4 September 2025

BROOKS MACDONALD GROUP PLC

2025 Full-year results

Brooks Macdonald Group plc ("Brooks Macdonald" or the "Group") today announces full-year results for the financial year ended 30 June 2025.

Andrea Montague, CEO of Brooks Macdonald, commented:

"This year we have focused on the execution of our strategy to Reignite Growth.

We are now a UK-focused wealth manager. We have created a scalable financial planning business. We have launched a suite of Retirement Strategies that meet a growing client need and continue to deliver strong investment performance.

We are building momentum and creating the conditions for success. I am confident in the outlook for the current financial year and beyond."

Financial highlights1

· Total funds under management and advice ("FUMA") increased by 17.3% to £19.2 billion (30 June 2024: £16.4 billion). Of this, funds under management ("FUM") was £16.6 billion and advised only assets were £2.6 billion.

· Full-year net outflows of £0.4 billion, with a marked improvement in the second half of the financial year (H2 2025 net outflows £0.1 billion, H1 2025 net outflows £0.3 billion).

· Revenue increased 4.6% to £111.6 million, supported by higher financial planning income following the acquisitions, partly offset by lower interest income and lower fee income.

· Underlying costs, excluding acquisitions, remained flat compared with the prior year, reflecting strict cost discipline. Total underlying costs, including acquisitions and net finance income, increased by 8.2% to £82.7 million.

· Underlying profit before tax ("PBT") reduced by 4.6% to £28.9 million, representing a margin of 25.9%.

· Statutory PBT reduced to £17.5 million (2024: profit of £24.6 million) largely due to higher acquisition and integration costs, and profit after tax from discontinued operations was £9.4 million (2024: loss of £13.9 million). Total comprehensive income for the year was £21.0 million (2024: £6.5 million).

· Proposed final dividend of 51.0 pence per share, resulting in a full-year dividend of 81.0 pence per share, an increase of 3.8% vs prior year and the 20th consecutive year of dividend growth.

· Completed £8.1 million share buyback, acquiring and cancelling 538,000 shares to date.

Strategic highlights

· Our strategy to 'Reignite Growth' is delivering.

· Sold Brooks Macdonald International ("BMI") and re-shaped the Group to be a UK-focused wealth manager.

· Completed three financial planning acquisitions and successfully launched Brooks Financial.

· New experienced leadership, executing at pace.

· Significant increase in client engagement over the year, and improved brand awareness.

· Strong investment performance, with all five risk profiles across our BPS offering exceeding their respective ARC peer group comparator over one-, three-, five- and 10-year horizons.

· Expanded product offering with the launch of Global MPS and new suite of Retirement Strategies, including a solution available on third-party platforms.

· Moved from AIM to the Main market of the London Stock Exchange ("LSE").

· Defaqto Gold award for Discretionary Fund Management Service for fourth consecutive year.

Key financials

| £ millions unless stated otherwise | 2025 | 20241 | Change |

| Revenue | 111.6 | 106.7 | 4.6% |

| Underlying operating expenses2 3 | 82.7 | 76.4 | 8.2% |

| Underlying operating PBT3 | 28.9 | 30.3 | (4.6)% |

| Underlying operating profit margin3 | 25.9% | 28.4% | 2.5ppts |

| Statutory PBT | 17.5 | 24.6 | (28.9)% |

| Underlying diluted earnings per share3 | 130.4p | 150.9p | (13.6)% |

| Statutory diluted earnings per share | 71.4p | 124.5p | (42.7)% |

| Dividend per share | 81.0p | 78.0p | 3.8% |

Outlook

We remain focused on delivering our Reignite Growth strategy. This includes continued organic investment to expand our technology and AI enablement, enhancing client service and our efficiency, as well as evaluating M&A opportunities, that align with our strategy.

Regular client engagement remains the key priority. We will be evolving our product offering, to ensure we can continue to meet the needs of our clients, throughout their financial lifecycle.

We are creating the conditions for success and see exciting growth opportunities in front of us in the year ahead.

2025 full-year results presentation

A presentation to investors and financial analysts, including a recorded webcast will be published on our website shortly, and can be found on: https://www.brooksmacdonald.com/investor-relations/results-centre

A Q&A session with Andrea Montague, CEO, and Katherine Jones, CFO, will be held at 9.00am BST on 4 September 2025, via a live webcast, or by dialling in using the conference call details below. Registration for the webcast is required and can be accessed via a link: https://brrmedia.news/BrooksMacdonaldFYResults2025

Dial in numbers:

UK-wide: +44 (0) 33 0551 0200

UK toll free: +44 (0) 808 109 0700

Password (if prompted): Quote 'Brooks Macdonald - FY Results'

Investor enquiries

Brooks Macdonald

Andrea Montague, CEO

Katherine Jones, CFO

Eva Hatfield, Director of Investor Relations +44 (0) 7418 923 061

Email: eva.hatfield@brooksmacdonald.com

Media enquiries

Misha Bayliss +44 (0) 20 74275465

Oscar Burnett +44 (0) 20 74275435

Email: brooksmacdonald@teneo.com

About Brooks Macdonald

Brooks Macdonald Group plc is a leading UK-focused wealth manager.

Proudly serving IFAs and clients since 1991, Brooks Macdonald is independent, financially strong, and aims to deliver strong and consistent investment performance for clients to meet their financial objectives. Brooks Macdonald provides innovative investment solutions to support IFAs and their clients throughout their entire lives as needs and circumstances change. The company is recognised as an innovator in the industry having been one of the first to develop and launch key products such as Managed Portfolio Service.

Realising Ambitions. Securing Futures. We are Brooks Macdonald.

Notes:

Numbers are subject to rounding.

1. The prior financial year has been restated to separate the results of discontinued operations, consistent with the presentation in the current financial year.

2. Includes net finance income of £2.5 million (2024: £2.4 million).

3. A reconciliation between the underlying measure and its closest IFRS equivalent can be found in the Financial Review section of this announcement.

Forward-looking statements

This announcement may include statements, beliefs or opinions that are, or may be deemed to be, "forward-looking statements". These forward-looking statements may be identified by the use of forward-looking terminology, including the terms "believes", "estimates", "plans", "projects", "anticipates", "targets", "aims", "continues", "expects", "intends", "hopes", "may", "will", "would", "could" or "should" or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals, future events or intentions. No representation or warranty is made that any of these statements or forecasts will come to pass or that any forecast results will be achieved. Forward-looking statements may and often do differ materially from actual results. Any forward-looking statements contained in the announcement speak only as of their respective dates, reflect Brooks Macdonald's current view with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to Brooks Macdonald's business, results of operations, financial position, liquidity, prospects, growth and strategies.

Except as required by any applicable law or regulation, Brooks Macdonald expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained in this announcement or any other forward-looking statements it may make whether as a result of new information, future developments or otherwise.

CEO's statement

The year in review

I am pleased to present these results covering a year of change in the markets, for our sector and for our Company. Regulatory and government policy changes brought additional uncertainty and served to underline the need for trusted financial advice and wealth management now more than ever from Brooks Macdonald.

We have reshaped the business and are now a UK-focused wealth manager, positioned to invest in the growth opportunities across our market.

Our clients

Responding to feedback from our clients, we launched two new products in three months - Global Managed Portfolio Service and our innovative Retirement Strategies offering bespoke, tailored and modelled options to bring clients clarity, choice and confidence in their retirement planning.

Our Retirement Strategies launch builds on our experience in this key area of retirement planning. With the growth in defined contribution pension schemes, managing drawdown is a growing challenge for many more people as they approach retirement. We are one of the first companies to offer modelled solutions for income drawdown. Initial interest has been strong.

Our Centralised Investment Proposition ("CIP"), a competitive differentiator for Brooks Macdonald, delivered another year of strong performance. Our BPS investment strategies have outperformed their relevant ARC peer group indices over one, three, five, and 10 years across all risk profiles. Our diversified positioning across regions, sectors and styles ensures portfolios remain well-placed to capture opportunities and navigate the evolving macroeconomic landscape.

Our company

The sale of our international business focused Brooks Macdonald on the UK. The acquisition of three financial planning businesses scaled our financial advice business with new lines of business in mortgages, life insurance, benefits, sport and charities. Our business is about building trusted relationships, and this means we are spending more time with our valued IFAs and direct financial planning clients across the country. We continue to invest in our operating platform to provide quality client service.

