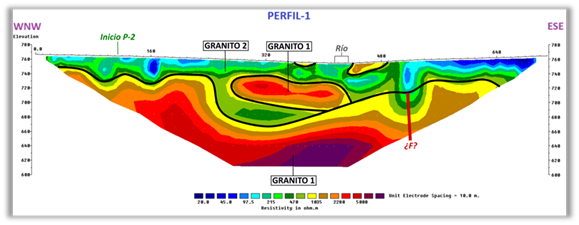

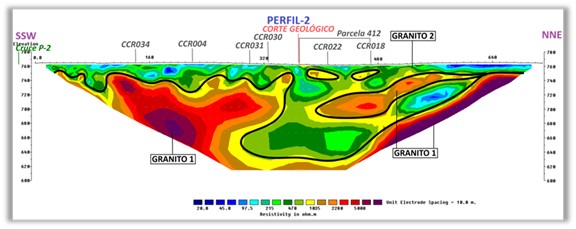

Trial Geophysical Survey - Electrical Resistivity Tomography (ERT)

A trial geophysical survey to determine the applicability of ERT to differentiate and map the key geological units at Conchas was undertaken during the quarter.

ERT is a geophysical method used to determine the electrical resistivity distribution of the subsurface. By measuring resistivity variations, it is possible to generate a detailed resistivity profile of the underground environment. This technique is widely used in geotechnical engineering, environmental and geological investigations due to its effectiveness in mapping subsurface materials.

The primary objective of the trial survey was to determine the effectiveness of ERT in mapping the host muscovitic leucogranite and underlying regional granite, and in turn provide an indication of the geometries, thicknesses, variations, intercalations etc. of the two granite units.

The trial survey was conducted by Spanish geophysical consultants, Análisis y Gestión del Subsuelo (AGS), and involved measurements along two profiles, each ~700m long, with electrodes spaced 10m apart, allowing data collection down to 150m depth (Figure 6).

The two ERT profiles obtained have shown that the technique clearly distinguished, in the subsurface, two materials with a sufficient resistivity contrast to confirm the existence of two distinct lithological units (Figures 7 and 8). These ERT results were subsequently compared with proximal drill hole data, demonstrating good correlation with the mineralised muscovite leucogranite and the underlying barren regional granite.

The findings of this initial trial survey provided encouragement (results of the initial trial are not considered material) to plan a more comprehensive ERT survey covering most of the surface area mapped as muscovite leucogranite. This second survey was conducted in late October 2025, with the results pending.

Figure 6: Location of ERT Profiles

Figure 7: ERT Trial Profile 1

Figure 8: ERT Trial Profile 2

Conchas Portugal

Given the interpreted continuity of the host muscovite leucogranite at Conchas into Portugal, the Company has submitted an application for the granting of prospecting and exploration rights for copper (Cu), lead (Pb), zinc (Zn), silver (Ag), gold (Au), antimony (Sb), Sn, W, Ta, Li, and other minerals, within an area referred to herein as "Conchas Portugal" to the Directorate General for Energy and Geology of the Ministry of Environment and Energy of Portugal.

The Conchas Portugal application, which covers an area of 219 km², is located in the District of Guarda and includes the municipalities of Sabugal and Almeida (Figure 9).

Figure 9: Conchas Portugal IP Application Location Plans

Oliva and La Majada Projects

These projects comprise three tenements within two project areas in Spain which are considered prospective for W, Sb, cobalt (Co) and other metals.

The Company has designed exploration programs for both projects, communicated with the relevant authorities, and conducted the required studies e.g. a birdlife study at the La Majada Project, to progress the pending grant of the IPs for two of the tenements.

An updated Exploration Program for the La Majada Project, together with the birdlife study and rehabilitation plan, was submitted to the relevant authorities during the year. The Exploration Program was updated to align it to new legislation recently introduced for the Castilla La Mancha Region.

The submitted documentation is currently being reviewed by the relevant authorities. Once the review is completed, the IP applications for two of the tenements (La Majada and Ampliación de los Bélicos) will be subjected to a public consultation period.

Salamanca Project Summary

The Salamanca Project is being developed in a historic uranium mining area in Western Spain about three hours west of Madrid.

The Company has received more than 120 European Union and National level approvals and favourable reports required for the initial development of the project to date.

The project has the potential to generate measurable social and environmental benefits in the form of jobs and skills training in a depressed rural community. It can also make a significant contribution to the security of supply of Europe's zero carbon energy needs.

The Project hosts a Mineral Resource of 89.3Mlb uranium, with more than two thirds in the Measured and Indicated categories. In 2016, Berkeley published the results of a robust Definitive Feasibility Study (DFS) for Salamanca confirming that the Project could be one of the world's lowest cost producers, capable of generating strong after-tax cash flows.

Figure 10: Location of the Salamanca Project, Spain

Salamanca Project Update

The Company continues with its commitment to health, safety and the environment as a priority.

During the quarter, an internal audit of the Environmental and Sustainable Mining Management System was completed to assess the System's compliance with the requirements of ISO Standards 14001:2015 "Environmental Management" and UNE 22480/70:2019 "Sustainable Mining Management".

