1 September 2025

Empyrean Energy PLC / Index: AIM / Epic: EME / Sector: Oil & Gas

Empyrean Energy PLC ('Empyrean' or 'the Company')

Final Results

Empyrean Energy is pleased to announce its final results for the year ended 31 March 2025 ("Report and Accounts"). The full Report and Accounts will be made available on the Company's website in the coming days.

Key Activities

Duyung PSC Project, Indonesia (EME 8.5%)

Reporting period

· On 24 June 2024, the Company announced that the Mako JV partners had entered into a binding domestic Gas Sales Agreement ("GSA") for the sale and purchase of the domestic portion of Mako gas with PT Perusahaan Gas Negara Tbk ("PGN"), the gas subsidiary of PT Pertamina (Persero), the national oil company of Indonesia.

· The domestic GSA will be subject to the construction of a pipeline connecting the West Natuna Transportation System ("WNTS") with the domestic gas market in Batam and it forms part of Mako JV's Domestic Market Obligation ("DMO") as set out in the Mako revised Plan of Development ("POD").

· The Total Contracted Gas volume under the PGN GSA is up to 122.77 trillion British Thermal Units ("TBtu"), with estimated plateau production rates of 35 billion British thermal units ("Bbtud") per day. The remainder of the Mako sales gas volumes were targeted to be sold via an export GSA.

· Due to the very strong growth in domestic demand for gas in Indonesia, the Indonesian Ministry of Energy and Mineral Resources ("MEMR") directed that all Mako gas (plateau sales gas rate of 111 Bbtud) be made available for the Indonesian domestic market in Batam with the gas to be purchased by PT PLN Energi Primer Indonesia ("PLN EPI" or "PLN") a wholly owned subsidiary of the Indonesian state-owned electric utility company PT Perusahaan Listrik Negara (Persero) ("PLN Persero").

· The Mako gas price will be linked to the Indonesian Crude Price ("ICP"), which is akin to Brent oil-linked Liquified Natural Gas ("LNG") pricing. This structure will be economically equivalent to the pricing previously approved for Mako gas to be sold both domestically and for export, thereby underpinning the value of gas from Mako.

· As a result of the MEMR Directive, in July 2025, Conrad Asia Energy Ltd ("Conrad") signed a binding GSA for the sale and purchase of natural gas from the Mako Gas Field with PLN EPI.

· In addition, MEMR has revoked its earlier allocation and pricing Directive to sell Mako gas to PT Perusahaan Gas Negara Tbk ("PGN") and Sembcorp Gas Pte Ltd. ("Sembcorp") and the GSAs with PGN and Sembcorp has been terminated.

· The MEMR Directive is anticipated to support potential farmout arrangements in Duyung and a Financial Investment Decision ("FID") for Mako.

· Empyrean holds an 8.5% operating interest in the Duyung Production Sharing Contract ("PSC") in which Mako is located, offshore in the West Natuna Sea, Indonesia.

Wilson River Project, Queensland Australia (EME 8.5%)

Reporting period

· Acquisition of option to participate in Wilson River conventional oil prospect. The Wilson Prospect is situated close to existing infrastructure in the prolific Cooper Basin in South-West Queensland, Australia, and adjacent to several producing oil fields.

· Following the securing of land access and completion of cultural heritage surveys and drill preparation activities, the Wilson River-1 well spudded on 14 March 2025. The well was funded by Empyrean and Condor Energy Services Limited ("Condor Energy"), an experienced Australian based well services and drilling company with recent drilling contracts completed nearby in the Cooper Basin.

Post-Reporting period

· Following drilling the JV partners in the Wilson River-1 decided to conduct a Drill Stem Test ("DST") over the potential oil zone identified in the Murta Formation from analysis of logs and hydrocarbon shows from the well. However, the final well testing report confirmed the recovery of formation water in the potential oil zone and, as a result, the well was plugged and abandoned.

Sacramento Basin, California USA (EME 25-30%)

No work was conducted on the project during the year.

Corporate

Reporting period

· Placing, Subscription and Retail Offer to raise US$1.592 million (£1.255 million) completed in November 2024.

· Placing to raise US$0.840 million (£0.675 million) completed in January 2025.

· Placing to raise US$0.787 million (£0.625 million) completed in February 2025.

· Mr John (Spencer) Laycock assumed the role of Non-Executive Chairman of the Company in April 2024, replacing Dr Patrick Cross who remained on the Board as Non-Executive Director.

Post-Reporting period

· Placing and Retail Offer to raise US$0.825 million (£0.661 million) completed in April 2025.

· Placing to raise US$1.354 million (£1 million) completed in July 2025.

Chairman's Statement

At the time of writing this statement, Empyrean's Board and staff became aware of the very distressing news that the Company's Managing Director and CEO, Tom Kelly, had passed away after a tragic accident. Tom was much loved and respected and will be dearly missed by everyone at Empyrean and we are still coming to terms with what has happened. For now, on behalf of the Board and all at Empyrean, I reiterate our earlier sentiments that our thoughts are with Tom's family and friends and our deepest condolences go out to them.

I will now provide a review of the reporting period as is custom for an Annual Report.

As noted in August 2024, I have assumed the Chairmanship of the Company and I would again like to formally extend my thanks to Dr Patrick Cross for serving in this role for the past 20 years and for the meaningful contribution he made in that time.

It has clearly been a very frustrating year for Empyrean and its shareholders.

In Indonesia it has been a protracted waiting period for Empyrean, as we seek to ultimately maximise value from our 8.5% interest in the Mako gas field discovery on the Duyung permit. However, recent developments have been somewhat more encouraging. After the presidential election, the Indonesian government has changed its energy policy objectives and has directed that all Mako gas be made available for the Indonesian domestic market. This is a significant development in terms of ultimately commercialising the asset in a timely manner.

As a result, in July 2025, Conrad signed a binding GSA for the sale and purchase of natural gas from the Mako Gas Field with PLN EPI. Pleasingly, Conrad have indicated that the finalisation of the GSA with PLN Persero has sparked renewed interest in the farm down process with Conrad having received further non-binding offers and having entered into confidential discussions with one party. Empyrean hopes this process will reach a conclusion during 2025 and it can look to commercialise its current interest in the project.

In January 2025, Empyrean acquired an option to participate in Wilson River conventional oil prospect located within the ATP 1173 permit that is situated close to existing infrastructure in the prolific Cooper Basin in South-West Queensland, Australia, and adjacent to several producing oil fields. In March 2025, the Wilson-1 well spud. The JV partners elected to conduct a DST on potential oil zone identified from the drilling but, unfortunately, this confirmed the recovery of formation water in the potential oil zone and, as a result, the well was plugged and abandoned.

From a corporate perspective, the Company has successfully raised funds throughout the reporting period through a series of Placings and Retail Offers. While dilutive, these funds have enabled increased operational activity and will provide much-needed working capital while events in Indonesia progress. Despite the disappointing result at Wilson, the Company continues to assess other project opportunities while mindful of preserving its capital.

I would like to thank the Board, management and staff for their patience and perseverance as it has been a particularly difficult year. I'd also like to thank those shareholders that have remained steadfast in their support - I do appreciate how frustrated many are right now. Empyrean remains optimistic of a positive conclusion to the sell down process from Indonesia, which we hope will provide the impetus to rebuild value for its shareholders.

John Laycock

Non-Executive Chairman, 1 September 2025

For further information please visit www.empyreanenergy.com or contact the following:

| Empyrean Energy plc | Tel: +61 (8) 6146 5325 |

| Gaz Bisht/Jonathan Whyte | |

| | |

| Cavendish Capital Markets Limited (Nominated Advisor and Broker) | Tel: +44 (0) 207 220 0500 |

| Neil McDonald Pearl Kellie | |

| | |

| Novum Securities Limited (Joint Broker) | Tel: +44 (0) 207 399 9400 |

| Colin Rowbury | |

Operational Review

The Company's corporate objective remains to build a significant asset portfolio across the Australasian region.

Empyrean remains optimistic about the significant value potential of its interest in Indonesia, which will be reflected in a renewed sell down process and the recent execution of the export GSA with PLN EPIas announced on 17 July 2025. The project has been further supported by strong gas prices in the Asian region.

