09 October 2025

Tertiary Minerals plc

("Tertiary" or the "Company")

Project Focus: Target A1 (silver-copper-zinc), Mushima North Project, Zambia

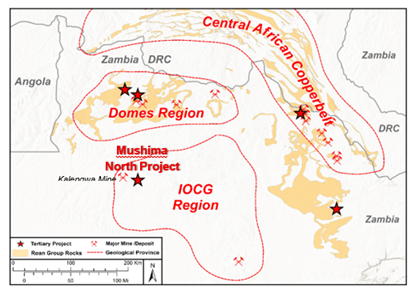

Tertiary Minerals plc (AIM: TYM) is pleased to provide the following summary of recent news highlighting the Target A1 prospect located within its Mushima North Project ("Mushima North" or the "Project"). Mushima North is located in the prospective Iron-Oxide-Copper-Gold region of Zambia. Target A1 is a polymetallic, silver-copper-zinc prospect located 28km to the east of the historic Kalengwa copper-silver mine which is currently under redevelopment.

Highlights:

Ø Near surface (from 2m) mineralisation identified up to a depth of 84m with a surface footprint of approximately 450m by 400m.

Ø Mineralisation remains open to the north/northwest, south/southwest and at depth.

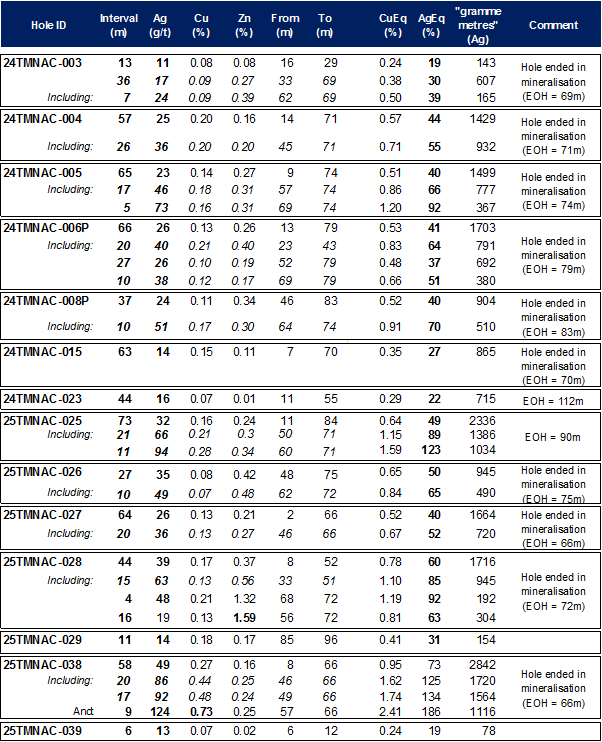

Ø Best intercepts to date include (downhole widths, not true widths):

· 58m at 49 g/t Ag, 0.26% Cu and 0.16% Zn (72 g/t Ag equivalent or 0.94% copper equivalent) from 8m downhole (hole 25TMNAC-038).

§ Including: 20m at 86 g/t Ag, 0.44% Cu and 0.24% Zn from 46m downhole.

§ And: 9m at 124 g/t Ag, 0.73% Cu and 0.25% Zn (185 g/t Ag equivalent or 2.40% copper equivalent) from 57m downhole. The hole ended in mineralisation.

· 73m at 32 g/t Ag, 0.16% Cu and 0.24% Zn (49 g/t Ag equivalent or 0.64% copper equivalent) from 11m downhole (hole 25TMNAC-025).

§ Including: 21m at 66 g/t Ag, 0.21% Cu and 0.30% Zn from 50m downhole.

Ø Elevated values of additional critical metals, including antinomy (up to 0.21%) and gallium (up to 40 g/t), as well as bismuth (up to 991 g/t).

Ø Multiple targets defined based on regional geochemical and geophysical targets still to be drill tested located within 12km of Target A1.

