Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector: Mining

3 September 2025

Cora Gold Limited ('Cora' or 'the Company')

Sanankoro Gold Project: Updated Reserves and Definitive Feasibility Study

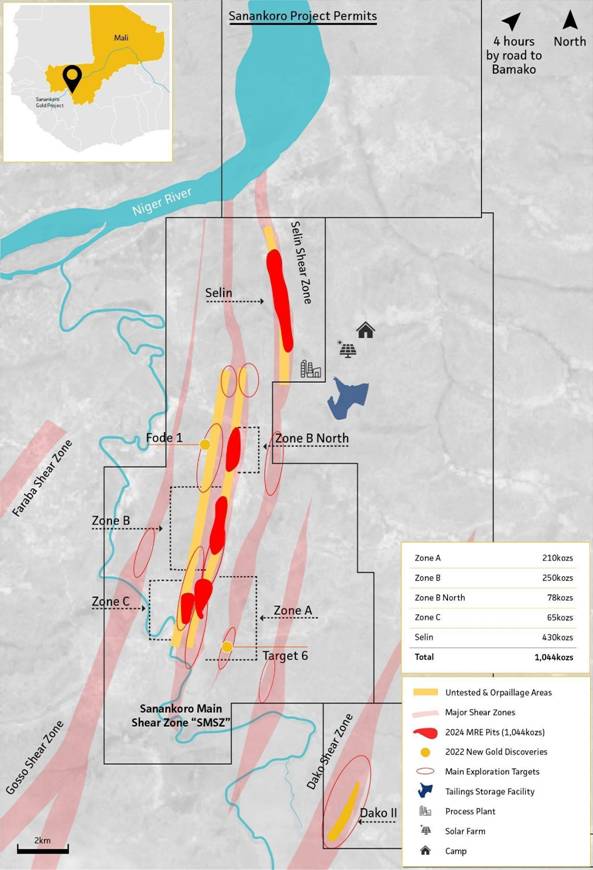

Cora Gold Limited, the West African focused gold company, is pleased to announce Updated Reserves and the results of an updated Definitive Feasibility Study ('DFS') for its flagship Sanankoro Gold Project ('Sanankoro' or the 'Project') in southern Mali.

Highlights

● Updated Probable Reserve of 531 koz at 1.13 g/t gold ('Au') based on a gold price of US$2,200/oz (a 26% increase over the Maiden Probable Reserve of 422 koz at 1.30 g/t Au based on a gold price of US$1,650/oz (see announcement dated 21 November 2022)).

● 2025 DFS economics (post tax, based on a gold price of US$2,750/oz)

○ 65% internal rate of return ('IRR')

○ 1.1 year payback period

○ US$479m free cash flow ('FCF') over life of mine ('LOM')

○ US$67m pa average FCF in first 5 years

○ US$221m NPV8

○ US$948/oz LOM cash cost and US$1,478/oz LOM all-in sustaining costs ('AISC')

○ 10.2 years Reserve mine life

○ 47 koz pa average production LOM

○ 64 koz pa average production in first 5 years

○ US$124m pre-production capital cost (including mining pre-production & contingencies)

● Metallurgical test work confirmed an average LOM gold recovery of 90.7% through a conventional 1.5 Mtpa Carbon in Leach ('CIL') processing plant.

● Solar hybrid power option incorporated into the plant design, delivering savings in both operating costs at current fuel prices and carbon emissions by reducing consumption of 40 million litres diesel over LOM.

● As part of the 2025 DFS various optimisations have been incorporated taking greater advantage of the oxide nature of the ore at the front end of the process flow sheet.

● Management Plan, including pit optimised Inferred Resources, based on the same parameters as the Reserves, offers the potential for an additional 173 koz gold produced, adding 5 years to the mine life. Further drilling should enable the conversion of these Inferred Resources to Reserves.

● Sanankoro has excellent exploration and resource growth potential providing the opportunity to significantly add to the current resource base of 1.04 Moz, as optimised pits bottomed out due to lack of deeper drilling and mineralisation is open along strike and at depth. Additionally, there are undrilled artisanal workings, and 19 new exploration targets identified, the majority of which are within 3-4 km from the process plant and the oxide nature of the ore offers further upside.

Bert Monro, Chief Executive Officer of Cora, commented, "Sanankoro is an exceptional project well positioned to become a significant new high margin open pit oxide gold mine. We are delighted to have meaningfully increased the Project's Reserves, with an initial 10 year mine life, from minimal drilling. The updated Reserves and enhanced DFS significantly improve upon the previous 2022 study, highlighting both the progress we have made in advancing the asset, as well as the opportune time to be developing a gold project of Sanankoro's calibre.

"In the first 5 years, the Project will average 64 koz of gold production and US$67m of FCF per year, delivering a 1.1 year pay back period and US$479m of FCF over the LOM at a gold price of US$2,750/oz.

"Additionally, significant upside remains as pit optimised Inferred Resources were used to produce a Management Plan, by modelling them using the same parameters as the reserves, indicating an additional 173 koz gold could be added to the life of mine. These ounces will require infill drilling to be classified as Reserves and there remains significant exploration potential outside of current Resources at Sanankoro.