Empyrean also has a 25-30% working interest in a package of gas projects in the Sacramento Basin, onshore California. While no activity occurred during the past years Empyrean will assess the technical and commercial merits of other prospects or proposals as they are presented.

Empyrean has retained an interest in the Riverbend Project (10% WI) located in the Tyler and Jasper counties, onshore Texas and a 58.084% WI in the Eagle Oil Pool Development Project, located in the prolific San Joaquin Basin onshore, Southern California. No technical work has been undertaken on these projects during the year.

Duyung PSC, Indonesia (8.5% WI)

Background

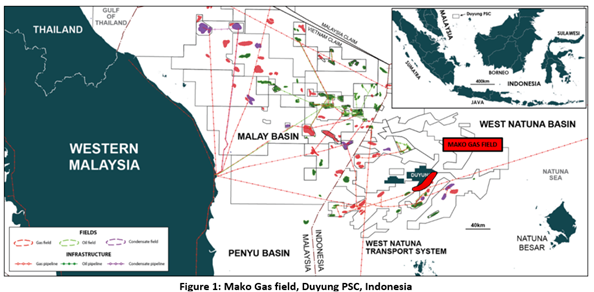

In April 2017, Empyrean acquired a 10% shareholding in WNEL from Conrad Petroleum (now Conrad Asia Energy Ltd), which held a 100% Participating Interest in the Duyung Production Sharing Contract ("Duyung PSC") in offshore Indonesia and is the operator of the Duyung PSC. The Duyung PSC covers an offshore permit of approximately 1,100km2 in the prolific West Natuna Basin. The main asset in the permit is the Mako shallow gas field that was discovered in 2017, and comprehensively appraised in 2019.

In early 2019, both the operator, Conrad, and Empyrean divested part of their interest in the Duyung PSC to AIM-listed Coro Energy Plc. Following the transaction, Empyrean's interest reduced from 10% to 8.5% interest in May 2020, having received cash and shares from Coro.

During October and November 2019, a highly successful appraisal drilling campaign was conducted in the Duyung PSC. The appraisal wells confirmed the field-wide presence of excellent quality gas in the intra-Muda reservoir sands of the Mako Gas Field.

Empyrean holds an 8.5% operated interest in the Duyung PSC. Duyung is located in the Riau Islands Province, Indonesian waters in the West Natuna area, approximately 100 km to the north of Matak Island and 400 km northeast of Singapore.

Current Activities

In March 2025, Conrad received a Directive from MEMR, including that due to the very strong growth in domestic demand for gas in Indonesia, all Mako gas (plateau sales gas rate of 111 billion British Thermal Units per day ("Bbtud")) be made available for the Indonesian domestic market in Batam with the gas to be purchased by PLN, a wholly owned subsidiary of the Indonesian state-owned electric utility company PLN Persero.

PLN Persero is wholly-owned by the Government of Indonesia through the Ministry of State-Owned Enterprise. The organisation has over 7,000 power plants supplying over 89 million customers and sells over 288,000 GWh of electricity annually.

The Mako gas price will be linked to the Indonesian Crude Price ("ICP"), which is akin to Brent oil-linked Liquified Natural Gas ("LNG") pricing. This structure will be economically equivalent to the pricing previously approved for Mako gas to be sold both domestically and for export, thereby underpinning the value of gas from Mako.

As a result of the MEMR Directive, in July 2025 Conrad signed a binding GSA for the sale and purchase of natural gas from the Mako Gas Field with PLN EPI.

In addition and a result of the above, MEMR has revoked its earlier allocation and pricing Directive to sell Mako gas to PGN and Sembcorp and those GSAs with PGN and Sembcorp has been terminated.

The new Government of Indonesia is formulating its New Energy Plan 2024-2034 (or "New RUPTL") under which it will prioritise gas exploration and production to meet rapidly rising domestic energy demand. Around 15 Gigawatts ("GW") of gas power capacity across Indonesia is planned to be built until 2034, especially to support the base load capacity.

The MEMR Directive is anticipated to support potential farmout arrangements in Duyung and FID for Mako.

On 24 June 2024, the Company announced that the Mako JV partners had entered into a binding domestic GSA for the sale and purchase of the domestic portion of Mako gas with PGN, the gas subsidiary of PLN Persero. The domestic GSA will be subject to the construction of a pipeline connecting the WNTS with the domestic gas market in Batam and it forms part of Mako JV's DMO.

The domestic gas sale agreement with PGN for gas from the Mako gas field is an important step in the commercialisation of the Mako gas field (the largest undeveloped gas field in the West Natuna Sea). The Total Contracted Gas volume under the PGN GSA is up to 122.77 trillion TBtu, with estimated plateau production rates of 35 billion Bbtud per day. The remainder of the Mako sales gas volumes were targeted to be sold via an export GSA.

The West Natuna Sea gas gathering system is already connected to Singapore. PGN will now proceed with planning a smaller tie line to the island of Batam across the Malacca Straight that will connect the Natuna Sea to the Indonesian market.

Indonesia, the fourth most populated country on earth has a stated objective of doubling its gas production by 2030 in order to deliver a cleaner energy source to fuel its rapidly growing economy. PGN will play a significant role in this Indonesian energy transition.

The Mako field contains 2C Contingent Resources (100%) of 376 billion cubic feet ("Bcf"), and is scheduled to begin production in 2026. The West Natuna Sea has been supplying Singapore with natural gas for more than two decades and Mako is expected to extend this supply for at least another decade via the existing transportation system.

The contract term is until the end of the Duyung PSC in January 2037 and allows for the sale of plateau gas rates of 111 Bbtud which is equivalent to around 111.9 mmscfd. The contract is for the entirety of Mako's 2C Contingent Resources.

Discussions continue with Conrad regarding settlement of claims over unpaid cash calls.

Wilson River, Queensland Australia (EME 8.5%)

In January 2025 the Company announced the acquisition of an option to participate in Wilson River conventional oil prospect. The Wilson Prospect is situated close to existing infrastructure in the prolific Cooper Basin in South-West Queensland, Australia, and adjacent to several producing oil fields.

Following the securing of land access and completion of cultural heritage surveys and drill preparation activities the Wilson River-1 well spudded on 14 March 2025. The well was funded by Empyrean and Condor Energy, an experienced Australian based well services and drilling company with recent drilling contracts completed nearby in the Cooper Basin.

Following drilling the JV partners in the Wilson River-1 decided to conduct a DST over the potential oil zone identified in the Murta Formation from analysis of logs and hydrocarbon shows from the well. The final well testing report however confirmed the recovery of formation water in the potential oil zone and as a result the well was plugged and abandoned.

Multi Project Farm-in in Sacramento Basin, California (25%-30% WI)

Background

In May 2017, Empyrean agreed to farm-in to a package of opportunities including the Dempsey and Alvares prospects in the Northern Sacramento Basin, onshore California. The rationale for participating in this potentially significant gas opportunity was a chance to discover large quantities of gas in a relatively 'gas hungry' market. Another attractive component of the deal was the ability to commercialise a potential gas discovery using existing gas facilities that are owned by the operator.

There were no significant activities conducted during the past years however the Company will continue to work with its joint venture partners in reviewing and assessing any further technical and commercial opportunities as they relate to the project.

Riverbend Project (10%)

No work has been completed on the project in the year and no budget has been prepared for 2025/26 whilst the Company focuses on other projects. The Company previously fully impaired the carrying value of the asset and any subsequent expenditure, mainly for license fees, has been expensed through the profit and loss statement.

Eagle Oil Pool Development Project (58.084% WI)

No work has been completed on the project in the year and no budget has been prepared for 2025/26 whilst the Company focuses on other projects. The Company previously fully impaired the carrying value of the asset and any subsequent expenditure, mainly for license fees, has been expensed through the profit and loss statement.

The information contained in this report was completed and reviewed by the Company's Executive Director (Technical), Mr Gajendra (Gaz) Bisht, who has over 36 years' experience as a petroleum geoscientist.

