NEWS RELEASE I 31 October 2025

SEPTEMBER 2025 QUARTERLY REPORT

SEPTEMBER 2025 QUARTERLY REPORT

Sovereign Metals Limited (ASX:SVM, AIM:SVML, OTCQX:SVMLF) (Sovereign or the Company) is pleased to provide its quarterly report for the period ended 30 September 2025 including advances made at its Kasiya Rutile-Graphite Project (Kasiya or the Project) in Malawi.

HIGHLIGHTS DURING AND SUBSEQUENT TO THE QUARTER

Japanese Government Launches New Nacala Logistics Corridor Development Initiative

· Japan commits US$7 billion in development funding - $5.5 billion through joint program with African Development Bank, plus $1.5 billion in public-private impact investment through Japan's development agency.

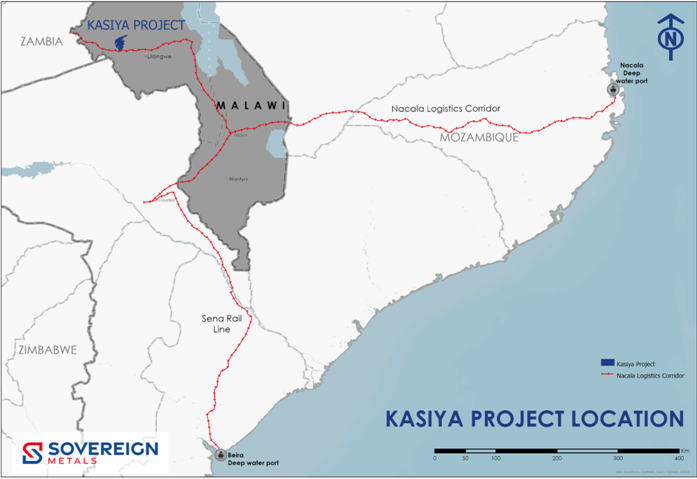

· Initiative focuses on capacity expansion, refurbishment, and resilience upgrades to increase throughput, enhance reliability, and reduce bottlenecks, positioning Kasiya as a key beneficiary of Japan's mineral security strategy.

· Nacala Corridor is Kasiya's preferred transport route - providing lowest-cost pathway from Kasiya to international markets via a deep-water port.

Various Critical Components of DFS now complete

· Geotechnical investigations successfully completed across all critical infrastructure locations with oversight from the Sovereign-Rio Tinto Technical Committee confirming favourable subsurface conditions aligned with regional geology

o Over 400 individual tests conducted covering mining infrastructure, tailings storage facility and raw water dam

o Consistent stratigraphy and suitable subsurface conditions to enable more standardised foundation designs and construction approaches across infrastructure areas

· Mining fleet specifically engineered for large-scale dry mining operations following the results of the successful Pilot Mining and Land Rehabilitation (Pilot Phase).

o No drilling, blasting, crushing or milling required at Kasiya resulting in low capital outlays and operating costs.

o Equipment selection and supplier identification completed for all operational requirements across the proposed initial 25-year mine life

· Rehabilitation of land at Pilot Phase test pit site successfully completed during the quarter, further de-risking DFS

o Exceptional first-year results from its rehabilitation trials at the Kasiya, delivering critical data that will inform the progressive rehabilitation strategy for the ongoing definitive feasibility study (DFS).

o Rehabilitation trials achieved 5x crop yield improvement - demonstrating superior post-mining land productivity versus traditional farming.

New Graphite Tariff Environment Underscores Kasiya's Global Significance

· In July 2025, the U.S. Commerce Department announced 93.5% preliminary anti-dumping duties on Chinese graphite imports, fundamentally altering the economics for battery manufacturers seeking secure, cost-competitive supply chains.

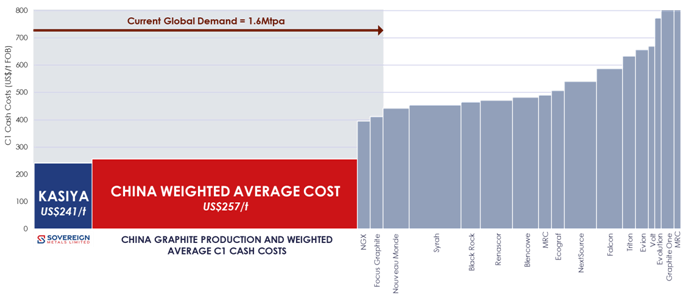

· The new tariff environment highlights Kasiya's potential as the world's largest and lowest-cost non-Chinese graphite producer with industry-leading US$241/t incremental cost of production.

