The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse (amendment) (EU Exit) Regulations 2019/310 ("MAR"). With the publication of this announcement via a Regulatory Information Service, this inside information is now considered to be in the public domain.

4 September 2025

Fusion Antibodies plc

("Fusion" or the "Company")

Final results

and

Investor presentations

Fusion Antibodies plc (AIM: FAB), specialists in pre-clinical antibody discovery, engineering and supply for both therapeutic drug and diagnostic applications, announces its final results for the year ended 31 March 2025.

Commercial and operational highlights (including post period end)

· Audited revenues for FY2025 of £1.97m (FY2024: £1.14m)

· Increased activity in the second half of FY2025 including the continuation of the collaboration agreement with the National Cancer Institute for the use of OptiMAL®

· Placing announced in March 2025, raising £1.17m (before expenses) for general working capital and investment into commercial activities

· Significant increase in sales pipeline opportunities during the second half of FY2025

· Grant of U.S. Patent for OptiMAL®

· Cash position as at 31 March 2025 of £0.4m (31 March 2024: £1.2m)

Adrian Kinkaid, CEO of Fusion Antibodies commented: "We were very pleased to deliver an improved FY2025. We made significant progress in improving revenues and in Fusion's strategic development in key new markets such as Diagnostics which has reduced our exposure to the more volatile VC funded biotech sector. We also announced large contract wins in May 2024 and again in February 2025, the latter being the source of three further contract wins announced on 27 August 2025.

"In addition, we secured significant grant funding through the excellent Future Medicines Institute (FMI) initiative announced in December 2024. This in turn helped Fusion to apply for a further grant in conjunction with Queen's University Belfast for the DR5 project, which Fusion secured in the current financial year.

"We also made very significant progress with our flagship OptiMAL® programme. This progress was achieved largely through Fusion's collaboration with the National Cancer Institute (NCI) and the successful £1.17m fundraise. The successful fundraise allowed Fusion to increase its internal research and development (R&D) efforts to validate hits from the NCI as well as to commit to increased sales and marketing towards building a formal launch of OptiMAL® as a service later in 2025.

"We are increasingly positive about the improved position of the Company, and we look forward to realising the true potential of the business going forward. Lastly, we are always grateful to our dedicated shareholders for their constant support."

Investor presentations (online and in-person)

The Company will host an online live investor presentation on Monday, 15 September 2025 at 11am BST, delivered by Dr Adrian Kinkaid, CEO and Stephen Smyth, interim CFO. The Company is committed to providing an opportunity for all existing and potential investors to hear directly from management.

The presentation will be hosted through the digital platform Investor Meet Company ("IMC").

Investors can sign up to Investor Meet Company for free and add to meet Fusion Antibodies plc via the following link: https://www.investormeetcompany.com/fusion-antibodies-plc/register-investor.

For those investors who have already registered and added to meet the Company, they will automatically be invited. Questions can be submitted pre-event via your IMC dashboard or in real time during the presentation, via the "Ask a Question" function. Whilst the Company may not be in a position to answer every question it receives, it will address the most prominent within the confines of information already disclosed to the market through regulatory notifications. A recording of the presentation, a PDF of the slides used, and responses to the Q&A session will be available on the Investor Meet Company platform afterwards.

In-person London investor event

As announced by the Company on 26 August 2025, the Company will also host an in-person investor presentation in London on Wednesday, 17 September 2025 at 2.30pm. To register for this, please email fusion@walbrookpr.com.

Enquiries:

| Fusion Antibodies plc | www.fusionantibodies.com | |

| Adrian Kinkaid, Chief Executive Officer Stephen Smyth, Chief Financial Officer | Via Walbrook PR | |

| | | |

| Fusion Antibodies interactive investor hub | https://investorhub.fusionantibodies.com/s/b8d633

| |

|

| | |

| Allenby Capital Limited | Tel: +44 (0) 20 3328 5656 | |

| James Reeve/Vivek Bhardwaj (Corporate Finance) Tony Quirke/Joscelin Pinnington (Sales and Corporate Broking) | | |

| | | |

|

| | |

| Shard Capital Partners LLP | | |

| Damon Heath (Joint Broker) | Tel: +44 (0) 207 186 9952 | |

| | | |

|

| | |

| Walbrook PR | Tel: +44 (0)20 7933 8780 or fusion@walbrookpr.com | |

| Anna Dunphy | Mob: +44 (0)7876 741 001 | |

About Fusion Antibodies plc

Fusion is a Belfast based contract research organisation ("CRO") providing a range of antibody engineering services for the development of antibodies for both therapeutic drug and diagnostic applications.

The Company's ordinary shares were admitted to trading on AIM on 18 December 2017. Fusion provides a broad range of services in antibody generation, development, production, characterisation and optimisation. These services include antigen expression, antibody production, purification and sequencing, antibody humanisation using Fusion's proprietary CDRx TM platform and the production of antibody generating stable cell lines to provide material for use in clinical trials. Since 2012, the Company has successfully sequenced and expressed over 250 antibodies and successfully completed over 200 humanisation projects and has an international, blue-chip client base, which has included eight of the top 10 global pharmaceutical companies by revenue.

The Company was established in 2001 as a spin out from Queen's University Belfast. The Company's mission is to enable pharmaceutical and diagnostic companies to develop innovative products in a timely and cost-effective manner for the benefit of the global healthcare industry. Fusion Antibodies provides a broad range of services in antibody generation, development, production, characterisation and optimisation.

Fusion Antibodies growth strategy is based on combining the latest technological advances with cutting edge science to deliver new platforms that will enable Pharma and Biotech companies get to the clinic faster, with the optimal drug candidate and ultimately speed up the drug development process.

The global monoclonal antibody therapeutics market was valued at $186 billion in 2021 and is forecast to surpass $445 billion in 2028, an increase at a CAGR of 13.2 per cent. for the period 2022 to 2028. Approximately 150 monoclonal antibody therapies are approved and marketed globally as of June 2022 with the top four antibody drugs each having sales of more than $3 bn in 2021.

Chairman's Statement

The financial year ended 31 March 2025 ("FY2025") has overall been positive for the Company. While it has not necessarily been a smooth journey, we ended the financial year in line with market expectations in respect of revenue for FY2025, saw positive growth in one of our new markets, that of diagnostics, and saw exciting data from our US-based collaborators in relation to the OptiMAL® library. On the back of these developments we have also been well supported by our shareholders, notably having successfully raised approximately £1.17 million in March 2025.

While the board of directors of Fusion (the "Board" or the "Directors") are encouraged by the progress that we have made in FY2025, we are aware that we are living through ever-evolving economic circumstances. From the global market perspective, FY2025 started on a positive note and a slow recovery appeared to be the direction of travel, with the confidence of venture capital (VC) and other investors seeming to be improving. Against this backdrop, we were hopeful that investment into our customers' early-stage therapeutic pipelines would start to grow. As we entered calendar year 2025, the global economic conditions became more uncertain and while we have not seen any clear indication that things are slowing down, we are very aware that this may change in the future. However, while this uncertainty may slow down the organic expansion of many of our therapeutic clients or prospective clients, we believe that they will continue to have a choice of either pausing certain development programs or to take the more flexible approach and outsource their development work to companies such as ourselves, thereby giving them greater control of their fixed cost base. Consequently, we view the threat of financial instability as a potential opportunity for Fusion.