In March, Brooks Macdonald moved from AIM to the Main Market of the LSE, broadening investor access.

Our performance

We reported FUMA of £19.2 billion (2024: £16.4 billion), driven by acquisitions and positive market and investment performance. FUM was up 7.0% in the year, with investment performance of £0.7 billion more than offsetting the impact of net outflows.

BPS outflows significantly improved in the second half along with strong inflows across our Platform MPS offering, especially in the final quarter, which delivered the best quarterly flow performance in two years with net outflows of £5 million. Our overall net outflows were at £396 million, with a notable improvement in the second half (H2 25: £134 million, H1 25: £262 million).

Revenue increased by 4.6% to £111.6 million (2024: £106.7 million), supported by higher financial planning revenue from acquired businesses, partially offset by lower interest and fee income. The underlying cost excluding acquisitions were flat on the prior year, demonstrating the strict cost control. The underlying profit before tax reduced to £28.9 million (2024: £30.3 million) and the underlying profit margin was 25.9% (2024: 28.4%). Statutory profit before tax fell to £17.5 million (2024: £24.6 million), primarily due to the acquisitions related costs.

Our people

As a wealth manager offering trusted financial advice, our people make the difference. We engage with our colleagues throughout the year through townhalls, small conversations and by visiting our offices. Our recent employee engagement survey has given valuable insight into views on career progression, learning and development, and our culture.

New appointments to our Executive Committee brought talent, expertise, diversity and experience. Together as a team, we have moved at pace to bring our strategy to life.

Looking ahead

In conclusion, it has been a busy year as we have refocused the Group, added new capabilities and strengthened our leadership team with new hires. We are changing the way we work to deliver excellent customer service, to extend our client reach and, as we grow, secure efficiencies. There is more to be done, and I am confident we are creating the conditions for success.

This coming year, we will continue to invest in growth, in technology and AI enablement to take our client service and efficiency to the next level. We will evolve our products so that they stand out in growth markets and continue to be relevant across all stages of our clients' financial lifecycle.

I want to thank all Brooks Macdonald colleagues for their contributions to our results and in the execution of our strategy and, most importantly, our clients for their support. Change brings opportunities and I remain confident in our future to live our purpose, to realise the ambitions and to secure the futures of our clients.

Andrea Montague

CEO

Financial Review

"I am pleased to report my first set of full-year results for Brooks Macdonald, delivering revenue growth alongside continued cost discipline. Following the acquisition of the three financial planning businesses, we have made good progress on integration and are well positioned as a UK-focused wealth manager to leverage our enhanced advice expertise and focus on driving and delivering our strategy to reignite growth."

Basis of presentation

During the 2025 financial year, we completed the sale of BMI, as well as the investment management contract of the SVS Brooks Macdonald Defensive Capital Fund ("DCF") (subsequently renamed SVS RM Defensive Capital Fund). As a result, the BMI operations and the DCF activities have been classified as discontinued operations in the 2025 results, and the prior year comparative financial information included in this report, has been restated in accordance with IFRS 5 'Non-current assets held for sale and discontinued operations'.

In addition, we completed three acquisitions during 2025 CST Wealth Limited ("CST Wealth"), Lucas Fettes (Holdings) Limited, with its wholly owned subsidiary, Lucas Fettes and Partners (Financial Services) Limited (together "Lucas Fettes"), and LIFT-Financial Group Limited and LIFT-Invest Limited (together "LIFT") (together "the acquisitions"). The financial results from the acquired businesses have been consolidated into the 2025 financial statements from their acquisition date, and so include eight months for CST Wealth, seven months for Lucas Fettes and five months for LIFT. Refer to note 14 of the consolidated financial statements for further information. The financial information is presented on a continuing basis, unless stated otherwise.

Financial results summary

The table below shows our financial performance for the years ended 30 June 2025 and 2024.

| £ million (unless stated otherwise) | 2025 | 2024 restated1 |

| Total FUMA (£'billion) | 19.2 | 16.4 |

| Total FUM (£'billion) | 16.6 | 15.5 |

| Net flows (£'billion) | (0.4) | (0.4) |

| |

| |

| Fee income | 72.9 | 74.7 |

| Financial planning income | 17.1 | 8.2 |

| Transactional and FX income | 14.0 | 12.4 |

| Interest income | 7.6 | 11.4 |

| Total revenue | 111.6 | 106.7 |

| Fixed staff costs | (41.7) | (37.2) |

| Variable staff costs | (10.3) | (11.4) |

| Total staff costs | (52.0) | (48.6) |

| Non-staff costs | (33.2) | (30.2) |

| Total underlying costs | (85.2) | (78.8) |

| Net finance income | 2.5 | 2.4 |

| Underlying profit before tax | 28.9 | 30.3 |

| Underlying adjustments | (11.4) | (5.7) |

| Statutory profit before tax | 17.5 | 24.6 |

| Taxation | (5.9) | (4.2) |

| Statutory profit after tax | 11.6 | 20.4 |

| Result from discontinued operations | 9.4 | (13.9) |

| Total comprehensive income for the year | 21.0 | 6.5 |

1. The prior financial year has been restated to separate the results of discontinued operations, consistent with the presentation in the current financial year. Refer to note 13 for details of the results of discontinued operations. In addition, there has been an update to the results presented in the restated comparative period previously disclosed in the interim report and accounts for the six months ended 31 December 2024. Refer to the note 2 of the consolidated financial statements for further details.

Movements in FUMA, by service

| £ million (unless stated otherwise) | Opening assets 1 July 2024 restated1 | Gross inflows | Gross outflows | Net flows | Acquired | Market and investment performance | Closing assets 30 June 2025 | Net flows growth | FUM growth |

| BPS | 8,880 | 649 | (1,372) | (723) | - | 371 | 8,528 | (8.1)% | (4.0)% |

| MPS Custody | 974 | 48 | (157) | (109) | - | 41 | 906 | (11.2)% | (7.0)% |

| MPS Platform | 4,367 | 1,682 | (1,081) | 601 | 788 | 227 | 5,983 | 13.8% | 37.0% |

| Total MPS | 5,341 | 1,730 | (1,238) | 492 | 788 | 268 | 6,889 | 9.2% | 29.0% |

| Funds | 1,323 | 210 | (375) | (165) | - | 50 | 1,208 | (12.5)% | (8.7)% |

| Total FUM | 15,544 | 2,589 | (2,985) | (396) | 788 | 689 | 16,625 | (2.5)% | 7.0% |

| Advised only assets | 826 | | | | 1,751 | | 2,577 | | |

| Total FUMA | 16,370 | | | | 2,539 | | 19,202 | | 17.3% |

1. The prior financial year has been restated to separate the results of discontinued operations, consistent with the presentation in the current financial year.

Total FUMA increased 17.3% to £19.2 billion (30 June 2024: restated £16.4 billion), as a result of recent acquisitions contributing £2.5 billion, and positive market and investment performance. Closing FUMA comprises total FUM of £16.6 billion (30 June 2024 restated: £15.5 billion) and advised only assets of £2.6 billion (30 June 2024: £0.8 billion).

Growth in FUM was largely driven by acquisitions, as well as market and investment performance, which added £0.7 billion. Total net outflows of £0.4 billion were broadly in line with the prior year (2024 restated: outflows £0.4 billion), with a marked improvement in net flows in the second half of the financial year (H2 2025 net outflows £0.1 billion, H1 2025 net outflows £0.3 billion). This reflects the benefit of management actions taken over the year, including extensive IFA roadshows and targeted meetings with clients. As a result, in the final quarter, we reported the best quarterly net flow performance in two years (net outflows of £5 million).

Net outflows across our BPS offering totalled £723 million (2024: outflows £558 million), with significant improvement in H2, driven by lower Core BPS outflows and higher inflows in our Retirement Strategies offering. This reflects the greater IFA outreach over the year, and key client engagement to promote our retirement offering. Overall, BPS FUM closed down 4.0% at £8.5 billion (30 June 2024: £8.9 billion).