Ø Located only 28km east of the Kalengwa copper-silver mine (approx. 4Mt @ 5.2% Cu, 40 g/t Ag) and with a similar geological setting.

Ø Located in the Iron-Oxide-Copper-Gold ("IOCG") region of northwestern Zambia. Highly prospective for not only IOCG but also sedimentary copper and polymetallic occurrences.

Richard Belcher, Managing Director of Tertiary Minerals plc, commented:

"Target A1, our recent silver-copper-zinc discovery within the Mushima North Project, now has a surface footprint of approximately 450m by 400m and remains open to the north/northwest, south/southeast and at depth. The silver grades and widths intersected to date (supported by copper and zinc values) are comparable in terms of silver equivalent grades to several polymetallic, open pit silver deposits currently being explored and mined elsewhere in the world and for which Mineral Resources estimates have been reported. We therefore believe this could represent a significant discovery for the company.

"We are now undertaking mineralogical studies to better understand the mineralisation style as a prelude to initial metallurgical testing. We hope to be able to fast-track the project along the valuation pipeline towards a maiden mineral resource estimation in the next 12 months."

Project Summary

The Mushima North Project (Licence 27068-HQ-LEL) is approximately 350km2 in size and located within northwest Zambia (Figure 1). It is held through Group company Copernicus Minerals Limited ("Copernicus"), which is 90% owned by Tertiary Minerals (Zambia) Limited (which in turn is 96% owned by Tertiary Minerals plc) and 10% by local partner, Mwashia Resources Limited.

The Project is under a technical cooperation agreement with First Quantum Minerals Limited ("FQM"), which allows Tertiary to benefit from FQM's historic exploration data in the area, as well as FQM's geological team's extensive experience and understanding of the area's geology. The agreement is non-binding to any further agreement and there are no commercial restrictions for Tertiary, nor does FQM have a right of first refusal over the project. Further details can be found in the news release of 15 September 2022.

Figure 1. Location map of Mushima North Project, located in the west of the Iron Oxide Copper Gold ("IOCG") Region.

Regional Geological Setting

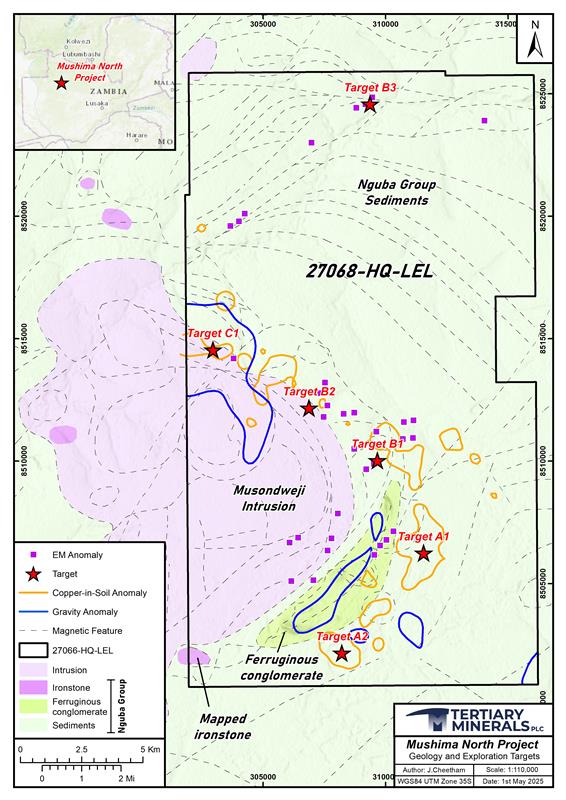

The licence is underlain by early Palaeozoic metasediments (sandstones, shales, carbonate rocks) most likely of the Nguba or Kundelungu Groups (Katanga Supergroup). These rocks were subject to regional metamorphism and deformation during the Lufilian Orogeny and intruded by the Musondweji granite, part of the wider Pan-African-aged, syn- to post-tectonic Hook Granite intrusive complex (Figure 2). Wide-spread ferruginous alteration (magnetite-heamatite) is present in the conglomerates and ironstones that outcrop around the granite margin, particularly in the south and southeast.

