This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

20 October 2025

KEFI Gold and Copper plc

("KEFI" or the "Company")

US$240 Million Debt Offering Signed

KEFI (AIM: KEFI), a gold and copper exploration and development company focused on the Arabian-Nubian Shield with a pipeline of projects in the Federal Democratic Republic of Ethiopia, and the Kingdom of Saudi Arabia, is pleased to provide an update on the continuing progress of the Company's high-grade/high-recovery Tulu Kapi Gold Project (the "Project" or "TKGM").

Highlights

· US$240 million Project debt capital has been formally offered and accepted, having been signed by both co-lenders and by KEFI on behalf of its group of companies.

· Various construction projects are underway funded by working capital and facilities, all as part of the current launch of the full US$340 million development project.

· Focus is now on closing the equity-risk capital, for which commitments and proposals received for investment at the Project level exceed the required US$100 million, primarily from local investors and African specialist funds.

· The project has been designed to take into account both local and international ESG (environmental, social, and governance) standards and alignment with local stakeholders, including the community, government, and private sectors. The project is seen as a showcase for international project finance in Ethiopia, contributing to the country's growing gold sector.

Project Update

· Debt capital signed: The co-lenders and KEFI have signed the US$240 million debt offering.

· Site preparations progress on schedule with various construction projects advancing:

o Housing contractor for resettling households has been mobilised to construct the replacement housing selected for the local community.

o The Ethiopian Roads Authority is installing new all-weather site access roads which will more than halve travel time from the highway.

o The Ethiopian Electric Power Company is connecting the site to the mains grid generation facilities at the Grand Ethiopian Renaissance Dam ("GERD"), the largest hydro-electric scheme in Africa. Tulu Kapi is the closest industrial-scale electricity consumer of the GERD - excellent for reliability of low-cost "green energy".

o The process plant contractor has been at site planning his security and logistics for delivery of plant components the procurement of which has started. The plant is designed to highest international standards, and its footprint is laid out to accommodate expansion for production uplift from the planned underground mine after the open pit has settled down.

o Mining contractors have been at site planning the mining operations in 2027 and the bulk earthworks (for airstrip and other initial works) to commence in early 2026 after the Government resettles relevant households.

· Pending project finance drawdown, funding is from working capital and as-yet unused facilities.

· Equity-risk project capital US$100 million:

o A significant portion has already been secured, with US$20 million from the Government of Ethiopia, US$10 million already invested by KEFI and c.US$10 million of KEFI share participation post-closing in respect of certain closing fees and costs.

o KEFI has received conditional proposals that exceed the remaining amount of $60 million, through a combination of:

§ non-convertible preference shares for Ethiopian investors ("KEFI Ethio Prefs") issued by newly incorporated Ethiopian holding company KME Minerals Ethiopia Holdings Limited ("KME Ethiopia"),

§ a subordinated equity risk note structured as a "Gold Prepayment" or "Stream" from a mining specialist fund, and

§ the issue of ordinary shares in either of the Ethiopian subsidiaries, priced on the basis of a TKGM valuation reflecting its advanced status as a funded project in construction.

o The breakdown and details of the finalised equity-risk capital instruments will be published by KEFI upon commitment and the signing of definitive documentation in November 2025.

· The Company will convene general meetings of KEFI, KME and TKGM in November 2025 to approve elements of the Tulu Kapi project finance package requiring shareholder approval, such as the debt package requiring approval under the various Articles of Association.

· The detailed documentation for equity, debt and insurance facilities can now be finalised with the syndicate of investors, banks, security agents and insurers in various countries. Standard "conditions precedent" apply to drawdown, including that equity be drawn first. Thereafter standard covenants and "conditions subsequent" apply, including change of control provisions to protect providers of both debt and equity project finance.

