Ecofin U.S. Renewables Infrastructure Trust PLC

31 October 2025

For immediate release.

This announcement contains information that is inside information for the purposes of Article 7 of the UK version of Regulation (EU) No. 596/2014 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018, as amended (the "Market Abuse Regulation").

Ecofin U.S. Renewables Infrastructure Trust PLC (the "Company")

Proposal for Disposal of Whirlwind

The Board of the Company is pleased to announce that it has signed a letter of intent, (the "Proposal") for the sale of Whirlwind, a 59.8 MW wind project in Texas (the "Project") and granted the potential buyer an exclusivity period of 60 days. The Proposal is subject to open items of due diligence being resolved to the satisfaction of the buyer (the "Buyer") and the negotiation of definitive legal documentation.

The total consideration payable to RNEW Capital, LLC (an indirect wholly-owned subsidiary of the Company) (the Seller) would consist of:

· US$12.0 million at closing (the "Closing Payment"), plus

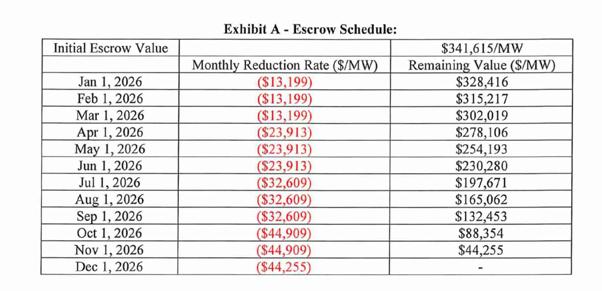

· an "Escrow Holdback" of US$11.0 million, which will be placed into an interest-bearing escrow account at Closing (the "Escrow"). The escrow serves as a security for the resolution of the interconnection stability curtailment issue (the "Stability Issue") which is limiting the Project's operational capacity. The Escrow Holdback is sized assuming the current 32.2MW of curtailment at an initial value of $341,615 per MW of curtailed capacity ("Initial Escrow Value").

Full Release: All escrowed funds are released to the Seller upon the full lifting of the Project's operational curtailment and Project can operate consistently at full nameplate capacity, confirming the resolution of the Stability Issue. If the Stability Issue is resolved prior to the Closing Date, there will be no Escrow Holdback.

Partial Release: If there is a partial lifting of the Project's operational curtailment then escrow funds proportional to the MWs of curtailment lifted multiplied by the Remaining Value as per the schedule in Exhibit A (below) will be released from Escrow to the Seller.

Monthly Reduction: Beginning Jan 1st, 2026 and on the 1st of every successive month, funds will be forfeited from Escrow to the Buyer for every MW still under curtailment, compensating for the reduced asset value. The monthly reduction amount forfeited from Escrow to Buyer will be equal to the Monthly Reduction Rate shown in the Exhibit A below multiplied by the MWs under curtailment at that time. For example, if on March 1st the curtailment is 10MW, then $131,990 ($13,199/MW x 10MW) will be forfeited from Escrow to Buyer.

Final Deadline: Any remaining Escrow balance is forfeited to Buyer if the Stability Issue is not resolved by December 1st, 2026.

plus

· a "Repowering Earnout" of up to US$7.0 million : $269,230 shall be payable for each eligible unit that is repowered and placed in service by December 31st, 2027, provided such unit qualifies for the Production Tax Credit ("PTC"). Based on the 26 qualifying units in the Project, the total Repowering Earnout is up to $7,000,000.

The Company expects to execute definitive agreements on the Proposal by the end of 2025, with closing expected to take place within 10 business days of finalizing such definitive agreements. There can be no certainty that definitive agreements in respect of the Proposal will be entered into.

The Company's carrying value of the Project in the Half Yearly Financial results to 30 June 2025 was $29.9m.

Marathon Capital Markets, LLC is acting as financial adviser to the Company in connection with the Proposal.

|

Enquiries

|

|

|

|

|

| Ecofin U.S. Renewables Infrastructure Trust PLC Brett Miller

| via the Company Secretary |

|

| |

| Marathon Capital Markets, LLC (Financial Adviser) Andrea Rosko (Director, Marketing & Communications)

| +1 312 989 1348 |

|

Apex Listed Companies Services (UK) Limited (Company Secretary) |

+44 20 3327 9720 |

IMPORTANT NOTICES

Financial adviser

Marathon Capital Markets, LLC (Marathon) which is registered with the U.S. Securities and Exchange Commission and regulated by the Financial Industry Regulatory Authority in the United States, has acted as financial adviser to the Company and for no one else in connection with the matters set out in this announcement and is not, and will not be, responsible to anyone other than the Company for providing the protections afforded to clients nor for providing advice in connection with the matters set out in this announcement.

Neither Marathon nor any persons associated or affiliated with it accepts any responsibility whatsoever or makes any representation or warranty, express or implied, concerning the contents of this announcement, including its accuracy, completeness or verification, or concerning any other statement, made or purported to be made by it or them, or on its or their behalf, the Company or the directors in connection with the Company or the Disposal, and nothing in this announcement is, or shall be relied upon as, a promise or representation in this respect, whether as to the past or future. Marathon and its respective associates and affiliates accordingly disclaim, to the fullest extent permitted by law, all and any responsibility and liability whether arising in tort, contract or otherwise which it or they might otherwise have in respect of this announcement or any such statement.

General

This announcement is not a prospectus and is not intended to, and does not, constitute or form part of any offer, invitation or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, or issue any securities whether pursuant to this announcement or otherwise.

The release, publication or distribution of this announcement in jurisdictions outside the United Kingdom may be restricted by laws of the relevant jurisdictions and therefore persons into whose possession this announcement comes should inform themselves about, and observe, such restrictions. Any failure to comply with the restrictions may constitute a violation of the securities law or any such jurisdiction.

The person responsible for arranging for the release of this announcement on behalf of the Company is Jenny Thompson of Apex Listed Companies Services (UK) Limited.

Presentation of financial information

References to "US$" are to the lawful currency of the United States.

Certain financial data has been rounded, and, as a result of this rounding, the totals of data presented in this announcement may vary slightly from the actual arithmetic totals of such data.

LEI Number

The Company's LEI Number is 2138004JUQUL9VKQWD21

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.