Statement of Comprehensive Income

For the Year Ended 31 March 2025

| |

| 2025 | 2024 |

| ||||

| Continued Operations | Notes | US$'000 | US$'000 |

| ||||

|

|

| | |

| ||||

| Revenue |

| - | - |

| ||||

| |

| | |

| ||||

| Expenses |

| | |

| ||||

| Administrative expenses |

| (168) | (355) |

| ||||

| Compliance fees |

| (245) | (326) |

| ||||

| Directors' remuneration | 4 | (406) | (416) |

| ||||

| Foreign exchange loss | 3 | (115) | (123) |

| ||||

| Total expenses |

| (934) | (1,220) |

| ||||

| |

|

|

|

| ||||

| Operating loss | 3 | (934) | (1,220) |

| ||||

| |

|

|

|

| ||||

| Finance expense | 5 | (1,210) | (1,770) |

| ||||

| Impairment - exploration and evaluation assets | 8 | (1,205) | (6,595) |

| ||||

| |

|

|

|

| ||||

| Loss from continuing operations before taxation |

| (3,349) | (9,585) |

| ||||

| Tax expense | 6 | (1) | (1) |

| ||||

| |

|

|

|

| ||||

| Loss from continuing operations after taxation |

| (3,350) | (9,586) |

| ||||

| |

|

|

|

| ||||

| Total comprehensive loss for the year attributable to owners of the Company |

| (3,350) | (9,586) |

| ||||

| | | | |

| ||||

| Earnings (loss) per share from continuing operations attributable to owners of the Company (expressed in cents) | |

| | |||||

| - Basic | 7 | (0.18)c | (0.98)c |

| ||||

| - Diluted |

| (0.18)c | (0.98)c |

| ||||

The accompanying accounting policies and notes form an integral part of these financial statements.

Statement of Financial Position

As at 31 March 2025

| Company Number: 05387837 |

| 2025 | 2024 |

| | Notes | US$'000 | US$'000 |

| Assets |

|

| |

| Non-Current Assets |

|

| |

| Exploration and evaluation assets | 8 | 5,763 | 5,355 |

| Total non-current assets |

| 5,763 | 5,355 |

| |

|

|

|

| Current Assets |

|

|

|

| Trade and other receivables | 10 | 56 | 17 |

| Cash and cash equivalents |

| 1,675 | 981 |

| Total current assets |

| 1,731 | 998 |

| |

|

|

|

| Liabilities |

|

|

|

| Current Liabilities |

|

|

|

| Trade and other payables | 11 | 3,125 | 2,929 |

| Provisions | 12 | - | 189 |

| Convertible loan notes | 13 | 8,938 | 7,594 |

| Total current liabilities |

| 12,063 | 10,712 |

|

|

|

|

|

| Net Current Liabilities |

| (10,332) | (9,714) |

| Net Liabilities |

| (4,569) | (4,359) |

| |

|

|

|

| Shareholders' Equity |

|

|

|

| Share capital | 15 | 472 | 3,405 |

| Share premium reserve | 16 | 52,948 | 46,891 |

| Warrant and share-based payment reserve |

| 129 | 123 |

| Retained losses |

| (58,118) | (54,778) |

| Total Equity |

| (4,569) | (4,359) |

| |

|

| |

The Financial Statements were approved by the Board of Directors on 1 September 2025

The accompanying accounting policies and notes form an integral part of these financial statements.

Statement of Cash Flows

For the Year Ended 31 March 2025

| |

| 2025 | 2024 |

| | Notes | US$'000 | US$'000 |

| Operating Activities |

|

| |

| Payments for operating activities |

| (937) | (827) |

| Net cash outflow for operating activities | 14 | (937) | (827) |

| |

|

|

|

| Investing Activities |

|

|

|

| Payments for exploration and evaluation | 8 | (1,418) | (964) |

| Net cash outflow for investing activities |

| (1,418) | (964) |

| |

|

|

|

| Financing Activities |

|

|

|

| Issue of ordinary share capital |

| 3,180 | 2,790 |

| Payment of finance costs |

| - | (29) |

| Payment of equity issue costs |

| (156) | (72) |

| Net cash inflow from financing activities |

| 3,024 | 2,689 |

| |

|

|

|

| Net increase in cash and cash equivalents |

| 669 | 898 |

| Cash and cash equivalents at the start of the year |

| 981 | 83 |

| Forex gain on cash held |

| 25 | - |

| |

|

|

|

| Cash and Cash Equivalents at the End of the Year |

| 1,675 | 981 |

| |

|

| |

The accompanying accounting policies and notes form an integral part of these financial statements.

Statement of Changes in Equity

For the Year Ended 31 March 2025

| |

| Share Capital | Share Premium Reserve | Warrant and Share-Based Payment Reserve | Retained Losses | Total Equity |

| | Notes | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 |

| | | | | | | |

| Balance at 1 April 2023 |

| 2,170 | 45,319 | 73 | (45,265) | 2,297 |

| | | | | | | |

| Loss after tax for the year | | - | - | - | (9,586) | (9,586) |

| Total comprehensive loss for the year | | - |

- | - |

(9,586) |

(9,586) |

| Contributions by and distributions to owners | | | | | | |

| Shares issued in the period | 15 | 1,179 | 1,611 | - | - | 2,790 |

| Exercise/expiry of warrants | | - | - | (73) | 73 | - |

| Equity issue costs | | 7 | (123) | 44 | - | (72) |

| Share-based payment expense | | 49 | 84 | 79 | - | 212 |

| Total contributions by and distributions to owners |

| 1,235 |

1,572 | 50 | 73 | 2,930 |

|

|

|

|

|

|

|

|

| Balance at 1 April 2024 |

| 3,405 | 46,891 | 123 | (54,778) | (4,359) |

| |

| | | | | |

| Loss after tax for the year |

| - | - | - | (3,350) | (3,350) |

| Total comprehensive loss for the year |

| - |

- | - |

(3,350) |

(3,350) |

| Contributions by and distributions to owners |

| | | | | |

| Shares issued in the period | 15 | 306 | 2,914 | - | - | 3,220 |

| Expiry of warrants |

| - | - | (10) | 10 | - |

| Equity issue costs |

| 1 | (158) | - | - | (157) |

| Share-based payment expense |

| 2 | 59 | 16 | - | 77 |

| Capital reorganisation | 15 | (3,242) | 3,242 | - | - | - |

| Total contributions by and distributions to owners |

| (2,933) |

6,057 | 6 | 10 | 3,140 |

| |

| | | | | |

| Balance at 31 March 2025 |

| 472 | 52,948 | 129 | (58,118) | (4,569) |

The accompanying accounting policies and notes form an integral part of these financial statements.

Notes to the Financial Statements

For the Year Ended 31 March 2025

Note 1. Statement of Significant Accounting Policies

Basis of preparation

The Company's financial statements have been prepared in accordance with United Kingdom adopted International Accounting Standards ("UK adopted IAS") and Companies Act 2006. The principal accounting policies are summarised below. The financial report is presented in the functional currency, US dollars and all values are shown in thousands of US dollars (US$'000), unless otherwise stated.

The preparation of financial statements in compliance with UK adopted IAS requires the use of certain critical accounting estimates. It also requires Company management to exercise judgement in applying the Company's accounting policies. The areas where significant judgements and estimates have been made in preparing the financial statements and their effect are disclosed below.

Basis of measurement

The financial statements have been prepared on a historical cost basis, except for derivative financial instruments, which are measured at fair value through profit or loss.

Nature of business

The Company is a public limited company incorporated and domiciled in England and Wales and listed on the AIM market of the London Stock Exchange. The address of the registered office is Yarnwicke, 119-121 Cannon Street, London EC4N 5AT. The Company is in the business of financing the exploration, development and production of energy resource projects in regions with energy hungry markets close to existing infrastructure. The Company has typically focused on non-operating working interest positions in projects that have drill ready targets that substantially short cut the life-cycle of hydrocarbon projects by entering the project after exploration concept, initial exploration and drill target identification work has largely been completed.

Going concern

At the year end the Company had a cash balance of US$1.68 million (2024: US$0.98 million) and made a loss after income tax of US$3.35 million (2024: loss of US$9.59 million).