"This study fully incorporates the impact of the new 2023 Mining Code to both the Capex, Opex and local content conformity. Amongst other factors, we made design modifications to the tailings storage facility impacting the Capex. The impact on the AISC in tax and royalty changes was approximately US$290/oz at US$2,750/oz gold price. In light of these factors, it is a strong testament to the robustness of the Project that it is delivering such strong returns.

"Looking ahead, our focus is on concluding the permitting process for the mine so that we can complete financing and begin mine construction. I look forward to updating investors on progress with this in the near future.

"Finally, I'd like to take this opportunity to thank Cora's technical team and all the DFS consultants for their work on the Project."

Updated Definitive Feasibility Study - Summary of Results

The key results and financial outcomes of the 2025 DFS are set out in the table below:

| Parameters | Values based on a gold price of US$2,750/oz |

| Construction period 1 (months) | 21 |

| Life of Mine ('LOM') (years) | 10.2 |

| LOM waste mined (kt) | 71,520 |

| LOM ore mined (kt) | 14,603 |

| Strip ratio (waste : ore) | 4.90 : 1 |

| LOM grade processed (g/t Au) | 1.13 |

| Average gold recovery | 90.7% |

| LOM production (koz) | 482 |

| Average production (koz pa) | 47 |

| Average production first 5 years (koz pa) | 64 |

| LOM FCF post tax (US$m) | 479 |

| Average FCF post tax (US$ pa) | 47 |

| Average FCF post tax first 5 years (US$m pa) | 67 |

| Mining costs (US$/t ore) | 16.5 |

| Processing & maintenance costs (US$/t ore) | 11.1 |

| General & administration plus other costs to mine gate (US$/t ore) | 3.3 |

| Payback period from start of operations (years) | 1.1 |

| Pre-production capital (US$m) (including US$5m mining pre-production & US$8m contingency) | 124 |

| Sustaining capital (US$m)2 | 57 |

| Average cash cost (US$/oz Au) | 948 |

| Average AISC (US$/oz Au) | 1,478 |

| IRR pre-tax | 74.5% |

| IRR post tax | 64.9% |

| NPV8 pre-tax (US$m) | 302.1 |

| NPV8 post tax (US$m) | 220.8 |

1 includes pre-construction engineering work and commissioning the plant

2 includes closure costs

Gold Price Sensitivity on Key Financial Metrics

| Gold price | US$2,250/oz | US$2,500/oz | US$2,750/oz | US$3,000/oz | US$3,250/oz |

| IRR post tax | 40.9% | 53.5% | 64.9% | 75.9% | 87.5% |

| LOM FCF post tax (US$m) | 336 | 410 | 479 | 547 | 620 |

| NPV8 post tax (US$m) | 121.4 | 172.8 | 220.8 | 268.3 | 318.9 |

| AISC (US$/oz Au) | 1,393 | 1,429 | 1,478 | 1,530 | 1,568 |

Updated Definitive Feasibility Study - Capital and Operating Costs

A pre-production initial capital cost of US$124m, including US$5m mining pre-production and US$8m contingency.

The pre-production capital cost estimate is based on a contractor mining scenario and therefore excludes capital costs associated with a mining fleet.

| Capital items | US$m |

| Civil works | 6.9 |

| Earth works | 3.8 |

| Machinery & equipment | 47.6 |

| Infrastructure | 1.4 |

| Transport | 7.5 |

| First fills | 0.9 |

| Mine camp | 2.8 |

| Project management | 10.3 |

| Insurance & guarantees | 0.8 |

| Tailings storage facility ('TSF'; phase 1) | 23.5 |

| Owner's costs | 5.2 |

| Mining pre-production | 5.2 |

| Contingency | 8.1 |

| Total pre-production capital | 124.0 |

| Sustaining & closure capital | 57.0 |

| Total LOM capital | 181.0 |

A solar hybrid power option has been incorporated into the plant design, delivering savings in both operating costs and carbon emissions. The hybrid power generation solution, combining thermal and solar power with a battery energy storage system, anticipates a substantial reduction in diesel fuel consumption saving approximately 4 million litres annually and 40 million litres over the processing period during the mine-life. Reducing diesel use lowers emissions, improving community health, complying with regulations and is a sign of our responsible governance.

| Operating / unit costs (US$/oz of gold) | Values based on a gold price of US$2,750/oz |

| Mining | 499.8 |

| Processing | 322.9 |

| Maintenance | 14.8 |

| General & administration | 101.0 |

| Total cost to mine gate | 938.5 |

| Transport, insurance & refining | 9.1 |

| Total cash cost ('C1') | 947.6 |

| Royalties & statutory | 411.7 |

| All-in sustaining cost ('AISC') | 1,478 |

Updated Ore Reserves

The 2025 Ore Reserves for the Selin, Zone A and Zone B deposits have been reported according to the JORC (2012) Code.

The estimation of the Ore Reserves followed a process of pit optimisation, design and scheduling:

● The Mineral Resource models were prepared by ERM Australia Consultants Pty Ltd ('ERM'; formerly CSA Global).