The project lies within a broad region considered prospective for IOCG-style of mineralisation. However, sedimentary-hosted copper occurrences and also polymetallic massive sulphide, carbonate-hosted/replacement occurrences have also been identified regionally. For example, the Project lies 20km to the east of the Kalengwa copper mine (historic, non-compliant resource of approximately 4Mt @ 5.2% Cu and 40-80 g/t Ag), one of the highest-grade copper deposits ever to be mined in Zambia. In the 1970s, high-grade ore, in excess of 26% copper, was trucked for direct smelting at other mines in the Copperbelt. The Kalengwa mine is currently under redevelopment by Moxico Resources plc and is expected to produce 15,000 tonnes of copper annually.

Figure 2. Geological Map of the Mushima North project showing the locations of the priority targets within the lincence.

Target A1

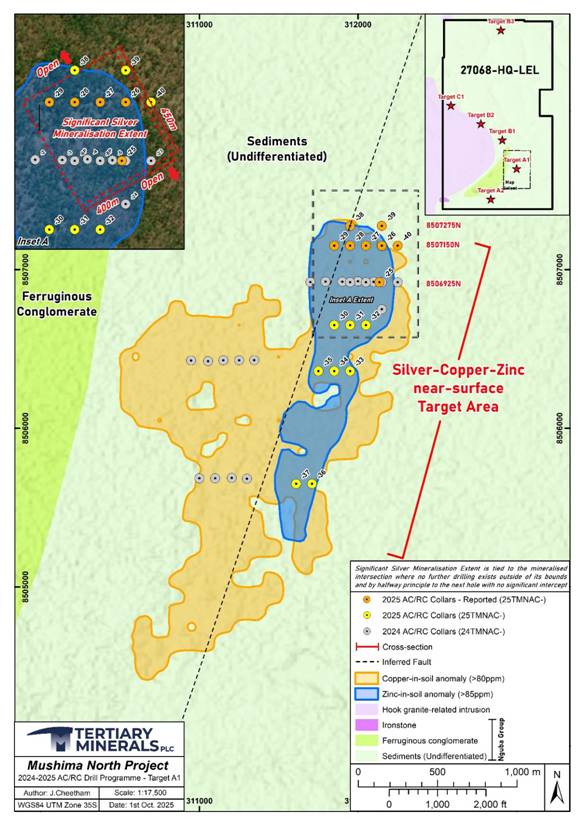

Target A1 is a large copper-in-soil anomaly (3.1km by 1.7km) with copper values up to 302ppm (per Portable X-Ray Fluorescence, "pXRF") associated with a 1.7km by 0.5km zinc- and coincidental 1.3km by 0.3km silver-in-soil anomaly.

Phase 1 drilling (1,486m) in 2024 targeted the copper-in-soil anomaly and returned broad but generally low-grade copper mineralisation as reported in the news release dated 28 October 2024 (e.g. 57m at 0.20% Cu from 14m downhole, hole 24TMNAC-004). Higher grade copper mineralisation was also intersected within these broader zones (e.g. 6m at 0.58% Cu within 35m at 0.21% Cu, from 22m downhole, hole 24TMNAC-024). Drilling over the silver- and zinc-in-soil anomaly (drill line: 8506925N) to the east identified wide and thick, near surface silver mineralisation associated with low-grade copper and/or zinc mineralisation.

The Phase 2 drill programme (1,116m) targeted the silver and zinc-in soil anomaly. The silver mineralisation has now been confirmed to extend approximately 450m northwest-southeast and by 400m northeast-southwest and to a depth from near surface to 84m and remains open both to the north/northwest, south/southeast and at depth.

The mineralisation at Target A1 is associated with a massive, haematitic and carbonaceous silty-sandy conglomerate. Where visible, copper mineralisation is in the form of the secondary copper minerals malachite and chrysocolla. The mineralogical speciation of silver and zinc is yet to be determined. Elevated bismuth (up to 991 g/t), antimony (up to 0.21%) and gallium (up to 40 g/t) are also associated with the mineralisation in places.

