Company Registration No. 009753V (Isle of Man)

PANTHER METALS PLC

ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2024

PANTHER METALS PLC

COMPANY INFORMATION

Directors Darren Hazelwood (Chief Executive Officer)

Nicholas O'Reilly (Executive Chairman)

Simon Rothschild (Non-executive Director)

Tracy Hughes (Non-executive Director)

Katherine O'Reilly (Non-executive Director)

Secretary Cavendish Secretaries Limited

Company number 009753V (Isle of Man)

Registered office 19-21 Circular Road

DouglasIM1 1AF

Isle of Man

Auditors Keelings Limited

Broad House

The Broadway

Old Hatfield

Hertfordshire

AL9 5BG

United Kingdom

Lawyers Orrick, Herrington & Sutcliffe (UK) LLP

107 Cheapside

London

EC2V 6DN

United Kingdom

Bankers Bank of Montreal

595 Burrard Street

Vancouver

V7X1L7

Canada

Lloyds Bank PLC

1 Bancroft

Hitchin

SG25 1JQ

United Kingdom

Registrars Computershare Investor Services (Jersey) Limited

Queensway House,

Hilgrove Street

St. Helier

Jersey

JE1 1ES

Channel Islands

PANTHER METALS PLC

CONTENTS

Page

STRATEGY AND PERFORMANCE

Chairman's Statement 1

Strategic Report 2

GOVERNANCE

Corporate Governance Statement 30

Compliance with the QCA Code of Practice 35

Directors' Report 38

Statement of Directors' Responsibilities 41

Directors' Remuneration Report 43

INDEPENDENT AUDITORS' REPORT 52

FINANCIAL STATEMENTS

Consolidated Statement of Comprehensive Income 59

Consolidated and Company Statement of Financial Position 60

Consolidated and Company Statement of Cash Flows 61

Consolidated Statement of Changes in Equity 62

Company Statement of Changes in Equity 63

Notes to the Financial Statements 64

The 2024 reporting year saw significant developments at the Dotted Lake Project following the award of the Exploration Permit in July, and as Panther focussed on the critical mineral potential offered by the ultramafic intrusive system on the northern limb of the Schreiber-Helmo Greenstone Belt. An additional soil sampling programme supported by the Ontario Junior Exploration Program ("OJEP"), extended high-resolution soil survey coverage to 5.5km strike length over high priority targets and delineating highly anomalous, regionally significant, nickel and cobalt anomalies coincident with ultramafic intrusive targets along the eastern north shore of Dotted Lake.

The five hole (1,558m), Phase 1 Diamond Drilling Programme undertaken during October/November successfully defined the extensive ultramafic body, modelled from Panther's airborne geophysics data, as a mineralised magnesium-rich serpentinite carrying the platinum group elements, platinum (Pt) and palladium (Pd), as well as nickel (Ni), chromium (Cr) and silver (Ag). The drilling confirmed the intrusive displays distinct ultramafic layering pointing to the Dotted Lake project being part of a Fertile Mineral System. Post period end, Panther was delighted to note that drill hole DL24-002, which was ended within the intrusive body, is displaying strengthening nickel grade layering with depth, with the bottom two layers intersected each exceed 3% Ni equivalent over a combined 19.5m wide interval. This layering bodes very well for grades continuing to increase with depth towards the base of the intrusive. This layering is the subject of ongoing interpretation and modelling work.

We also extended the Obonga Project purchase agreement with Broken Rock Resources, and additional Exploration Permit applications were lodged and successfully awarded for further drilling at the Wishbone volcanogenic massive sulphide (VMS) copper-zinc target and over the Awkward Prospect which is targeting magmatic conduit hosted nickel sulphide as well as graphite.

Existing permits are in place for work over the VMS targets at the Obonga Project's Survey Lake and Ottertooth prospects and for the Silver Rim target which hosts exceptionally anomalous rare earth element lake sediment assays. High resolution drone-based airborne magnetic geophysical surveys and inversion modelling was completed by Pioneer Exploration Consultants, over these three prospects in advance of the permitted work.

With the graphite intersection in drill hole AW-P1-1 at the Awkward Prospect being extended to 27.2m @ 2.25 % Total Graphitic Carbon (TGC), Bayside Geoscience conducted geological fieldwork targeting crystalline or 'flake' graphite, in advance of further planned drone magnetitic and drone VLF geophysics survey work at both Awkward and Wishbone.

Panther continues to nurture our important relationships with First Nation stakeholders, local community and governmental relations, to maintain the Company's standing as an active explorer dedicated to make a positive impact for all concerned. In corporate activities, Panther raised £375,000 in the period through a placing and directors made additional on-market share purchases in the Company.

We have now advanced our Dotted Lake and Obonga projects, beyond generative exploration to delineate multiple drill ready discovery and resource targets that now demand our focus. It was against this backdrop that the Company took the difficult decision to terminate the option and sale and purchase agreement with Shear Gold Exploration Corporation over the Manitou Lakes Project on the Eagle - Manitou Lakes Greenstone Belt in Ontario, Canada.

The Board and I are extremely pleased with the work and developments during 2024, and I would like to thank everyone involved for their hard work and dedication. The Company's positive trajectory is poised to accelerate as we investigate the dual listing of the Company in Canada to leverage the advantageous critical minerals focussed Flow-Through tax exploration funding scheme for both Obonga and Dotted Lake.

Nicholas O'Reilly

Executive Chairman

28 April 2025

Results

The loss at Group level for this year after taxation was £2,212,416 (2023: profit £269,184) and at company level £1,940,312 (2023: profit £321,477).

Review of the Business and Operations

Mineral Exploration in Ontario, Canada

Key operational milestones achieved during the year are as follows:

Obonga Project Background

· Total Area: 291 km2

· Prospective for: Base Metals (Copper, Zinc, Lead, Nickel) and Precious Metals (Gold, Silver and Platinum Group Metals) with Energy Mineral (Lithium, Graphite) potential.

· Significant Neighbours: Mattabi Mine (Glencore) and Sturgeon Lake VMS Camp to west, Lac des Iles Mine (Impala Canada) to south.

· Potential: Canada's Next Mining District

The Obonga Project is Panther's flagship project, which has advanced from a greenfield regional data based target area, through proof of concept to drilling success and base metal VMS and graphite discoveries. The project covers 90% (291 km2) of the district scale Obonga Greenstone Belt in northwest Ontario.

Panther has achieved significant milestones through successful drilling campaigns at Obonga's Wishbone prospect, revealing a substantial Volcanogenic Massive Sulphide system. The Wishbone discovery, a first of its kind on the Obonga Greenstone Belt, is characterised by impressive drill hole intercepts, including 27.3m of massive sulphide and 51m of sulphide-dominated mineralisation.

Further drilling in late 2022 reaffirmed the potential, with intersections such as 3.6m @ 3.9% Zn, including 2m @ 6.8% Zn & 4.3 g/t Ag, indicating proximity to metal-fertile fluid flow. The discovery of the Wishbone VMS system is pivotal, boding well for the existence of additional VMS bodies in the vicinity, given their tendency to occur in clusters.

The Survey and Awkward targets have also benefitted from preliminary drilling, confirming VMS style mineralisation at Survey with a 29m wide intercept of cyclical semi-massive and disseminated sulphide, with graphite discovered at Awkward. This, coupled with the Wishbone discovery, solidifies the Obonga Greenstone Belt's status as a new emerging VMS Camp.

The Obonga Greenstone Belt, with its emerging VMS Camp status, is strategically positioned close to national railroad transport links and the industrial port city of Thunder Bay. Moreover, it is approximately 75km east of the former Mattabi/Sturgeon Lake Mining Camp on the Wabigoon Greenstone Belt, underlining its advantageous geological and logistical position.

The presence of significant gold occurrences, base metals, and promising exploration results in the Obonga Greenstone Belt contribute to its appeal as a potential mining district. This strategic positioning makes it an attractive prospect for future resource development and exploration.

Obonga 2024 Developments

On 11 January 2024 the Company provided the additional graphite assay results for drill hole BBR22_AW-P1-1, following additional sample submissions targeting crystalline or 'flake' graphite. The additional sampling was part of a review of the graphitic core drilled at the Awkward Prospect in the autumn of 2022 and a comprehensive historical data review which has extended the graphite potential.