● The mining models were derived from the Mineral Resource models modified for dilution and mining losses through application of Mineable Shape Optimiser ('MSO') to determine appropriate factors.

● Using the mining models, pit optimisations were completed in Studio NPVS software (Datamine).

● Using the selected pit shells as templates, pit designs for the final pits and push backs were developed in Deswik CAD. The pit designs and pushbacks considered practical access and geotechnical parameters.

● Based on these designs, a monthly LOM schedule was completed in Deswik IS (Interactive Scheduler) software.

● The schedule economics was verified through a financial analysis and proved to be economically viable.

The 2025 Ore Reserve is stated in Table 1 and the breakdown of the 2025 Ore Reserve by zones is presented in Table 2. An Ore Reserve comparison between 2022 and 2025 by classification and zone is shown in Table 3.

The independent Competent Person for Mineral Reserve estimates is Frikkie Fourie (BEng, Pr. Eng, MSAIMM) of Moletech SA (Pty) Ltd ('Moletech').

Table 1: Sanankoro Ore Reserve

| Classification | Oxidation Zone | Tonnage | Grade | Contained metal (koz Au) |

| Proved | Oxide | - | - | - |

| | Transitional | - | - | - |

| | Fresh | - | - | - |

| | All Zones | - | - | - |

| Probable | Oxide | 13.7 | 1.08 | 476 |

| | Transitional | 0.9 | 1.86 | 55 |

| | Fresh | - | - | - |

| | All Zones | 14.6 | 1.13 | 531 |

| Total |

| 14.6 | 1.13 | 531 |

Notes:

● Figures have been rounded to the appropriate level of precision for the reporting of Ore Reserves.

● Due to rounding, some columns or rows may not compute exactly as shown.

● Ore Reserves are stated as in situ dry tonnes; figures are reported in metric tonnes.

● The Ore Reserve is classified in accordance with the guidelines of the Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012 Edition). Probable Ore Reserves converted from Indicated Mineral Resources.

● The Ore Reserve is reported at a gold price of US$2,200 per troy ounce.

● All Ore Reserves are reported above 0.3 g/t Au cut-off grades and constrained within detailed mine designs derived from mining (including dilution and mining recovery), haulage and processing costs and metallurgical recovery and geotechnical parameters as defined in the study.

● Modifying factors applied:

o Mining recovery and dilution:

▪ Selin: Mining recovery 97.7%, Dilution 6.8%

▪ Zone A: Mining recovery 97.7%, Dilution 6.6%

▪ Zone B: Mining recovery 99.5%, Dilution 8.0%

▪ Zone B North: Mining recovery 97.6%, Dilution 10.1%

o Processing recovery:

▪ Selin: Oxides 93.6%, Transitional 65.6%

▪ Zone A: Oxides 93.6%, Transitional 65.6%

▪ Zone B: Oxides 93.6%, Transitional 65.6%

▪ Zone B North: Oxides 93.6%, Transitional 65.6%

● There are no known legal, political, environmental, or other risks that could materially affect the potential Ore Reserves.

Table 2: Sanankoro Ore Reserve by Zone

| Zone | Classification | Tonnage | Grade | Contained metal (koz Au) |

| A | Proved | - | - | - |

| Probable | 3.7 | 1.17 | 140 | |

| Total | 3.7 | 1.17 | 140 | |

| B | Proved | - | - | - |

| Probable | 3.1 | 1.10 | 111 | |

| Total | 3.1 | 1.10 | 111 | |

| B North | Proved | - | - | - |

| Probable | 1.6 | 0.85 | 43 | |

| Total | 1.6 | 0.85 | 43 | |

| C | Proved | - | - | - |

| Probable | - | - | - | |

| Total | - | - | - | |

| Selin | Proved | - | - | - |

| Probable | 6.2 | 1.19 | 237 | |

| Total | 6.2 | 1.19 | 237 | |

| Total | Proved | - | - | - |

| Probable | 14.6 | 1.13 | 531 | |

| Total | 14.6 | 1.13 | 531 |

Notes:

● Figures have been rounded to the appropriate level of precision for the reporting of Ore Reserves.

● Due to rounding, some columns or rows may not compute exactly as shown.

● Ore Reserves are stated as in situ dry tonnes; figures are reported in metric tonnes.

● The Ore Reserve is classified in accordance with the guidelines of the Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012 Edition). Probable Ore Reserves converted from Indicated Mineral Resources.

● The Ore Reserve is reported at a gold price of US$2,200 per troy ounce.

● All Ore Reserves are reported above 0.3 g/t Au cut-off grades and constrained within detailed mine designs derived from mining (including dilution and mining recovery), haulage and processing costs and metallurgical recovery and geotechnical parameters as defined in the study.