MPS Platform reported net inflows of £601 million (2024: £467 million) representing growth of 13.8%. Of this total, MPS Platform saw organic net flows of £575 million and transfers from the acquired businesses contributed £26 million. Acquisitions added £0.8 billion of FUM and market and investment performance added a further £0.2 billion, leading to overall FUM growth of 37.0% to £6.0 billion (30 June 2024: £4.4 billion).

Advised only assets increased to £2.6 billion (30 June 2024: £0.8 billion) benefitting from £1.8 billion of acquired assets in the second half of the year. Over time, in line with our strategy and subject to client suitability, a greater proportion of these advised only assets may become managed and advised.

The market and investment performance of £0.7 billion represents 4.4% of opening FUM. Overall, we recorded a robust performance when compared to MSCI and ARC Benchmarks over the course of the financial year.

Revenue

Total revenue increased by 4.6% to £111.6 million (2024: £106.7 million). This was principally driven by financial planning income growing to £17.1 million (2024: £8.2 million), of which financial planning income from recent acquisitions contributed £8.2 million, and transactional and FX income of £14.0 million (2024: £12.4 million), which benefitted from increased trading volume in the financial year. This was partially offset by lower interest income, down 33.3% to £7.6 million (2024: £11.4 million), and fee income, which decreased by 2.4% to £72.9 million (2024: £74.7 million). The reduction in interest income was largely due to lower average interest rates over the year, while the reduction in fee income principally reflects mix effects, with stronger growth across lower margin MPS Platform offerings compared to the higher margin BPS offering, which experienced outflows.

Revenue, average FUM and yields

| | Revenue | Average FUM | Yields | ||||||

| | 2025 £m | 20241 £m | Change % | 2025 £m | 20241 £m | Change % | 2025 bps | 20241 bps | Change bps |

| BPS fees | 51.4 | 54.4 | (5.6)% | 8,373 | 8,579 | (2.4)% | 61.4 | 63.5 | (2.1) |

| BPS transactional and FX income | 14.0 | 12.2 | 14.7% | | | | 16.7 | 14.2 | 2.5 |

| Total BPS | 65.4 | 66.6 | (1.8)% | 8,373 | 8,579 | (2.4)% | 78.1 | 77.7 | 0.4 |

| MPS Custody | 5.4 | 5.8 | (5.4)% | 929 | 972 | (4.5)% | 58.6 | 59.2 | (0.6) |

| MPS Platform | 9.0 | 7.1 | 26.7% | 5,058 | 3,892 | 30.0% | 17.7 | 18.2 | (0.5) |

| Total MPS | 14.4 | 12.9 | 11.8% | 5,987 | 4,864 | 23.1% | 24.0 | 26.4 | (2.4) |

| Funds | 6.5 | 6.8 | (3.7)% | 1,445 | 1,486 | (2.8)% | 44.9 | 45.4 | (0.5) |

| Total (excluding interest income) | 86.3 | 86.3 | 0.0% | 15,805 | 14,929 | 5.9% | 54.6 | 57.8 | (3.2) |

| Interest income - BPS | 6.8 | 10.2 | (33.0)% | | | | 8.2 | 11.9 | (3.7) |

| Interest income - MPS Custody | 0.8 | 1.2 | (34.6)% | | | | 8.2 | 11.9 | (3.7) |

| Total FUM-related revenue | 93.9 | 97.7 | (3.9)% | 15,805 | 14,929 | 5.9% | 59.4 | 65.4 | (6.0) |

| Financial planning | 17.1 | 8.2 | 108.8% | | | | 45.4 | 34.6 | 10.8 |

| Other income | 0.6 | 0.8 | (19.2)% | | | | | | |

| Total non-FUM-related revenue | 17.7 | 9.0 | 97.7% | | | | | | |

| Total revenue | 111.6 | 106.7 | 4.6% | | | | | | |

1. The prior financial year has been restated to separate the results of discontinued operations, consistent with the presentation in the current financial year.

During the year, the overall yield decreased by 6.0bps to 59.4bps (2024: 65.4bps). The yield on total BPS increased by 0.4bps to 78.1bps (2024: 77.7bps). This reflects higher transaction and FX income, offsetting the impact of lower fee and product mix. This was driven by the variation in fee rates on gross BPS outflows and rates achieved on new business within Core BPS and the product mix across the underlying BPS services, including the Gilts offering.

The yield on total MPS decreased by 2.4bps to 24.0bps (2024: 26.4bps), largely due to the increased proportion of FUM held within the lower-yielding MPS Platform compared to MPS Custody.

The yield on interest income, net of amounts paid to clients, decreased by 3.7bps to 8.2bps (2024: 11.9bps). The reduction reflects the fall in the Bank of England base rate over the year, combined with an increase in the proportion of interest income shared with clients.

Underlying costs

Excluding costs acquired with the Financial Planning businesses of £6.2 million (2024: nil), the underlying costs (including £2.5 million of finance income) were broadly flat at £76.5 million. This reflects inflationary and regulatory cost increases of 2.6% and investment in capability and capacity of 5.4% to support business growth, offset by 7.7% of cost savings due to management actions, including organisational restructuring, lower variable pay costs and more discipline around non-staff costs. Total underlying costs, including acquisitions and finance income, increased by 8.2% to £82.7 million (2024 restated: £76.4 million).

Underlying cost analysis (£m)

1. Includes net finance income of £2.5 million (2024: £2.4 million).

Excluding acquisitions, staff costs decreased by 3.3% to £47.0 million (2024 restated: £48.6 million), as a result of organisational restructuring and lower variable pay, which countered inflationary pressures and senior hires to support our 'Reignite Growth' strategy. Total staff costs increased by 7.0% to £52.0 million, primarily as a result of 171 employees joining the Group through the acquisitions made over the year, representing c.30% of the overall headcount at 30 June 2025.

Non-staff costs

Excluding acquisitions, non-staff costs increased by 5.6% to £31.9 million (2024 restated £30.2 million), driven by higher regulatory fees and levies, depreciation and amortisation charges from strategic investments, and property and distribution costs. The acquisitions added £1.3 million in non-staff costs, resulting in total non-staff costs of £33.2 million (2024: £30.2 million).

Profit before tax

Underlying profit before tax decreased by 4.6% to £28.9 million (2024 restated: £30.3 million), and the underlying profit margin was 25.9% (2024 restated: 28.4%).

On a statutory basis, the profit before tax was down 28.9% to £17.5 million (2024: £24.6 million), driven by non-recurring one-off items including acquisition and integration costs and organisational restructure costs.

The profit from discontinued operations, which is presented after tax, was £9.4 million (2024: loss of £13.9 million). This comprises the operating results generated by the DCF and BMI prior to their respective disposal dates (November 2024 and February 2025, respectively) and the gains on their disposal. Further information is provided in note 13 of the consolidated financial statements.

Reconciliation between underlying and statutory PBT

Underlying PBT is considered by the Board to be an appropriate reflection of the Group's performance when compared to the statutory results as this excludes income and expense categories, which are deemed to be of a non-recurring nature or non-operating items. The Non-IFRS financial information section includes a glossary of the Group's APMs and the criteria for how each are considered.

A reconciliation between underlying and statutory PBT for the year ended 30 June 2025, with comparative financial information is presented in the following table.

| £ million (unless stated otherwise) | 2025 | 2024 |

| Underlying profit before tax | 28.9 | 30.3 |

| Acquisition and integration related costs | (4.4) | (0.4) |

| Amortisation of acquired client relationships | (4.0) | (3.4) |

| Organisational restructure | (2.1) | (2.1) |

| Move to LSE Main Market costs | (1.9) | - |

| Head office relocation | (1.3) | - |

| Other non-operating items | 2.3 | 0.2 |

| Total underlying adjustments | (11.4) | (5.7) |

| Statutory profit before tax | 17.5 | 24.6 |

Acquisition and integration related costs (£4.4 million charge)

These represent costs incurred in relation to the Group's recent acquisitions, and include legal fees, fair value adjustments and finance costs in relation to the deferred contingent consideration. The prior financial year charge relates to the share-based payment for share options awarded to onboarded employees as part of the integration of a prior period acquisition. These costs are excluded from the underlying results in view of their one-off nature arising as part of an acquisition.

Amortisation of acquired client relationships (£4.0 million charge)

Intangible assets are recognised on the acquisition of new businesses and in the course of acquiring FUM and financial advice portfolios. These are amortised over their useful life, which has been assessed to range between six and 20 years. This amortisation charge has been excluded from underlying profit since it is a significant non-cash item. Refer to note 17 of the consolidated financial statements for more detail.