The Directors have prepared cash flow forecasts for the Company covering the period to 30 September 2026 and these demonstrate that the Company will require further funding within the next 12 months from the date of approval of the financial statements. As disclosed previously, in June 2022, the Company entered into an agreement with CNOOC to drill an exploration well on the Topaz prospect in China, by 12 June 2024, which includes a payment of US$250,000 to CNOOC. It is estimated that the cost of drilling this well would be approximately US$12 million. The Company did not commence the drilling of the Topaz well by 12 June 2024 and therefore the permit expired on 12 June 2024.

On 24 August 2024, the Company received a letter of demand from CNOOC's lawyers, King Wood & Mallesons, in relation to Block 29/11. The letter of demand alleged, inter alia, that Empyrean has outstanding obligations under the relevant Petroleum Contract entered into with CNOOC and that Empyrean has failed to pay certain amounts that CNOOC consider due and payable under the Petroleum Contract relating to the prospecting fee and exploration work. The Company rejected the outstanding amounts claimed, which total US$12 million, and responded to the letter of demand requesting clarification of the basis for the demands made in the letter. The Company received an email from CNOOC on 21 August 2025 which referred to the previous letter of demand and reiterated CNOOC's position on this matter.

During and subsequent to the reporting period, the Company has raised equity funds across multiple tranches, with a Placing, Subscription and Retail Offer to raise US$1.592 million (£1.255 million) completed in November 2024, Placings to raise US$0.840 million (£0.675 million) and US$0.787 million (£0.625 million) completed over January 2025 and February 2025. a Placing and Retail Offer to raise US$0.825 million (£0.661 million) completed in April 2025 and a further Placing to raise US$1.354 million (£1 million) completed in July 2025.

However, in order to meet the repayment terms of the Convertible Note (which was renegotiated in 2023), any further commitments at the Mako Gas Field including reaching agreement on a settlement of existing claims from Conrad, any potential further costs or payments to CNOOC in relation to Block 29/11, and working capital requirements the Company is required to raise further funding either through equity or the sale of assets and as at the date of this report the necessary funds are not in place.

The Directors remain optimistic that its funding commitments will be met should it be able to monetise its interest in Mako through the current sell down process. Both Conrad and PLN ESI have now signed a binding GSA in July 2025. Conrad have indicated that the finalisation of the GSA with PLN ESI has sparked renewed interest in the farm down process with Conrad having received further non-binding offers and having entered into confidential discussions with one party.

It is the belief of the Board that the completion of the GSA is a significant value catalyst that is a necessary precursor to maximising the value of its interest at the Mako Gas field through the current sell down process.

The Company therefore requires additional funding to fund the ongoing cash needs of the business for the foreseeable future and may require further funding should it be required to settle amounts claimed by CNOOC. The Directors acknowledge that this funding is not guaranteed. These conditions indicate that there is a material uncertainty which may cast significant doubt over the Company's ability to continue as a going concern and, therefore, the Company may be unable to realise its assets and discharge its liabilities in the normal course of business.

Given the above and the Company's proven track record of raising equity funds and advanced Mako sell-down process, which the Directors believe would be sufficient to meet all possible funding needs as set out above, the Directors have therefore concluded that it is appropriate to prepare the Company's financial statements on a going concern basis and they have therefore prepared the financial statements on a going concern basis.

The financial statements do not include the adjustments that would result if the Company was unable to continue as a going concern.

Adoption of new and revised standards

(a) New and amended standards adopted by the Company:

There were no new standards effective for the first time for periods beginning on or after 1 April 2024 that have had a significant effect on the Company's financial statements.

(b) Standards, amendments and interpretations that are not yet effective and have not been early adopted:

Any standards and interpretations that have been issued but are not yet effective, and that are available for early application, have not been applied by the Company in these financial statements. International Financial Reporting Standards that have recently been issued or amended but are not yet effective have been assessed by the Company and are not considered to have a significant effect on the Company's financial statements.

Tax

The major components of tax on profit or loss include current and deferred tax.

(a) Current tax

Tax is recognised in the income statement. The current tax charge is calculated on the basis of the tax laws enacted at the statement of financial position date in the countries where the Company operates.

(b) Deferred tax

Deferred tax assets and liabilities are recognised where the carrying amount of an asset or liability in the statement of financial position differs to its tax base. Recognition of deferred tax assets is restricted to those instances where it is probable that taxable profit will be available, against which the difference can be utilised. The amount of the asset or liability is determined using tax rates that have been enacted or substantively enacted by the reporting date and are expected to apply when the deferred tax liabilities/(assets) are settled/(recovered). The Company has considered whether to recognise a deferred tax asset in relation to carried-forward losses and has determined that this is not appropriate in line with IAS 12 as the conditions for recognition are not satisfied.

Foreign currency translation

Transactions denominated in foreign currencies are translated into US dollars at contracted rates or, where no contract exists, at average monthly rates. Monetary assets and liabilities denominated in foreign currencies which are held at the year-end are translated into US dollars at year-end exchange rates. Exchange differences on monetary items are taken to the Statement of Comprehensive Income. Items included in the financial statements are measured using the currency of the primary economic environment in which the Company operates (the functional currency which is US dollars).

Oil and gas assets: exploration and evaluation

The Company applies the full cost method of accounting for Exploration and Evaluation ("E&E") costs, having regard to the requirements of IFRS 6 Exploration for and Evaluation of Mineral Resources. Under the full cost method of accounting, costs of exploring for and evaluating oil and gas properties are accumulated and capitalised by reference to appropriate cash generating units ("CGUs"). Such CGUs are based on geographic areas such as a concession and are not larger than a segment. E&E costs are initially capitalised within oil and gas properties: exploration and evaluation. Such E&E costs may include costs of license acquisition, third party technical services and studies, seismic acquisition, exploration drilling and testing, but do not include costs incurred prior to having obtained the legal rights to explore an area, which are expensed directly to the income statement as they are incurred, or costs incurred after the technical feasibility and commercial viability of extracting a mineral resource are demonstrable, which are reclassified as development and production assets.

Property, Plant and Equipment ("PPE") acquired for use in E&E activities are classified as property, plant and equipment. However, to the extent that such PPE is consumed in developing an intangible E&E asset, the amount reflecting that consumption is recorded as part of the cost of the intangible E&E asset. Intangible E&E assets related to exploration licenses are not depreciated and are carried forward until the existence (or otherwise) of commercial reserves has been determined. The Company's definition of commercial reserves for such purpose is proven and probable reserves on an entitlement basis.

The ultimate recoupment of the value of exploration and evaluation assets is dependent on the successful development and commercial exploitation, or alternatively, sale, of the exploration and evaluation asset.

The carrying amounts of the Company's non-financial assets are reviewed at each reporting date to determine whether there is any indication of impairment. E&E assets are assessed for impairment if (i) sufficient data exists to determine technical feasibility and commercial viability, or (ii) facts and circumstances suggest that the carrying amount exceeds the recoverable amount. If any such indication exists, then the asset's recoverable amount is estimated.

For the purpose of impairment testing, assets are grouped together into CGU's. The recoverable amount of an asset or a CGU is the greater of its value in use and its fair value less costs of disposal.

In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. Value in use is generally computed by reference to the present value of the future cash flows expected to be derived from production of proven and probable reserves.

Fair value less costs of disposal is the amount obtained from the sale of an asset or CGU in an arm's length transaction between knowledgeable, willing parties, less the costs of disposal.

An impairment loss is recognised if the carrying amount of an asset or its CGU exceeds its estimated recoverable amount. Impairment losses are recognised in the consolidated statement of comprehensive loss.

Impairment losses recognised in respect of CGU's are allocated first to reduce the carrying amount of any goodwill allocated to the units and then to reduce the carrying amounts of the other assets in the unit (or group of units) on a pro rata basis. Impairment losses recognised in prior years are assessed at each reporting date for any indications that the loss has decreased or no longer exists. An impairment loss is reversed if there has been a change in the estimates used to determine the recoverable amount. An impairment loss is reversed only to the extent that the asset's carrying amount does not exceed the carrying amount that would have been determined, net of depletion and depreciation or amortization, if no impairment loss had been recognised. Reversal of impairment losses are recognised in the consolidated statement of comprehensive loss.

The key areas of judgement and estimation include:

· Recent exploration and evaluation results and resource estimates;

· Environmental issues that may impact on the underlying tenements; and

· Fundamental economic factors that have an impact on the planned operations and carrying values of assets and liabilities.