Latest Testwork Validates Kasiya Graphite's World-Class Quality to Anode Manufacturers

· Latest coating optimisation testwork achieved successful coated spherical purified graphite (CSPG) production characteristics with superior performance metrics.

· Samples of Kasiya fine flake graphite concentrate have been distributed to leading natural graphite anode producers and anode project developers to support development of offtake agreements while validating market demand for Kasiya's high-quality battery-grade graphite

Kasiya Unaffected by Malawi Raw Mineral Export Order

· Subsequent to the quarter, His Excellency President Peter Mutharika, the newly elected President of Malawi, announced an Executive Order regarding the prohibition of the export of raw minerals from the country.

· This prohibition does not apply to the Company or to Kasiya as the ban only relates to minerals that have not been processed, refined, or value-added in Malawi.

o With regards to its future planned Kasiya operations, Sovereign has no plans to export run-of-mine Heavy Mineral Sands as defined in the Executive Order. All future mineralisation will be extracted and beneficiated in country to a final premium quality rutile (+95% TiO2) product. The high-quality Kasiya rutile product is planned to be a direct feedstock for titanium sponge production for high-end titanium metal products, including aerospace and defence applications.

o Similarly, Sovereign intends to process the run-of-mine Graphite as defined in the Executive Order in-country to produce a high-quality graphite product (96% C) suitable for major industry end markets including battery producers and refractory manufacturers.

Next Steps

Over the quarter ending December 2025, Sovereign will:

· continue to advance the Kasiya DFS, for completion in the first quarter of 2026, including finalising mining fleet design, process plant configuration, and mine gate-to-vessel logistics solutions;

· advance rutile and graphite offtake discussions; and

· further the Company's community and social development programs in Malawi.

| Enquiries |

|

| Frank Eagar, Managing Director & CEO South Africa / Malawi +27 21 140 3190 |

|

|

Nominated Adviser on AIM and Joint Broker |

|

| SP Angel Corporate Finance LLP | +44 20 3470 0470 |

| Ewan Leggat Charlie Bouverat | |

|

|

|

| Joint Broker |

|

| Stifel | +44 20 7710 7600 |

| Varun Talwar | |

| Ashton Clanfield | |

| | |

JAPAN TARGETS KASIYA TRANSPORT CORRIDOR IN NEW STRATEGIC MINERALS INITIATIVE

During the quarter, the Government of Japan launched a dedicated investment initiative targeting the Nacala Corridor infrastructure, significantly strengthening the strategic positioning of the Kasiya Project. As discussed above Toho Titanium confirmed that natural rutile from Kasiya meets specifications for high-performance titanium metal production.

The initiative aims to improve transportation infrastructure and promote industrial development in the Nacala Corridor region, including Malawi, to increase its value as a transportation route for mineral resources and ultimately strengthen Japan's global supply chains related to critical minerals.

Japan's US$7 billion commitment includes US$5.5 billion through the Enhanced Private Sector Assistance for Africa program, which provides development funding to African countries through the African Development Bank. Additionally, US$1.5 billion will be mobilised through Japan's development agency for direct investment in private sector projects, including mining and infrastructure developments.

The initiative creates multiple strategic advantages for Kasiya, positioning the Project as a key beneficiary of Japan's mineral security strategy.

The Nacala Corridor serves as the preferred transportation route for Sovereign's forthcoming DFS, providing a direct route to the deep-water port of Nacala and offering Kasiya a low-cost pathway to global markets with significant capital and operating savings.

Japan's initiative focuses on capacity expansion, refurbishment, and resilience upgrades to increase throughput, enhance reliability, and reduce bottlenecks, directly benefiting projects such as Kasiya.

To access the Nacala Corridor, Sovereign plans to construct a six-kilometre rail spur linking the proposed plant to the Nacala Corridor, ensuring efficient freight handling. The Company is in discussions with leading regional logistics providers on rail and port solutions to ensure reliable and cost-efficient transport of rutile and graphite to international markets.