Organisational restructure (£2.1 million charge)

As part of the Group's strategy to ensure it operates in an efficient manner and delivers the best service to clients, further opportunities were identified to streamline and remove duplication from core processes, resulting in redundancy costs. These have been excluded from underlying earnings on the basis that they are in relation to business restructuring .

Move to LSE Main Market costs (£1.9 million charge)

In March 2025, the Group announced its successful admission to the LSE's Main Market, which the Board believes will further enhance the Group's corporate profile and extends the opportunity to own its ordinary shares to a broader group of investors. Costs incurred in this transaction have been excluded from underlying earnings due to their one-off nature.

Head office relocation (£1.3 million charge)

This primarily relates to the dual running costs whilst the Group relocates to the new head office in Q4 2025. These have been excluded from underlying earnings on the basis that they are non-recurring in nature.

Other non-operating items (£2.3 million credit)

This primarily relates to a refund from HMRC (£3.1 million) in respect of VAT arising on the Group's AIM Portfolio Services as it was confirmed this was exempt from VAT, covering the period from 1 October 2019 to 30 September 2024. This is partially offset by legacy legal costs and strategic and transformation reviews, conducted as a result of the significant business change following the acquisitions and BMI disposal. These items are excluded from underlying results in view of their non-recurring nature.

Taxation

The underlying tax charge increased to £7.7 million (2024 restated: £5.5 million), representing an effective tax rate ("ETR") of 26.5% (2024 restated: 18.2%). This is slightly higher than the corporation tax rate of 25.0% due to higher disallowable expenses, which include the corporate activity over the year, of £0.4 million (2024: £0.2 million).

The statutory tax charge was £5.9 million (2024 restated: £4.2 million), representing an ETR of 33.6% (2024 restated: 17.2%). The increase is driven by lower share option exercises and non-deductible expenses, including the impact of corporate activity over the year of £0.5 million and the move to the LSE's Main Market of £0.5 million. Refer to note 12 of the consolidated financial statements for further information.

Earnings per share ("EPS")

Underlying diluted EPS reduced by 13.6% to 130.4p (2024 restated: 150.9p), and statutory diluted EPS decreased by 42.7% to 71.4p (2024 restated: 124.5p), reflecting the combined effects of the movements in earnings and ETRs, and a diluted weighted average number of shares in issue of 16.3 million (2024: 16.4 million). Details on the basic and diluted EPS are provided in note 15 of the consolidated financial statements.

| | 2025 | 2024 restated1 |

| EPS from continuing operations |

| |

| Basic | 72.0p | 126.6p |

| Diluted | 71.4p | 124.5p |

| EPS from discontinued operations |

| |

| Basic | 57.9p | (86.5)p |

| Diluted | 57.4p | (85.0)p |

| Underlying EPS from continuing operations |

| |

| Basic | 131.5p | 153.5p |

| Diluted | 130.4p | 150.9p |

1. There has been an update to the results presented in the restated comparative period previously disclosed in the interim report and accounts for the six months ended 31 December 2024. Refer to the note 2 of the consolidated financial statements for further details.

Financial position, capital, cash and dividend

| £ million (unless stated otherwise) | 2025 | 2024 |

| Net assets | 154.4 | 152.3 |

| Excess capital after internal capital buffer1 | 15.6 | 47.1 |

| Cash resources and liquid assets | 53.8 | 74.7 |

| Final dividend | 51.0p | 49.0p |

| Total dividend | 81.0p | 78.0p |

1. Excess capital after internal capital buffer is stated before payment of the final dividend.

Net assets and capital

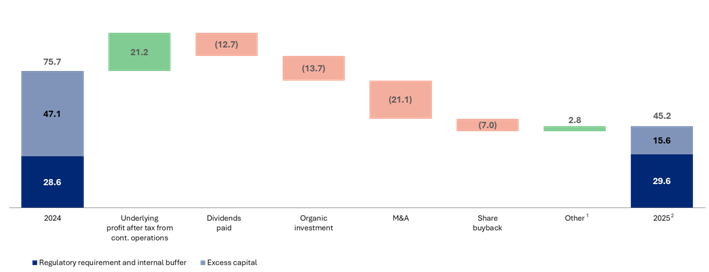

Net assets increased by 1.4% to £154.4 million at 30 June 2025 (30 June 2024: £152.3 million). Total tangible net assets (net assets excluding intangibles) were £35.0 million at 30 June 2025 (30 June 2024: £69.1 million). As at 30 June 2025, the Group had regulatory capital resources of £45.2 million (30 June 2024: £75.7 million) excluding the impact of the final dividend payment of c.£8 million payable in November 2025. The reduction in capital resources was predominantly driven by organic investment and M&A activities of £13.7 million and £21.1 million, respectively, and the repurchase of shares through the share buyback programme of £7.0 million.

The total net assets and the regulatory capital resources consider the respective period's profits as these are deemed to be verified at the date of publication of the interim results. In applying its internal capital management approach, the Group seeks to maintain a capital buffer in addition to the regulatory minimum requirement. At 30 June 2025, after taking into account the regulatory minimum requirement and internal capital buffer, the excess capital was £15.6 million (30 June 2024: £47.1 million), excluding the impact of the final dividend payment.

Capital position (£m)

1. Other includes purchase of shares by the Employee Benefit Trust ("EBT"), head office relocation costs, a refund received from HMRC associated with VAT, and other movements in deferred tax and intangible assets.

2. 2025 excess capital stated before final dividend, payable in November 2025.

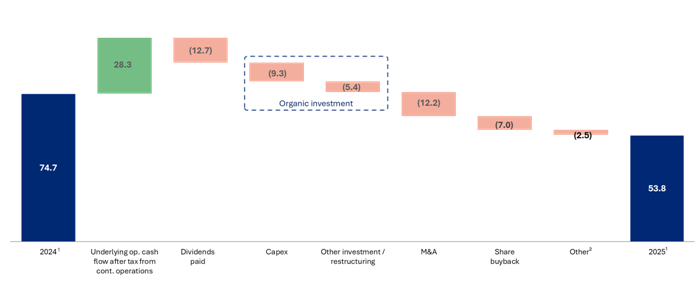

Liquidity

Total cash resources and liquid assets at 30 June 2025 were £53.8 million (30 June 2024: £74.7 million). The reduction on the prior year largely reflects the cash impacts of M&A consideration of £12.2 million and a share buyback of £7.0 million (30 June 2024: nil). During the year ended 30 June 2025, the Group also incurred capital expenditure of £9.3 million (2024: £1.8 million), including investment in technological transformation to deliver continued performance improvements, automation and process efficiencies and to enhance our clients' digital journeys, and property-related costs. A further £5.4 million was deployed on other strategic and transformational actions such as organisational restructuring, integration and the move from AIM to the Main Market.

Cash resources and liquid assets1 (£m)

Note: Subject to rounding.

1. Group liquid assets are inclusive of UK government gilts and money market funds which are classified as a liquid resource in nature due to their ability to be easily translated into cash.

2. Other includes purchase of shares by the EBT, payment of lease liabilities and a refund received from HMRC associated with VAT.

Dividend

The Board recognises the importance of dividends to shareholders and the benefit of providing sustainable shareholder returns. In determining the level of dividend in any year, the Board considers a number of factors such as the level of retained earnings, future cash commitments, statutory profit cover, capital and liquidity requirements and the level of profit retention required to sustain the growth of the Group. The Board has declared a final dividend of 51.0 pence per share (2024: 49.0 pence). This represents an increase of 4.1% compared to the previous financial year and brings the total dividend for the full year to 81.0 pence per share (2024: 78.0 pence). Subject to shareholder approval, the final dividend will be paid on 4 November 2025 to shareholders recorded on the register on 19 September 2025.

Share buyback

In January 2025, the Group initiated its first ever share buyback programme of up to £10.0 million, consistent with its capital allocation priorities. At 30 June 2025, the Group had repurchased and cancelled 464,000 shares for a total consideration of £7.0 million. At the date of signing the Annual Report and Accounts, a further 74,000 shares were purchased and cancelled, for additional total consideration of £1.2 million. The Board will continue to deploy the remainder of the £10 million buyback in due course.