The audit concluded that the Environmental and Sustainable Mining Management System remains in full compliance with the relevant ISO Standards with no "Non-Compliance" items identified.

International Arbitration Dispute

In May 2024, the Company's wholly owned subsidiary, BEL, filed the Request for its investments in Spain through its Spanish subsidiary, BME, initiating arbitration proceedings against the Spain before ICSID.

As part of its Request, BEL alleges that Spain's actions against BME and the Salamanca Project have violated multiple provisions of the ECT, and that BEL is seeking preliminary compensation in the order of US$1 billion (US$1,000,000,000) for these violations.

In November 2022, BEL submitted a written notification of an investment dispute to the Prime Minister of Spain and the MITECO informing them of the nature of the dispute and the ECT breaches, and that it proposed to seek prompt negotiations for an amicable solution pursuant to article 26.1 of the ECT. The Spanish government has not engaged in any discussions related to the dispute to date, and BEL filed its Request in order to enforce its rights at the Salamanca Project through international arbitration.

During the quarter, the timetable and arbitration rules were established by the Tribunal, with the Company's Statement of Claim due to be filed in early 2026.

Notwithstanding the investment dispute, BEL remains committed to the Salamanca Project and continues to be open to a constructive dialogue with Spain. BEL is ready and open to collaborate with the relevant Spanish authorities to find an amicable resolution to the permitting situation and remains hopeful discussions can take place in the near term.

Background to Dispute

In April 2021, the Spanish Government approved an amendment to the draft climate change and energy transition bill relating to the investigation and exploitation of radioactive minerals (e.g. uranium). The Government reviewed and approved the amendment to Article 10 under which: (i) new applications for exploration, investigation and direct exploitation concessions for radioactive materials, and their extensions, would not be accepted following the entry into force of this law; and (ii) existing concessions, and open proceedings and applications related to these, would continue as per normal based on the previous legislation. The new law was published in the Official Spanish State Gazette and came into effect in May 2021.

The Company's wholly owned subsidiary, BME, currently holds legal, valid and consolidated rights for the investigation and exploitation of its mining projects, including the 30-year mining licence (renewable for two further periods of 30 years) for the Salamanca Project, however any new proceedings opened by the Company are now not allowed under the aforementioned new law.

In November 2021, BME received formal notification from MITECO that it had rejected the construction of the plant as a radioactive facility (NSC II) at the Company's Salamanca Project following an unfavourable report for the grant of NSC II issued by the Board of the NSC in July 2021.

BEL strongly refutes the NSC's assessment and, in its opinion, the NSC adopted an arbitrary decision with the technical issues used as justification to issue the unfavourable report lacking in both technical and legal support.

BME submitted documentation, including an 'Improvement Report' to supplement its initial NSC II application, along with the corresponding arguments that address all the issues raised by the NSC, and a request for its reassessment by the NSC, to MITECO in July 2021.

Further documentation was submitted to MITECO in August 2021, in which BME, with strongly supported arguments, dismantled all of the technical issues used by the NSC as justification to issue the unfavourable report. BME again restated that the project is compliant with all requirements for NSC II to be awarded and requested its NSC II Application be reassessed by the NSC.

In addition, BME requested from MITECO access to the files associated with the Authorisation for Construction and Authorisation for Dismantling and Closure for the radioactive facilities at La Haba (Badajoz) and Saelices El Chico (Salamanca), which are owned by ENUSA Industrias Avandas S.A., in order to verify and contrast the conditions approved by the competent administrative and regulatory bodies for other similar uranium projects in Spain.

Based on a detailed comparison of the different licensing files undertaken by BME following receipt of these files, it is clear that BME, in its NSC II submission, has been required to provide information that does not correspond to: (i) the regulatory framework, (ii) the scope of the current procedural stage (i.e., at the NSC II stage), and/or (iii) the criteria applied in other licensing processes for similar radioactive facilities). Accordingly, BEL considers that the NSC has acted in a discriminatory and arbitrary manner when assessing the NSC II application for the Salamanca Project.

In BEL's strong opinion, MITECO has rejected BME's NSC II Application without following the legally established procedure, as the Improvement Report has not been taken into account and sent to the NSC for its assessment, as requested on multiple occasions by BME.

In this regard, BEL believes that MITECO have infringed regulations on administrative procedures in Spain but also under protection afforded to BEL under the ECT, which would imply that the decision on the rejection of BME's NSC II Application is not legal.

In April 2023, BME submitted a contentious-administrative appeal before the Spanish National Court in an attempt to overturn the MITECO decision denying NSC II.

Further, the BME received formal notifications in December 2023 which upheld appeals submitted by a non-governmental organisation, Plataforma Stop Uranio, and the city council of Villavieja de Yeltes (the appellants) to revoke the first instance judgements related to the Authorisation of Exceptional Land Use (AEUL) and the Urbanism License (UL), which annuled both the AEUL and UL.

The AEUL and the UL were granted to BME in July 2017 and August 2020 by the Regional Commission of Environment and Urbanism, and the Municipality of Retortillo respectively.