Figure 1: Bulk cargo trains operating on Nacala Corridor

Figure 2: Kasiya is ideally located on the Nacala Corridor

VARIOUS CRITICAL COMPONENTS OF DFS NOW COMPLETE

Geotechnical Programs Complete

In July 2025, the Company announced the successful completion of comprehensive feasibility-level geotechnical fieldwork programs at Kasiya.

The geotechnical investigations conducted by ARQ Geotech (Pty) Ltd and with oversight from the Sovereign-Rio Tinto Technical Committee, provide essential subsurface data that will inform detailed engineering design and infrastructure planning across major Project components. The comprehensive scope covered critical infrastructure areas including mining operations, process plants, tailings storage facility (TSF), and raw water storage dam - representing the foundational elements required for the Project's development.

The fieldwork programs employed a sophisticated combination of near-surface and deep investigation techniques across the project site, with over 400 individual tests conducted to characterise soil and rock profiles comprehensively.

Initial results indicate highly favourable subsurface conditions that correlate well with the expected regional geology. The material profiles encountered across all infrastructure sites show generally consistent stratigraphy comprising the following:

· Surface topsoil horizon,

· Underlying transported horizon of variable origin (aeolian, colluvium, and alluvium),

· Reworked residual gneiss transitioning to residual gneiss with depth,

· Deeply weathered soil profile consistently observed across the areas,

· The weathered soil profile transitioning to extremely soft to very soft rock, and ultimately into hard rock at greater depths, and

· Subsurface materials are generally derived from gneissic bedrock.

Consistent stratigraphy and suitable subsurface conditions to enable more standardised foundation designs and construction approaches across infrastructure areas, potentially reducing engineering complexity and construction costs.

Significantly, ferricrete identified within the transported horizon has been assessed as potentially reusable as engineered fill material.

Figures 3-6 Clockwise from Top Left: Geotechnical diamond drilling, auger drilling, seismic geophysics testing using multi-channel analysis of surface waves (MASW), Cone Penetration Test with pore pressure measurements (CPTu) rig.

Mining Method and Fleet Design Finalised

During the quarter, the Company finalised the selection of mining equipment specifically designed for large-scale dry mining operations at Kasiya. Following the successful 2024 Pilot Phase, which confirmed that Kasiya ore can be efficiently mined using conventional dry mining techniques, the comprehensive fleet design encompasses both primary mining operations and support activities across the Project's proposed initial 25-year life of mine.

The dry mining approach, detailed in the Optimised Prefeasibility Study (OPFS), will deliver superior project delivery, operational flexibility, and environmental outcomes. The fleet deployment follows a strategic phased approach, with a total of ~200+ equipment units to be purchased over the mine life, including replacements.

The Company has conducted a comprehensive market analysis and identified leading global equipment manufacturers as potential suppliers, including Caterpillar Inc., Komatsu Ltd., Liebherr Group, Hitachi, Ltd., and Volvo Group.

Primary mining equipment includes draglines, large excavators, mine trucks and front-end loaders. Support equipment will include dozers, graders, articulated dump trucks, and other light vehicles, along with ancillary equipment.

Figure 7: Example of a dragline excavator in action (Source: Liebherr Group)

Successful Rehabilitation Further De-Risks DFS

In August 2025, the Company announced exceptional first-year results from its rehabilitation trials at Kasiya, delivering critical data that will inform the progressive rehabilitation strategy for the ongoing DFS.

The successful rehabilitation trials address a key component of Kasiya's development pathway, demonstrating that post-mining land can achieve superior agricultural productivity compared to pre-mining conditions. With maize yields of 5.2 tonnes per hectare, compared with the regional average of 1 tonne per hectare, the trials validate Sovereign's progressive mining, backfilling, and rehabilitation approach, which will be integrated into the DFS.