With the biotechnology drug development sector's funding environment being uncertain, our diversification strategy is providing us with more growth opportunities as well as a buffer against the ups and downs of the investment community. Last year we explained that the Diagnostic sector uses antibodies for the majority of their tests and that they have a need to discover new versions, to improve the effectiveness of the antibodies that they already have and to develop stable versions for manufacturing, albeit in smaller quantities. What this means for Fusion is that many of our genetic engineering skills are as relevant to this market as to therapeutic market and as outlined later in the annual report, has started to show some positive results. The same applies to the veterinary market, and although we are finding some new prospects, it is a smaller and less established market and, therefore, will take us longer to make any significant gains. Furthermore, we believe that the increasing adoption of artificial intelligence and machine learning (AI and ML) approaches will play a key role in discovery and one that Fusion should be a part of. Our US collaboration gives us early exposure to in-silico antibody designs as we prepare for greater market acceptance in the in-silico approach to antibody design.

Alongside economic risks we must also remember that we are working with Companies that are at the forefront of scientific endeavour and that by the very nature of the work there is always the prospect of scientific failures being the root cause of a program being paused or cancelled. As reported in the year-end trading statement on 6 May 2025, this scientific attrition can slow or delay pipeline projects and impact revenue forecasts. However, our diverse client base and market reach helps mitigate these risks.

Business performance

The Company and all of its staff have risen to the challenge, and while the financial year ended 31 March 2024 ("FY2024") was very focussed on cost cutting with the business in survival mode, the results for FY2025 are the beginning of Fusion's turnaround phase, with the new commercial strategy delivering revenues of approximately £1.97m, representing a 73% increase on the previous financial year (FY2024: £1.14m). The diversification strategy has delivered significant growth from the Diagnostics sector, which represents 33% of our revenue for FY2025, and we have seen first signs of real interest from the Veterinary market, a promising sign that there is potential for further growth in this sector. While FY2025's financial results are encouraging, we remain mindful of the ongoing economic challenges and the risks tied to our main business in therapeutic antibody development. For details on the Company's Key Performance Indicators, please refer to page 34 of this report.

We have always been very proud of our scientific expertise, and this was truly exemplified by the award of the Future Medicines Institute (FMI) grant announced by the Company in December 2024. This approval recognises that we have a strong scientific reputation, technical ability and that we can play a significant part in The Northern Ireland Precision Biomarkers and Therapeutics consortium's goals, which includes Fusion. The FMI project has been designed to support platform development in diagnostics and therapeutics and so maps very closely to the ambitions of the Company. It has the benefit of bringing in approximately £1m of direct non-dilutive funding to the Company, access to relevant expertise and use of to up to £5m of new capital equipment within Queen's University Belfast (QUB) and the consortium, something that would normally be out of reach for us.

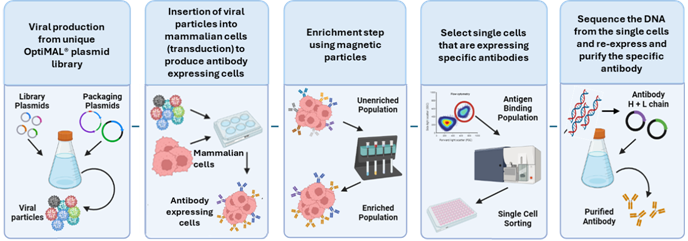

One of our most exciting scientific development projects is the OptiMAL® library, which is being developed to allow the direct and fast discovery of complete human antibodies against a target of choice using a cell-based screening process. This is expected to remove the need for animals and humanisation of a non-human antibody, speed up the discovery phase plus the unique choice of library has the potential to develop antibodies that are already human in structure, stable and suitable for their purpose. The OptiMAL® library has attracted the interest of our now collaborator, the National Cancer Institute (NCI), who recently provided us with the first independently derived positive cells from the OptiMAL® platform against a cancer related target of their choice. The Company confirmed their results and took it one step further by using the DNA sequences obtained from the positive cells to synthesise the antibodies through an independent transient gene expression process. These antibodies were subsequently shown to bind to the protein antigen, completing the process. Although further validation work is required, this represents a significant step in the independent validation of the OptiMAL® platform.

Building on the work being carried out on our OptiMAL® library, our 'Opti' technology for library design is well suited for phage display screening platforms. While phage libraries only produce antibody fragments, which have to be further developed to generate full antibodies, it is a well-established format within the market and often the preferred choice for some customers. The first OptiPhageTM library contract was for non-human antibodies for a leading antibody research Company, with the client having an option to license the library on an exclusive basis. It is anticipated that the Project will provide the client with an alternative pathway to produce high quality antibodies, reducing its need to run animal-based antibody generation. Fusion remains free to develop further OptiPhageTM libraries for its own use or for other clients as it adds this service to its increasingly comprehensive range of offerings.

New Funding

Having last year reduced the cost base of the Company to a minimum operational level, R&D resources were stretched for the work on OptiMAL® and the anticipated further positive cells from NCI would further compound this. To build on the positive data coming from the NCI laboratories and to ensure effective and efficient internal R&D work on the OptiMAL® development, together with enhancing the commercial activities, the Board decided that it would be to the benefit of the shareholders to raise some further funds. The equity fundraise, announced on 18 March 2025, raised approximately £1.17m (before expenses) by way of a placing (the "Placing") of a total of 17,365,228 new ordinary shares of 4 pence each in the Company ("Ordinary Shares") at a price of 6.75 pence per new Ordinary Share for this additional R&D work, some general working capital and to invest into commercial activities, especially to support OptiMAL® should the validation prove successful. The Placing was very well supported by existing institutional investors and VCT funds and the issue price of the Placing was not discounted with the price equal to the closing mid-market price of an Ordinary Share on 17 March 2025.

We very much appreciate the confidence that our shareholders have in the Company, and it is always our objective to keep all shareholders up to date with any significant progress. This year, to help facilitate this, we introduced the new interactive Investor Hub which brings all the Company's existing content into a single integrated platform and will enable investors and stakeholders to be better informed and engaged in the Company's business. It is worth noting at this point that the Company is committed to continuing to keep shareholders up to date via announcements made of any significant news or of a regulatory nature through the regulatory news service (RNS) in line with its obligations under the AIM Rules for Companies and the UK Market Abuse Regulation (UK MAR).

Board and Employees

There have been no changes to the Board this year and the effort, dedication and hard work they have put in during the year is much appreciated. For FY2025 the NEDs continued to demonstrate their commitment and belief in the Company and helped to minimise the outgoing costs for the second year by taking their remuneration as part salary and part new Ordinary Shares. This structure will cease to continue going forward and they will be paid their full remuneration entirely in cash for the financial year ending 31 March 2026 ("FY2026").

A big thank you also goes to all the staff who have diligently and creatively worked to deliver services to our clients, often under significant pressure, and achieved the revenue targets for the year. Their efforts have been instrumental in this year's turnaround and recovery. Despite the significantly reduced headcount, they have demonstrated flexibility and undergone extensive cross-training to ensure that the Company can continue to offer its full range of services.

Finally, it is worth mentioning and thanking our auditors, Kreston Reeves LLP, who quickly grasped our business needs last year and have proven to be an excellent fit. They replaced PwC last year, as we determined a smaller, more cost-effective firm was better suited to our limited resources and future direction. After an extensive search, Kreston Reeves LLP was chosen for their size, commitment and relevant experience in Life Sciences. We would like to thank PwC for all they did for us over their 17-year tenure.

Corporate governance

The long-term success of the business and delivery on strategy depends on good corporate governance. The Company complies with the Quoted Companies Alliance Corporate Governance Code as explained more fully in the Governance Report.

Post year end and outlook

On 7 April 2025, at the Company's general meeting, all resolutions in connection with the issue of the 8,416,020 second tranche placing shares were approved. As a result, the 8,416,020 second tranche placing shares were issued and admitted to trading on AIM on 9 April 2025, completing the approximately £1.17m raise (before expenses). This cash boost at the start of FY2026, along with the first FMI grant payments, positions the Company well for the current financial year.