In summary

I look forward with confidence as we focus on delivering our 'Reignite Growth' strategy and achieving our medium-term targets of annualised net flows of 5% and keeping BAU cost growth below 5% per annum.

Katherine Jones

CFO

Consolidated statement of comprehensive income

For the year ended 30 June 2025

| | Note | 2025 £'000 | 2024 restated1 £'000 |

| Revenue | 6 | 111,560 | 106,682 |

| Administrative costs | 7 | (99,282) | (84,509) |

| Gross profit | | 12,278 | 22,173 |

| | | | |

| Other (losses)/gains | 8 | (272) | 83 |

| | | | |

| Operating profit | 9 | 12,006 | 22,256 |

| | | | |

| Finance income | 10 | 2,827 | 2,525 |

| Finance costs | 10 | (597) | (166) |

| Other non-operating income | 11 | 3,283 | - |

| | | | |

| Profit before tax | | 17,519 | 24,615 |

| | | | |

| Taxation | 12 | (5,889) | (4,236) |

| | | | |

| Profit for the period attributable to equity holders of the Company | | 11,630 | 20,379 |

| | | | |

| Result from discontinued operations | 13 | 9,354 | (13,922) |

| | | | |

| Other comprehensive income | | - | - |

| | | | |

| Total comprehensive income for the year | | 20,984 | 6,457 |

| | | | |

| Earnings per share from continuing operations | | | |

| Basic | 15 | 72.0p | 126.6p |

| Diluted | 15 | 71.4p | 124.5p |

| Earnings/(loss) per share from discontinued operations | | | |

| Basic | 15 | 57.9p | (86.5)p |

| Diluted | 15 | 57.4p | (85.0)p |

1 The prior financial year has been restated to separate the results of discontinued operations, consistent with the presentation in the current financial year. Refer to note 13 for details of the results of discontinued operations. In addition, there has been an update to the results presented in the restated comparative period previously disclosed in the interim report and accounts for the six months ended 31 December 2024. Refer to note 2 for further details.

The above consolidated statement of comprehensive income should be read in conjunction with the accompanying notes.

Consolidated statement of financial position

As at 30 June 2025

| | Note | 2025 £'000 | 20241,2 £'000 | 20232 £'000 |

| Assets | | | | |

| Non-current assets | | | | |

| Intangible assets | 17 | 119,465 | 83,224 | 100,582 |

| Property, plant and equipment | 18 | 3,418 | 1,350 | 2,123 |

| Right-of-use assets | 19 | 12,790 | 3,225 | 4,329 |

| Financial assets at amortised cost | 20 | 19,925 | 29,963 | - |

| Financial assets at fair value through other comprehensive income | 20 | - | 500 | 500 |

| Deferred contingent consideration receivable | 21 | 13,899 | - | - |

| Total non-current assets | | 169,497 | 118,262 | 107,534 |

| | | | | |

| Current assets | | | | |

| Financial assets at fair value through profit or loss | 20 | 1,095 | 905 | 825 |

| Deferred contingent consideration receivable | 21 | 289 | - | - |

| Trade and other receivables | 22 | 25,881 | 29,061 | 33,542 |

| Cash and cash equivalents | 23 | 33,915 | 44,732 | 53,355 |

| Total current assets | | 61,180 | 74,698 | 87,722 |

| Total assets | | 230,677 | 192,960 | 195,256 |

| | | | | |

| Liabilities | | | | |

| Non-current liabilities | | | | |

| Lease liabilities | 24 | 14,218 | 1,645 | 3,181 |

| Provisions | 25 | 773 | 378 | 322 |

| Deferred contingent consideration payable | 26 | 1,929 | - | - |

| Net deferred tax liabilities | 27 | 9,163 | 5,394 | 6,033 |

| Other non-current liabilities | 28 | 1,044 | 587 | 783 |

| Total non-current liabilities | | 27,127 | 8,004 | 10,319 |

| | | | | |

| Current liabilities | | | | |

| Lease liabilities | 24 | 700 | 2,169 | 1,960 |

| Provisions | 25 | 1,890 | 1,628 | 1,000 |

| Deferred contingent consideration payable | 26 | 14,176 | - | 1,467 |

| Trade and other payables | 29 | 31,294 | 27,889 | 22,521 |

| Current tax liabilities | | 1,041 | 935 | 645 |

| Total current liabilities | | 49,101 | 32,621 | 27,593 |

| Net assets | | 154,449 | 152,335 | 157,344 |

| | | | | |

| Equity | | | | |

| Share capital | 30 | 160 | 165 | 164 |

| Share premium account | 30 | 83,987 | 83,135 | 81,830 |

| Other reserves | 31 | 197 | 192 | 192 |

| Retained earnings | 31 | 70,105 | 68,843 | 75,158 |

| Total equity | | 154,449 | 152,335 | 157,344 |

1 The 30 June 2024 comparative statement of financial position includes discontinued operations.

2 Restated (refer to note 4(v)).

The consolidated financial statements were approved on 3 September 2025 by the Board of Directors and authorised for issue, and signed on their behalf by:

Andrea Montague Katherine Jones

CEO CFO

Company registration number: 04402058

The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Consolidated statement of changes in equity

For the year ended 30 June 2025

| | Note | Share capital £'000 | Share premium account £'000 | Other reserves1 £'000 | Retained earnings1 £'000 | Total equity £'000 |

| Balance at 1 July 2023 | | 164 | 81,830 | 192 | 75,158 | 157,344 |

| | | | | | | |

| Comprehensive income | | | | | | |

| Profit from continuing operations | | - | - | - | 20,379 | 20,379 |

| Result from discontinued operations | | - | - | - | (13,922) | (13,922) |

| Total comprehensive income | | - | - | - | 6,457 | 6,457 |

| | | | | | | |

| Transactions with owners | | | | | | |

| Issue of ordinary shares | 30 | 1 | 1,305 | - | - | 1,306 |

| Share-based payments | | - | - | - | 2,407 | 2,407 |

| Purchase of own shares by Employee Benefit Trust | | - | - | - | (2,150) | (2,150) |

| Tax on share options | 27 | - | - | - | (935) | (935) |

| Dividends paid | 16 | - | - | - | (12,094) | (12,094) |

| Total transactions with owners | | 1 | 1,305 | - | (12,772) | (11,466) |

| | | | | | | |

| Balance at 30 June 2024 | | 165 | 83,135 | 192 | 68,843 | 152,335 |

| | | | | | | |

| Comprehensive income | | | | | | |

| Profit from continuing operations | | - | - | - | 11,630 | 11,630 |

| Result from discontinued operations | | - | - | - | 9,354 | 9,354 |

| Total comprehensive income | | - | - | - | 20,984 | 20,984 |

| | | | | | | |

| Transactions with owners | | | | | | |

| Issue of ordinary shares | 30 | - | 852 | - | - | 852 |

| Share-based payments | | - | - | - | 2,856 | 2,856 |

| Purchase of own shares by Employee Benefit Trust | | - | - | - | (2,566) | (2,566) |

| Shares repurchased in the share buyback programme | 30 | (5) | - | 5 | (6,971) | (6,971) |

| Tax on share options | 27 | - | - | - | (346) | (346) |

| Dividends paid | 16 | - | - | - | (12,695) | (12,695) |

| Total transactions with owners | | (5) | 852 | 5 | (19,722) | (18,870) |

| | | | | | | |

| Balance at 30 June 2025 | | 160 | 83,987 | 197 | 70,105 | 154,449 |

1 Restated (refer to note 4(v)).

The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

Consolidated statement of cash flows

For the year ended 30 June 2025

| | Note | 2025 £'000 | 2024 restated1 £'000 |

| Cash flows from operating activities | | | |

| Cash generated from operations | 33 | 28,727 | 41,179 |

| Corporation tax paid | | (7,064) | (6,249) |

| Other non-operating income | 11 | 3,073 | - |

| Net cash generated from operating activities | | 24,736 | 34,930 |

| | | | |

| Cash flows from investing activities | | | |

| Purchase of computer software and system development costs | | (7,491) | (1,734) |