The Awkward Prospect area is also prospective for sulphide bearing magmatic conduits and graphite and is located in the eastern side of the Obonga Project

Highlights

· Updated graphite assay results for drill hole BBR22_AW-P1-1, following further sample submissions. BBR22_AW-P1-1 was drilled to test a geophysical modelled conductive target at the western end of a 730m long conductive lineament 'Trend 3'.

· Samples analysed by ALS Laboratories for Total Graphitic Carbon ('TGC') analysis (by method C- IR18) in order to confirm the presence of crystalline 'flake' graphite.

· Results extend the downhole intersection of graphitic carbon to 27.2m @ 2.25 % TGC between 12m to 43.3m downhole.

· Key downhole Total Graphitic Carbon ('TGC') intersections as follows:

· 27.2 m @ 2.25 % TGC from 12m downhole, including;

o 4.0 m @ 3.64 % TGC from 14.0 m, with 1.0 m @ 5.15 % TGC from 16.0 m ;

o 6.0 m @ 3.60 % TGC from 19.0 m, with 1.0 m @ 5.12 % TGC from 21.0 m ; and

o 8.0 m @ 2.42 % TGC from 27.0 m, with 2.0 m @ 4.16 % TGC from 29.0 m downhole.

· Additional geophysical plate modelling has the prospect of extending Trend 3 a further 4.1km eastwards.

· Factoring the additional claim package recently acquired by Panther, initial geological interpretation suggests a preliminary graphite target area in the region of 21.5 km2 across the Awkward and Awkward East prospect areas.

· Historic data review notes graphite at surface and abundant in some units within the wider exploration area.

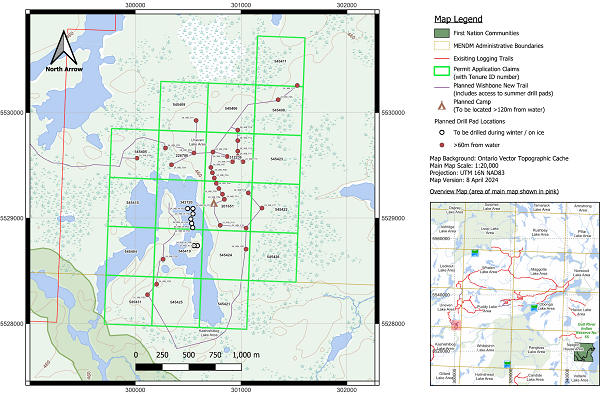

On 1 February 2024 Panther announced it had submitted an Exploration Permit application for additional drilling following the discovery of VMS base metal mineralisation on the Obonga Project's Wishbone Prospect. The Exploration Permit application was submitted in collaboration with Broken Rock Resources Ltd., and concerns planned work within 19 Single Cell Mining Claims in the Kashishibog Lake Area and Uneven Lake Area administrative regions (Figure 1). The application covered a planned series of up to 39 diamond core drill holes and associated down-hole geophysics surveys spread across the Wishbone Prospect in the centre-west of the Obonga area. The Wishbone application supplemented Exploration Permit PR-22-000116 which covers work through to 14 July 2025 at Obonga's Survey VMS discovery, and the Ottertooth and Silver Rim prospect areas.

Figure 1: Wishbone Exploration Permit Planned Drill Pads and Access

On 5 March 2024 the Company announced an extension to the Obonga Project purchase agreement with Broken Rock Resources Ltd. The revised agreement allows for an additional year to meet the exploration commitment (announced 2 August 2021) over Panther's flagship project, which has advanced from a greenfield regional data-based target area, through proof of concept to drilling success and base metal VMS and graphite discoveries. The Panther exploration commitment entails funding 8,000 meters of drilling on Obonga (and all associated costs including assay results and core storage); and to make available a budget of not less than CAN$1,000,000 (which has already been met by Panther) over an initial four year period, ending 31 July 2025, to fund all other operating costs on the area covered by the Claims (including trail building, field work, community relations, access rights and personnel costs).

On 2 April 2024 Panther announced the submission of Exploration Permit application PR-24-000059 for additional drilling following the intersection of significant widths of graphite mineralisation comprising 27.2m @ 2.25 % Total Graphitic Carbon, on the eastern extension of the Awkward Prospect.

The Exploration Permit application concerned planned work within 35 Single Cell Mining Claims in the Puddy Lake Area and Obonga Lake Area administrative regions and covered a planned series of up to 31 diamond core drill pads and associated down-hole and surface geophysics surveys spread across the Awkward East application area on the eastern side of the Obonga Project (Table 1). The Awkward East claims covering a total area of 7.25km2 are covered by a Purchase Agreement announced on 29 December 2023.

Table 1: Awkward East Exploration Permit Application and Prospect Details

| Exploration Permit Application Number (Administrative Area & Claim numbers) | Prospect Name (location) | Targeting & Exploration Rational | Requested / Planned Activities |

|

PR-24-000059

(Puddy Lake Area and Obonga Lake Area

Cells: 638074, 638075, 638076, 638077, 638078, 638079, 638080, 638081, 638082, 638083, 638084, 638085, 638086, 638087, 638088, 638089, 638090, 638091, 638092, 638093, 638094, 638095, 638096, 638097, 638098, 638099, 638100, 638101, 638102, 638103, 638104, 638105, 638106, 638107, 638108) | Awkward East

(Eastern side of Obonga Project) | Targeting graphite mineralisation to east of previous drilling intersection.

Plate modelling of airborne electromagnetic geophysics data shows potential targets for graphite and/or sulphide mineralisation.

Historical reports note graphite at surface and within a historical drill hole in the area.

| · Mechanised Drilling (up to 31 diamond core drill holes)

· Down-hole Electromagnetic ("EM") Geophysics

· Airborne drone magnetic high resolution survey

· Ground EM, Magnetic and Induced Polarisation Geophysics Surveys

· Exploration Camp for 15 persons

· Access Trails to link with existing logging trails from the north of the Obonga Project area. |

On 22 April 2024 the Company announced a second Exploration Permit application PR-24-000076 for additional drilling within 21 Mining Claims on the western side of the Awkward Prospect. The Awkward West application covered a planned series of up to 31 diamond core drill pads and associated down-hole and surface geophysics surveys (Table 2).

On 24 May 2024 the Company announced the commissioning of Pioneer Exploration Consultants Ltd. ("Pioneer") to conduct an estimated 430 line/km high resolution 25m line spacing airborne drone magnetic geophysical survey at Obonga. Pioneer were initially commissioned to cover the three VMS prospect areas at Wishbone, Survey Lake and the Ottertooth, with the Awkward and Silver Rim prospects subsequently added to the planned survey list. Pioneer completed the surveys over the Survey, Ottertooth and Silver Rim prospects during July with the remaining surveys rescheduled for 2025, due to availability and the autumn moose harvest season.

The high-resolution magnetic surveys provided a variety of data products, including three-dimensional ("3D") inversion models that will help refine planned drill hole orientations to target high grade base metal zones at depth, as well as providing inputs for the mineral system modelling.

On 30 May 2024 Panther announced the appointment of Bayside Geoscience Inc ("Bayside"), a highly experienced independent geological consulting company, to commence graphite focussed ground exploration work on the Awkward and Awkward East prospect areas on the eastern side of the Obonga Project.

The Bayside work programme followed on from a comprehensive data review, initially targeting numerous surface occurrences of graphite noted in historical reports, and with the objective of mapping the strike extensions of the wide graphite mineralisation intersected by the Panther drill hole BBR22_AW-P1-1 which was drilled to test a geophysical modelled conductive target at the western end of a 730m long conductive lineament 'Trend 3'. Ground prospecting and additional plate modelling has the potential of extending the conductive Trend 3 a further 4.1 km eastwards.

As reported on 1 July 2024, over the course of two separate visits, interspersed by a week-long period of bad weather which prevented helicopter access, the Bayside team successfully traversed and mapped five separate regions along strike and parallel to Panther's graphite drill discovery and the conductive plate modelling targets based on the regional electromagnetic geophysical data. They mapped out metavolcanic and metasedimentary rock packages constrained by gabbroic intrusives that are orientated strike parallel to the conductive plates. Encouragingly more competent rock units at a number of localities displayed distinct tourmaline veining, a metamorphic hydrothermal mineral that often forms in association with graphite and with gold.

On 19 July 2024 the Company announced the receipt of Exploration Permit PR-24-000076 covering the Awkward West Prospect, it is valid through to 17 July 2027 and allows for a comprehensive programme of works over the Awkward West area which includes both the 730m long 'Trend 3' graphite target and the Awkward magmatic feeder conduit target focused on a nickel-copper-platinum-palladium discovery.