On 24 April 2025, the Company announced the approval of an Innovate UK Launchpad grant led by the Company in collaboration with Queen's University Belfast ("QUB") to develop a humanised antibody targeting and activating the DR5 protein on cancer cells for the treatment of cancers. The total funding being made available under the Grant is over £808k, with up to £545k expected to be provided to Fusion over a period of approximately 18 months. The antibody asset generated under the Grant project will be jointly owned by Fusion and QUB although the ownership ratios are still to be determined. This antibody asset goes alongside our grant-based collaboration with Finn Therapeutics, who are developing the antibody against RAMP which is protected by a Fusion patent. Any additional grants that become available will be identified and applied for within the next 12 months.

We were excited to announce on 5 August 2025 that the United States Patent and Trademark Office has granted the Company's U.S. OptiMAL® patent application. The application entitled "Antibody Library and Method", concerns the library of antibodies that is currently screened within the OptiMAL® platform, as well as the method for the design of additional libraries. This is key to Fusion's offering to provide "Opti" designed libraries for a range of applications including Antibody Discovery, Affinity Maturation, and Sequence Optimisation.

While the Board is mindful of the potential global economic challenges, with our core new technologies strengthening and a solid sales pipeline we remain confident that Fusion can continue its growth and build on last year's performance.

Simon Douglas

Chairman

03 September 2025

CEO's report

The overall market in which we operate stabilised and started to recover during FY2025. Fusion's revenues recovered rather more effectively than the overall market with Fusion reporting revenues of approximately £1.97m for FY2025, representing a 73% increase from the previous financial year. This achievement was due to the dedication and ability of our team combined with several successful initiatives including additional efforts in the diagnostics sector and the research antibodies field, more so than the overall market changes alone. We specialise in antibodies and, as antibodies have a diverse and varied application, there is demand for our services in each of those sectors. The recovery is ongoing, and the outlook appears positive although we, like many in our sector, remain somewhat cautious reflecting the disruption in geopolitical and economic circles, which could have an impact on our client base despite its enhanced diversity.

On the R&D front, FY2025 has been an excellent year. We received a significant boost from the award of the Future Medicines Initiative (FMI) grant to the consortium led by Queen's University Belfast. This recognised the highly applicable and innovative nature of our proprietary technologies and Fusion's ability to convert cutting edge innovations into class leading services and products. The FMI grant also provides us with approximately £1m of direct non-dilutive funding and access to up to £5m of capital equipment at no cost to Fusion. Additionally, being a founding member of the FMI gives us access to a superb array of talent and expertise, some of which will be used to develop a phage display panning laboratory which we can use to screen the OptiPhageTM library as and when required. This negates the need to undertake building work at our own facility, which would have been needed to modify air handling systems to secure effective separation of air flows between bacterial and mammalian cell laboratories. We had previously estimated such work would have required a budget of around £300,000, but due to the FMI grant this is no longer needed.

Perhaps the icing on the FMI cake is the PhD studentships which comes fully funded as part of the FMI programme. The FMI grant provides for a total of 20 PhD studentships across the consortium. These are expected to be run in two or three cohorts each starting around a year apart. We are currently seeking applications for two of these PhD studentships in the first cohort for two projects designed and nominated by Fusion creating important opportunities for our development, again at no direct cost to the Company.

The Board believes that if it was not for the FMI grant, the Company would have required to have spent at least £6 million in capital to receive the same benefits of the FMI grant.

As significant as the FMI grant is for the business, progress made this year with our flagship OptiMAL® platform has far more potential. Due to the rescaling of the business in the previous financial year, our internal R&D resources had been significantly reduced. It was therefore hugely advantageous to have the collaboration agreement with the National Cancer Institute USA (NCI), announced toward the end of November 2023, to pursue the validation of the platform at minimal cost to the Company. The Director of the Antibody Engineering program at the NCI is Dr. Mitchell Ho: our principal point of contact. Mitchell is a highly respected world leader in both mammalian display and antibody generation. The work undertaken through the collaboration has demonstrated the utility of the OptiMAL® platform and that it can be used to identify cell-bound antibodies for a range of targets. Many of these antibodies have been isolated and verified by Fusion and the NCI is now seeking to demonstrate their functional utility. We look forward to further updates from the NCI and once this work is complete, patent applications filed, peer reviewed publications submitted and to their independent statements which we are confident will formally validate OptiMAL®.

The OptiMAL® Human Antibody Discovery Process

In the meantime, the Company is pressing ahead with the commercialisation plans for OptiMAL® which is scheduled for launch at a significant conference for the industry: the Antibody Engineering and Therapeutics conference in San Diego in December 2025. We have secured booth space and a presentation within the conference's scientific programme. Prior to this taking place we are continuing to diligently gather as much scientific data as possible to highlight the advantages of the platform in the discovery of antibodies for our clients.

It is also worth highlighting the importance of the ability to transfer the OptiMAL® technology to other laboratories, which was also demonstrated as part of the validation project with the NCI. The capability to transfer the technology means that we can seek to exploit a much wider market than would be possible if all screens were to be run within the Fusion laboratories, which itself would require significant scaling of resources in terms of personnel, capital equipment and consumables. Moving to a technology licensing model will allow us to bypass the restrictions on capacity due to internal resources.

Market outlook: growth prospects by sector

We were very pleased to announce, on 27th August 2025, that we had secured three follow-on contracts from an existing client providing combined anticipated further revenues of nearly $460,000. These are significant amounts and bear testimony to our commitment to our clients, building long term relationships with them, and the high-quality standards to which we hold ourselves. It is also worth noting that this win was achieved while the market is very competitive.

Even in the most competitive of times, our clients such as pharmaceutical and biotech companies constantly develop their pipelines while committing significant proportions of their available resource in this respect. This may become exaggerated as various pharmaceutical companies around the globe face a number of their lead products coming off patent in the period to 2030 and will want to fill this gap in their product line up with new patented products. It is anticipated that the closing of this gap will require the acquisition of products from biotechnology companies who in turn will wish to replenish their own discovery pipelines, deploying the revenues from the sale of their more developed assets. Consequently, it is reasonable to align with reports stating that the market for antibody discovery, including services such as those offered by Fusion, will grow significantly in the coming years. Many market reports testify to this outlook. Two examples of these market reports include reports from Precedence Research and The Business Research Company. These estimate the market in the current year, 2025, to be worth $9.06Bn with a CAGR of 8.3%, and $9.87Bn with a CAGR of 10.3% respectively. Whilst it is wise to treat such forward looking projections as no more than estimates, the trends are reassuring.

Furthermore, these reports and others, delve into market segments such as phage display, hybridomas and humanisation, as well as the putative underlying causes for growth. Growth drivers are predominantly reported as being new technology, such as AI/ML and new discovery technology, and the increase in precision medicines with more patient stratification being better met through more specifically targeted antibody drugs. The split in the Antibody Discovery market between phage display and the use of hybridomas is significant. Phage display enables the use of partial human sequences, but only for fragments of antibodies which then require reconstructing into the final product and not all fragments are compatible with other fragments found through this method. The challenges associated with this complex process are likely a significant contributor to the apparently lower historical returns from Phage Display versus the hybridoma approach which has arguably yielded more drug registrations.

Hybridomas are, however, restricted by the immune responses of the hosts, typically mice or rabbits, for those now approved as therapeutics. The use of animals is something that the pharmaceutical companies try to avoid as much as possible. Furthermore, the innate function of the immune system to avoid auto-immune disease means that output is focussed on the differences between the human antigen and the host equivalent protein. Whilst this is eminently sensible from an evolutionary perspective it is not advantageous to our industry. We consequently see antibody development teams turning to more and more evolutionarily distinct host species, such as chickens and sharks, in order to improve the scope for more diverse immune responses. However, this also makes the humanisation process concomitantly more challenging. In this context, it is my belief that the industry would significantly benefit from a system capable of delivering fully intact human antibodies without the compromises and complications of the existing approaches. This is what we have set out to provide in developing OptiMAL® as the technological solution to the industry wide problem.