The appellants subsequently filed administrative appeals against the AEUL and the UL at the first instance courts in Salamanca. The administrative appeals against the AEUL and UL were dismissed in September 2022 and January 2023 respectively.

One of the appellants subsequently lodged appeals before the High Court of Justice of Castilla y León (TSJ), with the TSJ delivering judgements in December 2023 to revoke the first instance judgements and declare the AEUL and the UL null.

BME strongly disagrees with the fundamentals of the TSJ's judgement and having previously submitted cassation appeals against the TSJ judgements before the Spanish Supreme Court, BME has withdrawn the appeals to preserve BEL's rights under international arbitration.

Issue of Unlisted Options

The Company advises that it has issued 3,300,000 unlisted incentive options exercisable at A$0.80 each on or before 30 September 2028 to key employees and consultants.

Following the issue of unlisted options, Berkeley has the following securities on issue:

· 445,796,715 ordinary fully paid ordinary shares;

· 2,000,000 unlisted options exercisable at A$0.40 each on or before 31 December 2025;

· 7,600,000 unlisted options exercisable at A$0.65 each on or before 30 June 2026; and

· 3,300,000 unlisted options exercisable at A$0.80 each on or before 30 September 2028.

Forward Looking Statements

Statements regarding plans with respect to Berkeley's mineral properties are forward-looking statements. There can be no assurance that Berkeley's plans for development of its mineral properties will proceed as currently expected. There can also be no assurance that Berkeley will be able to confirm the presence of additional mineral deposits, that any mineralisation will prove to be economic or that a mine will successfully be developed on any of Berkeley mineral properties. These forward-looking statements are based on Berkeley's expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Berkeley, which could cause actual results to differ materially from such statements. Berkeley makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that report.

Competent Persons Statements

The information in this report that relates to Exploration Results (the Electrical Resistivity Tomography Survey) is based on, and fairly represents, information compiled by Mr Enrique Martínez, a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Martínez is Berkeley's Geology Manager and a holder of shares and options in Berkeley. Mr Martínez has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Martínez consents to the inclusion in the report of the matters based on his information in the form and context in which it appears

The information in this announcement that relates to Exploration Results (drilling results at Conchas) is extracted from an announcement dated 29 January 2025, entitled 'Shallow, thick zones of lithium and rubidium mineralisation intersected in drilling at Conchas Project', which is available to view at www.berkeleyenergia.com. Berkeley confirms that: a) it is not aware of any new information or data that materially affects the information included in the original announcement; b) all material assumptions and technical parameters underpinning the Exploration Results in the original announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons' findings are presented in this announcement have not been materially modified from the original announcement.

The information in this announcement that relates to Metallurgical Test Work is extracted from an announcement dated 28 October 2025, entitled 'Positive Preliminary Metallurgical Test Work Results at Conchas', which is available to view at www.berkeleyenergia.com. Berkeley confirms that: a) it is not aware of any new information or data that materially affects the information included in the original announcement; b) all material assumptions and technical parameters underpinning the Exploration Results in the original announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons' findings are presented in this announcement have not been materially modified from the original announcement

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ('MAR'). Upon the publication of this announcement via Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.

Appendix 1: Mineral Resource at Salamanca

| Deposit Name | Resource Category | Tonnes (Mt) | U3O8 (ppm) | U3O8 (Mlbs) |

| Retortillo | Measured | 4.1 | 498 | 4.5 |

|

| Indicated | 11.3 | 395 | 9.8 |

| | Inferred | 0.2 | 368 | 0.2 |

| | Total | 15.6 | 422 | 14.5 |

| Zona 7 | Measured Indicated | 5.2 10.5 | 674 761 | 7.8 17.6 |

|

| Inferred | 6.0 | 364 | 4.8 |

|

| Total | 21.7 | 631 | 30.2 |

| Alameda | Indicated | 20.0 | 455 | 20.1 |

| | Inferred | 0.7 | 657 | 1.0 |

|

| Total | 20.7 | 462 | 21.1 |

| Las Carbas | Inferred | 0.6 | 443 | 0.6 |

| Cristina | Inferred | 0.8 | 460 | 0.8 |

| Caridad | Inferred | 0.4 | 382 | 0.4 |

| Villares | Inferred | 0.7 | 672 | 1.1 |

| Villares North | Inferred | 0.3 | 388 | 0.2 |

| Total Retortillo Satellites | Total | 2.8 | 492 | 3.0 |

| Villar | Inferred | 5.0 | 446 | 4.9 |

| Alameda Nth Zone 2 | Inferred | 1.2 | 472 | 1.3 |

| Alameda Nth Zone 19 | Inferred | 1.1 | 492 | 1.2 |

| Alameda Nth Zone 21 | Inferred | 1.8 | 531 | 2.1 |

| Total Alameda Satellites | Total | 9.1 | 472 | 9.5 |

| Gambuta | Inferred | 12.7 | 394 | 11.1 |

| Salamanca Project Total | Measured | 9.3 | 597 | 12.3 |

| Indicated | 41.8 | 516 | 47.5 | |

| Inferred | 31.5 | 395 | 29.6 | |

| Total (*) | 82.6 | 514 | 89.3 |

Appendix 2: Summary of Mining Tenements

As at 30 September 2025, the Company had an interest in the following tenements:

| Location | Tenement Name | Percentage Interest | Status |

| Spain | | | |

| Salamanca | D.S.R Salamanca 28 (Alameda) | 100% | Granted |

| | D.S.R Salamanca 29 (Villar) | 100% | Granted |

| | E.C. Retortillo-Santidad | 100% | Granted |

| | E.C. Lucero | 100% | Pending |

| | I.P. Abedules | 100% | Granted |

| | I.P. Abetos | 100% | Granted |

| | I.P. Alcornoques | 100% | Granted |

| | I.P. Alisos | 100% | Granted |

| | I.P. Bardal | 100% | Granted |

| | I.P. Barquilla | 100% | Granted |

| | I.P. Berzosa | 100% | Granted |

| | I.P. Campillo | 100% | Granted |

| | I.P. Castaños 2 | 100% | Granted |

| | I.P. Ciervo | 100% | Granted |

| | I.P. Conchas | 100% | Granted |

| | I.P. Dehesa | 100% | Granted |

| | I.P. El Águila | 100% | Granted |

| | I.P. El Vaqueril | 100% | Granted |

| | I.P. Espinera | 100% | Granted |

| | I.P. Horcajada | 100% | Granted |

| | I.P. Lis | 100% | Granted |

| | I.P. Mailleras | 100% | Granted |

| | I.P. Mimbre | 100% | Granted |

| | I.P. Pedreras | 100% | Granted |

| | E.P. Herradura | 100% | Granted* |

| Cáceres | I.P. Almendro | 100% | Granted^ |

| | E.C. Gambuta | 100% | Pending |

| | I.P. Ibor | 100% | Granted |

| | I.P. Olmos | 100% | Granted |

| Badajoz | I.P. Los Bélicos | 100% | Granted** |

| | I.P.A. Ampliación Los Bélicos | 100% | Pending** |

| Ciudad Real | I.P.A. La Majada | 100% | Pending** |

| | I.P. Anchuras | 100% | Pending# |

| Zaragoza | I.P. Moros-Ateca | 100% | Pending# |

| | I.P. Alvón | 100% | Pending# |

| Portugal | I.P Conchas Portugal | 100% | PendingV |

*An application for a 1-year extension at E.P. Herradura was previously rejected however this decision has been appealed and the Company awaits the decision regarding its appeal.

**Exploracion de Recuros Minerales S.L.U (ERM), a wholly owned subsidiary of the Company, has entered into a Tenement Sale and Purchase Agreement and Royalty Deed to acquire I.P. Los Bélicos, I.P.A. Ampliación Los Bélicos, and I.P.A. La Majada.

^The Company has applied for an Exploitation Concession from the existing I.P. Almendro.

#The Company has applied for three I.P.s covering areas prospective for Sb as part of its Critical Minerals Exploration Initiative.

VThe Company has applied for an I.P. covering an area prospective for Li, Rb and other metals in Portugal as part of its Critical Minerals Exploration Initiative.

Appendix 3: Related Party Payments

During the quarter ended 30 September 2025, the Company made payments of $81,000 to related parties and their associates. These payments relate to existing remuneration arrangements (director and consulting fees plus statutory superannuation).

Appendix 4: Exploration and Mining Expenditure

During the quarter ended 30 September 2025, the Company made the following payments in relation to exploration and development activities:

| Activity | A$000 |

| Permitting related expenditure (including legal costs) | 200 |

| Assay costs, radiological protection and monitoring | 3 |

| Consultants and other expenditure | 198 |

| Payment/(return) of VAT and other social taxes in Spain | 23 |

| Total as reported in the Appendix 5B | 424 |

There were no mining or production activities and expenses incurred during the quarter ended 30 September 2025.

Appendix 5 - JORC Code, 2012 Edition - Table 1

Section 1 Sampling Techniques and Data - Electrical Resistivity Tomography Survey

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques | Nature and quality of sampling (eg cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc). These examples should not be taken as limiting the broad meaning of sampling. | A trial of Electrical Resistivity Tomography ("ERT") was conducted at the Conchas Project in July 2025. The trial survey was carried out by Análisis y Gestión del Subsuelo ("AGS"). The trial survey was supervised and coordinated by Berkeley Minera España ("BME"). The measurements were taken using a Syscal Pro 72 geophysical unit manufactured by IRIS Instruments (Orleans, France). This fully digital resistivity and induced polarisation system is designed for environmental, civil engineering, and mineral exploration applications. It features an internal 250 W transmitter with a maximum output of 800-1000 V and 2.5 A, ten simultaneous acquisition channels providing up to 1,000 readings per minute, and automatic switching for up to 72 electrodes. The equipment ensures high-quality data acquisition and depth penetration suitable for subsurface investigations. The six multi-electrode cable reels used in the measurements were either manufactured by IRIS Instruments itself or by Beijing Harvest Technology Co, a Chinese company certified by IRIS Instruments as an approved supplier. This ensures compatibility and quality standards for the geophysical equipment used during surveys. |

