The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the UK Market Abuse Regulation

18 July 2025

Panthera Resources Plc

("Panthera" or "the Company")

Bido Drilling Programme

Gold exploration and development company Panthera Resources Plc (AIM: PAT), with gold assets in West Africa and India, announces that the Company has commenced a drilling programme at the Bido Project in Burkina Faso (the "Drilling Programme").

Highlights

· Drilling Programme comprises 1740 metres of reverse circulation (RC) drilling at the Kwademen prospect within the Bido Project

· Main objective is to test for continuity of mineralisation hit by previous drilling where intercepts included 24 m @ 1.38 g/t Au

· Modest Drilling Programme preserves the good standing of the licence while the Company advances the potential restructuring of its interest in its West African gold assets

Mark Bolton, Managing Director of Panthera, commented:

"The Bido Project is an exciting gold prospect for the Company that is maturing as the gold price pushes well above US$3000 per ounce. The Company has been actively exploring the licence for several years culminating in a focused drilling campaign. The Drilling Programme will test the continuity of historical drilling from the 1980's period as well as exploration targets developed by the company's experienced in country and international geological team who have completed systematic geological mapping, data compilation, geochemical and geophysical surveys that have led to the recommendations to drill these priority targets.

As previously reported, the Company continues to advance the potential restructuring of its interest in its West African gold assets with this modest Drilling Programme preserving the good standing of the licence."

About the Bido Project

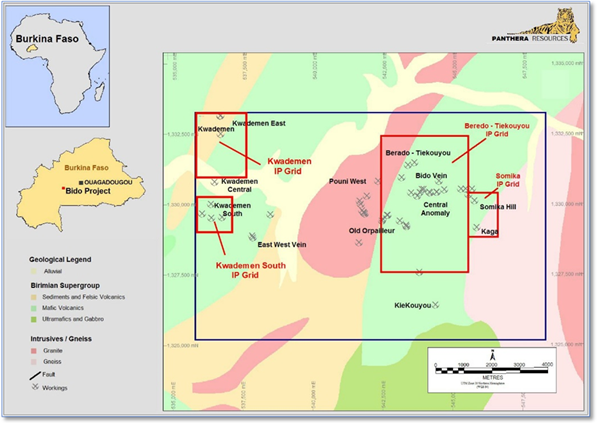

The Bido permit in Burkina Faso (Figure 1) is located some 125 km WSW of the capital Ouagadougou. The tenement lies within the Boromo greenstone belt which is principally composed of Paleoproterozoic Birimian terrain within the West African Man Craton. This belt also hosts the Poura gold deposit (1 to 2 Moz), situated about 50 km to the SSW of the area, as well as numerous gold occurrences. The Perkoa VMS deposit is located about 35 km to the north of the area.

The Kwademen Prospect (Figure 1) was originally identified from a review of historical data from 1980s exploration work undertaken by BUVOGMI, the national geological service of Haute Volta (former name of Burkina-Faso) under financing from the United Nations Development Program ("UNDP"). This was a regional programme aimed at both gold and base metal targets (the Perkoa VMS deposit had already been discovered). It culminated in trenching and diamond drilling over many targets.

In that early historical work several interesting intervals were intersected in different holes and were not followed at the time, we understand for different reasons, among which the more plausible is the end of the financing of the UNDP program. Exploration was then placed on 'ice' in terms of continuing exploration until 2014 where Mr. Sanou, the joint-venture partner of Panthera, performed some RAB drilling and trenching.

The Company's experienced in country and international geological team have completed systematic geological mapping, data compilation, geochemical and geophysical surveys and the interpretation of these databases have identified the drill targets to be tested. This has led to the recommendations to drill these priority targets in this round of exploration drilling.

Figure 1: Bido Project Prospects and Geophysical Survey Grid Locations

The Company has completed the earn-in obligations at Bido in Burkina Faso and owns an 80% interest in the Bido Project. The Company may acquire the remaining 20% by expenditure of a further US$1,000,000 on exploration and development within two years, subject to the vendor's rights of a buy-back right of 1% interest in the Tenements and Associated Rights for the price of US$1,000,000. A royalty will be payable to the vendor on all minerals produced by exercise of rights under the Tenements which shall be calculated at the rate of 1% of the net smelter returns ("NSR") on all minerals extracted from the Properties pursuant to the Tenements, inclusive of any withholding tax (if any) payable in respect of those royalties and shall be paid quarterly. Payments via the NSR will be capped at US$3 million in total.

Drilling Programme

An RC drilling program targeting the Kwademen prospect has commenced. The Drilling Programme aims to advance with the development of the mining potential of the Bido tenement.

The Kwademen prospect is located on the north-western part of the Bido tenement limits (Figure 1). Panthera started exploration work on the area initially through performing compilation work followed by soils sampling in 2018. The soil sampling program consisted of sampling on east-west lines spaced of 200 m with sampling repeated at 50 m interval on each line. An Induced Polarized (IP) survey was conducted in 2023 and consisted of a gradient survey exploring the ground at a relatively constant depth of 50 m followed by a Pole-Dipole survey on some selected lines to help determining the depth of the anomalies identified by gradient as long as determining the dip of the chargeable structures. More recently and prior the finalisation of this proposal for drilling, a program of systematic mapping of all orpailleurs shafts as long as all eluvial workings areas was completed.