OptiMAL® and Mammalian Display: the right products at the right time.

I believe that the time is right for just such a disruptive antibody discovery platform which could allow human sequences to be used, without the auto-immune filter of a host animal or the restriction in fragment size. Such a platform would instead deliver full antibody sequences, ideally expressed by mammalian cells. This is what OptiMAL® offers the market.

Where more is known about the target antigen, there is scope for a more focused approach utilising artificial intelligence (AI) and/or machine learning (ML). These novel design methods are intended to generate full length antibody sequences which need to be synthesised in the real world for testing. This can be achieved through our AI/ML-AbTM platform utilising the same mammalian display technology developed for OptiMAL®.

It is fair to say that our AI/ML-AbTM has not yet delivered its full potential. This will take time. It is widely recognised that while there has been considerable excitement about the potential capability of AI, like many new technologies, the uptake and confidence in the approach is building cautiously. Antibody design, especially de novo design, is no exception. Nevertheless, many antibody experts believe that AI/ML will be a key part of the mix of approaches for antibody discovery and development going forward. It is important therefore that Fusion remains active in the field. Our collaboration with a leading US-based AI/ML business announced in 2023 is still in place and will use our proprietary Mammalian Display platform to enable screening of designs derived from AI/ML. Our AI based research project with Oxford University is similarly progressing well with in silico designs being successfully expressed in our laboratories in Belfast and generating data which will be used to improve the novel algorithms and their outputs so adding value to our services in the future.

Developing a Fusion asset

On 24th April 2025 we announced the approval of a grant to support the development of an antibody against DR5 (death receptor 5) as a potential therapeutic and or diagnostic antibody for certain types of cancer. The award of the grant followed on from the successful identification of a lead antibody with some exceptional biological properties. The grant funding will allow the Company to progress this interesting lead molecule by humanising it and, accessing expertise at Queen's University Belfast, demonstrate its potential efficacy in vivo. The ambition is to have a clinic ready asset available for partnering from late FY2027.

Conclusion

In conclusion, I firmly believe that Fusion has the proven capabilities, track record and an improving business performance to provide the Company with a stable foundation from which to launch groundbreaking disruptive technologies. In my opinion, the most significant of these is OptiMAL® complemented by the underlying mammalian display and the Opti-library, which is also applicable to phage display. The range of services we offer our clients is increasingly comprehensive and highly complementary to diverse antibody development strategies positioning us well to continue to gain traction with a broad client base across Therapeutics, Diagnostics and Research antibody sectors. The year ahead is an exciting one for the business. We will continue to support our existing client bases, appeal to wider markets through technological differentiation which provides significant benefits to our existing and new clients. We will also use the OptiMAL® technologies, and such assets as may be available, to position the Company for a transition from a service provider with repeat business to a technology licensor with recurring revenues.

Adrian Kinkaid

Chief Executive Officer

03 September 2025

Statement of Profit or Loss and Other Comprehensive Income

For the year ended 31 March 2025

|

|

| Note | 2025 | 2024 | |||

|

| | £'000 | £'000 | |||

| | | | |

| ||

| Revenue | 4 | 1,965 | 1,136 | |||

| Cost of sales |

| (1,535) | (1,181) | |||

|

Gross profit |

|

430 |

(45) | |||

|

Other operating income |

|

- |

5 | |||

|

Administrative expenses |

|

(2,209) |

(2,247) | |||

| |

|

| | |||

| Operating loss | 5 | (1,779) | (2,288) | |||

| | |

| | |||

| Finance income | 8 | 5 | 3 | |||

| Finance expense | 8 | (3) | (5) | |||

| Loss before tax |

| (1,777) | (2,289) | |||

|

Income tax credit |

10 |

64 |

63 | |||

|

Loss for the financial year |

|

(1,713) |

(2,226) | |||

|

Total comprehensive expense for the year |

|

(1,713) |

(2,226) | |||

|

|

|

|

| |||

|

|

| Pence | Pence | |||

| Loss per share | |

| | |||

| Basic | 11 | (1.8) | (3.9) | |||

Statement of Financial Position

As at 31 March 2025

|

|

| Notes |

| 2025 £'000 |

| 2024 £'000 |

| Assets |

| | | | |

| Non-current assets |

| | | | |

| Intangible assets | 12 | | - | | - |

| Property, plant and equipment | 13 |

| 63 | | 158 |

| |

|

| 63 | | 158 |

| Current assets |

|

|

| | |

| Inventories | 15 |

| 269 | | 460 |

| Trade and other receivables | 16 |

| 632 | | 557 |

| Current tax receivable |

|

| - | | 46 |

| Cash and cash equivalents |

|

| 359 | | 1,199 |

| |

|

| 1,260 | | 2,262 |

| Total assets |

|

| 1,323 | | 2,420 |

|

|

|

|

| | |

| Liabilities |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

| Trade and other payables | 17 |

| 603 | | 564 |

| Borrowings | 18 |

| 20 | | 20 |

| |

|

| 623 | | 584 |

| |

|

|

| | |

| Net current assets |

|

| 637 |

| 1,678 |

|

|

|

|

|

| |

| Non-current liabilities |

|

|

|

|

|

| Borrowings | 18 | | - | | 23 |

| Provisions for other liabilities and charges | 19 |

| 31 | | 20 |

| |

|

| 31 | | 43 |

| |

|

|

| | |

| Total liabilities |

|

| 654 |

| 627 |

| |

|

|

| | |

| Net assets |

|

| 669 | | 1,793 |

| |

|

|

| | |

| Equity |

|

|

| | |

| Called up share capital | 21 |

| 4,197 | | 3.815 |

| Share premium reserve | 27 |

| 7,939 | | 7,743 |

| Accumulated losses | |

| (11,467) | | (9,765) |

| Total equity | |

| 669 | | 1,793 |

Simon Douglas Adrian Kinkaid

Director Director

Statement of Changes in Equity

For the year ended 31 March 2025

|

| | Notes | Called up share capital £'000 | Share premium reserve £'000 | Accumulated losses £'000 | Total equity £'000 |