Other investments

In a situation where the Company has direct contractual rights to the assets, and obligations for the liabilities, of an entity but does not share joint control, the Company accounts for its interest in those assets, liabilities, revenues and expenses in accordance with the accounting standards applicable to the underlying line item. This is analogous to the "joint operator" method of accounting outlined in IFRS 11 Joint arrangements.

Financial instruments

Financial assets and liabilities are recognised in the statement of financial position when the Company becomes party to the contractual provision of the instrument.

(a) Financial assets

The Company's financial assets consist of financial assets at amortised cost (trade and other receivables, excluding prepayments, and cash and cash equivalents). Financial assets at amortised cost are initially measured at fair value and subsequently at amortised cost and attributable transaction costs are included in the initial carrying value.

(b) Financial liabilities

All financial liabilities are classified as fair value through the profit and loss or financial liabilities at amortised cost. The Company's financial liabilities at amortised cost include trade and other payables and its financial liabilities at fair value through the profit or loss include the derivative financial liabilities. Financial liabilities at amortised cost, are initially stated at their fair value and subsequently at amortised cost. Interest and other borrowing costs are recognised on a time-proportion basis using the effective interest method and expensed as part of financing costs in the statement of comprehensive income. Derivative financial liabilities are initially recognised at fair value of the date a derivative contract is entered into and subsequently re-measured at each reporting date. The method of recognising the resulting gain or loss depends on whether the derivative is designated as a hedging instrument, and if so, the nature of the item being hedged. The Company has not designated any derivatives as hedges as at 31 March 2024 or 31 March 2025.

(c) Impairment for financial instruments measured at amortised cost

Impairment provisions for financial instruments are recognised based on a forward-looking expected credit loss model in accordance with IFRS 9. The methodology used to determine the amount of the provision is based on whether there has been a significant increase in credit risk since initial recognition of the financial asset. For those where the credit risk has not increased significantly since initial recognition of the financial asset, twelve month expected credit losses along with gross interest income are recognised. For those for which credit risk has increased significantly, lifetime expected credit losses along with the gross interest income are recognised. For those that are determined to be credit impaired, lifetime expected credit losses along with interest income on a net basis are recognised.

Convertible loan notes ("CLNs")

The proceeds received on issue of convertible loan notes are allocated into their liability and equity components. The amount initially attributed to the debt component equals the discounted cash flows using a market rate of interest that would be payable on a similar debt instrument that does not include an option to convert. Subsequently, the debt component is accounted for as a financial liability measured at amortised cost until extinguished on conversion or maturity of the CLN.

The conversion option is determined by deducting the amount of the liability component from the fair value of the compound instrument as a whole. Where material, this is recognised and included as a financial derivative where the convertible loan notes are issued in a currency other than the functional currency of the Company because they fail the fixed for fixed criteria in IAS 32. The conversion option is recorded as a financial liability at fair value through profit or loss and revalued at each reporting date.

In the case of a substantial modification, the existing liability is derecognised, the modified liability is recognised at its fair value and the difference between the carrying value of the old instrument and the modified instrument is recognised as a gain or loss in the statement of comprehensive income.

Share capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction, net of tax, from the proceeds.

Share-based payments

The Company issues equity-settled share-based payments to certain employees. Equity-settled share-based payments are measured at fair value at the date of grant. The fair value determined at the grant date of the equity-settled share-based payments is expensed over the vesting period, based on the Company's estimate of shares that will eventually vest. The fair value of options is ascertained using a Black-Scholes pricing model which incorporates all market vesting conditions. Where equity instruments are granted to persons other than employees, the income statement is charged with the fair value of goods and services received.

The Company has also issued warrants on placements which form part of a unit. These warrants do not fall into the scope of IFRS 2 Share Based Payments because there is no service being provided and are assessed as either a financial liability or equity. If they fail the fixed for fixed criteria in IAS 32 Financial Instruments: Presentation, they are classified as financial liability and measured in accordance with IFRS 9 Financial Instruments.

Critical accounting estimates and judgements

The Company makes judgements and assumptions concerning the future that impact the application of policies and reported amounts. The resulting accounting estimates calculated using these judgements and assumptions will, by definition, seldom equal the related actual results but are based on historical experience and expectations of future events. The judgements and key sources of estimation uncertainty that have a significant effect on the amounts recognised in the financial statements are discussed below.

Critical estimates and judgements

The following are the critical estimates and judgements that management has made in the process of applying the entity's accounting policies and that have the most significant effect on the amounts recognised in the financial statements.

(a) Carrying value of exploration and evaluation assets (judgement)

The Company monitors internal and external indicators of impairment relating to its exploration and evaluation assets. Management has considered whether any indicators of impairment have arisen over certain assets relating to the Company's exploration licenses. Management consider the exploration results to date and assess whether, with the information available, there is any suggestion that a commercial operation is unlikely to proceed. In addition, management have considered the likely success of renewing the licences, the impact of any instances of non-compliance with license terms and are continuing with the exploration and evaluation of the sites. After considering all relevant factors, management were of the opinion that no impairment was required in relation to the costs capitalised to exploration and evaluation assets except for the below (refer to Note 8 for further detail):

i) In January 2025 Empyrean acquired an option to participate in Wilson River conventional oil prospect, situated close to existing infrastructure in the prolific Cooper Basin in South-West Queensland, Australia, and adjacent to several producing oil fields. Following the securing of land access and completion of cultural heritage surveys and drill preparation activities the Wilson River-1 well spudded on 14 March 2025. The JV partners subsequently elected to conduct a DST on potential oil zone identified from the drilling but unfortunately this confirmed the recovery of formation water in the potential oil zone and as a result the well was plugged and abandoned. Accordingly, the Company fully impaired the carrying value of the asset at 31 March 2025.

ii) While the Company will continue to work with its joint venture partners in reviewing and assessing any further technical and commercial opportunities as they relate to the Sacramento Basin project, particularly in light of strong gas prices for gas sales in the region, it has not budgeted for further substantive exploration expenditure. Whilst the Company maintains legal title it has continued to fully impair the carrying value of the asset as at 31 March 2025.

iii) In light of current market conditions, little or no work has been completed on the Riverbend or Eagle Oil projects in the year and no substantial project work is forecast for either project in 2025/26 whilst the Company focuses on other projects. Whilst the Company maintains legal title it has continued to fully impair the carrying value of the asset as at 31 March 2025.

(b) Share based payments (estimate)

The Company has made awards of options and warrants over its unissued share capital to certain employees as part of their remuneration package. Certain warrants were issued to shareholders as part of their subscription for shares and suppliers for services received.

The valuation of these options and warrants involves making a number of critical estimates relating to price volatility, future dividend yields, expected life of the options and forfeiture rates. These assumptions have been described in more detail in Note 15.

(c) Valuation of embedded derivative - Convertible loan notes (estimate)

The Company has made estimates in determining the fair value of the embedded conversion feature portion of the CLN. Fair value inputs are subject to market factors as well as internal estimates. The Company considers historical trends together with any new information to determine the best estimate of fair value at the date of initial recognition and at each period end. The Company has determined that the fair value of the embedded conversion feature is not material and therefore has not been separately recognised, in line with the Company's accounting policy. Refer to Note 13 for further detail on the CLN.

Note 2. Segmental Analysis

The Directors consider the Company to have three geographical segments, being Australia (Wilson River project), Indonesia (Duyung PSC project) and North America (Sacramento Basin project), which are all currently in the exploration and evaluation phase. Prior year segment allocation included China (Block 29/11 project), which terminated during the current year. Unallocated results, assets and liabilities represent corporate amounts that are not core to the reportable segments. The Company's registered office is located in the United Kingdom.

Basis of accounting for purposes of reporting by operating segments

(a) Accounting policies adopted

Unless otherwise stated, all amounts reported to the Board of Directors, being the chief decision makers with respect to operating segments, are determined in accordance with accounting policies that are consistent to those adopted in the annual financial statements of the Company.

(b) Segment assets

Where an asset is used across multiple segments, the asset is allocated to that segment that receives the majority asset economic value from that asset. In the majority of instances, segment assets are clearly identifiable on the basis of their nature and physical location.

