|

|

|

16 September 2025

AIM: AAU

ASX: AA2

SIGNIFICANT DRILLING PROGRAMME PLANNED TO COMMENCE

AT THE DOKWE GOLD PROJECT, ZIMBABWE

Ariana Resources plc (AIM: AAU, ASX: AA2, "Ariana" or the "Company"), the mineral exploration, development and production company with gold project interests in Africa and Europe, provides the following summary of its projects and development plans, particularly at the Dokwe Gold Project ("Dokwe") following its 10 September 2025 admission to the Official List of the Australian Securities Exchange ("ASX") and the quotation of its securities.

Highlights:

o Ariana commenced trading on the ASX on 10 September 2025, following the completion of a A$11 million IPO, capitalising the Company at c.A$72.5 million.

o Flagship >1Moz Dokwe Gold Project in Zimbabwe continues to be advanced through its Definitive Feasibility Study ("DFS"), as additional technical consultancy companies are appointed.

o Drilling companies have submitted tenders to undertake a significant new diamond and Reverse Circulation ("RC") drilling programme of c.11,000m at Dokwe; with contracts due to be awarded imminently and drilling to commence in early October.

o The drilling programme is designed to substantially increase the current 1.4Moz Resource and 0.8Moz Reserve (as defined in the Pre-feasibility Study - "PFS") at Dokwe, while also providing additional technical data for the DFS.

o Gold-silver production continues from the Turkish operations (held 23.5% by Ariana), with production from the Tavşan Mine due to be augmented through its heap-leach imminently.

Dr. Kerim Sener, Managing Director, commented:

"The successful dual-listing of Ariana on the ASX and its associated capital raising of A$11 million, is a landmark moment since first listing on AIM in 2005. In that time, the Company has evolved from a greenfield exploration company to a gold producer.

"The ASX listing provides a powerful platform for us to accelerate our growth strategy, broaden our investor base, and unlock the full potential of our asset portfolio. Central to this is the 100% owned Dokwe Gold Project in Zimbabwe, a highly compelling development opportunity with significant scale, strong economics and exciting upside potential.

"With a gold price currently exceeding US$3,600/oz the Company continues to optimise the path forward for the fast-track development of Dokwe, deploying all our skills and capabilities to build up a planned annual gold production of at least 60,000 ounces of gold per annum over a thirteen-year mine life, based on the PFS. With a proven track record of discovery and delivery, Ariana is well positioned to continue building a long-term, sustainable and globally recognised gold company."

Portfolio Overview

Dokwe Gold Project, Zimbabwe

The Company holds a 100% interest in Dokwe, which represents one of the most significant gold projects in Zimbabwe and is Ariana's flagship growth project. The project hosts a substantial in-pit JORC-compliant resource of >1Moz of gold (Table 1) with a robust grade profile and hosts significant exploration upside across the broader licence area. With excellent project economics and a clear pathway to development, Dokwe is positioned to become a long-life, low-cost gold operation and a transformative asset for the Company.

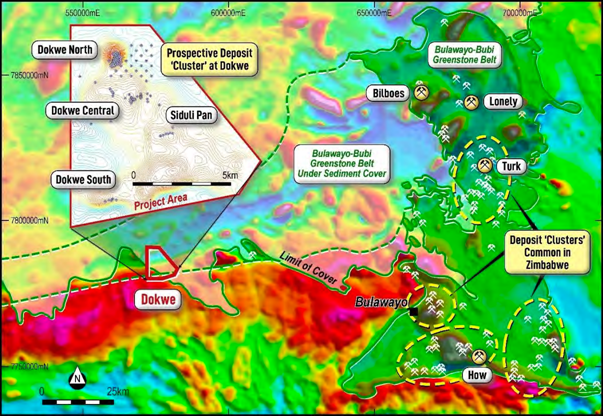

The Project is located approximately 110km west of Bulawayo and currently comprises two known gold deposits; Dokwe North and Dokwe Central (Figure 1). The project comprises 81 blocks of gold claims and a further 22 blocks of copper and copper base metal claims covering a total area of 4,040 hectares. These mining claims allow for mining to commence without the requirement for further permitting.