| At 1 April 2023 | | 1,040 | 7,647 | (7,564) | 1,123 |

| Loss and total comprehensive expense for the year | |

- |

- |

(2,226) |

(2,226) |

| Issue of share capital | 21 | 2,775 | 96 | - | 2,871 |

| Share options - value of employee services | |

- |

- |

25 |

25 |

| Total transactions with owners, recognised directly in equity | |

2,775 |

96 |

25 |

2,896 |

| At 31 March 2024 | 21 | 3,815 | 7,743 | (9,765) | 1,793 |

| | | | | | |

| At 1 April 2024 |

| 3,815 | 7,743 | (9,765) | 1,793 |

| Loss and total comprehensive expense for the year |

|

- |

- |

(1,713) |

(1,713) |

| Issue of share capital | 21 | 358 | 196 | - | 554 |

| Share options - value of employee services Share based payment expense |

|

- 24 |

- - |

(10) 21 |

(10) 45

|

| Total transactions with owners, recognised directly in equity |

|

382 |

196 |

11 |

589 |

| At 31 March 2025 | 21 | 4,197 | 7,939 | (11,467) | 669 |

Statement of Cash Flows

For the year ended 31 March 2025

|

| | Notes | 2025 £'000 | 2024 £'000 |

| Cash flows from operating activities |

|

| |

| Loss for the year |

| (1,713) | (2,226) |

| Adjustments for: |

|

| |

| Share based payment expense |

| 35 | 86 |

| Depreciation |

| 105 | 220 |

| Finance income |

| (5) | (3) |

| Finance costs |

| 3 | 5 |

| Income tax credit |

| (64) | (63) |

| Decrease/(Increase) in inventories |

| 191 | 79 |

| Decrease/(Increase) in trade and other receivables |

| (75) | 133 |

| Increase/(Decrease) in trade and other payables |

| 49 | (280) |

| Cash used in operations |

| (1,474) | (2,049) |

| Income tax received |

| 110 | 280 |

| Net cash used in operating activities |

| (1,364) | (1,769) |

|

|

|

| |

| Cash flows from investing activities |

|

| |

| Purchase of property, plant and equipment | 13 | (10) | (2) |

| Finance income - interest received | 8 | 5 | 3 |

| Net cash used in investing activities |

| (5) | 1 |

|

|

|

| |

| Cash flows from financing activities |

|

| |

| Proceeds from new issue of share capital net of transaction costs |

| 555 | 2,808 |

| Repayment of borrowings | 18 | (23) | (33) |

| Finance costs - interest paid | 8 | (3) | (5) |

| Net cash generated/(used in) from financing activities |

| 529 | 2,770 |

|

|

|

| |

| Net (decrease)/increase in cash and cash equivalents |

| (840) | 1,002 |

|

Cash and cash equivalents at the beginning of the year |

|

1,199 |

195 |

| Effects of exchange rate changes on cash and cash equivalents | | - | 2 |

|

Cash and cash equivalents at the end of the year |

|

359 |

1,199 |

Notes to the Financial Statements

For the year ended 31 March 2025

1 General information

Fusion Antibodies plc is a company incorporated and domiciled in the United Kingdom and is registered in Northern Ireland having its registered office and principal place of business at 1 Springbank Road, Springbank Industrial Estate, Dunmurry, Belfast, BT17 0QL

The principal activity of the Company is the research, development and manufacture of recombinant proteins and antibodies, particularly in the areas of cancer and infectious diseases.

2 Significant accounting policies

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all years presented unless otherwise stated.

Basis of preparation

The financial statements have been prepared on the historical cost convention.

The financial statements are prepared in sterling, which is the functional currency of the Company. Monetary amounts in these financial statements are rounded to the nearest £1,000.

The financial statements of Fusion Antibodies plc have been prepared in accordance with UK-adopted International Accounting Standards and with the requirements of the Companies Act 2006 as applicable to companies reporting under those standards.

The preparation of financial statements in conformity with International Financial Reporting Standards ("IFRS") requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Company's accounting policies. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements are disclosed in note 3.

Going concern

The Company has returned a loss of £1.7m for the year ended 31 March 2025 (Year ended 31 March 2024: Loss of £2.2m) and at the year-end had net current assets of £0.6m (31 March 2024: £1.7m) including £0.4m of cash and cash equivalents (31 March 2024: £1.2m). During the financial year the Company has raised net proceeds of approximately £0.6m from the issue of new Ordinary Shares. The Company continues to expend cash in a planned manner to both grow the trading aspects of the business and to develop new services through research and development projects. Revenues for the financial year were approximately £1.97m, in line with market expectations and 73% higher than revenues for the prior financial year. Uncertainty in levels of investment in the sector has diminished but persists. The impact of this has been somewhat reduced through the Company's targeting of wider market sectors.

The financial statements have been prepared on the going concern basis, which assumes that the Company will continue to be able to meet its liabilities as they fall due for at least twelve months from the date of signing these financial statements. The directors have at the time of approving the financial statements, a reasonable expectation that the Company has adequate resources to continue in operational existence at least for 12 months from the date of approval of the financial statements. Thus, they continue to adopt the going concern basis of accounting in preparing the financial statements. To support the going concern basis of preparation, cash flow forecasts have been prepared which incorporate a number of assumptions upon which sensitivities have been performed to reflect severe but plausible downside scenarios. These assumptions include the rate at which revenue growth can be achieved.

The directors note that there is inherent uncertainty in any cash flow forecast, however this is further exacerbated given the nature of the company's trade and the industry in which it operates. Due to the risk that revenues and the related conversion of revenue to cash inflows may not be achieved as forecast over the going concern period, the Directors believe that there exists a material uncertainty that may cast significant doubt on the Company's ability to continue as a going concern and it may be unable to realise its assets and discharge its liabilities in the normal course of business.

The financial statements do not include the adjustments that would result if the Company were unable to continue as a going concern.

Revenue recognition

Revenue comprises the fair value of consideration received or receivable for the provision of services in the ordinary course of the Company's activities. Revenue is shown net of value added tax and where a contractual right to receive payment exists.

The Company's performance obligations are deemed to be the provision of specific services or materials to the customer. Performance obligations are identified on the basis of distinct activities or stages within a given contract that the customer can benefit from, independent of other stages in the contract. The transaction price is allocated to the various performance obligations, based on the relative fair value of those obligations.

Revenue is recognised over time where performance obligations are satisfied progressively, using the output method to measure progress towards completion. Revenue is recognised based on outputs of performance obligations. Where a contract includes a payment contingent upon the customer subsequently achieving a pre-defined milestone with their development programme, revenue in the amount of the total success payment due is recognised when the pre-defined condition(s) have been met. Progress is monitored regularly, and revenue is recognized in proportion to the work completed as of the reporting date. Any expected losses on projects are recognised immediately when identified.

Contract assets arise on contracts with customers for which performance obligations have been satisfied (or partially satisfied on an over time basis) but for which the related amounts have not yet been invoiced or received.

Contract liabilities arise in respect of amounts invoiced during the year for which the relevant performance obligations have not been met by the year-end. The Company's contracts with customers are typically less than one year in duration and any contract liabilities would be expected to be recognised as revenue in the following year.

Grant income

Revenue grants received by the Company are recognised in a manner consistent with the grant conditions. Once conditions have been met, grant income is recognised in the Statement of Comprehensive Income as other operating income.

Research and development

Research expenditure is written off as incurred. Development expenditure is recognised in the Statement of Comprehensive Income as an expense until it can be demonstrated that the following conditions for capitalisation apply:

· it is technically feasible to complete the scientific product so that it will be available for use;

· management intends to complete the product and use or sell it;

· there is an ability to use or sell the product;

· it can be demonstrated how the product will generate probable future economic benefits;

· adequate technical, financial and other resources to complete the development and to use or sell the product are available; and

· the expenditure attributable to the product during its development can be reliably measured.

Intangible assets

Software

Software developed for use in the business is initially recognised at historical costs, net of amortisation and provision for impairment. Subsequent development costs are included in the asset's carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost of the item can be measured reliably.

Software is amortised over its expected useful economic life, which is currently estimated to be 4 years. Amortisation expense is included within administrative expenses in the Statement of Comprehensive Income.

Property, plant and equipment

Property, plant and equipment are initially recognised at historical cost, net of depreciation and any impairment losses.

Subsequent costs are included in the asset's carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost of the item can be measured reliably. The carrying amount of the replaced part is de-recognised. All other repairs and maintenance are charged to the statement of comprehensive income during the financial year in which they are incurred.

Subsequently, property plant and equipment are measured at cost or valuation net of depreciation and any impairment losses.

Costs associated with maintaining computer software programmes are recognised as an expense as incurred. Software acquired with hardware is considered to be integral to the operation of that hardware and is capitalised with that equipment. Software acquired separately from hardware is recognised as an intangible asset and amortised over its estimated useful life.