Awarded in association with Broken Rock Resources Ltd and Karen Siltamaki, the Permit covers a planned series of up to 31 diamond core drill hole pads and associated down-hole geophysics surveys, and up to 12 pits or trenches spread across the Awkward West target area (see Table 2 and Figure 2). The permitted work follows on from the drilling conducted by Panther in 2022.

The Awkward West Permit supplements Exploration Permit PR-22-000116 which covers work through to 14 July 2025 at Obonga's Survey VMS discovery, and the Ottertooth and Silver Rim prospect areas; and Exploration Permit PR-24-000022 which covers the Wishbone VMS target area through to 20 June 2027.

Table 2: Awkward West Exploration Permit and Prospect Details

| Exploration Permit Application Number (Administrative Area & Claim numbers) | Prospect Name (location) | Targeting & Exploration Rational | Requested / Planned Activities |

| PR-24-000076

(Puddy Lake Area and Obonga Lake Area

Cells: 503963, 503964, 503965, 503966, 503967, 503968, 503969, 503970, 503971, 503972, 503973, 503974, 564422, 564425, 564429, 564432, 672121, , 845433, 845450, 845451, 845452) | Awkward (West)

(Eastern side of Obonga Project) | Targeting graphite mineralisation to north of previous drilling intersection.

Plate modelling of airborne electromagnetic geophysics data shows potential targets for graphite and/or platinum group element sulphide mineralisation. | · Mechanised Drilling (up to 31 diamond core drill holes)

· Down-hole Electromagnetic ("EM") Geophysics

· Airborne drone magnetic high resolution survey

· Ground EM, Magnetic and Induced Polarisation Geophysics Surveys

· Pitting/Trenching at 12 locations

· Exploration Camp for 15 persons

· Access Trails to link with existing logging trails from the north of the Obonga Project area. |

Figure 2: Awkward West Exploration Permit PR-24-000076 Permitted, Claim Cells, Drill Pads, Camp and Access

Dotted Lake Project Background: Critical Mineral Potential

· Total Area: 36.9 km2

· Prospective for: Base Metals (Nickel, Cobalt, Copper, Zinc) and Precious Metals (Gold, Silver, and Platinum Group Metals)

· Significant Neighbours: Barrick Gold (Hemlo Mine) to south, GT Resources (TSXV: GT) (Glencore 16.7% stake) to east.

The Dotted Lake Project encompasses a substantial 36.9 km² (Figure 3) within the North Limb of the Schreiber-Helmo Greenstone Belt, situated 16 km north of Barrick Gold's Hemlo Gold Mine which has produced over 22 Moz of gold over 30 years to date and 9 km from GT Resources recent discovery at West Pickle Lake on their Tyko One Belt. The area is considered very prospective for ultramafic intrusive related nickel and base metal mineralisation as well as gold.

Panther acquired 100% of the Dotted Lake Project in July 2020. An extensive soil programme conducted in 2021 identified numerous gold and base metal targets, all within the same geological footprint as Hemlo. Following the reopening of a historical trail providing direct access to the target location, an initial drilling programme in the autumn of 2021 confirmed the presence of gold mineralisation within this system with anomalous gold continuing along strike and present within the surrounding area. Dotted Lake sits upon 2.7-billion-year-old, Archaean age, rocks that form the north-eastern 'Dotted Lake Arm' of the Schreiber-Hemlo Greenstone Belt. Geology consists sequences of foliated, fine grained, dark green, amphibole rich metavolcanic rocks situated within an east-northeast trending isoclinal syncline. The metavolcanics have been intruded by granitoid rocks of the Dotted Lake Batholith in the southeast of the property whilst In the northeast an ultramafic intrusive complex flanks the two.

Panther's airborne electromagnetic and magnetics geophysics survey, extensive soil sampling and diamond drilling, have laid the groundwork for potential discoveries.

Figure 3: Location of the Dotted Lake Project, East of Thunder Bay, Ontario, Canada

On 22 February 2021, Panther announced the receipt of the processed high-resolution Airborne TDEM and Mag geophysics survey data and associated maps and report over the Dotted Lake Property on the north limb of the Schreiber-Hemlo greenstone belt in Ontario, Canada. Prospectair Geosurveys had conducted the helicopter 818 line-km survey over a series of seven flights between 9-11 December 2020. A total of 138 geophysical anomalies were identified by the survey, with high priority anomalies prioritised for follow-up ground investigation.

In June 2021, Panther contracted the experienced Thunder Bay based Fladgate Exploration Consulting Corporation to undertake a soil geochemistry sampling programme over a 1.60km by 0.85km target area. The soil geochemistry survey was designed to build out and in-fill the westerly strike extensions of high-grade gold mineralisation intersected by historical trenching undertaken by a previous licence holder in 2010 (Tr-10-4) and as confirmed during Panther's reconnaissance sampling (gold up to 18.9g/t Au) announced 5 November 2020. The soil survey provided important geochemical coverage of target structures outlined by Panther's airborne geophysical survey (see Figures 4 & 5) and delineated a 1.3km long shear-related gold anomaly striking westward from the site of Panther's Dotted Lake drill hole. A total of 18 multi-element anomalies were also identified including areas of very strong nickel in soil.

Figure 4: Dotted Lake Geochemical Soil Sampling Anomalies

Nickel and Cobalt Targets

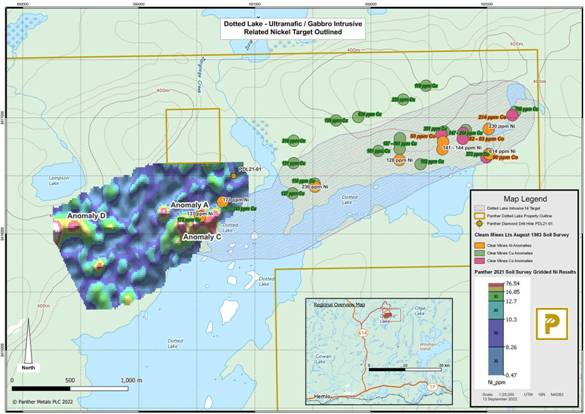

Panther also digitised historical exploration data in conjunction with the airborne and soil survey data. This work has defined a new area, in the northeast of the Dotted Lake property, which is also considered very prospective zone for nickel mineralisation and which is underlain by an ultramafic intrusive complex. The historical geochemical soil survey data based on work undertaken by Clear Mines Ltd in August 1983, shows a 2.8km long linear broadly east-west striking zone of elevated nickel in soil coinciding with a mapped ultramafic / gabbro intrusive unit and a distinct geophysical anomaly (Figure 5).

The Clear Mines Survey consisted of 577 soil samples analysed for 27 elements, collected on a series of north-south lines directly to the east of the Panther 2021 soil survey area. Nickel is elevated across the prospect area defined by highs ranging 137 - 235 ppm Ni and peaking at 614ppm Ni in the eastern end. Other soil anomalies across the Ni Target include cobalt (Co) up to 214 ppm Co and copper (Cu) up to 861 ppm Cu.

The western end of the ultramafic intrusive is shown on government mapping to lie beneath the lake, however the geophysics survey and the Panther soil survey data indicates that the intrusive rocks extend further to the west and may underlie the soil survey Anomaly A and Anomaly C (see Figure 5 & 6).

Panther's Ni Target is located 9km west of a new zone of massive nickel-copper sulphide mineralisation drilled by GT Resources (TSXV: GT) at their Tyko Project.

Figure 5: Panther Soil Nickel Results and Clear Mines Survey Historical Soil Assay Results

Figure 6: Map Showing Highly Anomalous Soil Geochemical Results over Airbourne Total Magnetic Intensity Magnetics and Electromagnetic Imagery

Dotted Lake 2024 Developments

On 10 July 2024 the Company announced the appointment of Abitibi Geophysics Ltd. ("Abitibi") a well-respected Canada headquartered international geophysical survey company, to provide geophysical modelling services for the Dotted Lake Project.

Abitibi undertook 3D inversion modelling and advanced processing (CET Grid Analysis) of the airborne high-resolution magnetic and time-domain electromagnetic ("TDEM") geophysical data resulting from the Prospectair Geosurvey Inc ("Prospectair") survey flown for Panther in 2020.