| Purchase of property, plant and equipment | | (1,852) | (83) |

| Consideration paid for acquisitions net of cash acquired | 14 | (34,150) | - |

| Investment in financial assets at amortised cost | 20 | - | (29,978) |

| Disposal of financial assets at amortised cost | 20 | 9,984 | - |

| Investment in financial assets at fair value through profit or loss | 20 | (146) | - |

| Disposal of financial assets at fair value through other comprehensive income | 20 | 500 | - |

| Deferred contingent consideration paid | 26 | - | (852) |

| Proceeds from disposal of International and DCF | 13 | 27,670 | - |

| Interest received | | 1,232 | 2,715 |

| Net cash used in investing activities | | (4,253) | (29,932) |

| | | | |

| Cash flows from financing activities | | | |

| Issue of ordinary shares | | 146 | 681 |

| Purchase of shares in the share buyback programme | | (6,971) | - |

| Payment of lease liabilities - Principal | | (2,678) | (2,015) |

| Payment of lease liabilities - Interest | | (287) | (171) |

| Purchase of own shares by Employee Benefit Trust | | (2,566) | (2,150) |

| Dividends paid to shareholders | 16 | (12,695) | (12,094) |

| Net cash used in financing activities | | (25,051) | (15,749) |

| | | | |

| Net decrease in cash and cash equivalents from continuing operations | | (4,568) | (10,751) |

| Net cash flows from discontinued operations | 13 | (6,249) | 2,128 |

| Cash and cash equivalents at beginning of year | | 44,732 | 53,355 |

| Cash and cash equivalents at end of year | | 33,915 | 44,732 |

1 The prior financial year has been restated to show the results of continuing operations, consistent with the presentation in the current financial year. Refer to note 13 for details of the results of discontinued operations.

The above consolidated statement of cash flows should be read in conjunction with the accompanying notes.

Notes to the consolidated financial statements

For the year ended 30 June 2025

1. General information

Brooks Macdonald Group plc ("the Company"), a public limited company incorporated and registered in England and Wales and domiciled in the United Kingdom ("UK") under the Companies Act 2006, is the Parent Company of a group of companies (collectively the "Group") and offers wealth management and financial planning services in the UK. The Company is listed on the London Stock Exchange ("LSE").

The Company's registration number is 04402058. The address of the registered office is 21 Lombard Street, London, EC3V 9AH, England.

2. Basis of preparation

The Group's consolidated financial statements for the year ended 30 June 2025 have been prepared in accordance with UK-adopted International Accounting Standards ("IAS") and with the requirements of the Companies Act 2006 as applicable to companies reporting under those standards. These consolidated financial statements have been prepared on a historical cost basis, except for the revaluation of certain financial instruments that are measured at fair value. The principal accounting policies adopted are set out below. Unless otherwise stated, they have been applied consistently to all periods presented in the financial statements.

All amounts in the financial statements have been rounded to the nearest thousand unless otherwise indicated.

At the time of approving the financial statements, the Directors have a reasonable expectation that the Company and the Group have adequate resources to continue in operational existence for the foreseeable future. Accordingly, they continue to adopt the going concern basis in preparing the financial statements. There have been no post balance sheet events that have materially impacted the Group's liquidity headroom and going concern assessment.

There has been an update to the results presented in the restated year ended 2024 result previously disclosed in the interim report and accounts for the six months ended 31 December 2024, which relates to a reclassification of the tax charge between discontinued and continuing operations. This has resulted in a decrease of £957,000 in the tax charge for continuing operations and a corresponding increase in the tax charge for discontinued operations. The profit after tax and earnings per share for respective continuing and discontinued operations have also been restated accordingly.

Non-statutory accounts

The financial information set out within does not constitute the Group's statutory accounts for the year ended 30 June 2025 or 2024 but is derived from those accounts. Statutory accounts for 2024 have been delivered to the registrar of companies, and those for 2025 will be delivered in due course. The auditors have reported on those accounts; their report was (i) unqualified, (ii) did not include a reference to any matters to which the auditors drew attention by way of emphasis without qualifying their report and (iii) did not contain a statement under section 498 of the Companies Act 2006.

Basis of consolidation

The Group's financial statements are a consolidation of the financial statements of the Company and its subsidiaries.

The underlying financial statements of the subsidiaries are prepared for the same reporting period as the Company, using consistent accounting policies. Subsidiaries and structured entities are all entities controlled by the Company, deemed to exist where the Company is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. The financial statements of the subsidiaries are included from the date on which control is transferred to the Group to the date that control ceases.

All intercompany transactions and balances between Group companies are eliminated on consolidation.

The Group has interests in structured entities, with one consolidated structured entity being the Brooks Macdonald Group Employee Benefit Trust (note 32). The Group has interests in other structured entities as a result of contractual arrangements arising from the management of assets on behalf of its clients but are not consolidated as the Group does not commit to financially support its funds, nor guarantee repayment of any borrowings (note 34).

3. New standards, amendments to standards and interpretations adopted by the Group in the year

In the year ended 30 June 2025, the Group did not adopt any new standards or amendments issued by the International Accounting Standards Board ("IASB") or interpretations by the International Financial Reporting Standards Interpretations Committee ("IFRS IC") that have had a material impact on the consolidated financial statements.

Certain new accounting standards, amendments to accounting standards and interpretations have been published that are not mandatory for the 30 June 2025 reporting periods and have not been early adopted by the Group.

| Standard, amendment or interpretation | Effective date |

| Amendments to IAS 21 regarding lack of exchangeability | 1 January 2025 |

| Amendments IFRS 9 and IFRS 7 regarding the classification and measurement of financial instruments | 1 January 2026 |

| Annual Improvements to IFRS Accounting Standards - Volume 11 | 1 January 2026 |

| IFRS 18 Presentation and Disclosures in Financial Statements | 1 January 2027 |

| IFRS 19 Subsidiaries without Public Accountability: Disclosures | 1 January 2027 |

The Group is currently assessing the impact that the adoption of the above standards and amendments will have on the Group's results reported within the financial statements.

IFRS 18 Presentation and Disclosures in Financial Statements

IFRS 18 includes requirements for all entities applying IFRS for the presentation and disclosure of information in the financial statements. The standard aims to improve how companies communicate in their financial statements, with a focus on information about financial performance in the statement of comprehensive income. IFRS 18 replaces IAS 1 Presentation of Financial Statements, although the standard is not yet endorsed by the UK Endorsement Board.

IFRS 18 is expected to have a significant impact on the Group's financial statements, although it is only expected to have an impact on the presentation and disclosure of the financial statements and is not expected to have an impact on recognition and measurement.

IFRS 19 Subsidiaries without Public Accountability: Disclosures

IFRS 19 specifies the reduced disclosure requirements an eligible subsidiary is permitted to apply instead of the disclosure requirements in other IFRS standards. The standard is not yet endorsed by the UK Endorsement Board and is not expected to impact the Group's financial statements.

4. Material accounting policies

The accounting policies applied in the preparation of these financial statements are set out below. These policies have been applied consistently to all years presented, unless otherwise stated.

4(a) Critical accounting estimates and significant judgements

The preparation of financial information requires the use of assumptions, estimates and judgements about future conditions. Use of currently available information and application of judgement are inherent in the formation of estimates. Actual results in the future may differ from those reported. In this regard, the Directors believe that the areas where critical accounting estimations are used, relate to the measurement of intangible assets, assumptions used in the goodwill impairment reviews and the measurement of contingent deferred consideration receivable/payable. There are no areas of significant judgement that have been identified.

The consolidated financial statements include other areas of judgement and accounting estimates. Whilst these areas do not meet the definition under IAS 1 of significant accounting estimates or critical accounting judgements, the recognition and measurement of certain material assets and liabilities are based on assumptions and/or are subject to longer-term uncertainties.

The underlying assumptions and estimates are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the financial year in which the estimate is revised only if the revision affects both current and future periods.

Further information about critical accounting estimates and sources of estimation uncertainty are set out below.

Intangible assets - client relationship contracts and goodwill impairment reviews

The Group has acquired client relationships and the associated investment management and financial advice contracts as part of business combinations, through separate purchase or with newly employed teams of fund managers, as described in note 17. In assessing the fair value of these assets, the Group has estimated their finite life based on information about the typical length of existing client relationships. Acquired client relationship contracts are amortised on a straight-line basis over their estimated useful lives, ranging from six to twenty years.