● Modifying factors applied:

o Mining recovery and dilution:

▪ Selin: Mining recovery 97.7%, Dilution 6.8%

▪ Zone A: Mining recovery 97.7%, Dilution 6.6%

▪ Zone B: Mining recovery 99.5%, Dilution 8.0%

▪ Zone B North: Mining recovery 97.6%, Dilution 10.1%

o Processing recovery:

▪ Selin: Oxides 93.6%, Transitional 65.6%

▪ Zone A: Oxides 93.6%, Transitional 65.6%

▪ Zone B: Oxides 93.6%, Transitional 65.6%

▪ Zone B North: Oxides 93.6%, Transitional 65.6%

● There are no known legal, political, environmental, or other risks that could materially affect the potential Ore Reserves.

Table 3: Comparison 2022 Ore Reserve vs 2025 Ore Reserve by Zone

| Classification | Zone | 2022 Ore Reserve | 2025 Ore Reserve | Difference | % difference | ||||||||

| Tonnage (Mt) | Au | Au | Tonnage (Mt) | Au | Au | Tonnage (Mt) | Au | Au | Tonnage (Mt) | Au | Au | ||

| (g/t) | (koz) | (g/t) | (koz) | (g/t) | (koz) | (g/t) | (koz) | ||||||

| Probable | A | 2.8 | 1.32 | 117 | 3.7 | 1.17 | 140 | 1.0 | -0.15 | 23 | 35% | -11% | 20% |

| B | 2.0 | 1.24 | 81 | 3.1 | 1.10 | 111 | 1.1 | -0.14 | 30 | 55% | -12% | 37% | |

| B Nth | 1.0 | 0.91 | 30 | 1.6 | 0.85 | 43 | 0.5 | -0.06 | 13 | 54% | -7% | 43% | |

| Selin | 4.3 | 1.41 | 194 | 6.2 | 1.19 | 237 | 1.9 | -0.21 | 43 | 44% | -15% | 22% | |

| Total | 10.1 | 1.30 | 422 | 14.6 | 1.13 | 531 | 4.5 | -0.17 | 109 | 45% | -13% | 26% | |

Notes:

● The 2022 Ore Reserves are at a 0.35 g/t Au cut-off and pits designed based on US$1,650/oz gold price. The 2025 Ore Reserves are at a 0.3 g/t Au cut-off and pits designed based on US$2,200/oz gold price.

Mining

The mining of Selin, Zone A and Zone B is well-suited to typical open pit methods using a backhoe configured excavator and truck fleet which will be operated by a mining contractor. Considering the highly-weathered nature of the orebody, both the oxide and transitional material are viewed as 'free-dig' with no need for drill and blast activities. Open pit operations will be undertaken using 5 metre benches which will be stacked to 10 metres at final limits. It is the intention that topsoil (initial 30cm) be stripped initially over the area of both the open pit and waste rock dumps ('WRDs') and stockpiled in a suitable allocated area proximal to each of the pits. Clearing and grubbing costs have been provisioned and this material will be used in remediation work as part of the mine closure.

Waste material will be dumped onto designated waste dumps. Dumping will take place in 10 metre layers to a general maximum of 50 metres in height. Run of mine ('ROM') material destined for the processing plant will be sent straight to the stockpile area. Stockpiling and blending may be necessary to optimise the head grade with feed constraints on transitional material. Sufficient space will be provided for several separate stockpiles. All process feed will be re-handled by a wheel loader from the stockpile straight into the crusher.

Plant Feed by Ore Type (kt) and Grade (g/t Au)

Au Recovered (Oz) and Recovery (%)

Processing

The proposed process plant design was initially based on a well-known and established gravity/CIL technology, which consisted of conventional crushing, milling, and gravity recovery of free gold, followed by leaching/adsorption of gravity tailings, elution, gold smelting, and tailings disposal with a cyanide detoxification plant.

The presence of fines (near product size material) in the ore body led to scrubbing testwork being conducted, which resulted in a modified front end for the process plant by replacing the jaw crusher with a mineral sizer; scrubber; cone crusher to treat scrubber oversize and a downsized ball mill. Transition ore, scheduled to be mined during year three of production, will be treated by initial mobile hard rock crushing facility for the limited transition ore mining period.

The process plant will cater for reagent mixing, storage and distribution, water and air services. A water treatment plant is included to manage any potential water discharge from the TSF and mining pits.

The plant will treat 1.5 Mtpa of oxide ore or 1.1 Mtpa of transition ore if treated independently, although oxide and transition ore blending is more likely during the period of processing transition ore, resulting in 1.2 Mtpa throughput at that time.

The process plant design incorporates the following unit process operations:

● Primary particle reduction by mineral sizer and jaw crusher - to crush the oxide and transition ores respectively.

● Milling - product from mineral sizer (oxide ore) will be fed into a rotary scrubber and screened by double deck vibrating screen. Oversized material will be conveyed to a cone crusher for further particle reduction and milled in a single-stage ball mill in closed circuit with hydro-cyclones to produce a P80 of 150 µm reporting to the CIL circuit. For the transition ore, the mobile crushing facility will reduce the ore to size adequate to feed the mill which is also in closed circuit with hydro-cyclones, to produce P80 grind size of 75 µm before reporting to the CIL circuit. Scrubber screen undersize product (<150 µm) will bypass the mill.