Depreciation is provided on all property, plant and equipment at rates calculated to write off the cost less estimated residual value of each asset on a straight line basis over its expected economic useful life as follows:

Right of use assets The remaining length of the lease

Leasehold improvements The lesser of the asset life or the remainder of the lease

Plant and machinery 4 years

Fixtures, fittings & equipment 4 years

Leases

Leases in which a significant portion of the risks and rewards of ownership remain with the lessor are deemed to give the Company the right-of-use and accordingly are recognised as property, plant and equipment in the statement of financial position. Depreciation is calculated on the same basis as a similar asset purchased outright and is charged to profit or loss over the term of the lease. A corresponding liability is recognised as borrowings in the statement of financial position and lease payments deducted from the liability. The difference between remaining lease payments and the liability is treated as a finance cost and taken to profit or loss in the appropriate accounting period.

Impairment of non-financial assets

For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are largely independent cash inflows (cash-generating units). As a result, some assets are tested individually for impairment and some are tested at cash-generating unit level.

All individual assets or cash-generating units are tested whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

An impairment loss is recognised for the amount by which the asset's or cash-generating unit's amount exceeds its recoverable amount. The recoverable amount is the higher of fair value, reflecting market conditions less costs to sell, and value in use. Value in use is based on estimated future cash flows from each cash-generating unit or individual asset, discounted at a suitable rate in order to calculate the present value of those cash flows. The data used for impairment testing procedures is directly linked to the Company's latest approved budgets, adjusted as necessary to exclude any restructuring to which the Company is not yet committed. Discount rates are determined individually for each cash-generating unit or individual asset and reflect their respective risk profiles as assessed by the directors. Impairment losses for cash-generating units are charged pro rata to the assets in the cash-generating unit. Cash generating units and individual assets are subsequently reassessed for indications that an impairment loss previously recognised may no longer exist. Impairment charges are included in administrative expenses in the Statement of Comprehensive Income. An impairment charge that has been recognised is reversed if the recoverable amount of the cash-generating unit or individual asset exceeds the carrying amount.

Current tax and deferred tax

The tax expense for the year comprises current and deferred tax. Tax is recognised in the statement of comprehensive income, except to the extent that it relates to items recognised directly in equity.

The current tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the reporting date in the UK, where the Company operates and generates taxable income.

Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation. It establishes provisions where appropriate on the basis of amounts expected to be paid to the tax authorities.

Deferred tax is recognised on temporary differences arising between the carrying amounts of assets and liabilities and their tax bases. Deferred tax is determined using tax rates (and laws) that have been enacted, or substantively enacted, by the reporting date and are expected to apply when the related deferred tax asset is realised or the deferred tax liability is settled.

Deferred tax assets are recognised only to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised.

Deferred tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities.

Share based employee compensation

The Company operates equity-settled share-based compensation plans for remuneration of its directors and employees.

All employee services received in exchange for the grant of any share-based compensation are measured at their fair values. The fair value is appraised at the grant date and excludes the impact of any non-market vesting conditions (e.g. profitability and remaining an employee of the Company over a specified time period).

Share based compensation is recognised as an expense in the Statement of Comprehensive Income with a corresponding credit to equity. If vesting periods or other vesting conditions apply, the expense is allocated over the vesting period, based on the best available estimate of the number of share options expected to vest.

Non-market vesting conditions are included in assumptions about the number of options that are expected to become exercisable. Estimates are subsequently revised if there is any indication that the number of share options expected to vest differs from previous estimates.

The proceeds received net of any directly attributable transaction costs are credited to share capital and share premium when the options are exercised.

Financial assets

Classification

The Company classifies its financial assets in the following measurement categories:

§ Those to be measured at amortised costs; and

§ Those to be measured subsequently at fair value (either through Other Comprehensive Income or through profit and loss).

The classification depends on the Company's business model for managing the financial assets and the contractual terms of the cash flows. The Company reclassifies its financial assets when and only when its business model for managing those assets changes.

Recognition and measurement

At initial recognition, the Company measures a financial asset at its fair value plus transaction costs that are directly attributable to the acquisition of the financial asset.

Subsequent measurement of financial assets depends on the Company's business model for managing those financial assets and the cash flow characteristics of those financial assets. The Company only has financial assets classified at amortised cost. Cash and cash equivalents represent monies held in bank current accounts and bank deposits. These assets are those held for contractual collection of cash flows, where those cash flows represent solely payments of principal and interest and are held at amortised cost. Any gains or losses arising on derecognition is recognised directly in profit or loss. Impairment losses are presented as a separate line in the profit and loss account.

Impairment

The Company assesses on a forward-looking basis, the expected credit losses associated with its debt instruments carried at amortised cost. For trade receivables the Company applies the simplified approach permitted by IFRS 9, which requires expected lifetime losses to be recognised from the initial recognition of the receivables. For other receivables the Company applies the three stage model to determine expected credit losses.

Inventories

Inventories comprise consumables. Consumables inventory is stated at the lower of cost and net realisable value. Cost is determined using the first-in, first-out (FIFO) method. Cost represents the amounts payable on the acquisition of materials. Net realisable value represents the estimated selling price less all estimated costs of completion and costs to be incurred in selling and distribution.

Financial liabilities

Financial liabilities comprise Trade and other payables and borrowings due within one year and after one year, which are recognised initially at fair value and subsequently carried at amortised cost using the effective interest method. The Company does not use derivative financial instruments or hedge account for any transactions. Trade payables represent obligations to pay for goods or services that have been acquired in the ordinary course of business from suppliers. Trade payables are classified as current liabilities if payment is due within one year. If not, they are presented as non-current liabilities.

Provisions

A provision is recognised in the Statement of Financial Position when the Company has a present legal or constructive obligation as a result of a past event, that can be reliably measured and it is probable that an outflow of economic benefits will be required to settle the obligation. Provisions are determined by discounting the expected future cash flows at a pre-tax rate that reflects risks specific to the liability. The increase in the provision due to the passage of time is recognised as a finance cost. Provisions for dilapidation charges that will crystallise at the end of the period of occupancy are provided for in full.

Employee benefits - Defined contribution plan

The Company operates a defined contribution pension scheme which is open to all employees and directors. The assets of the schemes are held by investment managers separately from those of the Company. The contributions payable to these schemes are recorded in the Statement of Comprehensive Income in the accounting year to which they relate.

Foreign currency translation

The Company's functional currency is the pound sterling. Transactions in foreign currencies are translated at the exchange rate ruling at the date of transaction. Monetary assets and liabilities in foreign currencies are translated at the rates of exchange ruling at the reporting date. Exchange differences arising on the settlement or on translating monetary items at rates different from those at which they were initially recorded are recognised in administrative expenses in the Statement of Comprehensive Income in the year in which they arise.

Equity

Equity comprises the following:

Called up share capital

Share capital represents the nominal value of equity shares.

Share premium

Share premium represents the excess over nominal value of the fair value of consideration received of equity shares, net of expenses of the share issue.

Accumulated losses

Accumulated losses represent retained profits and losses.