As well as the 3D magnetic susceptibility inversion models Abitibi Deliverables included complete digital files; colour levels maps of the magnetics data inversion at 3 depths of the total magnetic intensity (TMI) reduced to the pole and its derivatives (1st vertical derivative, analytic signal, tilt; colour maps of the frequency migration of the EM responses into early, mid, and late times and of the energy envelope; maps of the recommended targets, conductors, magnetic trends, and interpreted structures; maps of the structural analyses and predictive targeting; and ground geophysics follow-up and drilling recommendations.

Whilst the Abitibi work included the entire Dotted Lake Project area, the focus of the 2024 fieldwork is the eastern side of the project and the 4.2 km long trend of high priority soil geochemical and geophysical anomalies in association with the Dotted Lake ultramafic intrusion.

On 22nd July 2024 Panther announced the receipt of Exploration Permit PR-23-000215 covering a series of work and drilling at Dotted Lake (Table 3). The permit is valid through to 17 July 2027 and allows for a comprehensive programme of critical mineral discovery focussed works on the highly prospective intrusive linked nickel-copper-cobalt and Platinum Group Metal targets in the north-east of the Dotted Lake project area (Figure 6).

Table 3: Dotted Lake Exploration Permit and Prospect Details

| Exploration Permit Application Number (Administrative Area & Claim numbers) | Prospect Name (location) | Targeting & Exploration Rational | Requested Activities |

| PR-23-000215

(Black River and Olga Lake areas

Cells: 541544 ,541545 ,541546 ,541547 ,541548 ,541549 ,541550 ,541551 ,548348 ,548349 ,548350 ,548351 ,548352 ,548353 ,548354 ,548355 ,548356 ,548357 ,548358 ,548359 ,548362 ,548363 ,548364 ,548365 ,548366 ,550121 ,550122 ,550124 ,550125 ,550126 ,550127 ,550128 ,550129 ,550130 ,600373 ,600379 ,600380 ,600384 ,600386 ,600387 ,600388 ,600390 ,600391 ,600392 ,600394 ,600395 ,600396 ,600397 ,600399 ,600404 ,600409 ,600410 ,600413 ,600415 ,600418 ,600419 ,600421)

|

Intrusive related Critical Mineral Target

(Ni, Cu, Co, Zn & PGE)

(north and northeast of Dotted Lake property) |

Distinct 2.8km long linear trend of soil anomalies coincident with the geophysical signature of an interpreted ultramafic body.

Additional coincident electromagnetic and magnetic target associated with Cu soil anomalies along strike from a known Zn occurrence.

Historical soil anomalies peaking at 614ppm Ni , 861 ppm Cu and 214 ppm Co located east along strike from multi element anomalies identified by Panther's soil survey grid.

| · Mechanised Drilling (15 diamond core drill pads)

· Electromagnetic ("EM") and Induced Polarisation ("IP") Geophysics with associated line cutting

· Up to 36 planned pits / trenches

· Stripping (unto 10 localities)

· Exploration camps

· Access trails |

Figure 6: Dotted Lake Exploration Permit PR-23-000215 Permitted, Claim Cells, Drill Pads, Camp and Access

On 17 October 2024 the Company announced that Platinum Diamond Drilling Inc. had been contracted to undertake a critical mineral focussed Phase 1 diamond drilling programme and associated access trail logistics. The drilling programme was focussed on the discovery of Ni, platinum group element ("PGE"), Au, Co, Cu and bearing sulphide mineralisation associated with the mafic-ultramafic intrusive complex in the north-east of the Dotted Lake Project area and comprised up to six planned holes to test an initial four target areas

Figure 7: Dotted Lake Phase 1 Drill Target Areas

On 21 October 2024 the Company announced that Bayside Geoscience had commenced a concurrent 1,044 sample geochemistry soil survey in the vicinity of the drill targets. The survey comprised an extension and infill sampling to Panther's soil survey grid completed in 2021 which yielded significant Ni, Co, Cu, Au and PGE anomalies.

The assay results of the soil survey were announced post period end, on 13 March 2025. The soil assays returned standout multielement critical mineral geochemical anomalies closely linked and coincident with geophysical anomalies.

Highly anomalous soil assays range up to 1,665 ppm copper, 480 ppm nickel, 62 ppm cobalt, 190 ppm zinc, 0.99 ppm silver and 377 ppb gold (Table 4). The soil results delineated multiple new target areas around Lampson Lake where lake sediment samples returned highly anomalous readings of over 985 ppm Cu, 130 ppm Zn, 29 ppm Ni, 19 ppm Co and 0.28 g/t Ag. They also show highly anomalous, regionally significant, nickel and cobalt anomalies coincident with ultramafic intrusive targets along the eastern north shore of Dotted Lake ( Figure 8).

Table 4: Highest Three Soil Assay Results for Selected Elements

| Selected Element | Lower Limit of Detection | 1st Highest | 2nd Highest | 3rd Highest |

| Copper (Cu) | 0.01 ppm | 1,665 ppm | 1,030 ppm | 1,005 ppm |

| Nickel (Ni) | 0.04 ppm | 480 ppm | 456 ppm | 394 ppm |

| Cobalt (Co) | 0.001 ppm | 62 ppm | 61 ppm | 49 ppm |

| Zinc (Zn) | 0.1 ppm | 190 ppm | 157 ppm | 157 ppm |

| Silver (Ag) | 0.001 ppm | 0.99 ppm | 0.56 ppm | 0.50 ppm |

| Gold (Au) | 0.2 ppb | 377 ppb | 42.2 ppb | 30.6 ppb |

Table notes: Soil assay results by ALS Laboratories analytical method ME-MS41L. Limit of detection (LOD) = lower limit of stated method. ppm = parts per million. ppb = parts per billion. 1 ppm = 1,000 ppb. Results subject to rounding.

The Soil Survey work is supported by the Ontario Junior Exploration Program ("OJEP"), a provincial government grant to help junior companies finance early exploration projects. OJEP covers 50% of eligible costs for approved programmes, with the agreed contribution to Panther for this work totalling Canadian $56,930.

Figure 8: Significant Gold (top) and Nickel (bottom) Anomalies Trend Right Across the Survey Area

On 9 December 2024 Panther announced the successful completion of the Phase 1 drilling programme with a total of five diamond drill holes, for 1,558m drilled across the initial Target Areas C, D, E & F (Figure 7). The final metreage was an increase of 30% on the initially proposed 1,200m.

The drill core was logged, scanned, photographed and sampled by Bayside Geoscience Inc. The drill data which included downhole survey, magnetic susceptibility, x-ray fluorescence, geotechnical logging, lithological and alteration logging and wet and dry photography was incorporated into purpose designed MX Deposit and Imago databases.

The first batch of drill core sample assay results were announced on 30 December 2024. The downhole intersections from drillhole DL24-001 returned highly anomalous gold, silver, zinc and base metal assays at Target D on the southern shore of Lampson Lake. They confirmed a 1.2km long open-ended gold trend and the intersection of high-grade zinc/gold volcanogenic massive sulphide ("VMS") style mineralisation. Drill core assay results are by ALS Laboratories methods ME-MS61r (4 acid multielement package) and PGM-ICP23 (Pt, Pd and Au by fire assay and ICP-AES finish).

The subsequent three batches of drill core assay results were received and reported post period end. The Batch 2 results, reported 17 March 2025, verified an extensive mineralised ultramafic body and to Dotted Lake being part of a Fertile Mineral System. The Batch 3 results, reported 21 March 2025, gave 94m and 129m wide intercepts of mineralised magnesium-rich serpentinite.

The final, Batch 4, drill core assays were reported 25 March 2025, the results for hole DL24-002 show a 214.7m wide open-ended zone of intrusive ultramafic derived magnesium (Mg) rich serpentinite grading up to 21.7% Mg, which is mineralised with Pt Pd, Ni, Cr and silver (Ag), between 113.3m downhole to end of hole at 328m. The DL24-002 Ni and Cr assay result grade variations show layering with three distinct higher grade zones within the bottom 112m of the hole, with grades ranging up to 3.05% Ni Equivalent ("NiEq") as well as overlimit Cr. As hole DL24-002 was ended inside the intrusive, the prospect of strengthening grade-layering with depth is considered strong.

Panther notes that the separation of Mg from serpentinite has not yet applied on an industrial scale, despite success under laboratory and small pilot plant conditions. Given the potential value of the Mg contained within the ultramafic system the Company plans to conduct further research on the subject.

Manitou Lakes Project: Precious Metal

· Total Area: 123.4 km2

· Prospective for: Precious Metal (Gold)

· Significant Neighbours: Dryden Gold Corp (planned Canadian listing)

The gold focussed Manitou Lakes Project is located upon the Archean age Eagle-Manitou-Wabigoon Greenstone Belt in northwestern Ontario.