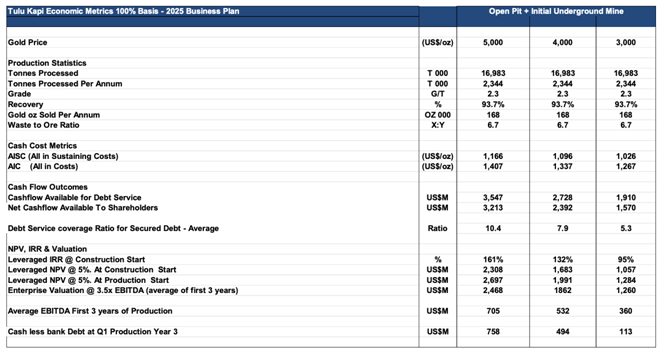

· The economic metrics of Tulu Kapi have benefited from the recent increase in the gold price. These are summarised at the foot of this announcement. Key metrics indicate the following, at gold prices ranging from US$3,000 (compared with the current Standard&Poors' average consensus price long-term forecast of US$3,000/oz, published 14 October 2025) to US$5,000/oz (equal to the current Bank of America forecast for 2026 (published 14 October 2025). These estimates are derived from this gold price range of $3,000/oz to $5,000/oz over the first seven to eight years from the existing open pit reserves and the initial contribution from the underground resource and are tabulated with more detailed explanation at the foot of this announcement:

o All-In-Sustaining Costs (after deducting royalties, taxes and sustaining capital) at c. US$1,000-1,200/oz (the royalty component rises as the gold price rises).

o Net Cash Flow available for servicing debt and equity capital at c. US$1.9-3.5 billion over 7 years of initial production from within today's open pit Ore Reserves and Underground Minerals Resources.

o Industry-standard valuation indicators for 100% of Tulu Kapi building up to US$1.1-2.7 billion on successful start-up. This implies a KEFI beneficial interest of US$740-2,292 million if we retain a beneficial interest for KEFI within the range of 70-85%, which will be determined by negotiations currently underway to optimize the structuring of the equity risk capital.

o IRR 95-161%

o These metrics:

§ will be updated once the equity-capital financings are finalised.

§ indicate more than enough scope to implement the Board's objectives for this large potential cash flow, which are:

· quickly repaying debt,

· distributing dividends, and

· supporting organic growth by taking advantage of our early mover position in the Arabian Nubian Shield.

§ do not include any contribution from:

· increasing Mineral Resource/Ore Reserve at the Tulu Kapi mining licence area, especially at depth, where the last drill-intercept was 90 metres at 2.8 g/t

· KEFI's 15%-owned and separately managed Saudi Arabian associate Gold and Minerals Company ("GMCO"), which has already reported an aggregate JORC Resource-base approximately double that of Tulu Kapi (in gold-equivalent terms) and has secured licences to more than double the strike length of the mineralised structures which host the current Resources.

· A separate update will be provided to shareholders as regards KEFI's pipeline of other projects and opportunities, including the following:

o In Saudi Arabia, where GMCO is now expected to:

§ Complete its DFS on Jibal Qutman Gold around the end of this year, targeting development of an open-pit and CIL-base gold production.

§ Establish an oxide gold Mineral Resource at the large Hawiah Copper-Gold VMS Project next year.

§ Advance both projects through a staged growth strategy, optimising development finance among the partners. KEFI and its partner each has the rights to participate in each project or allow the partner to either sole-risk or to dilute their GMCO shareholding.

§ Expand the Saudi exploration pipeline through the recent GMCO-Hancock Joint Venture with Australia's Hancock Prospecting.

o In Ethiopia, where KEFI's new holding company KME is expected to:

§ Enhance its portfolio of gold and critical material licences and applications, which will be assessed during construction at Tulu Kapi.

§ We will also pursue legal action for certain exploration licences originally held by the Company which we believe were improperly interfered with by third parties. This action will take some years. The outcome is unreliable but, either way, is not considered material to the Company's progress in the next ten years.

KEFI Executive Chairman, Harry Anagnostaras-Adams, commented: "We are delighted that the Tulu Kapi debt offering has now been signed by all the relevant parties.

"This has triggered further activity at site as part of the launch of full Project development this month and is allowing the remaining equity proposals to be finalised amongst the assembled local and specialist investors.