● Gravity Concentration - recovery of coarse gold from the milling circuit recirculating load and treatment of gravity concentrates by intensive cyanidation and electrowinning to recover gold to doré.

● Leach/CIL circuit - for gold dissolution and adsorption onto carbon incorporating six CIL tanks.

● Loaded Carbon Desorption - elution circuit, electrowinning, and gold smelting to recover gold from the loaded carbon to produce doré.

● Detoxification - an INCO air / SO2 cyanide detoxification facility for the CIL tails slurry, which will be used only when required as test work has shown that the weak acid dissociable cyanide levels in the leached tails are less than 50 ppm.

● Tailings Storage Facility ('TSF') - tailings pumping to the TSF.

Site Layout

Process Flow Sheet

|

Management Plan

The Company's independent mining engineer designed a Management Plan based on pit optimised Resources. These Resources were run through mine scheduling software using the same parameters as the Reserves to develop a theoretical mine plan. The Management Plan shows the potential for an additional 173 koz of gold to be mined from current Inferred Resources. The Company will in the future target these ounces with more drilling to convert to Reserves.

Permitting

In October 2022 Cora announced the award of an Environmental Permit for the Sanankoro Gold Project (see announcement dated 18 October 2022).

On 28 November 2023 the Mali government announced the suspension of issuing permits in the mining sector. On 15 March 2025 this moratorium was partially lifted by the government such that, in accordance with the provisions of the 2023 Mining Code and its implementing texts, the mining administration can receive for processing:

● applications to renew exploration permits and mining permits;

● applications for transition from the exploration phase to the mining phase; and

● applications for the transfer of mining permits.

This partial lifting of the moratorium does not apply to:

● applications for the issuance of new permits; or

● applications for the transfer of exploration permits.

During the period of the moratorium the processes for submission of applications both for new permits and for interim renewals, and for the issuance of new permits and interim renewals have been affected. With regards to Cora's five contiguous permits in the Sanankoro Project area, the moratorium impacted the interim renewals of the Bokoro Est, Dako II and Sanankoro II exploration permits, and applications for new permits in relation to the Bokoro II and Kodiou exploration permits, the respective expiry dates of which were in the moratorium period. Cora is actively engaging with the mining administration in Mali regarding these matters and being issued a mining permit for Sanankoro. The area of the mining permit will include parts of each of the Bokoro II, Kodiou and Sanankoro II exploration permits.

In accordance with the 2023 Mining Code:

● the granting of a mining permit entitles the State to hold a 10% free carried shareholding in the capital of the operating company;

● the State also has the option of increasing its participation in the operating company by purchasing an additional shareholding of up to 20% - this option can be exercised by the State within 12 months following the date of issue of the mining permit; and

● the operating company is required to transfer 5% of its shares to Malian national investors through the State-owned mining company, with Malian national investors purchasing such shares on the same basis as the State's purchase of its additional shareholding of up to 20%.

In summary, therefore, the total shareholdings of the State and Malian national investors in operating companies may be up to 35%.

Qualified Person Statements

Scientific or technical information in this disclosure that relates to mining results was reviewed by Mr Frikkie Fourie (BEng, Pr. Eng, MSAIMM), an independent consultant for Moletech. Mr Fourie is a Professional Engineer ('Pr. Eng') in good standing with the Engineering Council of South Africa, is a Member of the South African Institute of Mining and Metallurgy ('MSAIMM') and has sufficient experience that is relevant to the project under consideration which he is undertaking to qualify as a Competent Person under the JORC code.

The contents of this press release have been reviewed and approved by Philemon Bundo (BSc Eng (Metallurgy), FSAIMM, FAusIMM, MIMMM) Senior Vice President - Process Engineering & Studies of New SENET (Pty) Ltd with respect to processing and infrastructure.

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of UK law by virtue of the European Union (Withdrawal) Act 2018, until the release of this announcement.

* * ENDS * *

For further information, please visit www.coragold.com, follow us on social media (LinkedIn: www.linkedin.com/company/cora-gold/; and X: @cora_gold) or contact:

| Bert Monro | Cora Gold Limited | info@coragold.com |

| Derrick Lee | Cavendish Capital Markets Limited | +44 (0)20 7220 0500 |

| Susie Geliher | St Brides Partners | cora@stbridespartners.co.uk |

Notes

Cora is a West African gold developer with de-risked project areas within two known gold belts in Mali and Senegal. Led by a team with a proven track-record in making multi-million-ounce gold discoveries that have been developed into operating mines, its primary focus is on developing the Sanankoro Gold Project in the Yanfolila Gold Belt, south Mali, into an open pit oxide mine.

Cora has a Probable Reserve of 531 koz at 1.13 g/t Au (US$2,200/oz Au pit shell design), the 2025 Definitive Feasibility Study showed that the Project has strong economic fundamentals, including 64.9% IRR post tax, US$220.8m NPV8 post tax, US$479 million Free Cash Flow over life of mine and all-in sustaining costs of US$1,478/oz based on a gold price of US$2,750/oz. The Company is working to finalise the permitting process and conclude project financing so that mine construction can commence. Alongside this, the Company continues to seek value opportunities across its portfolio and has identified large scale gold mineralisation potential at the Madina Foulbé exploration permit within the Kenieba Project Area of east Senegal.