The Manitou Lakes region boasts over 200 known gold occurrences and more than 12 km of gold-bearing structures with numerous historic gold producers.

Manitou 2024 Developments

On 28 June 2024 Panther announced an update for the Manitou Lakes Project where the inaugural diamond drilling had confirmed gold mineralisation in four of the five holes drilled at the Glass Reef Target (Figure 9). The drilling followed‐up on the widespread anomalous gold in soil and rock sampling values in Panther's geochemical survey over the historical Glass Reef Mine area.

Panther's option partner for the Manitou Lakes Project, Shear Gold Exploration Corporation ("Shear Gold"), authored a technical report detailing the findings of the inaugural drill programme which completed December 2023. Interpretations show the five shallow holes, totalling 495m of core recovered, intersected metavolcanic schist shear zones where gold is associated with sulphides (up to 5% pyrite, pyrrhotite ± chalcopyrite) in quartz veins/veinlets. The historical Glass Reef Mine exploited a northeast trending shear zone, manifested by a narrow schist zone with strong iron carbonate alteration that is traced for several hundred metres along the strike.

Four of the five drill holes intersected low‐grade gold mineralisation over narrow widths in multiple schist zones of mafic volcanic and gabbroic protoliths. The low grade but anomalous gold (Table 5) occurs within strongly carbonatised (abundant carbonate veinlets) porphyritic gabbro units, or in highly altered and sulphide rich (pyrite, chalcopyrite, pyrrhotite) fractures and quartz veins in mafic volcanic rocks.

On 18 September 2024, Panther announced the termination of the option and sale and purchase agreement with Shear Gold Exploration Corporation dated 7 April 2022. Manitou Lakes remains a potentially highly prospective early-stage gold project in a very promising location in Ontario; the termination of the option Agreement was reflective of developments within Panther's wider exploration portfolio. Panther's growth strategy is now focused on the critical minerals sector, a sector which attracts growing support at both Canadian federal and provincial level, plus an increasing amount of overseas strategic funding options.

|

|

|

Figure 9: Location of the Glass Reef Target Drilling Programme, With Drill Hole Surface Geological Traces

Table 5: Drill Hole Locations and Anomalous Gold Intercept Details

Corporate and Financial Highlights

Corporate Matters

On 24 April 2024, the Company published the audited results for the year ended 31 December 2023. A copy of the 2023 Annual Report was submitted to the National Storage Mechanism and is available to the public for inspection at: https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

On 23 May 2024 the Company announced the completion of a placing raising £375,000 (before expenses) by the issue of 8,333,334 new ordinary shares at a price of 4.5 pence. The placing price of 4.5p per placing share represented a discount of 12.6% to the mid-market closing price of the Company's ordinary shares at close of business on 21 May 2024. The placing was conducted within existing shareholder authorities.

Each placing share was issued with one warrant attached entitling the holder to subscribe for one new ordinary share at a price of 7.5 pence with a life of 36 months from the date of Admission.

The Annual General Meeting ("AGM") of the Company was held on 13 June 2024, at which all resolutions were duly passed. At this Annual General meeting a resolution was passed which approved the consolidation of 92,822,307 existing ordinary shares ("Existing Ordinary Shares") of no par value on a 25 into 1 basis, such that every 100 Existing Ordinary Shares are consolidated into 4 ordinary shares. As a result of the approval of the Share Consolidation, the Company had 3,712,309 new Ordinary Shares in issue ("New Ordinary Shares"). Admission in respect of such New Ordinary Shares to the standard segment of the Official List of the FCA and to trading on the Main Market for listed securities of the London Stock Exchange will become effective and dealings in those New Ordinary Shares commenced on 14 June 2024. As a result of the Share Consolidation, the ISIN of the New Ordinary Shares changed from IM00BKDM2T52 to IM00BRF2WV49.

On 30 July 2024 the Company announced that it received notification on 28 July 2024 that Darren Hazelwood, the chief executive officer of the Company, had exercised the conversion rights attaching to the £56,000 of convertible loan notes held by him in respect of principal and accrued interest of £9,520. As a consequence, Mr Hazelwood was issued with 63,922 new ordinary shares of no par value in the capital of the Company at a price of £1.025 per ordinary share. The ordinary shares were admitted on 5 August 2024.

On 1 August 2024 the Company announced that it received notification on 31 July 2024 that Nicholas O'Reilly, the executive chairman of the Company, had exercised the conversion rights attaching to the £50,000 of convertible loan notes held by him in respect of principal and accrued interest of £8,500. As a consequence, Mr O'Reilly was issued with 57,073 new ordinary shares of no par value in the capital of the Company at a price of £1.025 per Ordinary Share. The ordinary shares were admitted on 8 August 2024.

On 6 November 2024 the Company announced that it received notification that the remaining convertible loan note holders had exercised their conversion rights attaching to the (£60,987) of convertible loan notes held by them in respect of principal and interest due (which includes a 4.25% extension premium). As a consequence, the remaining holders were issued with 59,500 new ordinary shares of no par value in the capital of the Company at a price of £1.025 per Ordinary Share. The ordinary shares were admitted on 11 November 2024.

On 25 November 2024 the Company announced that it received notification that the remaining convertible loan note holders had exercised their conversion rights attaching to the (£53,668) of convertible loan notes held by them in respect of principal and interest due (which includes a 4.25% extension premium). As a consequence, the remaining holders were issued with 52,360 new ordinary shares of no par value in the capital of the Company at a price of £1.025 per ordinary share. The ordinary shares were admitted on 28 November 2024.

March 2024- Partial Sale of Investment in Fulcrum Metals PLC and new lock in agreement

On 12 March 2024 the Company announced it has sold a total of 2,346,717 ordinary shares of 1 p each in Fulcrum Metals PLC on 11 March 2024 at an average price of 15.2 pence per Ordinary Share. Following the sale, Panther continues to hold 7,625,122 Ordinary Shares representing 15.26% of the Fulcrum issued share capital. Pursuant to the sale, Panther entered into a new lock-in agreement with Fulcrum, Allenby Capital and Clear Capital, thereby imposing a hard lock-in period on the Panther Shares to 15 May 2025 and the orderly market provision on the sale of the Panther Shares for a year thereafter through to 15 May 2026. The provisions apply to the existing Ordinary Shares and any Ordinary Shares allotted and issued to or subsequently acquired by Panther during the locked-in period described in the New Agreement. However as noted below, with Fulcrum Metals PLC's agreement, the entire holding was sold on 7 April 2025.

April 2024- Appointment of Strategic Advisor

On 11 April 2024 the Company announced the appointment of Melissa Sanderson in the role of Strategic Advisor for Government Relations, Environmental, Social and Governance (ESG) to the Company.

Melissa 'Mel' Sanderson combines over three decades of experience in geostrategic planning, Ethical Sustainable Growth (ESG), and cultural integration. Fluent in five languages Mel's wide-ranging expertise spans the mining industry, critical minerals strategy, international diplomacy, and sustainable development. Currently leading MECA Consulting and contributing her knowledge as a Professor at Thunderbird School of Global Management at Arizona State University, Mel holds significant roles on various public market Boards, driving ESG and decarbonisation efforts.

Entire disposal of the Investment in Panther Metals Limited ("Panther Australia")

On 31 May 2024, the Company announced the sale of 1,131,446 shares in Panther Metals Ltd (ASX:PNT) for a total aggregate amount of $55,615, approximately £28,935 sterling.

On 1 October 2024, the Company announced the sale of 645,249 shares in Panther Metals Ltd (ASX:PNT) for a total aggregate amount of $19,273, approximately £9,954 sterling.

On 11 October 2024, the Company announced the sale of 18,223,306 shares in Panther Metals Ltd (ASX:PNT) for a total aggregate amount of $421,328, approximately £219,000 sterling.

Post Year End Developments

Panther Metals PLC

On 20 January 2025 the Company announced the completion of a conditional placing, confirming it has placed 910,000 ordinary shares of no-par value at a price of 50 pence raising gross proceeds of £455,000. Each share was issued with one warrant attached entitling the holder to subscribe for one new ordinary share at a price of 75 pence. The warrants have a life of 36 months from the date of Admission. Admission took place on 28 February 2025.