The 10-hectare pilot program achieved a 5x increase in crop yield through soil remediation, engaged 28 local farmers as partners, and demonstrated the effectiveness of the rehabilitation process for scaled-up implementation. Sovereign followed a systematic six-step rehabilitation process that successfully restored the disturbed land back to productive agricultural use:

1. Land preparation with complete backfill and grading to original contours.

2. Soil nutrient enhancement via application of locally sourced lime, biochar and fertilisers.

3. Mechanical integration using community-sourced equipment.

4. Strategic planting of bamboo blocks with intercropped maize and legumes.

5. Harvest success delivering 5.2 tonnes/hectare average yield.

6. Year-round productivity enabled by drip irrigation for winter farming programs.

The rehabilitation approach combines proven agronomic practices with innovative techniques, including biochar application, precision nutrient management, and intercropping with Giant Bamboo, creating a replicable model for broader Kasiya development. These rehabilitation results will be integrated into Sovereign's progressive rehabilitation strategy within the DFS, supporting:

· Project-specific closure provisioning through demonstrated restoration success.

· Enhanced community value proposition via improved post-mining land productivity.

· Proven environmental stewardship.

· Strengthened ESG positioning.

Figures 8-9: LEFT - Test pit site during the mining trials (September 2024) & RIGHT - Rehabilitation site with mature crop (May 2025)

NEW GRAPHITE TARIFF ENVIRONMENT UNDERSCORES KASIYA'S GLOBAL SIGNIFICANCE

In July 2025, the Company announced that the latest testwork on graphite from Kasiya has delivered highly successful results. The testwork focused on optimising the coating process for conversion of Kasiya-derived spherical purified graphite (SPG) coated spherical CSPG while maintaining premium performance.

The results will assist with ongoing offtake discussions with anode manufacturers. Sovereign is developing Kasiya to potentially become the world's largest and lowest-cost natural graphite producer outside of China with an incremental cost of graphite production of US$241/t.

Figure 10: Natural Flake Graphite Industry Cost Curve for Projects at Prefeasibility Stage or Later

(Sources: See Appendix 4)

The global graphite supply chain is experiencing fundamental realignment following the U.S. Commerce Department's 17 July 2025 announcement of 93.5% preliminary anti-dumping duties on Chinese graphite imports. Combined with existing tariffs, this creates an effective 160% barrier on Chinese graphite, fundamentally altering the economics for battery manufacturers seeking secure, cost-competitive supply chains. China currently controls approximately 75% of global graphite production and 97% of anode material processing, creating critical supply chain vulnerabilities that major battery manufacturers are now actively addressing.

Tesla, Inc. (Tesla) and Panasonic were among companies that opposed the new US tariffs, with Tesla's submission to the U.S. Government stating that U.S. graphite producers have yet to demonstrate the "technical ability to produce commercial quantities" of graphite at the quality and purity required by Tesla and other battery cell manufacturers.

Once developed, Kasiya has the potential to become the world's largest and lowest-cost natural flake graphite producer, offering battery manufacturers a strategic alternative to Chinese supply chains for anode material feedstock. The latest successful coating testwork is a further demonstration of Kasiya's increasing strategic importance.

LATEST TESTWORK VALIDATES KASIYA GRAPHITE'S WORLD-CLASS QUALITY TO ANODE MANUFACTURERS

Optimisation testwork conducted by Prographite GmbH (Prographite) has once again demonstrated the exceptional characteristics of Kasiya graphite for CSPG production. The optimisation process successfully achieved target coating specifications and optimised inputs into the coating process while maintaining the premium performance metrics that position Kasiya graphite among the highest-quality sources globally (refer to Announcement "Outstanding Battery Anode Material Produced From Kasiya Graphite" dated 4 September 2024 for previously announced premium performance metrics).

Pitch coating is a standard refinement process where carbon-rich pitch material is applied to spherical graphite particles to create protective layers that enhance battery performance and longevity, turning SPG into CSPG. The latest testwork systematically evaluated pitch content to achieve optimal performance parameters.

Key achievements from the process include:

· Process Efficiency Demonstrated: Coating requirements optimised while maintaining superior CSPG characteristics

· Premium Performance Maintained: All target specifications achieved for discharge capacity (>360mAh/g) and first cycle efficiency (>94%)

· Physical Properties Achieved: Specific surface area (<4m²/g) and tap density (>1.0 g/cm³) specifications met

The electrochemical test results demonstrate the consistently high quality of CSPG produced from Kasiya graphite:

| Table 1: Electrochemical Half-Cell Testing Results | |||

| Pitch Coating Level | Initial Charge (mAh/g) | Initial Discharge (mAh/g) | First Cycle Efficiency (%) |

| Baseline (100%) | 390 | 369 | 94.64 |

| Optimised (60%) | 388 | 366 | 94.36 |

The data confirms that Kasiya graphite consistently delivers discharge capacity well above the critical 360mAh/g threshold while achieving first cycle efficiency above 94% - both key specifications for premium-quality natural graphite anode materials.