| Include reference to measures taken to ensure sample representation and the appropriate calibration of any measurement tools or systems used. | The measurement procedure involved placing 72 electrodes along two profiles, each 710m long, with a 10m spacing between electrodes. All electrodes were connected to the measurement equipment, and a specific sequential program was used to select which quadrupoles operated at each time and in what configuration. The final output is a terrain section displaying resistivity values in different colours, representing variations in this parameter. The measurement profiles were referenced at various points with Global Positioning System ("GPS") to precisely determine their location and to obtain the terrain topography, which will allow for reprocessing of the data considering the surface relief. | |

| Aspects of the determination of mineralisation that are Material to the Public Report. | The lithium (Li) and rubidium (Rb) mineralisation is associated with a fine-grained, sub-horizontal muscovite leucogranite , overlaying a regional granite. Intercalations of the regional granite within the leucogranite are also present. In various zones of the orebody, limits are not well defined, and the selected geophysical method can assist in delineating these boundaries. | |

| In cases where 'industry standard' work has been done this would be relatively simple (eg 'reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases, more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information. | The ERT system was applied along two profiles, each 710m long, oriented NE-SW and NW-SE, over the Conchas deposit. These profiles followed two tracks nearly perpendicular to each other. • A maximum electric load of 400 V was applied for both sequences. • Two measurement sequences were used: o The dipole-dipole sequence, optimised for detecting horizontal resistivity changes, with 2,921 data points. This method provides high lateral resolution and is sensitive to horizontal variations in resistivity, making it ideal for identifying geological boundaries and mineralised zones distributed horizontally. o The Schlumberger reciprocal sequence, used for detecting vertical resistivity changes, with 2,195 data points. This method is more sensitive to vertical variations and is commonly used for investigating stratified structures.

• Both sequences utilised a pulse duration of 500ms and a measurement stack of 2-4, meaning each reading was averaged from 2 to 4 repeated measurements to ensure data reliability. • The measurements were taken using a Syscal Pro 72 geophysical unit manufactured by Iris Instruments. This fully digital resistivity and induced polarisation system is designed for environmental, civil engineering, and mineral exploration applications. It features an internal 250 W transmitter with a maximum output of 800-1000 V and 2.5 A, ten simultaneous acquisition channels providing up to 1,000 readings per minute, and automatic switching for up to 72 electrodes. GPS points were recorded with a Garmin eTrex 32x device at the start and end of each profile, as well as at the end of each cable segment along the profile. This ensures precise geolocation for the entire geophysical survey line using a robust, colour-display handheld GPS capable of tracking both GPS and GLONASS satellites. | |

| Drilling techniques | Drill type (eg core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc) and details (eg core diameter, triple or standard tube, depth of diamond tails, face- sampling bit or other type, whether core is oriented and if so, by what method, etc). | No drilling was completed. |

| | ||

| Drill sample recovery | Method of recording and assessing core and chip sample recoveries and results assessed. | No drilling was completed. |

| Measures taken to maximise sample recovery and ensure representative nature of the samples. | The distribution of the electrodes and the sub-horizontal disposition of the mineralisation result in the generated section being perpendicular to the contacts. | |

| Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. | No drilling was completed. | |

| Logging | Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. | No drilling was completed. |

| Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. | The trial survey is treated as qualitative. The is no expected relationship between the resistivity or ERT anomalies and the grade of mineralisation. | |

| The total length and percentage of the relevant intersections logged | No drilling was completed. | |

| Sub- sampling techniques and sample preparation | If core, whether cut or sawn and whether quarter, half or all core taken. | No drilling was completed. |

| If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry. | No drilling was completed. | |

| For all sample types, the nature, quality and appropriateness of the sample preparation technique. | The forward modelling and the detection of two types of rocks with different resistivity in the surveyed area demonstrate the suitability and effectiveness of the ERT method for the study. This approach validates the identification of lithological contrasts and supports further interpretation of subsurface geological structures. | |

| Quality control procedures adopted for all sub- sampling stages to maximise representation of samples. | AGS had an onsite representative during the survey assessing the data quality. The measurement equipment is inspected and calibrated by the manufacturer according to its technical specifications, ensuring measurement reliability, accuracy, and traceability for all data collected during the geophysical survey. After placing all measurement electrodes for each profile, the equipment checks each electrode for proper connection and acceptable resistivity reading. Once all electrode resistivity values fall within the instrument's tolerance limits, measurements can begin. For each profile, about 5,000 to 8,000 resistivity readings are collected, with each reading performed in stacks of 2-4 repetitions. If successive readings deviate beyond tolerance, the instrument repeats the measurement up to four times, averages the result, and-if within tolerance-moves to the next reading. This process ensures accurate, reliable data for geophysical analysis. | |

| Measures taken to ensure that the sampling is representative of the in situ material collected, including for instance results for field duplicate/second-half sampling. | The 10m distance between electrodes and the 710m length of the survey lines ensure a penetration depth of over 150m into the ground. | |