JORC Code, 2012 Edition - Table 1

Section 4 Estimation and Reporting of Ore Reserves (Sections 1-3 were published with an updated MRE by RNS on 19 July 2022)

The following information provided complies with the 2012 JORC Code requirements specified by 'Table-1 Section 4' of the Code. Each item in this table has been summarised as the basis for the assessment of overall Ore Reserves risk in the table below, with each of the risks related to confidence and/or accuracy of the various inputs into the Ore Reserves qualitatively assessed.

JORC 2012 Code Table 1 Assessment and Reporting for the Sanankoro Ore Reserves 2024

| Criteria | JORC Code explanation | Supplementary Commentary |

| Mineral Resource estimate for conversion to Ore Reserves | ● Description of the Mineral Resource estimate used as a basis for the conversion to an Ore Reserve. ● Clear statement as to whether the Mineral Resources are reported additional to, or inclusive of, the Ore Reserves. | ● The Mineral Resource models were prepared by ERM Australia Consultants Pty Ltd ('ERM'; formerly CSA Global). ● The Ore Reserves, including adjustment for ore loss and dilution factors, are included within the declared Mineral Resources |

| Site visits | ● Comment on any site visits undertaken by the Competent Person and the outcome of those visits. ● If no site visits have been undertaken indicate why this is the case. | ● Independent consultant F. Fourie the Competent Person for the Ore Reserves has not visited the site due to security reasons at the time, but a site visit is planned for the future. |

| Study status | ● The type and level of study undertaken to enable Mineral Resources to be converted to Ore Reserves. ● The Code requires that a study to at least Pre-Feasibility Study level has been undertaken to convert Mineral Resources to Ore Reserves. Such studies will have been carried out and will have determined a mine plan that is technically achievable and economically viable, and that material Modifying Factors have been considered. | ● A feasibility level study (FS) has been completed for the Project in 2022, with an update completed in September 2025 to incorporate the new Malian Mining Code of 2023 (and its related effects), natural inflation escalation and an update to the MRE due to additional 2,669m of drilling at the Sanankoro Project. ● A detailed mine plan that is technically achievable and economically viable has been completed. |

| Cut-off parameters | ● The basis of the cut-off grade(s) or quality parameters applied. | ● A financial assessment was undertaken to ascertain whether the Cut-off grade fulfil the criteria of 'reasonable prospects for eventual economic extraction' using detailed costs ● To complete pit optimisation, which forms the basis of the final pit designs, a cut-off grade estimate was performed. The cost per tonne for mining, processing and overhead costs, mining dilution and loss factors, processing plant recoveries and net payable gold, were used to determine the cut-off grade. ● A cut-off grade of 0.3 g/t Au was used. ● The cut-off grade being used for the Project is considered by the CP to be appropriate for the operation, considering the nature of the deposit, and the associated project economics. |

| Mining factors or assumptions | ● The method and assumptions used as reported in the Pre-Feasibility or Feasibility Study to convert the Mineral Resource to an Ore Reserve (i.e. either by application of appropriate factors by optimisation or by preliminary or detailed design). ● The choice, nature and appropriateness of the selected mining method(s) and other mining parameters including associated design issues such as pre-strip, access, etc. ● The assumptions made regarding geotechnical parameters (eg pit slopes, stope sizes, etc), grade control and pre-production drilling. ● The major assumptions made and Mineral Resource model used for pit and stope optimisation (if appropriate). ● The mining dilution factors used. ● The mining recovery factors used. ● Any minimum mining widths used. ● The manner in which Inferred Mineral Resources are utilised in mining studies and the sensitivity of the outcome to their inclusion. ● The infrastructure requirements of the selected mining methods. | ● A method of re-blocking was used on the Mineral Resource model to account for dilution and ore losses. ● Using the re-blocked Mineral Resource model, which accounts for modifying factors, pit optimisations where completed. ● The pits selected for each deposit formed the basis of final pit and pushback designs, which were used in the life of mine schedule. The CP considers the LOM to be appropriate and practically achievable. ● The mining of Selin, Zone A and Zone B is well suited to typical open pit methods using a backhoe configured excavator and truck fleet which will be operated by a mining contractor. ● Allowance was made for bush clearing and topsoil removal before the start of any pit being mined. ● Geotechnical assumptions were based on the various geotechnical drilling and analysis completed by OHMS. ● Modifying factors applied: o Mining recovery and dilution: ▪ Selin: Mining recovery 97.7%, Dilution 6.8% ▪ Zone A: Mining recovery 97.7%, Dilution 6.6% ▪ Zone B: Mining recovery 99.5%, Dilution 8.0% ▪ Zone B North: Mining recovery 97.6%, Dilution 10.1% ● In the pit, the minimum mining width applied as far as practically possible was 35m, which is appropriate for the envisioned type of equipment to be used. The selected SMU has been set at 5m x 5m x 5m. ● Inferred Mineral Resource material has not been included in the pit optimisation or in the Ore Reserves estimation. ● The final designed pits incapsulates 30 koz of Inferred Mineral Resources, which was not included in the LOM schedule used for financial modelling. At this stage the Inferred Mineral Resources were considered to be waste material. ● The main mining infrastructure includes crusher, tailings and waste storage facilities, stockpiles, roadways/ramps, workshops and so forth. |