"I extend my sincere thanks to everyone involved in this international syndicate, spanning hundreds of people across public and private organisations at Tulu Kapi, in nearby regional centres, in Addis Ababa, and across multiple locations worldwide.

"With the gold price at a record high, this is the perfect time to be launching Tulu Kapi."

Enquiries

| KEFI Gold and Copper plc | |

| Harry Anagnostaras-Adams (Executive Chairman) | +357 2225 6161 |

| John Leach (Finance Director) | |

| SP Angel Corporate Finance LLP (Nominated Adviser) | +44 (0) 20 3470 0470 |

| Jeff Keating, Adam Cowl | |

| Tavira Financial Limited (Lead Broker) | +44 (0) 20 7100 5100 |

| Oliver Stansfield, Jonathan Evans | |

| IFC Advisory Ltd (Financial PR and IR) | +44 (0) 20 3934 6630 |

| Tim Metcalfe, Florence Staton | |

| 3PPB LLC (North American Institutional IR) | |

| Patrick Chidley | +1 (917) 991 7701 |

| Paul Durham | +1-203-940-2538 |

Further information can be viewed at https://www.kefi-goldandcopper.com

Updated Economic Metrics for Tulu Kapi Gold Project- 100% Basis

The updated metrics on a 100%-of-project basis indicate immaterial change since last modelled in January 2025 and uploaded into the KEFI website

(see https://www.kefi-goldandcopper.com/projects/ethiopia/tulu-kapi).

The equity-capital arrangements about to be implemented are expected to reduce KEFI shareholders' beneficial interest in the Project to the range of 70-85%

Board and Management Team

The organisation structure has been prepared for development, with KEFI Leadership providing oversight of project management and corporate development, and TKGM providing project management.

KEFI Leadership

· Board of Directors: KEFI's board is led by Executive Chairman Harry Anagnostaras-Adams and Finance Director John Leach, both of whom have extensive experience in launching, restructuring and operating natural resource-based companies. The board also includes three independent non-executive directors with deep industry and Ethiopian knowledge: Richard Robinson (mining operations), Alastair Clark (environmental and sustainability), and Addis Alemayehou (Ethiopian business and investment).

· Executive Committee: This committee, which includes Mr Anagnostaras-Adams and Mr Leach, is responsible for operational policy, organisational development and oversight of day-to-day operations and features specialists in key areas: Chief Operating Officer Eddy Solbrandt (systems and organisational optimisation), Rob Williams and Simon Cleghorn (technical due diligence), Norman Green (construction), and Geoff Davidson (mining engineering).

Tulu Kapi project-level governance

The governance and leadership structure for Tulu Kapi is composed of a diverse team drawn from KEFI and its project-level subsidiaries, with significant participation from Ethiopian stakeholders.

· KME Ethiopia Holdings: This entity, which has recently been incorporated to own the Group's shareholding in TKGM, will in due course seek listing on the Ethiopian Stock Exchange (ESX), will have a board where KEFI holds the majority, but which also includes non-executive directors nominated by local investors.

· TKGM: The board of this main operating company is also majority-appointed by KEFI, including its Executive Chair, COO, and an operations-focused non-executive director. Crucially, the Ethiopian government appoints non-executive directors representing its Federal Sovereign Fund, Ministry of Finance, and the Oromia Sovereign Fund, ensuring direct government oversight.

Tulu Kapi operational team and specialist advisory support

The on-the-ground TKGM operational team is led by Managing Director Simon Cleghorn and features a mix of international and local expertise, with key roles including Head of Finance Theron Brand and Head of Government Relations Abera Mamo. The project also relies on a wide array of specialist advisers for various technical, financial, and social aspects, including Snowdens (mineral resources), Lycopodium (processing), and Constellis (security).

GMCO

KEFI and its majority partner ARTAR (Al Rashid & Sons LLC) have, over the past 17 years, developed a stand-alone management structure for GMCO in which both shareholders are represented at the Board level (via the Executive Chairmen of each).

Both shareholders also provide additional support in respective areas of expertise.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.