KASIYA UNAFFECTED BY MALAWI RAW MINERAL EXPORT ORDER

Subsequent to the quarter, the Company acknowledged the Executive Order by His Excellency President Peter Mutharika, the newly elected President of Malawi, regarding the prohibition of the export of raw minerals from the country.

This prohibition does not apply to the Company or the Kasiya Rutile-Graphite Project (Kasiya or Project), as the ban applies only to minerals that have not been processed, refined, or value-added in Malawi.

With regards to its future planned Kasiya operations, Sovereign has no plans to export run-of-mine Heavy Mineral Sands as defined in the Executive Order. All future mineralisation will be extracted and beneficiated in country to a final premium quality rutile (+95% TiO2) product.

The high-quality Kasiya rutile product is planned to be a direct feedstock for titanium sponge production for high-end titanium metal products, including aerospace and defence applications. Similarly, Sovereign intends to process the run-of-mine Graphite as defined in the Executive Order in-country to produce a high-quality graphite product (96% C) suitable for major industry end markets including battery producers and refractory manufacturers.

The Company continues to work with the Government of Malawi and the Malawi Mines Department for the ongoing development of the Kasiya Project.

NEXT STEPS

Various new workstreams are being adopted into the DFS, with completion expected in the first quarter of 2026. These include enhanced focus on plant design and configuration, and environmental and social impact workstreams. These workstreams have been included in the DFS work program to ensure it meets many of the requirements of potential future lenders, including development finance institutions, export credit agencies and potential future offtakers.

The Company will continue to update stakeholders regarding progress, including:

· Mineral Resource update;

· active discussions with US-based and "allied-nation" offtakers of rutile and graphite;

· environmental and social impact assessments; and

· infrastructure and logistics planning.

Competent Person Statement

The information in this announcement that relates to the exploration results (metallurgy - graphite) is extracted from an announcement dated 28 July 2025, which is available to view at www.sovereignmetals.com.au. Sovereign confirms that a) it is not aware of any new information or data that materially affects the information included in the original announcement; b) all material assumptions included in the original announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons' findings are presented in this announcement have not been materially changed from the original announcement.

The information in this announcement that relates to Production Targets, Ore Reserves, Processing, Infrastructure and Capital and Operating Costs is extracted from an announcement dated 22 January 2025, which is available to view at www.sovereignmetals.com.au. Sovereign confirms that: a) it is not aware of any new information or data that materially affects the information included in the original announcement; b) all material assumptions included in the original announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons' findings are presented in this announcement have not been materially modified from the original announcement.

Forward Looking Statement

This release may include forward-looking statements, which may be identified by words such as "expects", "anticipates", "believes", "projects", "plans", and similar expressions. These forward-looking statements are based on Sovereign's expectations and beliefs concerning future events. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Sovereign, which could cause actual results to differ materially from such statements. There can be no assurance that forward-looking statements will prove to be correct. Sovereign makes no undertaking to subsequently update or revise the forward-looking statements made in this release, to reflect the circumstances or events after the date of that release.

The information contained within this announcement is deemed by Sovereign to constitute inside information as stipulated under the Regulation 2014/596/EU which is part of domestic law pursuant to the Market Abuse (Amendment) (EU Exit) Regulations (SI 2019/310) ("UK MAR"). By the publication of this announcement via a Regulatory Information Service, this inside information (as defined in UK MAR) is now considered to be in the public domain.