A Pre-Feasibility Study ("PFS") completed in May 2022, was subsequently revised and announced on 26 June 2025. The most recent revision indicated a potential IRR of approximately 75% and a post-tax NPV10 of approximately US$354 million (A$538 million)1, based on a gold price of US$2,750/oz. This PFS is based on the Dokwe North deposit only, contemplating total gold production of 0.8Moz of gold (Table 2). Refer to section 4.9 of the Independent Geologist's Report at Annexure A of the Company's replacement prospectus dated 5 August 2025 (IGR) for further information in relation to the PFS and the revised PFS.

The Company released an updated in-pit Mineral Resource Estimate for Dokwe North and Central on 4 March 2025 which is in compliance with the JORC Code (2012). This showed 1.12 million ounces of gold (based on the higher 0.6 g/t Au cut-off grade) in JORC (2012) Measured, Indicated and Inferred Resources, with significant scope to grow (Table 1) based on the exploration potential identified in the vicinity of the existing deposits (Figure 1).

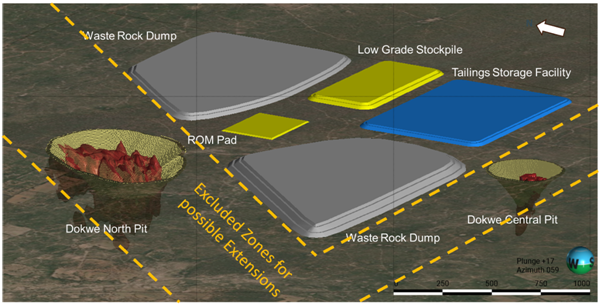

The Project targets an open-pit mining operation, with a treatment capacity of 125,000 tonnes per month of ore to the plant during steady-state production, based on the PFS (Figure 2). The PFS evaluated two processing options, with the Carbon-in-Leach (CIL) option advanced to a Reserve schedule. Other key aspects of the Project include its proximity to infrastructure, well-maintained road access and site facilities. The site facilities include a well-established field camp with a fast satellite data connection and with over 42,000 metres of drill core stored on site.

A 0.5% Net Smelter Return (NSR) royalty will be payable to Yataghan Investments (Private) Limited in respect of the Dokwe Project.

[1] Based on a foreign exchange rate of US$1:A$1.52.

Figure 1: Dokwe Project Area, with surface gold geochemistry and existing drilling, shown inset against a combined geological and aeromagnetic map of the Bulawayo-Bubi Greenstone Belt and surrounding areas.

Figure 2: Dokwe Project Area, showing the Dokwe North and Central open-pits and the mining infrastructure plans. The assessment of current exploration data has highlighted certain corridors which host potential for resource extensions and these are marked as the "Excluded Zones" for mining infrastructure. These areas will be the focus of new drilling programmes.

Dokwe Mineral Resource Estimate and Ore Reserves

Table 1: In-pit Mineral Resource Estimate for the Dokwe Gold Project.

| PROJECT | CLASSIFICATION (REPORTING CUT-OFF GRADE 0.3g/t Au) | TONNAGE | GRADE | CONTAINED GOLD (oz) |

| Dokwe North | Measured | 17,309,000 | 1.06 | 592,000 |

| Indicated | 18,562,000 | 0.90 | 537,000 | |

| Inferred | 7,095,000 | 0.82 | 187,000 | |

| Total | 42,966,000 | 0.95 | 1,316,000 | |

| Dokwe Central | Indicated | 1,811,000 | 1.60 | 93,000 |

| Inferred | 120,000 | 1.69 | 7,000 | |

| Total | 1,931,000 | 1.61 | 100,000 | |

| Total | Measured | 17,309,000 | 1.06 | 592,000 |

| Indicated | 20,373,000 | 0.96 | 631,000 | |

| Inferred | 7,214,000 | 0.83 | 193,000 | |

| TOTAL | 44,896,000 | 0.98 | 1,416,000 | |

|

|

|

|

| |

| PROJECT | CLASSIFICATION (REPORTING CUT-OFF GRADE 0.6g/t Au) | TONNAGE | GRADE | CONTAINED GOLD (oz) |

| Dokwe North | Measured | 10,220,000 | 1.50 | 493,000 |

| Indicated | 8,260,000 | 1.50 | 399,000 | |

| Inferred | 3,123,000 | 1.33 | 134,000 | |

| Total | 21,604,000 | 1.48 | 1,025,000 | |

| Dokwe Central | Indicated | 1,207,000 | 2.19 | 85,000 |

| Inferred | 98,000 | 1.98 | 6,000 | |

| Total | 1,306,000 | 2.18 | 91,000 | |

| Total | Measured | 10,220,000 | 1.50 | 493,000 |

| Indicated | 9,468,000 | 1.59 | 484,000 | |

| Inferred | 3,222,000 | 1.35 | 140,000 | |

| TOTAL | 22,909,000 | 1.52 | 1,116,000 | |

Notes:

1. The Dokwe Mineral Resource Estimate is reported in accordance with the JORC Code. Reported using cut-offs grades of 0.3g/t Au and 0.6g/t Au As at 4 March 2025.