| Whether sample sizes are appropriate to the grain size of the material being sampled. | This spacing and length allow for effective subsurface electrical resistivity measurements to study geological features at significant depths. | |

| Quality of assay data and laboratory tests | The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. | No assaying is conducted. The ERT technique is appropriate for the purpose used. |

| For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. | An industry standard ERT survey was carried out by EGS along 710 m lines. The main system parameters included: • A maximum electric load of 400 V was applied for both sequences. • Two measurement sequences were used: o The dipole-dipole sequence, optimised for detecting horizontal resistivity changes, with 2,921 data points. This method provides high lateral resolution and is sensitive to horizontal variations in resistivity, making it ideal for identifying geological boundaries and mineralised zones distributed horizontally. o The Schlumberger reciprocal sequence, used for detecting vertical resistivity changes, with 2,195 data points. This method is more sensitive to vertical variations and is commonly used for investigating stratified structures. • Both sequences utilised a pulse duration of 500ms and a measurement stack of 2-4, meaning each reading was averaged from 2 to 4 repeated measurements to ensure data reliability. • The measurements were taken using a Syscal Pro 72 geophysical unit manufactured by Iris Instruments. This fully digital resistivity and induced polarisation system is designed for environmental, civil engineering, and mineral exploration applications. It features an internal 250 W transmitter with a maximum output of 800-1000 V and 2.5 A, ten simultaneous acquisition channels providing up to 1,000 readings per minute, and automatic switching for up to 72 electrodes. GPS points were recorded with a Garmin eTrex 32x device at the start and end of each profile, as well as at the end of each cable segment along the profile. This ensures precise geolocation for the entire geophysical survey line using a robust, colour-display handheld GPS capable of tracking both GPS and GLONASS satellites. | |

| Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (ie lack of bias) and precision have been established. | AGS has an onsite representative during the survey assessing the data quality. After placing all measurement electrodes for each profile, the equipment checks each electrode for proper connection and acceptable resistivity reading. Once all electrode resistivity values fall within the instrument's tolerance limits, measurements can begin. For each profile, about 5,000 to 8,000 resistivity readings are collected, with each reading performed in stacks of 2-4 repetitions. If successive readings deviate beyond tolerance, the instrument repeats the measurement up to four times, averages the result, and-if within tolerance-moves to the next reading. This process ensures accurate, reliable data for geophysical analysis. | |

| Verification of sampling and assaying | The verification of significant intersections by either independent or alternative company personnel. | The anomalies identified during the study carried out by AGS have been confirmed by their technicians. The detected anomalies appear to correspond well with the two main types of rocks present in the study area when compared with surface mapping and drillholes near the profiles. |

| The use of twinned holes. | No drilling was completed. | |

| Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. | The measurement sequences are generated in advance on a computer using ELECTRE Pro software and uploaded to the field instrument with PROSYS. The instrument stores all measurement data in its memory, which are then downloaded to a computer via USB with PROSYS. This software is used for initial data analysis and filtering, creating *.bin files. These files are exported as *.INV files to RES2dINV, which allows further analysis and filtering. The final interpreted profiles, with colour-coded resistivity variations, are saved as *.DAT files. | |

| Discuss any adjustment to assay data. | Data may be levelled and is treated as qualitative. | |

| Location of data points | Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. | GPS points were recorded with a Garmin eTrex 32x device at the start and end of each profile, as well as at the end of each cable segment along the profile. This ensures precise geolocation for the entire geophysical survey line using a robust, colour-display handheld GPS capable of tracking both GPS and GLONASS satellites. The Garmin eTrex 32x offers typical location accuracy within ±3.65m under good conditions. |

| Specification of the grid system used. | The project currently uses the UTM Datum ETRS89 Zone 29 North grid system. | |

| Quality and adequacy of topographic control. | Topographic control is based on a digital terrain model with sub metric accuracy sourced from the Spanish Geographical Institute (Instituto Geográfico Nacional). | |

| Data spacing and distribution | Data spacing for reporting of Exploration Results. | A total of 72 electrodes were spaced every 10m along each of two 710m survey lines. |

| Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. | In ERT surveys, the spacing between electrodes critically affects the spatial resolution and depth of investigation. A 10m electrode spacing, as used in this study, provides a suitable balance to demonstrate continuity of lithology and resolve significant resistivity contrasts at depths beyond 150m. This spacing is adequate to detect and delineate subsurface features where mineralisation is oriented perpendicular to the survey lines, ensuring reliable geophysical imaging of the area. | |

| Whether sample compositing has been applied. | No composites reported. | |

| Orientation of data in relation to geological structure | Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. | Lithologies that are oriented perpendicular to the survey lines will be more prominent and apparent in the ERT results, making it easier to identify distinct resistivity contrasts and geological boundaries at the scale of interest during the geophysical survey. |

| If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. | No relevant bias is expected. | |

| Sample security | The measures taken to ensure sample security. | During the survey conducted by AGS, the data was kept under their custody. Berkeley received the interpreted data from AGS after the survey was completed. |

| Audits or reviews | The results of any audits or reviews of sampling techniques and data. | Berkeley evaluated the data and determined that its quality is adequate for further analysis. The Company notes that there appears to be sufficient contrast between different lithologies and that the results correlate well with the existing data, supporting the decision to undertake a broader geophysical campaign aimed at covering most of the deposit area. |