If the useful economic lives of the client relationship intangible assets held by the Group at 30 June 2025 were to reduce by two years, the estimated charge would have increased by £1,263,000.

Goodwill recognised as part of a business combination is not amortised but instead reviewed annually for impairment, or when a change in circumstances indicates that it might be impaired. The recoverable amounts of cash-generating units ("CGUs") are determined by value-in-use calculations, which require the use of estimates to derive the projected future cash flows attributable to each unit. Details of the more significant assumptions and sensitivity analysis are given in note 17.

In assessing the value of client relationships and the associated investment management and financial advice contracts and goodwill, the Group prepares forecasts for the cash flows acquired and discounts to a net present value. The key assumptions in these forecasts are the pre-tax discount rate and projected revenue growth. The pre-tax discount rate is adjusted from a post-tax discount rate derived from the Group's weighted average cost of capital ("WACC"), adjusted for any specific risks for the relevant CGU. The Group uses the capital asset pricing model ("CAPM") to estimate the WACC, which is calculated at the point of acquisition for a business combination, or the relevant reporting period date. Key inputs include the risk-free rate, market risk premium, the Group's adjusted beta with reference to beta data from peer-listed companies, small company premium and any risk-adjusted premium for the relevant CGU. Further details on discount rates used for each CGU are provided in note 17.

Deferred contingent consideration receivable and payable

Deferred contingent consideration arose during the year in connection with the Group's acquisition and disposal activities. These amounts represent portions of the transaction price that are payable or receivable at a future date, subject to the achievement of specific conditions or milestones. These typically include performance targets, client retention thresholds, or other contractual criteria agreed between the parties.

Deferred contingent consideration payable and receivable is measured at fair value and recognised within net finance income in the consolidated statement of comprehensive income in each reporting period.

The fair values of deferred contingent consideration at both the acquisition and disposal dates were determined using discounted cash flow models. These models incorporate management's expectations regarding the likelihood of meeting specified performance targets and client retention criteria, and apply an appropriate discount rate. The valuation of contingent consideration represents a critical accounting estimate due to the inherent uncertainty in forecasting future outcomes. Changes in expected future cash flows could materially impact the fair value measurement.

As at the reporting date, the Group reassessed the fair value of all deferred contingent consideration arrangements. For acquired businesses, if performance exceeds the forecasts by 10%, an additional charge of £0.2 million would be recognised in the statement of comprehensive income. Conversely, if performance is 10% below forecast, a gain of £0.4 million would be recognised. Similarly, for disposed businesses, if achievement of performance targets exceeds the forecasts by 5%, this would result in an additional gain of £3.2 million. While a 5% under performance versus those targets would lead to a charge of £4.8 million.

These valuations are subject to estimation and uncertainty, and actual outcomes may differ from those assumed, potentially resulting in material adjustments in future periods.

4(b) Discontinued operations

The Group completed the sale of its International operations, which comprised Brooks Macdonald Asset Management (International) Limited and its wholly-owned subsidiaries ("BMI"), on 21 February 2025. In accordance with IFRS 5 'Non-current assets held for sale and discontinued operations', the results of BMI have been reclassified as discontinued operations in these consolidated financial statements.

Additionally, Brooks Macdonald Asset Management Limited resigned as investment manager to the SVS Brooks Macdonald Defensive Capital Fund ("DCF") (subsequently renamed SVS RM Defensive Capital Fund) on 31 October 2024 and accordingly, the results have also been reclassified as discontinued operations in these consolidated financial statements.

Consistent with IFRS 5 requirements, profit after tax attributable to the discontinued operations in 2025 has been shown in a single line in the income statement with 2024 comparatives being restated accordingly and includes the gain from the disposal, with further analysis provided in note 13. Related notes have also been prepared on this basis.

IFRS 5 does not permit the comparative 30 June 2024 and 1 July 2023 statement of financial position to be re-presented, as BMI and DCF were not reclassified as held for sale at these dates.

Profit from the discontinued operations up to the date of disposal is presented in the consolidated statement of comprehensive income after the elimination of intragroup transactions within continuing operations. The statement of cash flows is presented for continuing operations only, excluding intragroup cash flows with the discontinued operations up to the date disposal. The cash flow from discontinued operations is presented in note 13.

4(c) Business combinations

Business combinations are accounted for using the acquisition method. The cost of an acquisition is measured at the fair value of the aggregate amount of the consideration transferred at the acquisition date, irrespective of the extent of any minority interest. Acquisition and integration-related costs are charged to the consolidated statement of comprehensive income when incurred.

When the Group acquires a business, it assesses the assets and liabilities assumed for appropriate classification and designation in accordance with the contractual terms, economic circumstances and pertinent conditions at the acquisition date. If the business combination is achieved in stages, the fair value of the Group's previously held equity interest is remeasured at the acquisition date and the difference is credited or charged to the consolidated statement of comprehensive income. Identifiable assets and liabilities assumed on acquisition are recognised in the consolidated statement of financial position at their fair value at the date of acquisition.

Any deferred contingent consideration to be paid by the Group to the vendor is recognised at its fair value at the acquisition date, in accordance with IFRS 9. Subsequent changes based on the revised estimated fair value of deferred contingent consideration are recognised in accordance with IFRS 9 by revaluing the liability on the consolidated statement of financial position and the associated amount recognised in the consolidated statement of comprehensive income.

Goodwill is initially measured at cost, being the excess of the consideration transferred over the acquired company's net identifiable assets and liabilities assumed.

Impairment

Goodwill and other intangible assets with an indefinite life are tested annually or more frequently if events or changes in circumstances indicate that they might be impaired. For the purposes of impairment testing, goodwill acquired in a business combination is allocated to each of the Group's CGUs that are expected to benefit from the combination, irrespective of whether other assets or liabilities of the acquisition are assigned to those units. The carrying amount of each CGU is compared to its recoverable amount, which relates to the higher of an asset's fair value less costs of disposals and value in use. This is determined using a discounted future cash flow model.

Where goodwill forms part of a CGU and part of the operation within that unit is disposed of, the goodwill associated with the operation disposed of is included in the carrying amount of the operation when determining the gain or loss on disposal of the operation. Goodwill disposed of in this circumstance is measured based on the relative values of the operation disposed of and the portion of the CGU retained.

4(d) Revenue

Investment management fees

Revenue from investment management services is recognised over time as the services are provided. Fees are typically billed monthly or quarterly in arrears and are calculated based on a percentage of the portfolio value, either daily or at the billing date, depending on the underlying product. The performance obligation is satisfied continuously over the service period, and revenue is recognised accordingly. Revenue from investment management fees is only recognised as the performance obligation is satisfied. Amounts are presented net of any rebates or discounts provided to clients.

Fund management fees

Revenue from fund management services provided to open-ended investment companies ("OEICs") is recognised over time as the services are provided. Fees are billed monthly in arrears and are calculated daily based on a fixed percentage of each fund's net asset value. As such, fund management fees include variable consideration but there is no significant estimation or level of judgement involved. The performance obligation is satisfied continuously throughout the reporting period, and revenue is recognised accordingly. Amounts are presented net of any rebates or discounts provided to investors.

Financial planning

Financial planning income relates to fees for the provision of financial advice. Fees are charged to clients either using an hourly rate, by a fixed fee arrangement, or by a fund-based arrangement whereby fees are calculated based on a percentage of the value of the portfolio at the billing date. All fees are recognised over the period the service is provided.

Transactional income and foreign exchange trading

Transactional income is earned through dealing and administration charges levied on trades at the time a deal is placed for a client. Fees are calculated based on a percentage of the individual trade value or a flat charge per trade. Revenue is recognised at the point of the trade being placed.

Foreign exchange trading fees are charged on client trades placed in non-base currencies, which therefore require a foreign currency exchange to action the trade. Revenue is recognised at the point of the trade being placed.

Interest income

Interest income on client money is the revenue earned on uninvested cash deposits held by clients. The amount recognised correlates with fluctuations in underlying interest rates and is recognised over time, based on balances held in investment accounts under administration.

4(e) Cash and cash equivalents

Cash comprises cash in hand and call deposits held with banks. Cash equivalents comprise short-term, highly liquid investments that are subject to an insignificant risk of change in value and with a maturity of less than three months from the date of acquisition. Cash and cash equivalents are classified at amortised cost, as the business model of these assets is to hold to collect contractual cash flows, which consist solely of payments of principal and interest. They are initially recognised at fair value and subsequently measured at amortised cost using the effective interest rate ("EIR") method.