APPENDIX 1: SUMMARY OF MINING TENEMENTS

As at 30 September 2025, the Company had an interest in the following tenements:

| Licence | Holding Entity | Interest | Type | Licence Renewal Date | Expiry Term Date1 | Licence Area (km2) | Status |

| EL0609 | MML | 100% | Exploration | 25/09/2026 | 25/09/2028 | 219.5 | Granted |

| EL0582 | SSL | 100% | Exploration | 15/09/20252 | 15/09/2028 | 69.8 | Granted |

| EL0561 | SSL | 100% | Exploration | 15/09/20252 | 15/09/2028 | 30.7 | Granted |

| EL0657 | SSL | 100% | Exploration | 3/10/2028 | 3/10/2031 | 2.3 | Granted |

| EL0710 | SSL | 100% | Exploration | 1/02/2027 | 1/02/2031 | 38.4 | Granted |

| RTL0035-RTL0045 | SSL | 100% | Retention | N/A | 26/06/2026 | 285.2 | Granted |

| EL0528 | SSL | 100% | Exploration | N/A | 27/11/20253 | 16.2 | Granted |

| EL0545 | SSL | 100% | Exploration | N/A | 12/05/20263 | 24.2 | Granted |

Notes:

SSL: Sovereign Services Limited, MML: McCourt Mining Limited

1 An exploration licence (EL) covering a preliminary period in accordance with the Mines and Minerals Act (2023) (2023 Mines Act) is granted an initial period of five (5) years with the ability to extend by three (3) years on two occasions (a total term of 11 years). ELs that have come to the end of their term can be converted by the EL holder into a retention licence (RL) for a term not exceeding five (5) years subject to meeting certain criteria or any conditions imposed on the RL.

2 The Company has submitted two EL applications, APL0739 (16.2km2) and APL0740 (71.5km2), which remain pending as at 30 September 2025.

3 Licence surrender letters submitted for non-core ELs.

APPENDIX 2: RELATED PARTY PAYMENTS

During the quarter ended 30 September 2025, the Company made payments of A$350,000 to related parties and their associates. These payments relate to existing remuneration arrangements (executive salaries, director fees, superannuation and bonuses (A$252,000)) and provision of serviced office facilities, company secretarial services and administration services (A$98,000).

APPENDIX 3: MINING EXPLORATION EXPENDITURES

During the quarter, the Company made the following payments in relation to mining exploration activities:

| Activity | A$'000 |

| Feasibility Studies (DFS & trial mining pilot phase) | 6,870 |

| Drilling related | 519 |

| Assaying and Metallurgical Test-work | 420 |

| ESG related (including community and social development programs) | 751 |

| Malawi Operations (site office, personnel, field supplies, equipment, vehicles and travel | 2,675 |

| Total as reported in Appendix 5B | 11,235 |

There were no mining or production activities and expenses incurred during the quarter ended 30 September 2025.

APPENDIX 4: FLAKE GRAPHITE OPERATING COST INFORMATION

1. China weighted average C1 cash cost source: Benchmark Mineral Intelligence

2. Cumulative Demand & China graphite production source: S&P Global Market Intelligence

3. Company specific disclosure sources as follows:

| Company | Project | Stage of Development | C1 Cash Costs (FOB) US$/t | Steady State Production tpa | Current Production tpa | Notes | Source |

| Black Rock Mining | Mahenge | Financing post DFS | 466 | 89,000 | - | Operating costs are for first 10 years therefore prodcution of first 10 years only shown | Company Announcement: Black Rock Completes FEED and eDFS Update (10 October 2022) |

| Blencowe Resources | Orom-Cross | PFS Complete | 482 | 101,000 | - | - | Company Announcement: Major Milestone as Blencowe Delivers US$482M NPV Pre-Feasibility Study for Orom-Cross Graphite Project (19 July 2022) |

| Ecograf | Epanko | BFS Complete | 508 | 73,000 | - | - | Updated Epanko Ore Reserve (25 July 2024) |

| Evion | Maniry | DFS Complete | 657 | 56,400 | - | Production of 56.4ktpa is from year 4. Years 1-3 production is 39ktpa | BlackEarth Minerals Maniry Graphite Project Definitive Feasibility Study (3 November 2022) |

| Evolution Energy | Chilalo | DFS Complete | 773 | 52,000 | - | Operating costs are for first 9 years of production | Company Announcement: FEED and updated DFS confirms Chilalo as a standout high margin, low capex and development-ready graphite project (20 March 2023) |

| Falcon Energy Materials | Lola | Updated DFS Complete | 588 | 92,435 | - | - | SEDAR Filing: Lola Graphite Project NI 43-101 Technical Report - Updated Feasibility Study (7 April 2023) |