Figure 3. Location map of Target A1 showing soil sample results for copper and zinc and the collar locations for the 2024 and 2025 drill programmes.

Drilling results (previously reported) from the Phase 1 and 2 drilling programmes are presented in Table 1 below.

Table 1. Selected silver intersections from Phase 1 and 2 drilling from Target A1. Equivalent grades ("Eq") are for illustrative purposes only. See Table 1 for notes.

Note to Table 1:

· Reported intersections (downhole, true widths unknown) are based on a cut-off grade of 10 g/t Ag. Intervals start and end with ≥10 g/t Ag and up to 3m consecutive internal dilution has been allowed. All grades are averages weighted by sample length.

· Silver values are rounded to whole numbers.

· EOH means End of Hole.

· CuEq (%) and AgEq (g/t) are the copper and silver equivalent grades, respectively, and were calculated assuming commodity prices of Cu: US$4.5 lb, Ag: US$40 oz, Zn: US$1.2 lb and 100% recovery. No information on beneficiation recoveries is available at this stage. The metal equivalent values are for illustrative purposes only.

· Gramme metres for silver are the silver values (g/t) multiplied by the intervals (m).

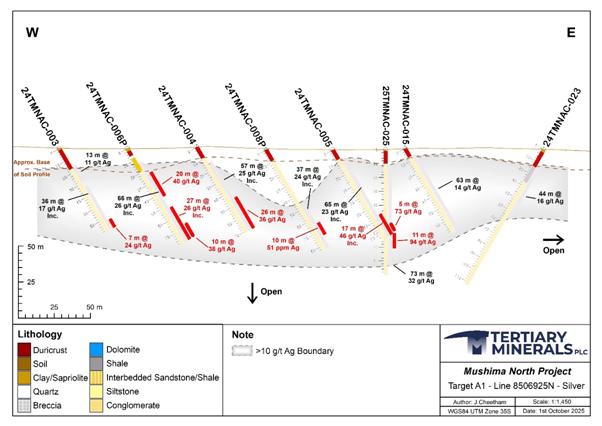

Figure 4. Drill cross-section for 8506925N (location on Figure 3) showing analytical results for silver and selected copper values. See Table 1 notes for further information.

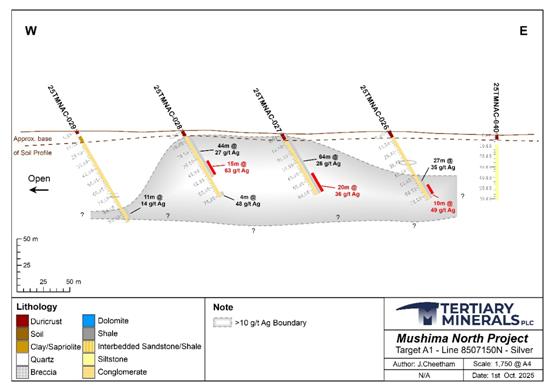

Figure 5. Drill cross-section for 8507150N (location on Figure 3) showing analytical results for silver and selected copper values. See Table 1 notes for further information.

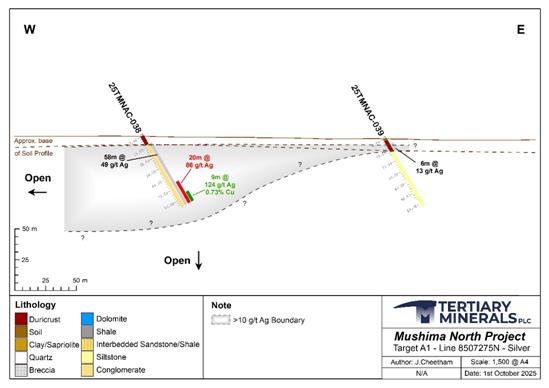

Figure 6. Drill cross-section for 8507275N (locations on Figure 3) showing analytical results for silver and selected copper values. See Table 1 notes for further information.