| Metallurgical factors or assumptions | ● The metallurgical process proposed and the appropriateness of that process to the style of mineralisation. ● Whether the metallurgical process is well-tested technology or novel in nature. ● The nature, amount and representativeness of metallurgical test work undertaken, the nature of the metallurgical domaining applied and the corresponding metallurgical recovery factors applied. ● Any assumptions or allowances made for deleterious elements. ● The existence of any bulk sample or pilot scale test work and the degree to which such samples are considered representative of the orebody as a whole. ● For minerals that are defined by a specification, has the ore reserve estimation been based on the appropriate mineralogy to meet the specifications? | ● The Sanankoro optimised gold processing plant is designed to process oxide and transition ores from the three main deposits: Selin, Zone A and Zone B ores. ● The proposed process gravity/carbon-in-leach (CIL) technology, which consists of mineral sizing and scrubbing for oxide ore and crushing for transition material, milling, and gravity recovery of free gold, followed by leaching/adsorption of gravity tailings, elution and gold smelting, and tailings disposal. The process is well suited to the style of mineralisation. ● The proposed process plant design is based on a well-proven and established gravity/CIL technology. ● Extensive test work on oxide ores have been completed on samples from the Selin, Zone A and Zone B to cover the entire deposit laterally and at depth, which are considered representative. Additional metallurgical test work was done earlier in 2025 from various drill holes at Selin, Zones A & B to complement previous metallurgical testing and confirm the concept of introducing a scrubber and downsized mill circuit.

Gold is expected to be extracted from each ore type at the following average recoveries: ● Oxides 93.6%, Transitional 65.6%.

● No deleterious elements are indicated in the ore head grade assayed.

● A bulk sample composite was taken per domain and per weathering zone (and at depth), which are considered representative of the individual domains and zones. ● Specifications are not applicable. The product will be in the form of gold doré. The doré bars will be weighed, sampled and assayed before being sent to the precious metal refinery. |

| Environmental | ● The status of studies of potential environmental impacts of the mining and processing operation. Details of waste rock characterisation and the consideration of potential sites, status of design options considered and, where applicable, the status of approvals for process residue storage and waste dumps should be reported. | ● The Company commissioned Digby Wells to complete an ESIA to both Malian and International standards. On completion of the ESIA an application for Environmental Permit was lodged with the Mali government and subsequently the permit was received, in October 2022, so the Project is fully permitted from an environmental perspective. |

| Infrastructure | ● The existence of appropriate infrastructure: availability of land for plant development, power, water, transportation (particularly for bulk commodities), labour, accommodation; or the ease with which the infrastructure can be provided or accessed. | ● The Sanankoro Project is a Greenfields project - minimal infrastructure has been established on the project site. The on-site infrastructure required will be related to the processing plant and the supporting facilities as follows: ● In-plant access roads ● Plant buildings ● Plant reagents and consumables stores ● Process plant site drainage ● Sewage disposal ● Security ● Water supply and treatment ● Communications ● Power supply ● Fuel supply and storage ● There is sufficient land available for the development of and access to these items. ● The main off-site infrastructure required for the development of the project will be the following: ⮚ Mining infrastructure and buildings ⮚ Camp and catering facilities ⮚ Medical facilities ⮚ Power supply and distribution ⮚ Fuel storage ⮚ Communication ⮚ Potable water supply system |

| Costs | ● The derivation of, or assumptions made, regarding projected capital costs in the study. ● The methodology used to estimate operating costs. ● Allowances made for the content of deleterious elements. ● The derivation of assumptions made of metal or commodity price(s), for the principal minerals and co- products. ● The source of exchange rates used in the study. ● Derivation of transportation charges. ● The basis for forecasting or source of treatment and refining charges, penalties for failure to meet specification, etc. ● The allowances made for royalties payable, both Government and private. | The capital cost estimate for the project has been derived from information collated from the following: ● Life of Mine (LOM) pit production schedule, including stockpiling operations ● LOM processing plan ● Mine haul road designs and layouts ● Process plant design criteria ● General layouts of the process plant and related infrastructure ● Tailings Storage Facility (TSF) development schedule and operations ● Process flow diagrams ● Process plant equipment data sheets and lists ● Process plant piping and instrumentation diagrams ● Process plant line, valve, and instrument lists ● Electrical single-line diagrams and motor lists ● Electrical reticulation routes ● Various discipline material take-offs ● Quotations from vendors on mechanical and/or process equipment ● Quotations from vendors on main construction contracts ● EPCM schedules ● In-house historical databases ● The mining operating costs were obtained from contractor quotations. ● General and Administration costs were determined from first principles and by using information from SENET's in-house database for similar projects from the same locality. ● The process plant operating costs were compiled from a variety of sources: ⮚ First principles, where applicable ⮚ Supplier quotations on reagents and consumables ⮚ SENET's in-house experience and database where applicable ⮚ Allowances have been made for royalties and taxes based on the current applicable mining laws |