(c) Segment liabilities

Liabilities are allocated to segments where there is a direct nexus between the incurrence of the liability and the operations of that segment. Borrowings and tax liabilities are generally considered to relate to the Company as a whole and are not allocated. Segment liabilities include trade and other payables.

(d) Unallocated items

Unallocated results, assets and liabilities represent corporate amounts that are not core to the reportable segments.

| | |||||

| Details | Australia | Indonesia | USA | Unallocated | Total |

|

| US$'000 | US$'000 | US$'000 | US$'000 | US$'000 |

| 31 March 2025 |

| | | |

|

| Unallocated corporate expenses | - | - | - | (934) | (934) |

| Operating loss | - | - | - | (934) | (934) |

| Finance expense | - | - | - | (1,210) | (1,210) |

| Impairment of oil and gas properties | (1,315) | - | (1) | 111 | (1,205) |

| Loss before taxation | (1,315) | - | (1) | (2,032) | (3,349) |

| Tax expense in current year | - | - | - | (1) | (1) |

| Loss after taxation | (1,315) | - | (1) | (2,033) | (3,350) |

| Total comprehensive loss for the financial year | (1,315) | - | (1) | (2,033) | (3,350) |

| |

| |

| |

|

| Segment assets | - | 5,763 | - | - | 5,763 |

| Unallocated corporate assets | - | - | - | 1,731 | 1,731 |

| Total assets | - | 5,763 | - | 1,731 | 7,494 |

| |

| |

| |

|

| Segment liabilities | - | 686 | - | - | 686 |

| Unallocated corporate liabilities | - | - | - | 11,377 | 11,377 |

| Total liabilities | - | 686 | - | 11,377 | 12,063 |

| | |||||

| Details | China | Indonesia | USA | Unallocated | Total |

|

| US$'000 | US$'000 | US$'000 | US$'000 | US$'000 |

| 31 March 2024 |

| | | |

|

| Unallocated corporate expenses | - | - | - | (1,220) | (1,220) |

| Operating loss | - | - | - | (1,220) | (1,220) |

| Finance expense | - | - | - | (1,770) | (1,770) |

| Impairment of oil and gas properties | (6,562) | - | (33) | - | (6,595) |

| Loss before taxation | (6,562) | - | (33) | (2,990) | (9,585) |

| Tax expense in current year | - | - | - | (1) | (1) |

| Loss after taxation | (6,562) | - | (33) | (2,991) | (9,586) |

| Total comprehensive loss for the financial year | (6,562) | - | (33) | (2,991) | (9,586) |

| |

| |

| |

|

| Segment assets | - | 5,355 | - | - | 5,355 |

| Unallocated corporate assets | - | - | - | 998 | 998 |

| Total assets | - | 5,355 | - | 998 | 6,353 |

| |

| |

| |

|

| Segment liabilities | - | - | - | - | - |

| Unallocated corporate liabilities | - | - | - | 10,712 | 10,712 |

| Total liabilities | - | - | - | 10,712 | 10,712 |

Note 3. Operating Loss

| | 2025 | 2024 |

| | US$'000 | US$'000 |

| The operating loss is stated after charging: |

| |

| Foreign exchange loss | (115) | (123) |

| Impairment - exploration and evaluation assets | (1,205) | (6,595) |

| |

| |

| Auditor's Remuneration |

| |

| PKF Littlejohn LLP and affiliated entities: | ||

| - Audit fees payable for the audit of the Company's annual accounts | (75) | - |

| - Other services relating to taxation compliance | (30) | - |

| | | |

| BDO LLP (Company's previous auditor): | | |

| - Audit fees payable for the audit of the Company's annual accounts | - | (91) |

| - Other services relating to taxation compliance | (24) | (15) |

| Total auditor's remuneration | (129) | (106) |

| |

| |

Note 4. Directors' Emoluments

| | Fees and Salary | Share Based Payments in lieu of Fees | Social Security Contributions | Short-Term Employment Benefits (Total) | ||||

| | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 |

| | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 |

| |

|

|

| |

|

|

|

|

| Non-Executive Directors: | | | | | | | | |

| Patrick Cross | 23 | 23 | - | - | 2 | 2 | 25 | 25 |

| John Laycock | 14 | 14 | - | - | 1 | 1 | 15 | 15 |

| Executive Directors: | | | | | | | | |

| Thomas Kelly(a) | 255 | 216 | 29 | 64 | - | - | 284 | 280 |

| Gajendra Bisht(b) | 196 | 165 | 24 | 55 | - | - | 220 | 220 |

| Total | 488 | 418 | 53 | 119 | 3 | 3 | 544 | 540 |

| Capitalised to E&E(b) |

(138) |

(124) |

- |

- |

- |

- |

(138) |

(124) |

| Total expensed |

350 |

294 |

53 |

119 |

3 |

3 |

406 |

416 |

(a) Services provided by Apnea Holdings Pty Ltd, of which Mr Kelly is a Director. Mr Kelly has not sold any shares during the reporting period. On 26 July 2024, Mr Kelly was issued 6,756,808 ordinary shares in lieu of cash remuneration for the period April through to July 2024 totalling US$29,000, under the Salary Sacrifice Share plan announced on 13 February 2024.

(b) Services provided by Topaz Energy Pty Ltd, of which Mr Bisht is a Director. 75% of Mr Bisht's fees are capitalised to exploration and evaluation expenditure (Note 8). On 26 July 2024, Mr Bisht was issued 5,803,560 ordinary shares in lieu of cash remuneration for the period April through to July 2024 totalling US$24,000, under the Salary Sacrifice Share plan announced on 13 February 2024.

The average number of Directors was 4 during 2025 and 2024. The highest paid director received US$284,000 (2024: US$280,000).

Note 5. Finance Expense

| | 2025 | 2024 |

| | US$'000 | US$'000 |

|

|

| |

| Convertible loan notes - interest and finance costs (Note 13) | (1,210) | (1,115) |

| Convertible loan notes - loss on substantial modification (Note 13) | - | (655) |

| Total finance expense | (1,210) | (1,770) |

Note 6. Taxation

| | 2025 | 2024 |

| | US$'000 | US$'000 |

| |

|

|

| Opening balance | - | - |

| Total corporation tax receivable | - | - |

| |

| |

| Factors Affecting the Tax Charge for the Year |

| |

| Loss from continuing operations | (3,349) | (9,585) |

| Loss on ordinary activities before tax | (3,349) | (9,585) |

|

Loss on ordinary activities at US rate of 21% (2024: 21%) |

(703) |

(2,013) |

| Non-deductible expenses | 523 | 1,567 |

| Movement in provisions | (40) | 6 |

| Carried forward losses on which no DTA is recognised | 219 | 439 |

| | (1) | (1) |

| Analysed as: |

|

|

| Tax expense on continuing operations | (1) | (1) |

| Tax expense in current year | (1) | (1) |

|

|

| |

| Deferred Tax Liabilities |

| |

|

|

| |

| Temporary differences - exploration | 1,700 | 1,691 |

| Temporary differences - other | 4 | 4 |

| | 1,704 | 1,695 |

| Offset of deferred tax assets | (1,704) | (1,695) |

| Net deferred tax liabilities recognised | - | - |

| Unrecognised Deferred Tax Assets | 2025 | 2024 |

| | US$'000 | US$'000 |

| | | |

| Tax losses(a) | 2,662 | 2,601 |

| Temporary differences - exploration | 4,120 | 4,310 |

| Temporary differences - other | 1,284 | 943 |

| | 8,066 | 7,854 |

| Offset of deferred tax liabilities | (1,704) | (1,695) |

| Net deferred tax assets not brought to account | 6,362 | 6,159 |

(a) If not utilised, carried forward tax losses of approximately US$10.69 million (2024: US$10.43 million) begin to expire in the year 2034. Deferred income tax assets are only recognised to the extent that it is probable that future tax profits will be available against which deductible temporary differences can be utilised.

Deferred tax assets and deferred tax liabilities are offset only if applicable criteria to set off is met.