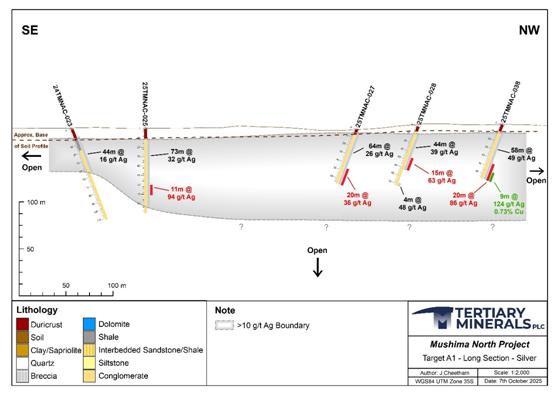

Figure 7. Drill long section (northwest-southeast orientation, location on Figure 3) showing analytical results for silver and selected copper values. See Table 1 notes for further information.

Copper-Silver Deposits of the Central African Copperbelt

Polymetallic copper deposits and occurrences are not uncommon within the Central African Copperbelt. The IOCG region in particular is host to many historic copper (and other metal) deposits and in fact was where copper was first identified and subsequently commercially extracted in Zambia (e.g. Sable Antelope Mine and surrounding deposits). These occurrences are often copper-gold, but other metals are present. For example, the Kalengwa Mine, as discussed above, and situated near to the Project was a copper-silver deposit.

Copper-silver occurrences are also seen further afield, for example in the Foreland region of the Copperbelt, in the Democratic Republic of Congo (e.g. Dikulushi copper-silver Mine). The commonality amongst these occurrences is the geological setting, as these occurrences all occur within rocks higher up in the stratigraphic sequence (the overlying Nuguba and Kundulungu Groups) than the Roan Group rocks which are synonymous with the Copperbelt and Domes Region copper deposits.

Silver Deposit Comparisons

Primarily lower grade open-cast silver deposits are well known in Mexico and Australia, where grades range in the 20-120 g/t silver range, often supported by other metals.

For example:

· The Texas Project, Queensland, Australia (Silver Star Resources) which consists of the Twin Hills Silver Mine and several satellite pits for a combined resource of 11.26 Mt @ 45 g/t Ag. Low grades of copper, zinc, lead and gold are also associated with the silver mineralisation (silver equivalent grade of 54 g/t AuEq).

· Dolores Silver Mine, Chihuahua, Mexico (Pan American Silver) which contains 17 Mt @ 20 g/t Ag and 0.57 g/t Au. Current operating costs are approximately US$11-26 per tonne.

Next Steps (Exploration Plan)

The Company aims to fast-track Target A1 along the exploration evaluation pipeline. The company is currently undertaking initial mineralogical work to understand characterisation and styles of mineralisation as a prelude to metallurgical studies. Historically, gold is associated with other deposits and occurrences with the region, and as such gold analysis is also being undertaken on selected mineralised intersections to ascertain whether gold mineralisation is associated with any of the mineralisation styles interested so far. The company is also in discussions with external, independent consultants to determine whether or not there is currently enough drilling data to support the reporting of an Exploration Target (following the guidelines of The JORC Code) so as to provide an estimated range of in-situ tonnes and grade.

Next steps would include additional drilling with aims to test:

· Further lateral extensions of the known mineralisation, particularly around the high-grade silver and copper mineralisation in the north, and

· The continuity of mineralisation between wider-spaced drill lines, by obtaining additional mineralisation intercepts, and extensions at depth.

The objectives being to define a much larger mineralisation footprint and have enough data to support a maiden Mineral Resource Estimate, if future drilling results warrant such an approach.

