The information contained within this announcement is deemed to constitute inside information as stipulated under the retained EU law version of the Market Abuse Regulation (EU) No. 596/2014 (the "UK MAR") which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. The information is disclosed in accordance with the Company's obligations under Article 17 of the UK MAR. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

FIRST CLASS METALS PLC

4 September 2025

Sunbeam Property Expanded - Strategic Position Between Agnico Eagle Holdings

First Class Metals PLC ("First Class Metals" "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to announce that it has entered into an option agreement ("Option Agreement") over two additional claim blocks ("Sunbeam SE" or "Sunbeam South East") contiguous to the Sunbeam Property, increasing the total land package to approximately 90km².

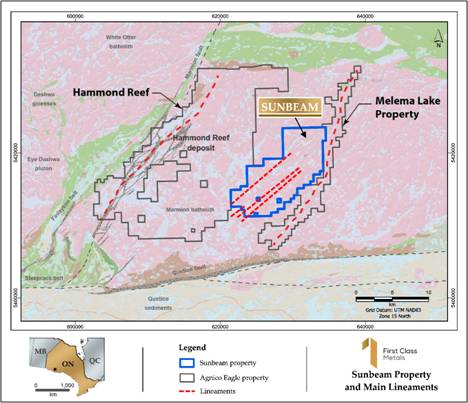

The Sunbeam Property is strategically located between Agnico Eagle's Hammond Reef deposit - which hosts 3.3 million ounces of open pit probable reserves (123.5Mt @ 0.84 g/t Au) - and Agnico Eagle's wider regional holdings. This positioning underscores Sunbeam's exceptional potential within a highly endowed and infrastructure-accessible gold district.

Highlights

· Strategic Expansion: Option Agreement secured over two new claim blocks contiguous to Sunbeam, increasing the project size to in excess of ~90km².

· Prime Location: Consolidates a gap between Sunbeam and Agnico Eagle's Melema property, only ~15km from Agnico Eagle's 3.3Moz Hammond Reef deposit.

· Enhanced Footprint: Enlarged land package now exceeds 90km², consolidating a highly prospective position across multiple mineralised structures and strengthening the exploration case and scale at Sunbeam.

· Very Low Frequency ("VLF")-magnetic survey: 905 stations across 17.1km of grid surveyed; data undergoing interpretation to refine targets ahead of possible drill planning.

· Cost-Effective Growth: Option ("Option") secured at modest cost - C$31,000 cash and C$55,000 in ordinary shares of £0.001 each ("Shares") over three years - with a 1.5% NSR royalty, 50% re-purchasable for C$400,000.

Marc J. Sale CEO First Class Metals Commented:

"The accretion of this parcel of claims to the expanding Sunbeam property is a sensible addition to our project portfolio. The new claims have added ~4km2 to the property further progressing the district scale potential.

Work is ongoing on the Sunbeam Property, specifically on the >10km Roy lineament. We eagerly await the results of the soil survey and the VLF interpretation so we can plan the next steps for this field season."

Sunbeam Property

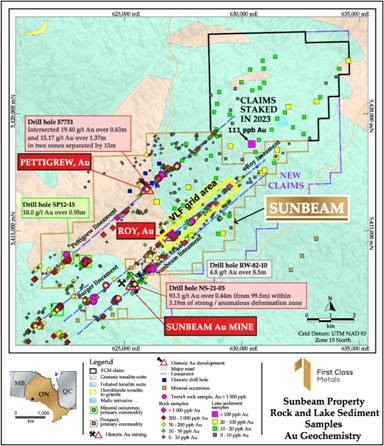

The Sunbeam property, which now extends over >90km2, contains three historic development sites: i) Sunbeam, the most exploited and the only site with recorded production, ii) Roy and iii) Pettigrew; these all sit on previously identified mineralised, district scale, structures, see Figure 1.