4(f) Share-based payments

The Group operates a number of share incentive plans for its employees. These involve an award of shares or options in the Group (share-based payments).

The fair value of the services received is measured by reference to the fair value of the shares or share options on the grant date. Fair value is measured using the Black-Scholes model.

The fair value determined at the grant date of the equity-settled share-based payments is expensed on a straight-line basis over the vesting period, based on the Group's estimate of shares that will eventually vest. At each reporting date, the Group revises its estimate of the number of equity instruments expected to vest as a result of the effect of non-market-based vesting conditions. The impact of the revision of the original estimates, if any, is recognised in the consolidated statement of comprehensive income, such that the cumulative expense reflects the revised estimate, with a corresponding adjustment to reserves.

4(g) Segmental reporting

The Group determines and presents operating segments based on the information that is provided internally to the Group Board of Directors, which is the Group's chief operating decision maker.

4(h) Fiduciary activities

The Group commonly acts as trustee and in other fiduciary capacities that result in the holding or placing of assets on behalf of individuals, trusts, retirement benefit plans and other institutions. These assets and income arising thereon are excluded from these financial statements, as they are not assets of the Group.

The Group holds money on behalf of some clients in accordance with the client money rules of the Financial Conduct Authority ("FCA"). Such monies and the corresponding liability to clients are not included within the consolidated statement of financial position as the Group is not beneficially entitled thereto.

4(i) Property, plant and equipment

All property, plant and equipment is included in the consolidated statement of financial position at historical cost less accumulated depreciation and impairment. Costs include the original purchase cost of the asset and the costs attributable to bringing the asset into a working condition for its intended use.

Provision is made for depreciation to write off the cost less estimated residual value of each asset, and is charged to administrative expenses in the consolidated statement of comprehensive income using a straight-line method, over its expected useful life as follows:

- Leasehold improvements - over the lease term

- Fixtures, fittings and office equipment - five years

- IT equipment - four or five years

The assets' residual values and useful economic lives are reviewed and adjusted, if appropriate, at the end of each reporting period. Gains and losses arising on disposal are determined by comparing the proceeds with the carrying amount. These are included in the consolidated statement of comprehensive income.

4(j) Intangible assets

Amortisation of intangible assets is charged to administrative expenses in the consolidated statement of comprehensive income on a straight-line basis over the estimated useful lives of the assets.

Acquired client relationship contracts

Intangible assets are recognised where client relationship contracts are either separately acquired or acquired with investment managers who are employed by the Group. These are initially recognised at cost and are subsequently amortised on a straight-line basis over their estimated useful economic life. Separately acquired client relationship contracts are amortised over six to twenty years. The intangible assets are reviewed annually to determine whether there exists an indicator of impairment or an indicator that the assumed useful economic life has changed.

Computer software

Costs incurred on internally developed computer software are initially recognised at cost, and when the software is available for use, the costs are amortised on a straight-line basis over an estimated useful life of either four years or the contract term ranging between three and eight years. Initial research and planning costs incurred prior to a decision to proceed with the software's development are recognised immediately in the consolidated statement of comprehensive income.

Goodwill

Goodwill arising as part of a business combination is initially measured at cost, being the excess of the fair value of the consideration transferred over the Group's interest in the net fair value of the separately identifiable assets, liabilities and contingent liabilities of the subsidiary at the date of acquisition. In accordance with IFRS 3 'Business Combinations', goodwill is not amortised but is reviewed annually for impairment and is therefore stated at cost less any provision for impairment of value. Any impairment is recognised immediately in the consolidated statement of comprehensive income and is not subsequently reversed. Gains and losses on the disposal of an entity include the carrying amount of goodwill relating to the entity sold. On acquisition, any goodwill acquired is allocated to CGUs for the purposes of impairment testing. If the cost of the acquisition is less than the fair value of the net assets of the subsidiary acquired, the difference is recognised directly in the consolidated statement of comprehensive income as a gain on bargain purchase.

4(k) Financial investments

The Group classifies financial assets in the following categories: fair value through profit or loss; fair value through other comprehensive income; and amortised cost. The classification is determined by management on initial recognition of the financial asset, which depends on the purpose for which it was acquired and the nature of the cash flows.

Fair value through profit or loss

Financial investments are classified as fair value through profit or loss if they are either held for trading or specifically designated in this category on initial recognition. Assets in this category are initially recognised at fair value and subsequently remeasured, with gains or losses arising from changes in fair value being recognised in the consolidated statement of comprehensive income.

Financial assets at fair value through profit or loss include investments in regulated OEICs, which are managed and evaluated on a fair value basis in line with the market value.

Fair value through other comprehensive income

Financial investments are classified as fair value through other comprehensive income if the objective of the business model is achieved by both collecting contractual cash flows and selling financial assets and if the asset's contractual cash flows represent solely payments of principal and interest. Assets in this category are initially recognised at fair value and subsequently remeasured, with gains or losses arising from changes in fair value being recognised in other comprehensive income.

Financial assets at fair value through other comprehensive income relates to an investment in redeemable preference shares, which satisfy the definition above due to being held to collect contractual cash flows via an annual fixed preferential dividend.

Amortised cost

Financial instruments are classified as amortised cost if the asset is held to collect contractual cash flows and the asset's contractual cash flows represent solely payments of principal and interest. Disposals of instruments held at amortised cost are not part of regular business practice, however one-off instances may occur due to significant events, although they do not alter the existing business model, which remains focused on collecting contractual cash flows. In assessing whether the 'held to collect' model remains appropriate, management considers the frequency and volume of disposals in relation to the total portfolio and disposals are disclosed in the financial statements, including the rationale for the transaction.

4(l) Foreign currency translation

The Group's functional and presentational currency is Pound Sterling ("£"). Foreign currency transactions are translated using the exchange rate prevailing at the transaction date. At the reporting date, monetary assets and liabilities that are denominated in foreign currencies are retranslated at the prevailing rates on that date. Foreign exchange gains and losses resulting from the settlement of such transactions, and from the translation of period-end monetary assets and liabilities, are recognised in the consolidated statement of comprehensive income.

4(m) Retirement benefit costs

Contributions in respect of the Group's defined contribution pension scheme are charged to the consolidated statement of comprehensive income as they fall due.

4(n) Taxation

Tax on the profit for the financial year comprises current and deferred tax. Current tax is the expected tax payable on the taxable income for the financial year, using tax rates enacted, or substantively enacted, at the reporting date, and any adjustment to tax payable in respect of previous years.

Deferred tax is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the Group's Financial statements. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the asset is realised or the liability settled based on tax rates (and laws) that have been enacted, or substantively enacted, at the reporting date.

Deferred tax assets are only recognised to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised.

Deferred tax balances are presented on the consolidated statement of financial position as the net deferred tax balance by each jurisdiction the Group operates within. The gross deferred tax assets and liabilities are disclosed within the deferred tax in note 27.

4(o) Trade receivables

Trade receivables represent amounts due for services performed in the ordinary course of business. They are recognised in trade and other receivables and, if collection is expected within one year, they are recognised as a current asset. If collection is expected in greater than one year, they are recognised as a non-current asset. Trade receivables are measured at amortised cost less any expected credit losses.

4(p) Right-of-use assets and lease liabilities

Right-of-use assets are initially recognised at cost which is measured at the initial amount of the lease liability, reduced for any lease incentives received and increased for lease payments made at or before commencement of the lease, initial direct costs incurred and the amount of any provision recognised where the Group is required to dismantle, remove or restore the asset. Additionally, they may be re-measured to reflect reassessment due to lease modifications.

The right-of-use asset is subsequently depreciated using the straight-line method from the commencement date to the end of the lease term. Additionally, the right-of-use asset is periodically reduced by impairment losses, if any, and adjusted for certain remeasurements of the lease liability.

The Group initially records a lease liability reflecting the present value of the future contractual cash flows to be made over the lease term, discounted using the Group's incremental borrowing rate. Interest is accrued on the lease liability using the effective interest rate method to give a constant rate of return over the life of the lease whilst the balance is reduced as lease payments are made.