| Revenue factors | ● The derivation of, or assumptions made regarding revenue factors including head grade, metal or commodity price(s) exchange rates, transportation and treatment charges, penalties, net smelter returns, etc. ● The derivation of assumptions made of metal or commodity price(s), for the principal metals, minerals and co-products. | ● A life-of-mine production schedule was derived from the mine designs and the geological block model. The production schedule was used to generate monthly estimates of the mined tonnes and grade. ● The gold price used for Ore Reserve declaration is US$2,200/oz and the financial model completed at US$2,750/oz for the base case. ● All cost inputs are based on tenders, quote estimates or calculated from first principal. |

| Market assessment | ● The demand, supply and stock situation for the particular commodity, consumption trends and factors likely to affect supply and demand into the future. ● A customer and competitor analysis along with the identification of likely market windows for the product. ● Price and volume forecasts and the basis for these forecasts. ● For industrial minerals the customer specification, testing and acceptance requirements prior to a supply contract. | ● Based on market and operation requirements |

| Economic | ● The inputs to the economic analysis to produce the net present value (NPV) in the study, the source and confidence of these economic inputs including estimated inflation, discount rate, etc. ● NPV ranges and sensitivity to variations in the significant assumptions and inputs. | ● Based on assumptions that built the financial model in line with existing industry norm assumptions around gold price, discount rate and other factors. ● The financial model of the Ore Reserves mine plan shows that the mine has a positive NPV. The discount rate is in line with Cora's corporate economic assumptions. ● Various sensitivity analyses on the key input assumptions were undertaken during mine optimisations and financial modelling. All produce robust positive NPVs. |

| Social | ● The status of agreements with key stakeholders and matters leading to social licence to operate. | ● An ESIA has been completed that has given guidance which will be reviewed and implemented as appropriate when Project execution commences. |

| Other | ● To the extent relevant, the impact of the following on the project and/or on the estimation and classification of the Ore Reserves: ● Any identified material naturally occurring risks. ● The status of material legal agreements and marketing arrangements. ● The status of governmental agreements and approvals critical to the viability of the project, such as mineral tenement status, and government and statutory approvals. There must be reasonable grounds to expect that all necessary Government approvals will be received within the timeframes anticipated in the Pre-Feasibility or Feasibility study. Highlight and discuss the materiality of any unresolved matter that is dependent on a third party on which extraction of the reserve is contingent. | ● As required by laws and or regulation of the country. A mining permit is required for the Project, but the Company sees no reasons that this would not be granted. ● Cora is fully committed to comply with the Mining Code that the Mali government implemented in 2023. |

| Classification | ● The basis for the classification of the Ore Reserves into varying confidence categories. ● Whether the result appropriately reflects the Competent Person's view of the deposit. ● The proportion of Probable Ore Reserves that have been derived from Measured Mineral Resources (if any). | ● The classification of Ore Reserves is based on the requirements set out in the JORC code 2012, based on the classification of Mineral Resources and the cut-off grade. The material classified as Measured and Indicated Mineral Resources is within the final pits and is above the cut-off (US$/t) value, classified as Proved and Probable Ore Reserves, respectively. ● Indicated Mineral Resources within the pit designs and which are above the nominated cut-off grade, have been classified as Probable Ore Reserves. ● The Competent Person considers this appropriate for the Sanankoro Ore Reserves estimate. ● No Probable Ore Reserves have been derived from Measured Mineral Resources. |

| Audits or reviews | ● The results of any audits or reviews of Ore Reserve estimates. | ● No external audits or reviews of the Ore Reserve has been completed |

| Discussion of relative accuracy/ confidence | ● Where appropriate a statement of the relative accuracy and confidence level in the Ore Reserve estimate using an approach or procedure deemed appropriate by the Competent Person. For example, the application of statistical or geostatistical procedures to quantify the relative accuracy of the reserve within stated confidence limits, or, if such an approach is not deemed appropriate, a qualitative discussion of the factors which could affect the relative accuracy and confidence of the estimate. ● The statement should specify whether it relates to global or local estimates, and, if local, state the relevant tonnages, which should be relevant to technical and economic evaluation. Documentation should include assumptions made and the procedures used. ● Accuracy and confidence discussions should extend to specific discussions of any applied Modifying Factors that may have a material impact on Ore Reserve viability, or for which there are remaining areas of uncertainty at the current study stage. ● It is recognised that this may not be possible or appropriate in all circumstances. These statements of relative accuracy and confidence of the estimate should be compared with production data, where available. | ● The Ore Reserve has been completed to feasibility level with the data being generated from a tightly spaced drilling grid, thus confidence in the resultant figures is considered high. ● The most significant factors affecting confidence in the Ore Reserves are: ● Mining Dilution and Ore Loss are a best estimate at this stage but could have an impact if reality does not match the estimation. ● Increase in operating costs for mining and processing due to external factors. ● Geotechnical risk related to slope stability. ● The Malian governance.

|

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.