In addition, along these three mineralised structures a number of other significant gold bearing sites have been identified, such as Road zone and AL 308. A potential 4th lineation, the Burger structure, has not been explored by FCM, neither has the Rubble zone.

The historic developments as well as the widespread occurrence of gold emphasise the mineral endowment of the property and the potential for a major discovery.

Figure 1 showing the mineralised trends on the Sunbeam property and with the locations of the lake sediment samples, the area of soil / VLF survey as well as the recently staked claims.

Sunbeam is situated between two extensive properties held by Agnico Eagle, both these properties have mineralised northeast striking structures, with the western property hosting the Hammond reef deposit of 3.3M oz of gold, see Figure 2.

Figure 2 showing the Sunbeam property's neighbours (Agnico Eagle) and similar mineralised structures

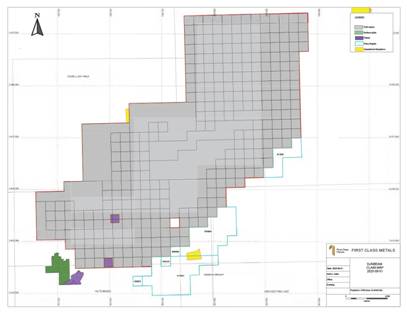

The 'new' claims that form the Option Agreement are contiguous to both the southeastern margin of the Sunbeam block and the northwestern margin of the Agnico Eagle's Melema property filling in a prospective as well as logistically important location, see Figure 3.

Figure 3 showing the new 'Sunbeam SE' claims in light blue, relative to the main property

The area is equivalent to 48 single cell claims and importantly, as stated are contiguous to the main property, which has positive implications for assessment credits, the new claims increased the property size from roughly 88km2 to above 90km2 making it truly district scale in its potential.

The key commercial terms of the Agreement are:

| Due Date | Common Share Payments | Cash Payment (CAD) |

| Signing the Agreement | Payment of $ 10,000 to be satisfied by the allotment of 276,924 Shares at a price of 1.95 pence per share within 30 days of execution | $5,000 |

| On the 1st anniversary of the Effective Date | $45,000 in Shares at a price equal to the closing mid-price on the 1st anniversary. | $6,000 |

| On the 2nd anniversary of the Effective Date | nil | $8,000 |

| On the 3rd anniversary of the Effective Date | nil | $12,000 |

| Total | $55,000 in share value | $31,000 |

There is also 1.5% NSR Royalty associated with the property with the ability to buy-back 50% of the same for C$ 400,000

Other developments

o Soil sampling

The results of the soil sampling programme are still to be received and will report once in-house and interpreted.

o VLF / magnetic survey

A VLF and magnetic survey has resumed over the southern, (Roy section) of the district lineament as well as completion of the central grid area which now has 6km line survey.

The southern grid (over the Roy shafts) as well as 'tie lines' orientated northeast, southwest bring the total surveyed on this grid at month's end to 12.1km. This data will be processed and then interpreted before completing the remainder (northern grid) of the survey.

Issue of Equity

276,924 Shares are being issued to cover the first Sunbeam South East Share Payment, they will rank Pari passu with the Company's existing issued ordinary shares. The Company intends to allot and issue these new ordinary shares under its existing authorities on a non-pre-emptive basis.

Application is being made to the FCA for admission of the 276,924 Shares to the Equity Shares (transition) category of the Official List and to the London Stock Exchange for admission to trading on the Main Market for listed securities (together, "Admission"). Admission is expected to occur on or around 10 September 2025.

Following Admission, the Company's issued ordinary share capital will be 233,932,820 ordinary shares, which may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company under the FCA's Disclosure Guidance and Transparency Rule

Qualified Person

The technical disclosures contained in this announcement have been drafted in line with the Canadian Institute of Mining, Metallurgy and Petroleum standards and guidelines and approved by Marc J. Sale, who has more than 30 years in the gold exploration industry and is considered a Qualified person owing to his status as a Fellow of the Australian Institute of Mining and Metallurgy.