| Focus Graphite | Lac Knife | FS Complete | 413 | 50,000 | - | Converted from Canadian Dollars to US Dollars based on exchange rate used in source document of 1.00 CAD / 0.736 USD | Company Announcement: NI 43-101 Technical Report - Feasibility Study Update Lac Knife Graphite Project Québec, Canada (14 April 2023) |

| Graphite One | Graphite Creek | PFS Complete | 1,394 | 51,813 | - | Production and costs relate to Graphite Creek Mine and not the proposed graphite manufacturing facility | Company Announcement: Graphite One Advances its United States Graphite Supply Chain Solution Demonstrating a Pre-tax USD$1.9B NPV (8%), 26.0% IRR and 4.6 Year Payback on its Integrated Project (29 August 2022) |

| Mineral Commodities | Skaaland | Production | 1,434 | 10,000 | 10,000 | Production based on annual operating target, costs based on latest reported numbers for September 2024 | Quarterly Activities Report: September 2024 |

| Mineral Commodities | Munglinup | DFS Complete | 491 | 54,000 | - | - | Company Announcement: Robust Munglinup DFS Results Allow MRC to Move to 90% Ownership of Munglinup Graphite Project (8 January 2020) |

| NextSource Materials | Molo | Construction | 541 | 150,000 | - | Figures relate to Molo expansion case. | Company Announcement: Nextsource Materials announces robust feasibility study results for Molo Mine expansion to 150,000 tonnes per annum of Superflake® graphite concentrate (12 December 2023) |

| NGX | Malingunde | PFS Complete | 396 | 52,000 | - | - | Company Presentation: Clean Energy Minerals in Africa (August 2024) |

| Nouveau Monde Graphite | Matawinie | Construction | 443 | 103,328 | - | Exchange rate used as per technical report | Technical Report: Feasibility Study for the Matawinie Property |

| Renascor | Siviour | DFS Complete | 472 | 150,000 | - | - | Company Announcement: Siviour Battery Anode Material Study Results (8 August 2023) |

| Syrah Resources | Balama | Production | 455 | 240,000 | - | Production based on Company guidance of 20kt per month production rate. Operating costs based on midpoint of Balama C1 cost (FOB Nacala/Pemba) medium-term guidance of US$430-480 per tonne. | Company Quarterly Activities Report September 2024 (30 October 2024) |

| Triton | Ancuabe | DFS Complete | 634 | 60,000 | - | 2023 updates to DFS do not include updated costs and base case production figures. On 9th December 2024, Triton Minerals announced that it had executed a Share Sale and Purchase Agreement with Shandong Yulong Gold Limited for the sale of at least 70% of its interests in the entities that hold the Ancuabe Graphite Project | Company Announcement: Triton Delivers Robust Ancuabe Definitive Feasibility Study and Declares Maiden Ore Reserve (15 December 2017) |

| Volt Resources | Bunyu | Stage 1 FS Complete | 670 | 24,780 | - | Relates to stage 1 development which has had a feasibility study completed | Company Announcement: Feasibility Study Update for Bunyu Graphite Project Stage 1, Tanzania, delivers significantly improved economics (14 August 2023) |

Notes:

1. Blencowe Resources C1 cash costs calculated as US$499/t operating costs (FOB) less US$17/t royalties as disclosed in the source above

2. South Star Battery Metals Corp.'s Santa Cruz mine not included as FOB costs not disclosed. For reference, operating costs are disclosed as US4396/t from source: Technical Report: Updated Resources and Reserves Assessment and Pre-feasibility Study (18 March 2020)

3. Magnis not included while shares are suspended by the ASX in December 2023

4. Walkabout's Lindi Project not included following appointment of voluntary administrators and Receivers in November 2024