2. Refer to sections 4.8.5 and 4.8.6 of the IGR for further information regarding the Dokwe Mineral Resource Estimate including information required by ASX Listing Rule 5.8.

3. The Dokwe Mineral Resource Estimate is inclusive of Reserves.

Table 2: Ore Reserves for Dokwe North.

| CATEGORY | DILUTED TONNAGE | GRADE | CONTAINED GOLD (oz) |

| Proven | 7.21 | 1.33 | 307,900 |

| Probable | 11.04 | 1.37 | 487,900 |

| TOTAL | 18.25 | 1.36 | 795,800 |

Notes:

1. The Dokwe Ore Reserves are reported in accordance with the JORC Code. Reported using a cut-off grade of 0.47g/t Au. As at 1 March 2022. Sub-totals are rounded to reflect the accuracy of estimates and this may lead to rounding errors.

2. Refer to section 4.9.1 of the IGR for further information regarding the Dokwe Ore Reserves including information required by ASX Listing Rule 5.9.

Zenit Mining Operations, Türkiye

Ariana established itself as a proven operator in Türkiye through a successful strategy of discovery, development, and production in partnership with local EPCM and general construction partners. The Company currently holds 23.5% of Zenit Mining Operations ("Zenit"), which operates the Kızıltepe Gold-Silver Mine, and which has delivered multiple years of profitable production of c. 21,500 ounces of gold per annum and consistent cashflow. Building on this success, the Tavşan Gold Project is advancing towards production from its heap-leach (Figure 3) and is currently the second producing mine of Zenit in the country (Figure 4). These assets demonstrate the Company's ability to generate long-term value through efficient, low-cost operations in highly prospective regions.

Figure 3: General site view at Tavsan showing the mine offices in the foreground with crushers, screens and agglomerator shown towards the top right. The overland conveyors to the Phase 1 heap-leach pad are installed and run diagonally across the image. Photograph taken in mid-June 2025.

Figure 4: Tavsan Main open pit, showing the current status of open-pit development. Due to the shallow-dipping nature of the mineralisation, the stripping ratio has not exceeded 2:1 to date. Photograph taken in mid-May 2025.

Western Tethyan Resources, Kosovo

Ariana holds an interest of 76% of Western Tethyan Resources ("WTR") in Kosovo. WTR in turn owns the rights to 51% of the Slivova Project2 which is a high-potential gold deposit located in central Kosovo, within an underexplored but richly mineralised belt with proven endowment. Ariana is working with its partners to advance Slivova through further technical studies, with the project showing strong potential to become a near-term development opportunity. The project offers exposure to a growing mining jurisdiction in Europe with favourable conditions for responsible development.

2 WTR applied for a new exploration licence over the Slivova Project in May 2025, which remains pending at the time of this announcement. Refer to the Company's replacement prospectus dated 5 August 2025 for further details.

Venus Minerals, Cyprus

Ariana holds an interest of 61% in Venus Minerals, a Cyprus-based company advancing a portfolio of copper-gold projects across Cyprus. These include several brownfield and greenfield opportunities within historically mined districts, positioning Venus to contribute to the growing demand for copper - a critical metal in the global energy transition. Ariana's involvement provides exposure to both precious and base metals within a jurisdiction strategically located at the crossroads of Europe, Asia, and Africa.

Compliance Statements

The information in this announcement relating to Mineral Resources and Ore Reserves has been reported by the Company in accordance with the 2012 Edition of the 'Australasian Code for Reporting of Exploration results, Mineral Resources and Ore Reserves' (JORC Code) previously (refer to the Company's replacement prospectus which was released to the ASX market platform on 8 September 2025 (Prospectus) and is available on the Company website at http://www.arianaresources.com/) (Previous Market Announcement). The Company confirms that it is not aware of any new information or data that materially affects the information included in the Previous Market Announcement and, in the case of estimates of Mineral Resources and Ore Reserves, that all material assumptions and technical parameters underpinning the estimates in the Previous Market Announcement continue to apply and have not materially changed.