Adoption of new and revised standards and changes in accounting policies

In the current year the following new and revised Standards and Interpretations have been adopted by the company. The adoption has had no impact on the current period however may have an effect on future periods.

| IAS 1 (Amendment) | Classification of liabilities as current or non-current - deferral of effective date | 1 January 2024 |

| IAS 1 (Amendment) | Non-current liabilities with covenants | 1 January 2024 |

| IFRS 16 (Amendment) | Liability in a Sale and Leaseback | 1 January 2024 |

| IAS 7 and IFRS 7 (Amendments) | Statement of Cashflows and Supplier finance agreements | 1 January 2024 |

| IFRS S1 | General requirements for disclosure of sustainability-related financial information | 1 January 2024 |

| IFRS S2 | Climate-related disclosures | 1 January 2024 |

| | | |

| | | |

| | | |

Standards which are in issue but not yet effective

At the date of authorisation of these financial statements, the Company has not applied the following new and revised IFRS Standards that have been in issue but are not yet effective. The Directors do not expect that the adoption of the other Standards listed below will have a material impact on the financial statements of the Company aside from additional disclosures:

| IAS 21 (Amendments) | Lack of Exchangeability | 1 January 2025 |

| IFRS 9 and IFRS 7 (Amendments) | Classification and Measurement of Financial Instruments | 1 January 2026 |

| IFRS 18 | New standard on presentation and disclosure of the statement of profit or loss | 1 January 2027 |

| | | |

3 Critical accounting estimates and judgements

Many of the amounts included in the financial statements involve the use of judgement and/or estimates. These judgements and estimates are based on management's best knowledge of the relevant facts and circumstances, having regard to prior experience, but actual results may differ from the amounts included in the financial statements. Information about such judgements and estimation is contained in the accounting policy and/or the notes to the financial statements and the key areas are summarised below:

Critical judgements in applying accounting policies

· Revenue recognition. The Company typically enters into a contract comprising one or more stages for each customer project. In the application of IFRS 15 "Revenue from Contracts with Customers" and the accounting policy set out in Note 2 to these financial statements, significant judgement is required to identify the individual performance obligations contained within each contract, particularly when a set-up charge is made relating to the initial collaboration with the customer to formulate a programme of development work, or when the pattern of sales invoices does not align with those stages explicit in the contract.

Customer contracts may contain a non-refundable set up charge of up to 30% of contract value which becomes payable upon commencement of the project. This represents the value of the transfer of knowledge involved in design, planning and preparation for the work to be done, and for the time and consumables committed to commence work on the project. As this work is distinct and of benefit to the customer independent of later stages within the contract, it is therefore judged to be a separate performance obligation within the meaning of IFRS 15 and is recognised as revenue in line with the accounting policy. The remaining performance obligations are based on the stages with defined deliverables which are explicitly outlined in the customer contracts.

During the process of delivering the contract, where delivery is part way through a stage at the reporting date, an estimate is made of the amount of revenue to recognise for that stage to reflect the work performed up to that date. This amount is estimated on a percentage completion basis.

Critical accounting estimates and assumptions

IAS 12 requires that a deferred tax asset relating to unused tax losses is carried forward to the extent that future taxable profits will be available. The company is in an investment phase, expecting to have increased expenditure on R&D and business development over the next two years which will increase the tax losses. After the investment period the Board expects the Company to generate healthy profits but it is difficult at this stage to reliably estimate the period over which profits may arise in the future. The Board has therefore determined to not recognise the asset at the reporting date. This approach does not affect the future availability of the tax losses for offset against future profits.

Share Options. The Company offers share options to employees in recognition of their service. These share options are valued using the Black Scholes model and accounted for under IFRS 2. Key estimates and judgements in the valuation model are the probability of exercise, as well as the volatility of the share price. For valuation, the Company has assumed that all outstanding options will vest and become exercisable. The Company has estimated volatility of the share price to be 24% which is based on historical movement in the Company's share price.

Dilapidations. The company leases space under an operating lease. A condition of the lease is to maintain the rented space and return the space in a suitable condition at the end of the lease period. The company maintain a dilapidation provision to account for any wear and tear during the lease period and to return the property to its original condition. At the time of leasing, the Company estimated future cost not to exceed £20k. This amount is reviewed annually. An £11k upward adjustment was considered necessary for the year ended 31 March 2025.

4 Revenue

All of the activities of the Company fall within one business segment, that of research, development and manufacture of recombinant proteins and antibodies.

|

Geographic analysis | 2025 £'000 | 2024 £'000 |

| UK | 569 | 195 |

| Rest of Europe | 101 | 95 |

| North America and Rest of World | 1,295 | 846 |

| | 1,965 | 1,136 |

In the year there were two customers (2024: two) to whom sales exceeded 10% of revenues, those customers together accounted for £909k or 47% of revenues (2024: £485k or 43% of revenues).

At the end of the year the Company held accrued and deferred income balances relating to revenue contracts of £178k and £38k respectively (2024: £77k and £101k).

5 Operating loss is stated after charging/(crediting):

| | 2025 £'000 | 2024 £'000 |

| Employee benefit costs |

| |

| -wages and salaries | 1,032 | 1,191 |

| -social security costs | 108 | 122 |

| -other pension costs | 44 | 61 |

| -share based payments | 35 | 86 |

| | 1,219 | 1,460 |

| |

| |

| Depreciation of property, plant and equipment (owned) | 102 | 217 |

| Depreciation of property, plant and equipment (leased) | 3 | 2 |

| |

| |

| Other operating expenses |

| |

| Rates, utilities and property maintenance | 180 | 155 |

| IT costs | 62 | 52 |

| |

| |

| Fees payable to the Company's auditors |

| |

| - for the audit of the financial statements | 47 | 45 |

| Raw materials and consumables used | 617 | 296 |

| Decrease/(increase) in inventories | 191 | 81 |

| Patent costs | 51 | 31 |

| Marketing costs | 149 | 123 |

| Loss/(gain) on foreign exchange | 53 | 15 |

| Other expenses | 1,070 | 951 |

| |

| |

| Total cost of sales and administrative expenses | 3,744 | 3,429 |

Included in the costs above is expenditure on research and development totalling £191k (2024: £254k). Accountancy fees of £155k (2024: £173k) were paid in the year and are included in other expenses above, none of which were paid to the Company's auditor Kreston Reeves LLP.

6 Average staff numbers

| | 2025 | 2024 |

| | Monthly Avg Number | Monthly Avg Number |

| Employed in UK (including executive directors) | 21 | 27 |

| Non-executive directors | 3 | 4 |

| | 24 | 31 |

7 Remuneration of directors and key senior management

Directors

| | 2025 £'000 | 2024 £'000 |

| Emoluments | 394 | 349 |

| Pension contributions | 20 | 18 |

| | 414 | 367 |

Highest paid director

The highest paid director received the following emoluments:

| | 2025 £'000 | 2024 £'000 |

| Emoluments | 207 | 169 |

| Pension contributions | 12 | 10 |

| | 219 | 179 |

The highest paid director did not exercise any share options in the year (2024: £nil). Retirement benefit contributions are being accrued for two directors (2024: three directors) in accordance with the terms of their service contracts. These contributions are made to defined contribution pension schemes and are recognised as an expense in the period in which they are incurred.

Key senior management personnel

Key senior management is considered to comprise the directors of the Company with total remuneration for the year of £414k (2024: £367k). Share-based payments of £35k were attributable to key senior management in the year. (2024: £24k).

8 Finance income and expense

|

Income | 2025 £'000 | 2024 £'000 |

| Bank interest receivable | 5 | 3 |

|

Expense | 2025 £'000 | 2024 £'000 |

| Interest expense on other borrowings | 3 | 5 |

9 Share based payments

At the reporting date the Company had three share-based reward schemes: two schemes under which options were previously granted and are now closed to future grants and a third scheme in place in which grants were made in the current year:

· A United Kingdom tax authority approved scheme for executive directors and senior staff;

· An unapproved scheme for awards to those, such as non-executive directors, not qualifying for the approved scheme; and

· A United Kingdom tax authority approved scheme for executive directors and senior staff which incorporates unapproved options for grants to be made following listing of the Company shares, "2017 EMI and Unapproved Employee Share Option Scheme".