On 12 March 2025 the Company announced it had agreed terms to capitalise its only outstanding debt facilities, comprising the £150,000 of unsecured convertible loan notes announced 20 November 2023, which carry an interest rate of 15%. The Company will settle this liability by the issue of new ordinary shares with warrants attached, on the same economic terms as the most recent placing announced on 20 January 2025. Subject to shareholder approval, the Company will proceed to allot, issue, and admit to listing, a combined total of 362,250 shares at an issue price 50p (the "Settlement Shares") and deliver 362,250 warrants with an exercise price of 75p to the former holders of the loan notes. The warrants will have a life of 3 years and be subject to an "accelerator" requiring the warrants to be exercised should the Panther share price exceed £1.50 at any time over a period of 20 trading days following the date of the issue of the warrants.

On 2nd April 2025 the Company held a General Meeting at which, relating to the allotment, issue, and admission to listing of a combined total of 362,250 new ordinary shares of no par value each ("Ordinary Shares") at an issue price 50p (the "Settlement Shares") and delivery of 362,250 warrants with an exercise price of 75p to the former holders of loan notes, authority was provided from Shareholders for Panther Metals to issue the Settlement Shares and the new Ordinary Shares underlying the warrants.

On 3 April 2025 the Company announced an Amending Agreement on the Obonga project extending the existing agreement for a further 12 months and meaning that the exploration commitment is now spread over five years; whilst the original net smelter return royalty is replaced with a gross revenue royalty equal to 1.5% of the gross value of the sale proceeds actually received by the royalty payer from activity carried out on the Property. In connection with the signing of the Amending Agreement the Company allotted and issued 42,070 new ordinary shares (the "Consideration Shares") with a value of Canadian $30,000 to Broken Rock based on the mid-market closing price of Panther's ordinary shares on 27 March 2025 and an exchange rate of CAD$1.85 to £1.00.

On 8 April 2025 the Company announced that it sold a total of 7,625,122 ordinary shares of nominal value 1 pence each in the capital of Fulcrum Metals plc ("Fulcrum") (the "Ordinary Shares") on 7 April 2025, at a price of 3.5 pence per Ordinary Share, for an aggregate amount of £266,879 (net of fees and expenses). The Fulcrum sale constitutes a disposal of Panther's remaining holding in Fulcrum.

Key Performance Indicators

The key performance indicators are set out below:

| | 31-Dec-24 | 31-Dec-23 | Change |

| | | | |

| Net asset value | £2,111,196 | £3,556,945 | (41%) |

| Market Capitalisation | £3.64m | £3.30m | 10% |

| Share Price (2023 converted for consolidation) | 85p | 89p | (4.5%) |

| | | | |

Principal Risks and Uncertainties

The principal risks and uncertainties of the Group are outlined below.

A 'majority of the Group's operating costs will be incurred in Canadian dollars, whilst the Group has raised capital in £ Sterling

The Group will incur exploration costs in Canadian Dollars but it has raised capital in £ Sterling. Fluctuations in exchange rates of the Canadian Dollar against £ Sterling may materially affect the Group's translated results of operations. In addition, given the relatively small size of the Group, it may not be able to effectively hedge against risks associated with currency exchange rates at commercially realistic rates. Accordingly, any significant adverse fluctuations in currency rates could have a material adverse effect on the Group's business, financial condition and prospects to a much greater extent than might be expected for a larger enterprise.

The Group will need additional financial resources if it moves into commercial exploitation of any mineral resource that it discovers

Whilst the Group has sufficient financial resources to conduct its planned exploration activities, meet its committed licence obligations and cover its general operating costs and overheads for at least 12 months, the Group will need additional financial resources if it wishes to commercially exploit any mineral resource discovered because of its exploration activity.

The Group has budgets for all near and short-term activities and plans, however in the longer term the potential for further exploration, development and production plans and additional initiatives may arise, which have not currently been identified, and which may require additional financing which may not be available to the Group when needed, on acceptable terms, or at all. If the Group is unable to raise additional capital when needed or on suitable terms, the Group could be forced to delay, reduce, or eliminate its exploration, development, and production efforts.

Even if the Group makes a commercially viable discovery in the future there are significant risks associated with the ability of such a discovery generating any operational cashflows

The economics of developing mineral properties are affected by many factors including the cost of operations, variations of the grade of ore mined, fluctuations in the price of the minerals being mined, fluctuations in exchange rates, costs of development, infrastructure and processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. Given that the Group is at the early exploration stage of its business many of these factors cannot be accurately assessed, costed, planned for or mitigated at the current time. As a result of these uncertainties, there can be no guarantee that mineral exploration and subsequent development of any of the Group's assets will result in profitable commercial operations.

The Group is not currently generating revenue and will not do so in the near term

The Group is an exploration company and will remain involved in the process of exploring and assessing its asset base for some time. The Group is unlikely to generate revenues until such time as it has made a commercially viable discovery. Given the early stage of the Group's exploration business and even if a potentially commercially recoverable reserve were to be discovered, there is a risk that the grade of mineralisation ultimately mined may differ from that indicated by drilling results and such differences could be material. Accordingly given the very preliminary stages of the Group's exploration activity it is not possible to give any assurance that the Group will ever be capable of generating revenue at the current time.

Going Concern

As a junior exploration company, the Directors are aware that the Company must seek funds from the market in the next 12 months to meet its investment and exploration plans and to maintain its listing status.

The Group's reliance on a successful fundraising presents a material uncertainty that may cast doubt on the Group's ability to continue to operate as planned and to pay its liabilities as they fall due for a period not less than twelve months from the date of this report.

On 23 May 2024 the Company announced the completion of a placing raising £375,000 (before expenses) by the issue of 8,333,334 new ordinary shares at a price of 4.5 pence. As at the year-end date the Group had total cash reserves of £17,536 (2023: £66,120).

The Directors are aware of the reliance on fundraising within the next 12 months and the material uncertainty this presents but having reviewed the Group's working capital forecasts they believe the Group is well placed to manage its business risks successfully providing the fundraising is successful. The financial statements have been prepared on a going concern basis and do not include adjustments that would result if the Group were unable to continue in operation.

Stakeholder Engagement

The Company did not have any employees during the Reporting Period and therefore this stakeholder engagement statement does not refer to how we consider their interests. The Company will monitor the need to incorporate the interests of employees in its decision making as the Company grows.

The table below acts as our stakeholder engagement statement by setting out the key stakeholder groups, their interests and how Panther Metals engages with them. Given the importance of stakeholder focus, long-term strategy and reputation to the Company, these themes are also discussed throughout this Annual Report.

The stakeholder engagement statement should be read in conjunction with the full Strategic Report and the Company's Corporate Governance Statement.

Task force on Climate-related Financial Disclosures (TCFD)

The Group is committed to conducting its business, in an efficient and responsible manner, in line with current best practice guidelines for the mining and mineral exploration sectors and international investment. Panther will integrate environmental, social and health and safety considerations to maintain its 'social licence to operate' in all its business, planning and investment activities. The board is committed to the disclosure of climate-related financial information in line with the four overarching pillars of the TCFD recommendations (Governance, Strategy, Risk Management, Metrics and Targets) in line with the revised TCFD guidance published in 2021.

| Pillar | Status |

| |||

| Governance

a) Describe the Board's oversight of climate-related risks and opportunities

b) Describe management's role in assessing and managing climate-related risks and opportunities. |

The Board has ultimate responsibility for ensuring that any material climate-related risks and issues are appropriately integrated into the Group's business plans, risk management and decision making.

On 9 December 2022, the Board established a Responsibility Committee to oversee this area.

The Responsibility Committee makes decisions and takes action to include climate risks and opportunities in our risk assessment/risk register as reported to them by management and then chooses an appropriate response to the risk or opportunity, together with the potential financial impact of that response.

Exploration project management, which includes certain board members, currently assesses, and manages climate related risks and opportunities as part of the planning and execution of exploration activities.

|

| |||

| Strategy

a) Describe the climate-related risks and opportunities the organisation has identified over the short, medium and long term ("s/t", "m/t" and "l/t").

b) Describe the impact of climate-related risks and opportunities on the organisation's businesses, strategy and financial planning.

c) Describe the resilience of the organisation's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. | The risk register is reviewed and discussed at least annually by the Audit Committee. In FY24 the committee concluded that these are the climate change-related risks and opportunities which may have a financial impact on the Group: (1) risks and opportunities related to the transition to a lower-carbon economy meaning that exploration activity is made impossible or possible at a higher cost a) Canadian governmental exploration policy changes (medium and long term). b) climate change litigation (First Nations and other environmental stakeholders- all terms) c) reputational risk tied to community perceptions of the Group's activities (First Nations- all terms) d) opportunities in relation to the emergence of new technologies where the Group's exploration activities and output could provide a key component e.g. battery metals (m/t and l/t)

(2) risks related to the physical impacts of climate change meaning exploration activity is made impossible or possible at a higher cost- a) extreme weather and higher temperatures (all terms).