5. Leading Edge Materials Woxna Graphite not included as it is currently under care and maintenance

6. Northern Graphite's Lac des Iles not included due to recent maintenance

7. Talga Group not shown as latest technical study based on integrated anode plant strategy

8. Tirupati Graphite not included due to lack of relevant disclosure

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity | ||

| Sovereign Metals Limited | ||

ABN | | Quarter ended ("current quarter") |

| 71 120 833 427 | | 30 September 2025 |

Consolidated statement of cash flows | Current quarter | Year to date | |

| 1. | Cash flows from operating activities | - | - |

| 1.1 | Receipts from customers | ||

| 1.2 | Payments for | (11,235) | (11,235) |

| | (a) exploration & evaluation | ||

| | (b) development | - | - |

| | (c) production | - | - |

| | (d) staff costs | (427) | (427) |

| | (e) administration and corporate costs | (307) | (307) |

| 1.3 | Dividends received (see note 3) | - | - |

| 1.4 | Interest received | 697 | 697 |

| 1.5 | Interest and other costs of finance paid | - | - |

| 1.6 | Income taxes paid | - | - |

| 1.7 | Government grants and tax incentives | - | - |

| 1.8 | Other - Business Development | (367) | (367) |

| 1.9 | Net cash from / (used in) operating activities | (11,639) | (11,639) |

| | |||

| 2. | Cash flows from investing activities | - | - |

| 2.1 | Payments to acquire or for: | ||

| | (a) entities | ||

| | (b) tenements | - | - |

| | (c) property, plant and equipment | (71) | (71) |

| | (d) exploration & evaluation | - | - |

| | (e) investments | - | - |

| | (f) other non-current assets | - | - |

| 2.2 | Proceeds from the disposal of: | - | - |

| | (a) entities | ||

| | (b) tenements | - | - |

| | (c) property, plant and equipment | - | - |

| | (d) investments | - | - |

| | (e) other non-current assets | - | - |

| 2.3 | Cash flows from loans to other entities | - | - |

| 2.4 | Dividends received (see note 3) | - | - |

| 2.5 | Other (provide details if material) | - | - |

| 2.6 | Net cash from / (used in) investing activities | (71) | (71) |

| | |||

| 3. | Cash flows from financing activities | - | - |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | ||

| 3.2 | Proceeds from issue of convertible debt securities | - | - |

| 3.3 | Proceeds from exercise of options | - | - |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | - | - |

| 3.5 | Proceeds from borrowings | - | - |

| 3.6 | Repayment of borrowings | - | - |

| 3.7 | Transaction costs related to loans and borrowings | - | - |

| 3.8 | Dividends paid | - | - |

| 3.9 | Other (provide details if material) | - | - |

| 3.10 | Net cash from / (used in) financing activities | - | - |

| | |||

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | | |

| 4.1 | Cash and cash equivalents at beginning of period | 54,538 | 54,538 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (11,639) | (11,639) |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (71) | (71) |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | - | - |

| 4.5 | Effect of movement in exchange rates on cash held | 26 | 26 |

| 4.6 | Cash and cash equivalents at end of period | 42,854 | 42,854 |

| 5. | Reconciliation of cash and cash equivalents | Current quarter | Previous quarter |

| 5.1 | Bank balances | 6,979 | 5,018 |

| 5.2 | Call deposits | 35,875 | 49,520 |

| 5.3 | Bank overdrafts | - | - |

| 5.4 | Other (provide details) | - | - |

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 42,854 | 54,538 |

| 6. | Payments to related parties of the entity and their associates | Current quarter |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | (349) |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. | ||

| 7. | Financing facilities | Total facility amount at quarter end | Amount drawn at quarter end |

| 7.1 | Loan facilities | - | - |

| 7.2 | Credit standby arrangements | - | - |

| 7.3 | Other (please specify) | - | - |

| 7.4 | Total financing facilities | - | - |

| |

| | |

| 7.5 | Unused financing facilities available at quarter end | - | |

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| | |||

| 8. | Estimated cash available for future operating activities | $A'000 |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (11,639) |

| 8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | - |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (11,639) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 42,854 |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | - |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 42,854 |

| | | |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 4 |

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as "N/A". Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

| 8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

| | 8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | |

| | Answer: Not applicable | |

| | 8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | |

| | Answer: Not applicable | |

| | 8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | |

| | Answer: Not applicable | |

| | Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | |

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 31 October 2025

Authorised by: Company Secretary

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity's activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: "By the board". If it has been authorised for release to the market by a committee of your board of directors, you can insert here: "By the [name of board committee - eg Audit and Risk Committee]". If it has been authorised for release to the market by a disclosure committee, you can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council's Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.