Note 7. Loss Per Share

| The basic loss per share is derived by dividing the loss after taxation for the year attributable to ordinary shareholders by the weighted average number of shares on issue being 1,867,696,610 (2024: 973,223,181) | |||||

| |

|

|

| ||

| | 2025 | 2024 |

| ||

| Loss per share from continuing operations |

| |

| ||

| Loss after taxation from continuing operations | US$(3,350,000) | US$(9,586,000) |

| ||

| Loss per share - basic | (0.18)c | (0.98)c |

| ||

| |

| |

| ||

| Loss after taxation from continuing operations adjusted for dilutive effects |

US$(3,350,000) |

US$(9,586,000) |

| ||

| Loss per share - diluted | (0.18)c | (0.98)c |

| ||

| |

|

| |||

| For the current and prior financial years, the exercise of the options is anti-dilutive and as such the diluted loss per share is the same as the basic loss per share. Details of the potentially issuable shares that could dilute earnings per share in future periods are set out in Note 15. | |||||

Note 8. Exploration and Evaluation Assets

| | 2025 | 2024 |

| | US$'000 | US$'000 |

| |

| |

| Balance brought forward | 5,355 | 10,635 |

| Exploration expenditure | 1,613 | 1,315 |

| Impairment | (1,205) | (6,595) |

| Net book value | 5,763 | 5,355 |

Exploration expenditure for the period includes an increase to trade and other payables (Note 11) totalling $195,000, payments made in the period relating to exploration expenditure total $1,418,000 as reflected in the Statement of Cash Flows.

|

Project |

Operator |

Working Interest | 2025 Carrying Value US$'000 | 2024 Carrying Value US$'000 |

| Exploration and evaluation |

| |

| |

| Duyung PSC | Conrad Asia Energy | 8.5% | 5,763 | 5,355 |

| Wilson River(a) | Condor Energy | 8.5% | - | - |

| Sacramento Basin(b) | Sacgasco | 25-30% | - | - |

| Riverbend(c) | Huff Energy | 10% | - | - |

| Eagle Oil Pool Development(c) | Strata-X | 58.084% | - | - |

| | | | 5,763 | 5,355 |

| | | |

| |

|

Exploration and evaluation assets relate to the Company's interest in the Duyung PSC. No indicators of impairment of these assets were noted.

(a) In January 2025 Empyrean acquired an option to participate in Wilson River conventional oil prospect, situated close to existing infrastructure in the prolific Cooper Basin in South-West Queensland, Australia, and adjacent to several producing oil fields. Following the securing of land access and completion of cultural heritage surveys and drill preparation activities the Wilson River-1 well spudded on 14 March 2025. The JV partners subsequently elected to conduct a DST on potential oil zone identified from the drilling but unfortunately this confirmed the recovery of formation water in the potential oil zone and as a result the well was plugged and abandoned. Accordingly, the Company fully impaired the carrying value of the asset at 31 March 2025.

(b) While the Company will continue to work with its joint venture partners in reviewing and assessing any further technical and commercial opportunities as they relate to the Sacramento Basin project, particularly in light of strong gas prices for gas sales in the region, it has not budgeted for further substantive exploration expenditure. Whilst the Company maintains legal title it has continued to fully impair the carrying value of the asset at 31 March 2025.

(c) In light of current market conditions, little or no work has been completed on the Riverbend or Eagle Oil projects in the year and no substantial project work is forecast for either project in 2025/26 whilst the Company focuses on other projects. Whilst the Company maintains legal title it has continued to fully impair the carrying value of the asset at 31 March 2025. | ||||

Note 9. Interests in Other Entities

Duyung PSC

The Company is the owner of an 8.5% interest in the Duyung PSC. The Duyung PSC partners have entered into a Joint Operating Agreement ("JOA"), which governs the arrangement. Through the JOA, the Company has a direct right to the assets of the venture, and direct obligation for its liabilities. Accordingly, the Company accounts for its share of assets, liabilities and expenses of the venture in accordance with the IFRSs applicable to the particular assets, liabilities and expenses. The operator of the venture is West Natuna Exploration Ltd ("WNEL"). WNEL is a company incorporated in the British Virgin Islands and its principal place of business is Indonesia.

Note 10. Trade and Other Receivables

|

| 2025 | 2024 |

|

| US$'000 | US$'000 |

| |

| |

| Other receivables | 40 | - |

| VAT receivable | 16 | 17 |

| Total trade and other receivables | 56 | 17 |

Note 11. Trade and Other Payables

|

| 2025 | 2024 |

|

| US$'000 | US$'000 |

| |

| |

| Trade payables | 3,020 | 2,599 |

| Accrued expenses | 105 | 330 |

| Total trade and other payables | 3,125 | 2,929 |

Note 12. Provisions

|

| 2025 | 2024 |

|

| US$'000 | US$'000 |

| |

| |

| Provision for Annual Leave | - | 189 |

| Total Provisions | - | 189 |

All annual leave accrued was relinquished during the 2025 financial year.

Note 13. Convertible Loan Notes

|

| 2025 | 2024 |

|

| US$'000 | US$'000 |

|

|

| |

| (a) Convertible Loan Note - Modification 1 |

| |

| Opening balance | - | 4,076 |

| Foreign exchange loss | - | 12 |

| Extinguishment on substantial modification | - | (4,088) |

| Total Convertible Loan Note - Modification 1 | - | - |

|

|

|

|

| (b) Convertible Loan Note - Modification 2 |

|

|

| Opening balance | 7,594 | - |

| Recognition of modified liability | - | 6,544 |

| Loss on substantial modification | - | 655 |

| Costs of finance | 1,210 | 261 |

| Foreign exchange loss | 134 | 134 |

| Total Convertible Loan Note - Modification 2 | 8,938 | 7,594 |

(a) In December 2021, the Company announced that it had entered into a Convertible Loan Note Agreement with a Melbourne-based investment fund (the "Lender"), pursuant to which the Company issued a convertible loan note to the Lender and received gross proceeds of £4.0 million (the "Convertible Note"). As announced in May 2022, the Company and the Lender then amended the key repayment terms of the Convertible Note, which at that time included the right by the Lender to redeem the Convertible Note within 5 business days of the announcement of the results of the Jade well at Block 29/11. The face value of the loan notes was reset to £3.3m with interest to commence and accrue at £330,000 per calendar month from 1 December 2022. The Convertible Note is secured by a senior first ranking charge over the Company, including its 8.5% interest in the Duyung PSC and Mako Gas Field.

(b) In May 2023, it was announced that the Company and the Lender had reached agreement on amended key terms to the Convertible Note to allow the sales process for Mako to complete. The key terms of the amendment are as follows:

1. The parties agreed a moratorium of accrual interest on the Convertible Note until 31 December 2023 - interest then accrued thereafter at a rate of 20% p.a.;

2. The conversion price on the Convertible Note was reduced from 8p to 2.5p per share;

3. The face value of the Convertible Note was reduced from £5.28m (accrued to the end of May 2023) to £4.6 million (to be repaid from Empyrean's share of the proceeds from Mako sell down process); and

4. Empyrean will pay the Lender the greater of US$1.5 million or 15% of the proceeds from its share in the Mako sell down process.