The impact of any of the climate related risks identified above could have a material financial impact on the Company by virtue of governmental policy change or eroding of our currently positive relationships with First Nations or other environmental stakeholders. · The nearest term risk which has the most immediate financial impact is our relationship with First Nations, as their consent is required to commence exploration activities. · In the medium-term governmental exploration policy changes from the prevailing administration or the impact of environmental pressure groups) could materially financially impact the Company although this is considered remote due to governmental support of the Company's exploration projects to date and the governmental activities currently underway to support and promote exploration related activities such as grants and other funding initiatives. · Weather related impacts could take place within any time period and can shorten the annual time period within which the Company can conduct its exploration activities or in extreme cases could make the exploration activities impossible due to feasibility or budget. Conversely opportunities in relation to the emergence of new technologies where the Group's exploration activities and output could provide a key component could present a material upside to the Company.

The Responsibility Committee continues to seek the relevant data to include a description of the resilience of the organisation's strategy taking into consideration different climate related scenarios, including a 2°C or lower scenario. Part of the data gathering requires a more extensive set of data and analytics from its exploration activities which is undertaken by third party suppliers, and which has not been available in 2024.

|

| |||

| Pillar | Status |

| |||

| Risk management a) Describe the organisation's processes for identifying and assessing climate-related risks. b) Describe the organisation's processes for managing climate related risks.

c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation's overall risk management. |

On 9 December 2022 the Board created a Responsibility Committee to ensure that the processes for identifying, assessing, and managing climate-related risks are integrated into the organisation's overall risk management.

The Responsibility Committee reports any change in climate related risks or the identification of any new climate-related risks to the Board as and when they are highlighted by exploration project management or by the members of the Responsibility Committee.

The organisation currently assesses and manages climate related risks and opportunities as part of the planning and execution of exploration activities. This assessment includes undertaking the following processes: A) Commissioning environmental impact surveys from independent third-party consultants prior to commencement of activities, together with adopting all appropriate recommendations. B) Timely consultation and liaison with key environmental stakeholders such as First Nations to explain the nature of the proposed exploration programme and seeking permission to commence exploration activities. Regular follow ups throughout the programme. C) Ensuring compliance with the Prospectors & Developers Association of Canada E3 Plus: A Framework for Responsible Exploration and the International Council on Mining and Metals Sustainable Development Framework (the ICMM 10 Principles). D) Consulting with and engaging local experts in the project area terrain and climate to provide guidance on risks and opportunities around the physical impacts of climate change e.g., heavy snow, rising water levels in the project area or potential weather conditions which may impact the exploration programme.

Management of these risks is performed by the exploration project management team and any significant risks or risks which cannot be adequately mitigated or have any uncertainty around mitigation are reported to the Responsibility Committee to escalate to the Board. Each Board meeting will typically contain reference to all the above risks and processes.

|

| |||

| Metrics and Targets

a) Disclose the metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process.

b) Disclose scope 1, scope 2 and, if appropriate, scope 3 greenhouse gas (GHG) emissions and the related risks.

c) Describe the targets used by the organisation to manage climate related risks and opportunities and performance against targets. |

In conjunction with ensuring that the processes for identifying, assessing, and managing climate-related risks are integrated into the organisation's overall risk management, the Responsibility Committee also tasks the project managers to compile a set of metrics and targets with which to assess climate-related risks and opportunities they have identified. These metrics and targets are listed in the table on the next page.

The Company operates from serviced offices in the UK and gas and electricity is included within the monthly service fee, as such, emissions disclosure is not possible.

In relation to Group's warehousing facilities in Canada, the Company's scope 1 emissions for the year are 18.5 (2023: 19.1) metric tonnes of CO2e and relate to gas. The Company's scope 2 emissions for the year are 3.7 (2023:4.2) metric tonnes of CO2e and relate to electricity. The Company's scope 3 emissions are 104.7(2023: 69.4) metric tonnes of CO2e and relate to UK and international travel and accommodation and additional goods and services.

The Company uses third party providers to undertake its project-based activities and emissions data is not readily available from these third parties. The Company has therefore used exploration expenditure data from these third parties to calculate an additional scope 3 emissions figure of 59.9 metric tonnes of CO2e.

The targets used by the organisation to manage climate related risks and opportunities and performance against targets are stated on the next page.

|

| |||

| Type of Risk | Specific Risk | Ongoing Metric and 2024 Target | 2024 Target Status and 2025 Objectives | ||

| Risks and opportunities related to the transition to a lower-carbon economy meaning that exploration activity is made impossible or possible at a higher cost.

| Canadian governmental exploration policy changes (medium and long term).

| Level of governmental support of the sector through grant funding and no adverse changes to current regulatory status.

Target is to apply for governmental grant funding in 2024. |

Grant funding received in 2025. Further grant funding opportunities to be sought in 2025/26. | ||

| Risks and opportunities related to the transition to a lower-carbon economy meaning that exploration activity is made impossible or possible at a higher cost.

| Reputational risk tied to community perceptions of the Group's activities (First Nations- all terms). |

Lines of communication with the First Nations in terms of frequency and nature of written and verbal communication with no adverse communication (verbal or written).

2024 target was to maintain positive lines of communication with First Nations and other environmental stakeholders and meet with First Nations during 2024 to foster relationships further.

| Positive lines of communication maintained with First Nations and other environmental stakeholders in 2024 with several meetings held with First Nations during 2024 and requested permits awarded or renewed due to a deeper understanding and trust between parties being achieved. 2025 target is to maintain this. | ||

| Risks and opportunities related to the transition to a lower-carbon economy meaning that exploration activity is made impossible or possible at a higher cost.

| Climate change litigation (First Nations and other environmental stakeholders- all terms). |

Lines of communication with the First Nations in terms of frequency and nature of written and verbal communication with no adverse communication (verbal or written) plus emissions data publication where possible to ensure transparency to all environmental stakeholders.

2024 target was to maintain positive lines of communication with First Nations and other environmental stakeholders and meet with First Nations during 2024 to foster relationships further.

2024 target was to obtain emissions data from key third party suppliers in 2024 where possible and publish where practicable. | Positive lines of communication maintained with First Nations and other environmental stakeholders in 2024 with several meetings held with First Nations during 2024 and requested permits awarded or renewed due to a deeper understanding and trust between parties being achieved. 2025 target is to maintain this. It has not been possible to obtain detailed emissions data from our third-party suppliers as this information is not readily available. However, we have used project expenditure to quantify our scope 3 emissions and will continue to do so whilst this remains the case. | ||

| Risks and opportunities related to the transition to a lower-carbon economy meaning that exploration activity is made impossible or possible at a higher cost.

| Opportunities from emergence of new technologies where Group's exploration activities and output could provide a key component (m/t and l/t). | Opportunity to be measured by keeping appraised of emerging new technologies in connection with Panther's exploration activities. 2024 target was to attend update sessions on emerging technologies which may be relevant to Panther's activities. | In March 2024 Darren Hazelwood and Nicholas O'Reilly attended PDAC in Toronto Canada and attended learning sessions to keep abreast of emerging technologies to supplement their day-to-day intelligence gathering on the subject. 2025 target is to attend update sessions on emerging technologies which may be relevant to Panther's activities. | ||

| Risks related to the physical impacts of climate change meaning exploration activity is made impossible or possible at a higher cost. | Extreme weather and higher temperatures (all terms). | Risk to be measured by monitoring of weather and weather change patterns in exploration areas. 2024 target is for no change to be highlighted in order or make exploration activities predictable.

| 2024 work programme in Dotted Lake was made more challenging by warmer than expected conditions. However, the team completed the work programme by adapting their approach and will take away learnings for subsequent work.

2025 target is for no further change to be highlighted in order or make exploration activities predictable.

| ||

Chairman's Overview

The Company is not required to comply with the UK Code of Corporate Governance ("UK Code"). However, the Directors recognise the importance of sound corporate governance, and the Company has adopted the Quoted Companies Alliance Corporate Governance Code ("QCA Code") to the extent it considers appropriate, considering the size, stage of development and resources of the Group.