Additional Prospect Summary:

Several prospective targets have so far been defined within the Project based on reviews of historic geochemical and geophysical survey data against the current exploration model developed by Tertiary. Many of these are located within 12km of Target A1. These include:

Target A2:

This target is located along the southeastern margin of the intrusion within metasediments and is spatially associated with a regional NE-SW structure. Iron alteration is prevalent within the area seen as magnetite-hematite enrichment of the host rocks. The target is associated with an approximately 1km by 1km copper-in-soil anomaly and is situated 6km to the SW of Target A1. Located between Target A1 and A2 are a series of electromagnetic conductor anomalies identified from the airborne survey which are spatially associated with the regional structure directly to the west of the targets

Targets B1, B2, B3:

The B1 and B2 targets are similar to the A1 and A2 targets being located along the eastern margin of the intrusion and are defined by a series of copper-in-soil and electromagnetic anomalies. These targets are approximately 4km and 7km northwest of Target A1, respectively. The B3 target is associated with a regional E-W fault and an electromagnetic anomaly towards the north of the Project.

No further exploration has been undertaken on these targets so far.

C1 Target:

The C1 target is located along the northeast margin of the intrusion, approximately 12km to the northwest of Target A1. It is associated with a large copper-in-soil anomaly which extends over an area of some 4km by 1.25km. A borehole was drilled in the 1960s (RKN800) targeting part of the copper-in-soil soil anomaly. Stringer sulphide mineralisation (pyrite, chalcopyrite) hosted in metamorphosed shales was observed in the core and resampling and assaying of the core by Tertiary returned:

· 33m grading 0.24% copper from 122m-155m downhole. The hole also ended in mineralisation (0.19% copper from 154-155m).

This soil anomaly is associated with a large gravity anomaly that was identified by BHP Billiton as a potential IOCG target in the 2010s. Limited shallow drilling by Tertiary (7 holes, maximum hole length was 50m) confirmed the copper-in-soil anomaly but was too shallow to test the gravity anomaly or the mineralisation intersection in the historic hole located off the gravity anomaly. Drill results include (down hole, not true widths):

· 3m @ 0.11% Cu from 29m (24TMNAC-016).

· 3m @ 0.12% Cu from 28m (24TMNAC-017).

· 2m @ 0.10% Cu from 28m (24TMNAC-018).

This remains a prospective IOCG target with the historic drilling intersecting the upper boundary of the gravity anomaly (interpreted to be from approximately 150m below surface to a depth exceeding 1.5km).

Further Information:

| Tertiary Minerals plc: | |

| Richard Belcher, Managing Director | +44 (0) 1625 838 679 |

| SP Angel Corporate Finance LLP Nominated Adviser and Broker | |

| Richard Morrison/Jen Clarke | +44 (0) 203 470 0470 |

| Peterhouse Capital Limited Joint Broker | |

| Lucy Williams/Duncan Vasey | +44 (0) 207 469 0930 |

Cautionary Note Regarding Forward-Looking Statements

The news release may contain certain statements and expressions of belief, expectation or opinion which are forward looking statements, and which relate, inter alia, to the Company's proposed strategy, plans and objectives or to the expectations or intentions of the Company's directors. Such forward-looking statements involve known and unknown risks, uncertainties, and other important factors beyond the control of the Company that could cause the actual performance or achievements of the Company to be materially different from such forward-looking statements. Accordingly, you should not rely on any forward-looking statements and, save as required by the AIM Rules for Companies or by law, the Company does not accept any obligation to disseminate any updates or revisions to such forward-looking statements.

Competent Persons Statement

The technical information in this release has been compiled and reviewed by Dr. Richard Belcher (CGeol, EurGeol) who is a qualified person for the purposes of the AIM Note for Mining and Oil & Gas Companies. Dr. Belcher is a chartered fellow of the Geological Society of London and holds the European Geologist title with the European Federation of Geologists.

About Tertiary Minerals plc

Tertiary Minerals plc (AIM: TYM) is an AIM-traded mineral exploration and development company whose strategic focus is on energy transition metals. The Company's projects are all located in stable and democratic, geologically prospective, mining-friendly jurisdictions. Tertiary's current principal activities are the discovery and development of copper and precious metal mineral resources in Nevada and in Zambia.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.