Section 2 - Reporting of Exploration Results - Electrical Resistivity Tomography Survey

| Criteria | Explanation | Commentary |

| Mineral tenement & land tenure status | Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environment settings. | The Conchas Prospect lies on the Conchas I IP 6930 which is 100% owned by Berkeley Minera España, S. L., a wholly owned subsidiary of Berkeley Energia Limited under the General Regulations for the Mining Regime established under Royal Decree 2857/1978 of 25 August in Spain. The Conchas I IP was originally granted in October 2020 for an initial three-year term. An extension of the Investigation Permit for a second three-year term (from October 2023) was granted in June 2024. There are no historical sites, reserves or specially protected areas in the zone, which is primarily used for livestock grazing and agriculture. The Conchas Prospect is located adjacent to the village of Fuentes de Oñoro and close to the border with Portugal. |

| The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. | Tenure in the form of a granted IP and is considered secure. There are no known impediments to obtaining a licence to operate in this area. | |

| Exploration done by other parties | Acknowledgement and appraisal of exploration by other parties. | Mining in the area dates back to the WWII years when, in an artisanal manner, tin and tungsten were obtained by means of surface excavations and washed by hand. Modern exploration at Conchas I was carried out by Billiton PLC between 1981 and 1983. The investigation was focused on tin and tantalum, with lithium, rubidium etc. not taken into account. Billiton carried out several exploration work programs which resulted in a regional geological map and another detailed geological map, a leucogranite bottom isopach map, geochemistry with 85 test pits, trenches and 20 percussion drill holes, and sectional interpretations of the different magmatic facies. SIEMCALSA (Mining Investigation and Exploration Society of Castilla y León, S.A.) within the European Union project POCTEP, summarized the Billiton data, making a review of the land and a chip sampling (14 samples) of the types of rocks existing in the area. Mineralogical and metallogenetic studies of samples were carried out at the Universities of León (Spain) and Porto (Portugal) however, Berkeley has not yet obtained access to these reports/results. Only public domain historical data has been obtained by Berkeley. |

| Geology | Deposit type, geological setting and style of mineralisation | Around the 70% of the permit area is filled by the Cenozoic cover and, only in the NW, the Fuentes de Oñoro granite can be found. Cenozoic materials have Oligocene age. Granites make up the Vilar Formoso-Fuentes de Oñoro area, which in turn belongs to the Guarda Batholith whose origin is associated with the Hercynian orogeny. Regionally, coarse to very coarse-grained granodiorites and porphyritic granites are found, porphyritic and with a considerable amount of biotite, arranged subparallel to the edge of the batholith and commonly considered as edge facies. The monzogranite facies is the one with the greatest superficial development and constitutes approximately 50% of the outcropping granites. They are two-mica granites, with a predominance of biotite, fine to coarse grain size and sometimes porphyry, although the potassium feldspar megacrystals do not reach the size of those of the previous edge facies. Aplogranites constitute the mineralised facies of aplo-pegmatitic leucogranites. This occurs in the vicinity of Fuentes de Oñoro and in front of the Portuguese town of Poço Velho. Preliminary mineralogy studies indicate the lithium, rubidium and caesium occurs in micas classified as intermediate between muscovite and zinnwaldite. It also presents a millimeter mineralisation of cassiterite, and columbo-tantalite distributed homogeneously throughout its surface. Cassiterite normally occurs in angular and heterometric crystals of between 10μm and 1mm. Tantalum and niobium occur in the form of columbo-tantalite, both in isolated crystals and in inclusions within the cassiterite. |

| Drill hole information | A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes: easting and northings of the drill hole collar; elevation or RL (Reduced Level-elevation above sea level in metres of the drill hole collar); dip and azimuth of the hole; down hole length and interception depth; and hole length | No drilling results reported. |

| If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is the case | No drilling results reported. | |

| Data aggregation methods | In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (e.g. cutting of high-grades) and cut-off grades are usually Material and should be stated. | No drilling results reported. |

| Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. | No drilling results reported. | |

| The assumptions used for any reporting of metal equivalent values should be clearly stated. | No drilling results reported. | |

| Relationship between mineralisation widths & intercept lengths | These relationships are particularly important in the reporting of Exploration Results. If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. | No drilling results reported. |

| If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (e.g. 'down hole length, true width not known'. | No drilling results reported. | |

| Diagrams | Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported. These should include, but not be limited to a plan view of the drill collar locations and appropriate sectional views. | Appropriate diagrams, including a map and ERT profiles are included in the main body of this announcement. |

| Balanced reporting | Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high-grades and/or widths should be practiced to avoid misleading reporting of exploration results. | Reporting of the ERT data is considered to be balanced. |

| Other substantive exploration data | Other exploration data, if meaningful and material, should be reported including (but not limited to: geological observations; geophysical survey results; geochemical survey results; bulk samples - size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. | All substantive results are reported |

| Further work | The nature and scale of planned further work (e.g. test for lateral extensions or depth extensions or large-scale step-out drilling). | The findings of this initial trial ERT survey provided encouragement to plan a more comprehensive ERT survey covering most of the surface area mapped as muscovite leucogranite. This survey was conducted in late October, with the results pending. Additional work at Conchas includes 3D modelling of the drilling data to refine the geological interpretation of the Li and Rb mineralisation as a precursor to resource estimation, preliminary pit optimisation, and a second phase of metallurgical test work to optimise the flotation and magnetic separation processes. |

| Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. | These diagrams are included in the main body of this release. |