The Directors are responsible for overall corporate governance, with respect to the management of the business and its strategic direction, establishing policies and in the evaluation of material investments of the Group. It is the responsibility of the Directors to oversee the financial position of the Group and to monitor its business and affairs on behalf of the Shareholders, to whom the Directors are accountable. The primary duty of the Board is to always act in the best interests of the Group.

The Directors have responsibility for the overall corporate governance of the Group and recognise the need for the highest standards of behaviour and accountability. The Board has a wide range of experience directly related to the Group and its activities and its structure ensures that no one individual or group dominates the decision-making process. The Board will also ensure that internal controls and the Group's approach to risk management are assessed periodically.

Board of Directors

The primary duty of the Board will be to always act in the best interests of the Company.

The Company will hold Board meetings periodically as issues arise which require the attention of the Board and the Board will be responsible for the following matters:

· the management of the business of the Company;

· setting the strategic direction of the Company;

· establishing the policies and strategies of the Company;

· appraising the making of all material investments, acquisitions and disposals;

· oversee the financial position of the Company including approval of budgets and financial plans, changes to the Group's capital structure;

· approval of financial statements and significant changes to accounting practices;

· Stock Exchange related issues including the approval of the Company's announcements and communications with shareholders;

· monitor internal control; and

· manage risk assessment.

The Company has also established a remuneration committee, an audit committee, and a nomination committee of the Board with formally delegated duties and responsibilities.

The Remuneration Committee comprises Tracy Hughes as chair (previously Nicholas O'Reilly), Simon Rothschild and Katherine O'Reilly and meets not less than twice each year. The Remuneration Committee is responsible for the review and recommendation of the scale and structure of remuneration for Directors, including any bonus arrangements or the award of share options with due regard to the interests of the Shareholders and other stakeholders.

The Audit Committee, which comprises Simon Rothschild as chair and Nicholas O'Reilly meets not less than twice a year. The Audit Committee is responsible for making recommendations to the Board on the appointment of auditors and the audit fee and for ensuring that the financial performance of the Company is properly monitored and reported. In addition, the Audit Committee receives, and reviews reports from management and the auditors relating to the interim report, the Annual Report and accounts and the internal control systems of the Company.

The Nomination Committee comprises Nicholas O'Reilly as chair, Simon Rothschild and Katherine O'Reilly, meets normally not less than twice each year. The Nomination Committee is responsible for reviewing succession plans for the Directors.

The Company has adopted and will operate a share dealing code governing the share dealings of the Directors of the Company and applicable employees with a view to ensuring compliance with the Market Abuse Regulation.

The Company has adopted, a share dealing policy regulating trading in the Company's shares for the Directors and other persons discharging managerial responsibilities (and their persons closely associated) which contains provisions appropriate for a company whose shares are admitted to trading on the Official List (particularly relating to dealing during closed periods which will be in line with the Market Abuse Regulation). The Company will take all reasonable steps to ensure compliance by the Directors and any relevant employees with the terms of that share dealing policy.

Current Director Biographies

Darren Hazelwood, Chief Executive Officer

A business career built around sound financial planning, execution, delivery and value creation. An entrepreneur and investor who has over 15 years' experience managing and directing teams focused on delivering value within organisations, always with a keen focus on cost controls and great financial management ensuring delivery of value.

Darren's recognition of the value created by using and expanding his network, combined with a strong focus on delivery, has enabled him to deliver on an enviable track record of business growth. Darren became Chief Executive Officer of Panther Metals in January 2019 and the business has since completed acquisitions in Australia and Canada as it builds its position in the exploration sector. During the period, the business reported a considerable reduction in its reported losses while trebling its asset base.

His pathway to success has been gained using astute controls and due diligence while managing fast growth and success. A keen focus on deal delivery and network identification laying the foundations for growth.

Nicholas O'Reilly, Executive Chairman

Nicholas is an experienced exploration geologist and consultant having worked for over 18 years on mining and exploration projects in Africa, North and South America, the Russian Federation, Asia and Australia. He specialises in the design and implementation of exploration and resource projects from grassroots to pre-feasibility in all terrains and environments, mobilising multidisciplinary field teams and managing major programmes. Nicholas became the Company's Non-Executive Chairman on 10 December 2021.

Nicholas holds a master's degree in Mineral Project Appraisal from the Royal School of Mines, Imperial College and a bachelor's degree in applied Geology from the University of Leicester.

Nicholas has previous experience as a non-executive on the board of an AIM listed mining sector investment vehicle and is currently a director of several private companies including Mining Analyst Consulting Ltd and Treasure Island Resources Ltd.

He is currently the Co-Chairman & Treasurer of the London Mining Club (formerly the Association of Mining Analysts), a non-profit London City based organisation representing the broad mining investment community. Nicholas is also a Member of The Australasian Institute of Mining and Metallurgy, Member of The Institute of Materials, Minerals and Mining, a member of the Society of Economic Geologists and a Fellow of The Geological Society of London.

Tracy Hughes, Non-Executive Director

Tracy Hughes is the Founder (2001), CEO, and Director of InvestorNews Inc., the publisher of InvestorNews.com, which is an independent source of market news that receives over 120 million hits annually. Further to its role as an online Publisher, InvestorNews has been providing digital media services in the capital markets since 2001. Well known since 2010 for hosting some of the largest critical mineral events in the world, Tracy is the Co-Founder and Executive Director for the recently formed (2021) Critical Minerals Institute (CMI), which is focused on critical minerals for a decarbonized economy.

Tracy's past business experience includes being the co-founder of a FTSE recognised rare earths indices company REE Stocks PLC (2011-2014), and a principal partner in a boutique investment banking firm Hughes & Cowans Ltd. that held an Exempt Market Dealers license for 8 years (2007-2013). This same firm was the catalyst for the business television series DealFlow, which was broadcast in 294 million households worldwide (2008-2010). Featured on CNBC for 1-year, Tracy was the Host, Executive Producer, and the President for DealFlow World Inc.

In the early nineties, Tracy started in PR for television and then quickly evolved into radio where Billboard Magazine cited her as one of the top 3 Radio Trackers in North America. Working for recording artists with many of the top record labels at the time, her last role in the music industry was as the VP of Marketing, Canada, for Red Ant Entertainment, a NYSE listed company at the time, which Tracy credits this as her first real introduction to the public markets.

Tracy received her BA in Political Science from the University of Tennessee in 1988 and is a well-known speaker, investment market interview host and columnist.

Simon Rothschild, Non-Executive Director

Simon studied at the University of St Andrews. He has been internationally active for over thirty years in financial public relations and financial investor relations. He started his career in the City of London's financial sector in 1982 at Dewe Rogerson Ltd and more recently was a Principal of Bankside Consultants, where he specialised in supporting natural resources companies. In 2014 he set up Capital Market Consultants Limited, a financial public relations consultancy. In addition to being a Non-Executive Director of Panther Metals, he served as NED of Rothschild Diamonds Limited, a private diamond broking company. He has previously served on the boards of Stonedragon Limited, a company set up to establish a digital distribution network in West Africa and Five Star diamonds, a TSX-V listed mining company with assets in Brazil.

Katherine O'Reilly, Non-Executive Director

Katherine O'Reilly is a Fellow of the Institute of Chartered Accountants in England and Wales. Katherine began her career as an auditor before transitioning into Corporate Finance, spending 11 years working in Capital Markets and Transaction Services. Since 2017 she has been providing Finance and Operations consultancy to a variety of companies across a number of different sectors, including natural resources.

Gender and Ethnic Diversity at Board Level

In accordance with the requirements of DTR7, the Board is required to provide a statement as to whether it has met certain targets related to gender and ethnic diversity at Board level.

The Board confirm that as of 31 December 2024 1 out of 3 diversity targets were met: 40% of the Board were women. None of the senior board positions was held by a woman. None of the Board members were from an ethnic minority background. The Board will look for opportunities to adhere to all three targets during 2025.

Gender and ethnicity data for the Board is collected on an annual basis through a standardised process managed via the completion of a confidential and voluntary form, through which the individual can self-report on their ethnicity and gender identity. Alternatively, they can specify that they do not wish to provide such data. The criteria of the questionnaire are aligned to the definitions specified in the UK Listing Rules.

| | Number of Board | Percentage of the Board | Number of Senior Positions on the Board | Number in Executive Management | Percentage in Executive Management |

| | | | | | |

| Men | 3 | 60% | 2 | 1 | 100% |