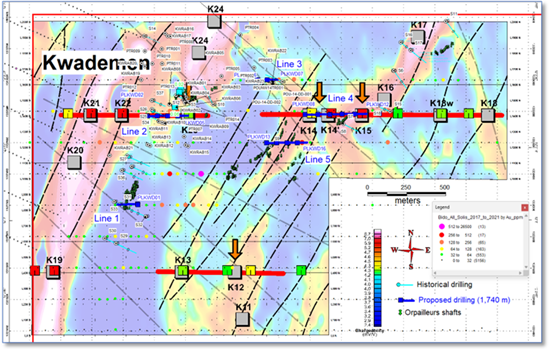

A total of sixteen reverse circulation drill holes for an advance of 1,740 m will test the five priority targets outlined below and is planned for this Drilling Programme with locations indicated at Figure 2 below.

Target 1: Test the continuity of historical holes where gold intervals of 24 m @ 1.38 g/t Au from 143 m, 9 m @ 0.51 g/t Au and 10 m @ 0.57 g/t Au reported in three holes.

Target 2: Test the combined geophysical (IP) and soil anomalies and coincident historical drill results such as 16 m @ 1.07 g/t Au, 11 m @ 0.40 g/t Au and 13 m @ 0.53 g/t Au.

Target 3: Test an area located north-east of Target 2 and includes follow up of a RAB hole drilled in 2014 reporting 13 m @ 22.11 g/t Au to the end of hole (reference the Company's AIM Admission Document).

Target 4: Located where the axis of high chargeability IP anomalies from the company's geophysical survey, and gold in soil anomalies are located at an area where recently dug orpailleurs shafts were mapped and observed to have depths to about 25 m.

Target 5: Test an area where a high chargeability IP anomaly is located underneath a recently dug and extensive line of orpailleurs shafts. A high gold in soil anomaly of 282 ppb is also recorded at this target.

Figure 2: Plan View of the proposed drilling at Kwademen

Contacts

Panthera Resources PLC

Mark Bolton (Managing Director) +61 411 220 942

contact@pantheraresources.com

Allenby Capital Limited (Nominated Adviser & Joint Broker) +44 (0) 20 3328 5656

John Depasquale / Vivek Bhardwaj (Corporate Finance)

Guy McDougall / Kelly Gardiner

VSA Capital Limited (Joint Broker) +44 (0) 20 3005 5000

Andrew Monk / Andrew Raca

Novum Securities Limited (Joint Broker) +44 (0) 20 7399 9400

Colin Rowbury

Subscribe for Regular Updates

Follow the Company on Twitter at @PantheraPLC

For more information and to subscribe to updates visit: pantheraresources.com

Qualified Persons

The technical information contained in this disclosure has been read and approved by Ian S Cooper (BSc, ARSM, FAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules - Note for Mining and Oil & Gas Companies. Mr Cooper is a geological consultant to Panthera Resources PLC.

Glossary

| Au:

| The chemical element for Gold |

| Diamond Core

| Diamond core drilling uses a diamond cutting bit, which rotates at the end of a steel rod (tube) allowing for a solid column of rock to be recovered from the tube at the surface. |

| g/t:

| Grammes per Tonne (Metric) |

| JORC: | Australasian Code for Reporting of Mineral Resources and Ore Reserves' of December 2012 ("JORC Code") as prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy. Terms including Measured, Indicated and Inferred Resources as defined therein

|

| km:

| Kilometres (Metric)

|

| IP: | Induced polarization (IP) is a geophysical imaging technique used to identify the electrical chargeability of subsurface materials. |

| Metres: | Metres (Metric)

|

| Moz: | Million Ounces (Troy)

|

| Mt:

| Million Tonnes (Metric) |

| NSR: | Net Smelter Return (NSR) is the net revenue that the owner of a mining property receives from the sale of the mine's metal products less transportation and refining costs

|

| ppb | |

| RC: | Reverse Circulation drilling, or RC drilling, uses rods with inner and outer tubes, the drill cuttings are returned to surface inside the rods. The drilling mechanism is a pneumatic reciprocating piston known as a hammer driving a tungsten-steel drill bit.

|

| Pole-Dipole:

| Induced polarization (IP) is a geophysical imaging technique used to identify the electrical chargeability of subsurface materials. Pole-Dipole relates to the method of configuration of the transmitting and receiving electrode positions

|

| ppb:

| Parts per billion |

| RAB: | Rotary Air Blast drilling, or RAB drilling is completed using a drill rod string providing compressed air to the drill bit face, drill sample cuttings are then returned to the surface via the 'open hole'. RAB drilling is generally completed to shallow depth of penetration. |

Forward-looking Statements

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterised by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly, undue reliance should not be put on such statements due to the inherent uncertainty therein.

**ENDS**

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.