Note 14. Reconciliation of Net Loss

| | 2025 | 2024 |

| | US$'000 | US$'000 |

| |

| |

| Loss before taxation | (3,349) | (9,585) |

| | | |

| Share-based payments | 77 | 212 |

| Finance expense (non-cash) | 1,210 | 1,770 |

| Impairment - exploration and evaluation assets | 1,205 | 6,595 |

| Foreign exchange loss (non-cash) | 90 | 123 |

| | | |

| Decrease in trade receivables relating to operating activities | - | 21 |

| Increase in trade payables relating to operating activities | 20 | 9 |

| (Decrease)/increase in provisions | (189) | 29 |

| Net cash outflow from operating activities before taxation | (936) | (826) |

| Payment of corporation tax | (1) | (1) |

| Net cash outflow from operating activities | (937) | (827) |

Note 15. Share Capital

|

| 2025 | 2024 |

| | US$'000 | US$'000 |

|

|

| |

| 3,735,092,441 (2024: 1,280,801,707) ordinary shares of 0.01p each (2024: 0.2p each) | 472 | 3,405 |

| |

|

|

| | 2025 | 2024 |

| | No. | No. |

| a) Number of Shares: Fully Paid Ordinary Shares of 0.01p each (2024: 0.2p each) |

| |

| At the beginning of the reporting year | 1,280,801,707 | 788,431,892 |

| Shares issued during the year: | | |

| · Placements | 2,430,167,332 | 469,753,783 |

| · Salary sacrifice shares | 14,123,402 | 19,728,532 |

| · Advisor shares (equity issue cost) | 10,000,000 | 2,887,500 |

| Total at the end of the reporting year | 3,735,092,441 | 1,280,801,707 |

| | 2025 | 2024 |

| | US$'000 | US$'000 |

| b) Value of Shares: Fully Paid Ordinary Shares of 0.01p each (2024: 0.2p each) |

| |

| At the beginning of the reporting year | 3,405 | 2,170 |

| Shares issued during the year: | | |

| · Placements | 306 | 1,179 |

| · Salary sacrifice shares | 2 | 49 |

| · Advisor shares (equity issue cost) | 1 | 7 |

| · Capital reorganisation - 0.2p to 0.01p per share1 | (3,242) | - |

| Total at the end of the reporting year | 472 | 3,405 |

Notes:

1. On 6 November 2024, the Company announced it had raised £1.12 million in a Placement for 1,120,500,000 new ordinary shares at a price of 0.01p per share. As the Company is not permitted to by law to issue ordinary shares at an issue price below the existing nominal value of 0.2p, the Company completed a capital reorganisation of the ordinary share capital of the Company to subdivide each existing ordinary share into one new ordinary share of 0.01p each and one deferred share of 0.19p each. The capital reorganisation was approved by shareholders at a General Meeting on 2 December 2024.

The Companies Act 2006 (as amended) abolishes the requirement for a company to have an authorised share capital. Therefore the Company has taken advantage of these provisions and has an unlimited authorised share capital.

Each of the ordinary shares carries equal rights and entitles the holder to voting and dividend rights and rights to participate in the profits of the Company and in the event of a return of capital equal rights to participate in any sum being returned to the holders of the ordinary shares. There is no restriction, imposed by the Company, on the ability of the holder of any ordinary share to transfer the ownership, or any of the benefits of ownership, to any other party.

| Share options and warrants |

| |

| The number and weighted average exercise prices of share options and warrants are as follows: | ||

|

| Weighted Average Exercise Price | Number of Options and Warrants | Weighted Average Exercise Price | Number of Options and Warrants |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| 2025 | 2025 | 2024 | 2024 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outstanding at the beginning of the year | £0.044 | 164,833,333 | £0.137 | 6,558,333 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issued during the year1 | £0.001 | 15,000,000 | £0.044 | 164,833,333 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expired during the year | £0.015 | (2,833,333) | £0.137 | (6,558,333) |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exercised during the year | - | - | - | - |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outstanding at the end of the year | £0.005 | 177,000,000 | £0.044 | 164,833,333 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Notes:

1. On 30 January 2025, the Company announced the issue of 15,000,000 incentive warrants to Company Secretary Jonathan Whyte. The warrants have an exercise price of 0.012p and expire on 31 January 2027. The warrants have been valued at $16,000 using a Black-Scholes pricing model and expensed to the statement of profit or loss and comprehensive income.

The options outstanding at 31 March 2025 have an exercise price in the range of £0.0012 to £0.02 (2024: £0.0025 to £0.02) and a weighted average remaining contractual life of 1.39 years (2024: 2.32 years). None of the outstanding options and warrants at 31 March are exercisable at period end. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Note 16. Reserves

| Reserve | Description and purpose |

| Share premium | Amount subscribed for share capital in excess of nominal value. |

| Warrant and share-based payment reserve | Records items recognised as expenses on valuation of employee share options and subscriber warrants. |

| Retained losses | All other net gains and losses and transactions with owners not recognised elsewhere. |

Note 17. Related Party Transactions

Directors are considered Key Management Personnel for the purposes of related party disclosure.

In the November 2024 equity placement that raised US$1.59 million, Mr John Laycock subscribed for 10,000,000 new ordinary shares for a total consideration of US$13,000.

In the January 2025 equity placement that raised US$0.84 million, Mr Tom Kelly subscribed for 11,000,000 new ordinary shares for a total consideration of US$14,000. Mr Gaz Bisht subscribed for 9,000,000 new ordinary shares for a total consideration of US$11,000.

In January 2025 Empyrean acquired an option to participate in Wilson River conventional oil prospect from Apnea Holdings Pty Ltd ("Apnea"). Apnea is a company wholly owned by Mr Tom Kelly, who served as Managing Director of Empyrean during the reporting period, and the acquisition of the option therefore constituted a related party transaction pursuant to Rule 13 of the AIM Rules for Companies. Under the terms of the acquisition of the option, Apnea was to receive consideration in the form of new ordinary shares in Empyrean representing 5 percent of the enlarged issued capital of Empyrean at the time, but only in the event that the Wilson prospect is declared a commercial discovery, which ultimately proved unsuccessful. The Company's independent Directors (Gaz Bisht, John Laycock and Patrick Cross) considered, having consulted with the Company's nominated adviser, Cavendish, that the terms of the acquisition were fair and reasonable insofar as the Company's shareholders are concerned.

There were no other related party transactions during the year ended 31 March 2025 other than those disclosed in Note 4.

Note 18. Financial Risk Management

The Company manages its exposure to credit risk, liquidity risk, foreign exchange risk and a variety of financial risks in accordance with Company policies. These policies are developed in accordance with the Company's operational requirements. The Company uses different methods to measure and manage different types of risks to which it is exposed. These include monitoring levels of exposure to interest rate and foreign exchange risk and assessment of prevailing and forecast interest rates and foreign exchange rates. Liquidity risk is managed through the budgeting and forecasting process.

Credit risk

Exposure to credit risk relating to financial assets arises from the potential non-performance by counterparties of contract obligations that could lead to a financial loss to the Company.

Risk is also minimised by investing surplus funds in financial institutions that maintain a high credit rating.

Credit risk related to balances with banks and other financial institutions are managed in accordance with approved Board policy. The Company's current investment policy is aimed at maximising the return on surplus cash, with the aim of outperforming the benchmark within acceptable levels of risk return exposure and to mitigate the credit and liquidity risks that the Company is exposed to through investment activities.

The following table provides information regarding the credit risk relating to cash and money market securities based on Standard and Poor's counterparty credit ratings.

|

| 2025 | 2024 |

|

|

| US$'000 | US$'000 |

|

| Cash and cash equivalents |

|

|

|

| AA-rated | 1,675 | 981 |

|

| Total cash and cash equivalents | 1,675 | 981 |

|

| | |||

Price risk

Commodity price risk

The Company is not directly exposed to commodity price risk. However, there is a risk that the changes in prevailing market conditions and commodity prices could affect the viability of the projects and the ability to secure additional funding from equity capital markets.

| Liquidity risk Liquidity risk arises from the possibility that the Company might encounter difficulty in settling its debts or otherwise meeting its obligations related to financial liabilities. The Company manages liquidity risk by maintaining sufficient cash or credit facilities to meet the operating requirements of the business and investing excess funds in highly liquid short-term investments. The Company's liquidity needs can be met through a variety of sources, including the issue of equity instruments and short or long-term borrowings.

Alternative sources of funding in the future could include project debt financing and equity raisings, and future operating cash flow. These alternatives will be evaluated to determine the optimal mix of capital resources.

The following table details the Company's non-derivative financial instruments according to their contractual maturities. The amounts disclosed are based on contractual undiscounted cash flows. Cash flows realised from financial assets reflect management's expectation as to the timing of realisation. Actual timing may therefore differ from that disclosed. The timing of cash flows presented in the table to settle financial liabilities reflects the earliest contractual settlement dates. |

| | Less than 6 months | 6 months to 1 year | 1 to 6 years | Total |

| | US$'000 | US$'000 | US$'000 | US$'000 |

| |

|

|

|

|

| Convertible loan note (2025) | 8,938 | - | - | 8,938 |

| Convertible loan note (2024) | 7,594 | - | - | 7,594 |

| Trade and other payables (2025) | 3,125 | - | - | 3,125 |

| Trade and other payables (2024) | 2,929 | - | - | 2,929 |