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

| Name of entity | ||

| Berkeley Energia Limited | ||

| ABN | | Quarter ended ("current quarter") |

| 40 052 468 569 | | 30 September 2025 |

| Consolidated statement of cash flows | Current quarter | Year to date | |

| 1. | Cash flows from operating activities | - | - |

| 1.1 | Receipts from customers | ||

| 1.2 | Payments for | (424) | (424) |

| | (a) exploration & evaluation | ||

| | (b) development | - | - |

| | (c) production | - | - |

| | (d) staff costs | (265) | (265) |

| | (e) administration and corporate costs | (334) | (334) |

| 1.3 | Dividends received (see note 3) | - | - |

| 1.4 | Interest received | 652 | 652 |

| 1.5 | Interest and other costs of finance paid | - | - |

| 1.6 | Income taxes paid | - | - |

| 1.7 | Government grants and tax incentives | - | - |

| 1.8 | Other (provide details if material) (a) Business Development (b) Arbitration related expenses | (95) (1,371) | (95) (1,371) |

| 1.9 | Net cash from / (used in) operating activities | (1,837) | (1,837) |

| | |||

| 2. | Cash flows from investing activities | - | - |

| 2.1 | Payments to acquire or for: | ||

| | (a) entities | ||

| | (b) tenements | - | - |

| | (c) property, plant and equipment | - | - |

| | (d) exploration & evaluation | - | - |

| | (e) investments | - | - |

| | (f) other non-current assets | - | - |

| 2.2 | Proceeds from the disposal of: | - | - |

| | (a) entities | ||

| | (b) tenements | - | - |

| | (c) property, plant and equipment | - | - |

| | (d) investments | - | - |

| | (e) other non-current assets | - | - |

| 2.3 | Cash flows from loans to other entities | - | - |

| 2.4 | Dividends received (see note 3) | - | - |

| 2.5 | Other (provide details if material) | - | - |

| 2.6 | Net cash from / (used in) investing activities | - | - |

| | |||

| 3. | Cash flows from financing activities | - | - |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | ||

| 3.2 | Proceeds from issue of convertible debt securities | - | - |

| 3.3 | Proceeds from exercise of options | - | - |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | - | - |

| 3.5 | Proceeds from borrowings | - | - |

| 3.6 | Repayment of borrowings | - | - |

| 3.7 | Transaction costs related to loans and borrowings | - | - |

| 3.8 | Dividends paid | - | - |

| 3.9 | Other (provide details if material) | - | - |

| 3.10 | Net cash from / (used in) financing activities | - | - |

| | |||

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | | |

| 4.1 | Cash and cash equivalents at beginning of period | 73,594 | 73,594 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (1,837) | (1,837) |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | - | - |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | - | - |

| 4.5 | Effect of movement in exchange rates on cash held | (563) | (563) |

| 4.6 | Cash and cash equivalents at end of period | 71,194 | 71,194 |

| 5. | Reconciliation of cash and cash equivalents | Current quarter | Previous quarter |

| 5.1 | Bank balances | 71,144 | 73,544 |

| 5.2 | Call deposits | 50 | 50 |

| 5.3 | Bank overdrafts | - | - |

| 5.4 | Other (provide details) | - | - |

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 71,194 | 73,594 |

]

| 6. | Payments to related parties of the entity and their associates | Current quarter |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | (81) |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. | ||

| 7. | Financing facilities Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end |

|

| 7.1 | Loan facilities | - | - |

| 7.2 | Credit standby arrangements | - | - |

| 7.3 | Other (please specify) | - | - |

| 7.4 | Total financing facilities | - | - |

| |

| | |

| 7.5 | Unused financing facilities available at quarter end | - | |

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| Not applicable | |||

| 8. | Estimated cash available for future operating activities | $A'000 |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (1,837) |

| 8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | - |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (1,837) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 71,194 |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | - |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 71,194 |

| | | |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | >10 |

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as "N/A". Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

| 8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

| | 8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | |

| | Answer: Not applicable | |

| | 8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | |

| | Answer: Not applicable | |

| | 8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | |

| | Answer: Not applicable | |

| | Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | |

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 31 October 2025

Authorised by: Company Secretary

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity's activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: "By the board". If it has been authorised for release to the market by a committee of your board of directors, you can insert here: "By the [name of board committee - eg Audit and Risk Committee]". If it has been authorised for release to the market by a disclosure committee, you can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.