Options awarded during the year under the 2017 EMI and Unapproved Employee Share Option Scheme have no performance conditions other than the continued employment within the Company. Options vest one, two and three years from the date of grant, which may accelerate for a change of control. Options lapse if not exercised within ten years of grant, or if the individual leaves the Company, except under certain circumstances such as leaving by reason of redundancy.

The total share-based remuneration recognised in the Statement of Comprehensive Income was £35k (2024: £24k). The most recent options granted in the year were valued using the Black-Scholes method. The share price on grant used the share price of open market value, expected volatility of 24.0% and a compound risk free rate assumed of 3.97% based on historical experience.

| | 2025 Weighted average exercise price £ |

2025 Number | 2024 Weighted average exercise price £ |

2024 Number |

| Outstanding at beginning of the year | 0.047 | 3,799,450 | 0.481 | 2,317,883 |

| Granted during the year | - | - | 0.043 | 3,760,700 |

| Exercised during the year | - | - | - | - |

| Lapsed during the year | - | - | 0.466 | (1,548,433) |

| Surrendered during the year | 0.0423 | (435,000) | 0.515 | (730,700) |

| Outstanding at the end of the year | 0.0425 | 3,364,450 | 0.047 | 3,799,450 |

The options outstanding at the end of each year were as follows:

| Expiry | Nominal share value | Exercise price £ | 2025 Number | 2024 Number |

| May 2027 | £0.04 | 0.040 | 3,750 | 3,750 |

| December 2028 | £0.04 | 0.545 | - | - |

| September 2032 | £0.04 | 0.520 | - | - |

| September 2032 | £0.04 | 0.475 | - | 35,000 |

| February 2034 | £0.04 | 0.0425 | 3,360,700 | 3,760,700 |

| Total |

|

| 3,364,450 | 3,799,450 |

Of the total number of shares outstanding, 3,750 were exercisable at the reporting date at a weighted average price of £0.04p/share (2024: 3,750 at a weighted average price of £0.04p/share)

10 Income tax (credit)

| | 2025 £'000 | 2024 £'000 |

| Current tax - UK corporation tax | (64) | (63) |

| Income tax credit | (64) | (63) |

The difference between loss before tax multiplied by the standard rate of 25% (2024: 25%) and the income tax credit is explained in the reconciliation below:

| | 2025 £'000 | 2024 £'000 |

| Factors affecting the tax credit for the year Loss before tax |

(1,777) |

(2,289) |

| |

| |

| Loss before tax multiplied by standard rate of UK corporation tax of 25% (2024: 25%) |

(444) |

(572) |

| Deferred tax not recognised on current year losses | 444 | 572 |

| RDEC/R&D tax credit | - | (46) |

| RDEC/R&D tax credit - adjustment relating to prior year | (64) | (17) |

| Total income tax credit | (64) | (63) |

Impact of future tax changes are not expected to materially impact the position of the Company, and no corporate tax liability is expected in the subsequent period.

11 Loss per share

| | 2025 £'000 | 2024 £'000 |

| Loss for the financial year | (1,713) | (2,226) |

| |

| |

| Loss per share | pence | pence |

| Basic | (1.8) | (3.9) |

| | Number | Number |

| Issued ordinary shares at the end of the year | 104,902,120 | 95,365,564 |

| Weighted average number of shares in issue during the year | 95,879,480 | 55,556,020 |

Basic earnings per share is calculated by dividing the basic earnings for the year by the weighted average number of shares in issue during the year. Diluted earnings per share is calculated by dividing the basic earnings for the year by the diluted weighted average number of shares in issue inclusive of share options outstanding at year end. As the Company is loss making for current and prior year, diluted earnings per share is not presented.

12 Intangible assets

| |

|

|

| 2024/2025 Software £'000 | 2023/2024 Software £'000 |

| Cost |

|

|

|

| |

| At 1 April |

|

|

| 8 | 8 |

| At 31 March |

|

|

| 8 | 8 |

| |

|

|

|

| |

| Accumulated amortisation |

|

|

|

| |

| At 1 April |

|

|

| 8 | 8 |

| Amortisation charged in the year |

|

|

| - | - |

| At 31 March |

|

|

| 8 | 8 |

| |

|

|

|

| |

| Net book value |

|

|

|

| |

| At 31 March |

|

|

| - | - |

| At 31 March | | | | - | - |

Amortisation is included in administrative expenses on the statement of comprehensive income.

13 Property, plant and equipment

| |

Right of use assets £'000 |

Leasehold improvements £'000 |

Plant & machinery £'000 | Fixtures, fittings & equipment £'000 |

Total £'000 |

| Cost |

|

|

|

|

|

| At 1 April 2024 | 14 | 844 | 2,398 | 277 | 3,533 |

| Additions | - | - | - | 10 | 10 |

| Disposals | - | - | (5) | - | (5) |

| At 31 March 2025 | 14 | 844 | 2,393 | 287 | 3,538 |

| |

|

|

|

|

|

| Accumulated depreciation |

|

|

|

|

|

| At 1 April 2024 | 11 | 844 | 2,271 | 249 | 3,375 |

| Depreciation charged in the year |

3 |

- |

81 |

21 |

105 |

| Disposals | - | - | (5) | - | (5) |

| At 31 March 2025 | 14 | 844 | 2,347 | 270 | 3,475 |

| |

|

|

|

|

|

| Net book value |

|

|

|

|

|

| At 31 March 2025 | - | - | 46 | 17 | 63 |

| At 31 March 2024 | 3 | - | 127 | 28 | 158 |

| |

Right of use assets £'000 |

Leasehold improvements £'000 |

Plant & machinery £'000 | Fixtures, fittings & equipment £'000 |

Total £'000 |

| Cost |

|

|

|

|

|

| At 1 April 2023 | 14 | 844 | 2,396 | 277 | 3,531 |

| Additions | - | - | 2 | - | 2 |

| Disposals | - | - | - | - | - |

| At 31 March 2024 | 14 | 844 | 2,398 | 277 | 3,533 |

| |

|

|

|

|

|

| Accumulated depreciation |

|

|

|

|

|

| At 1 April 2023 | 9 | 812 | 2,112 | 223 | 3,156 |

| Depreciation charged in the year |

2 |

32 |

159 |

26 |

219 |

| Disposals | - | - | - | - | - |

| At 31 March 2024 | 11 | 844 | 2,271 | 249 | 3,375 |

| |

|

|

|

|

|

| Net book value |

|

|

|

|

|

| At 31 March 2024 | 3 | - | 127 | 28 | 158 |

| At 31 March 2023 | 5 | 32 | 284 | 54 | 375 |

Plant & machinery with a net book value of £32k is held under hire purchase agreements or finance leases (2024: £49k).

The carrying value of right of use assets at the reporting date comprises fixtures, fittings and equipment of nil (2024: £3k).

The depreciation expense is included in administrative expenses in the statement of comprehensive income in each of the financial years shown.

14 Investment in subsidiary

The Company had the following investment in a subsidiary:

|

| 2025 £ | 2024 £ |

| Fusion Contract Services Limited | - | 1 |

| 100% subsidiary | | |

| Dormant company | | |

| 1 Springbank Road, Belfast, BT17 0QL | | |

The Company's wholly owned dormant subsidiary, Fusion Contract Services Limited, was formally dissolved on 8th October 2024. The investment in the subsidiary, which was held at cost of £1, has been derecognised.

Given the subsidiary was dormant and had no assets or liabilities at the date of strike-off, no gain or loss has been recognised in the profit and loss account.

15 Inventories

| | 2025 £'000 | 2024 £'000 |

| Raw materials and consumables | 269 | 460 |

The cost of inventories recognised as an expense for the year was £619k (2024: £400k).

16 Trade and other receivables

| | 2025 £'000 | 2024 £'000 |

| Trade receivables | 420 | 584 |