For Further Information:

Engage with us by asking questions, watching video summaries, and seeing what other shareholders have to say. Navigate to our Interactive Investor hub here:

https://fcm-l.investorhub.com/link/MP7o0P

For further information, please contact:

James Knowles, Executive Chair

Email: JamesK@Firstclassmetalsplc.com

Tel: 07488 362641

Marc J Sale, CEO and Executive Director

Email: MarcS@Firstclassmetalsplc.com

Tel: 07711 093532

Novum Securities Limited (Financial Adviser)

David Coffman / Dan Harris

Website: www.novumsecurities.com

Tel: (0)20 7399 9400

Axis Capital Markets (Broker)

Lewis Jones

Website: Axcap247.com

Tel: (0)203 026 0449

First Class Metals PLC - Background

First Class Metals listed on the LSE in July 2022 and is focused on metals exploration in Ontario, Canada which has a robust and thriving junior mineral exploration sector. In particular, the Hemlo 'camp' near Marathon, Ontario is a proven world class address for gold exploration, featuring the Hemlo gold deposit operated by Barrick Mining (>23M oz gold produced), with the past producing Geco and Winston Lake base metal deposits also situated in the region.

FCM currently holds 100% ownership of seven claim blocks covering over 250km² in northwest Ontario. A further three blocks are under option and cover an additional 30km2.FCM is focussed on exploring for gold but has base metals and critical metals mineralisation. FCM is maintaining a joint venture with GT Resources on the West Pickle Lake Property a drill-proven ultra-high-grade Ni-Cu project.

The flagship properties, North Hemlo and Sunbeam, are gold focussed. North Hemlo has a significant discovery in the Dead Otter trend which is a discontinuous 3.5km gold anomalous trend with a 19.6g/t Au peak grab sample. This sampling being the highest known assay from a grab sample ever recorded on the North Limb of Hemlo.

In October 2022 FCM completed the option to purchase the historical high-grade past-producing Sunbeam gold mine near Atikokan, Ontario, ~15 km southeast of Agnico Eagle's Hammond Reef gold deposit (3.3 Moz of open pit probable gold reserves).

FCM acquired the Zigzag Project near Armstrong, Ontario in March 2023. The property features Li-Ta-bearing pegmatites in the same belt as Green Technology Metals' Seymour Lake Project, which contains a Mineral Resource estimate of 9.9 Mt @ 1.04% Li2O. Zigzag was successfully drilled prior to Christmas 2023 and results have now been released.

The Kerrs Gold property, acquired under option by First Class Metals in April 2024, is located in northeastern Ontario within the Abitibi Greenstone Belt, one of the world's most prolific gold-producing regions. The project holds a historical inferred resource of approximately 386,000 ounces of gold, underscoring its potential as a meaningful addition to FCM's expanding gold portfolio. Kerrs Gold complements the Company's exploration strategy and provides exposure to a well-established mining district. FCM is currently reviewing plans to advance the project and further unlock its value.

The significant potential of the properties for precious, base and battery metals relates to 'nearology', since all properties lie in the same districts as known deposits (Hemlo, Hammond Reef, Seymour Lake), and either contain known showings, geochemical or geophysical anomalies, or favourable structures along strike from known showings (e.g. the Esa project, with an inferred Hemlo-style shear along strike from known gold occurrences).

For further information see the Company's presentation on the web site:

www.firstclassmetalsplc.com

Forward Looking Statements

Certain statements in this announcement may contain forward-looking statements which are based on the Company's expectations, intentions and projections regarding its future performance, anticipated events or trends and other matters that are not historical facts. Such forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as 'aim', 'anticipate', 'target', 'expect', 'estimate', 'intend', 'plan', 'goal', 'believe', or other words of similar meaning. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Given these risks and uncertainties, prospective investors are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.