The information in this announcement that relates to the Dokwe PFS production target, or the forecast financial information derived from that production target was first reported on the ASX in the Previous Market Announcement. The Company confirms that all the material assumptions underpinning the production target, and the forecast financial information derived from the production target, in the Previous Market Announcement continue to apply and have not materially changed.

Competent Persons Statement

The information in the Investment Overview Section of the prospectus (included at Section 3), the Company and Projects Overview (included at Section 5), and the Independent Geologist's Report (included at Annexure A of the prospectus), which relate to exploration targets, exploration results, mineral resources, Ore Reserves and forward looking financial information is based on, and fairly represents, information and supporting documentation prepared by Alfred Gillman, Ruth Woodcock, Izak van Coller, Hovhannes Hovhannisyan (together, the JORC Competent People), and Richard John Siddle, Andrew Bamber and Daniel Van Heerdan (together, the Qualified People). Refer to the Independent Geologist's Report for further information in relation to the information compiled by each of the JORC Competent People and the Qualified People, their professional memberships, their relevant qualifications and experience and their relationship with the Company.

The Company confirms that the form and context in which the Competent Persons' findings are presented have not been materially modified from the Previous Market Announcement.

Forward looking statements and disclaimer

This announcement contains certain "forward-looking statements". Forward-looking statements can generally be identified by the use of forward looking words such as "forecast", "likely", "believe", "future", "project", "opinion", "guidance", "should", "could", "target", "propose", "to be", "foresee", "aim", "may", "will", "expect", "intend", "plan", "estimate", "anticipate", "continue", "indicative" and "guidance", and other similar words and expressions, which may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production dates, expected costs or production outputs for the Company, based on (among other things) its estimates of future production of the Projects.

To the extent that this document contains forward-looking information (including forward-looking statements, opinions or estimates), the forward-looking information is subject to a number of risk factors, including those generally associated with the gold exploration, mining and production businesses. Any such forward-looking statement also inherently involves known and unknown risks, uncertainties and other factors that may cause actual results, performance and achievements to be materially greater or less than estimated. These factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations, general economic and share market conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development (including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of reserves), changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, geological and geotechnical events, and environmental issues, and the recruitment and retention of key personnel.

The Board of Ariana Resources plc has approved this announcement and authorised its release.

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 as it forms part of UK Domestic Law by virtue of the European Union (Withdrawal) Act 2018 ("UK MAR").

Contacts:

| Ariana Resources plc Michael de Villiers, Chairman Dr. Kerim Sener, Managing Director | | Tel: +44 (0) 20 3476 2080 |

| | | |

| Beaumont Cornish Limited (Nominated Adviser) Roland Cornish / Felicity Geidt | | Tel: +44 (0) 20 7628 3396 |

|

| | |

| Zeus Capital (Joint Broker) Harry Ansell / Katy Mitchell

Fortified Securities (Joint Broker) Guy Wheatley

Shaw and Partners (Lead Manager - ASX) Damien Gullone

Yellow Jersey PR Limited (Financial PR) Dom Barretto / Shivantha Thambirajah / Bessie Elliot |

| Tel: +44 (0) 203 829 5000

Tel: +44 (0) 203 411 7773

Tel: +61 (0)2 9238 1268

Tel: +44 (0) 7983 521 488 arianaresources@yellowjerseypr.com |

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

About Ariana Resources plc:

Ariana is a mineral exploration, development and production company dual listed on AIM (AIM: AAU) and ASX (ASX: AA2), with an exceptional track record of creating value for its shareholders through its interests in active mining projects and investments in exploration companies. Its current interests include a major gold development project in Zimbabwe, gold-silver production in Türkiye and copper-gold-silver exploration and development projects in Kosovo and Cyprus.

For further information on the vested interests Ariana has, please visit the Company's website at www.arianaresources.com.

Zeus Capital Limited, Fortified Securities and Shaw and Partners Limited are the brokers to the Company and Beaumont Cornish Limited is the Company's Nominated Adviser.

Ends.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.