Alba Mineral Resources Plc / EPIC: ALBA / Market: AIM / Sector: Mining

28 October 2025

Alba Mineral Resources Plc

("Alba" or the "Company")

Motzfeldt Acquisition Completion

Share Placing to raise £500k

Alba Mineral Resources plc (AIM: ALBA), the gold and critical raw materials focused exploration and development company, is pleased to announce that it has completed the first stage of its acquisition of a majority stake in the Motzfeldt Critical Metals Project, a large and highly prospective niobium-tantalum-zirconium-rare earth element (Nb-Ta-Zr-REE) project located in southern Greenland ("Motzfeldt" or the "Project"). The Company also provides an update across its project portfolio, and confirms that it has raised £500,000 (before costs) in a share placing.

Highlights

· The transaction terms for Motzfeldt announced on 14 July 2025 have been modified by agreement to provide for a more even split between the phasing of Alba's acquisition of a 51% interest in the Project, consequently reducing both Alba's initial sole funding commitment and its initial obligation to reimburse the Project owner for its 2025 field programme costs. Total consideration and ultimate interest in the Project remain unchanged.

· Alba has completed the acquisition of an initial 25.5% interest in the Motzfeldt Critical Metals Project in southern Greenland, enriched in Niobium (Nb), Tantalum (Ta), Zirconium (Zr), and Rare Earth Elements ("REEs").

· Review of 2025 drone photogrammetric survey at Motzfeldt reveals potential for greater zones of high-grade mineralisation at Merino Prospect at depth.

· Pre-blasting works at Clogau Gold Mine progressing.

· Drilling at Finnsbo copper-gold-rare earths project scheduled to start w/c 4 November 2025.

· The Company has also raised £500k (before costs) in a share placing.

Company Comment

The Chairman, George Frangeskides, commented:

"We are pleased to have completed the first phase of the acquisition of a majority stake in the Motzfeldt Project, the only one of Greenland's three large-scale rare earth projects which is not already in the ownership of a publicly listed company. Work is progressing well at Motzfeldt, with the present focus being on the review of the airborne photogrammetric survey which is providing remarkable detail of both the Aries deposit and the Merino prospect, which will be invaluable as we continue to develop our understanding of those sites.

"Work is also advancing in respect of the activities we need to complete at Clogau before we can blast, however these additional mandated works have materially extended both our timelines and our budget for the project, resulting in the Board's decision to raise further funds at this time.

"With that behind us now, we enter into a period of great promise and anticipation for Alba, as we build up to both the blasting of our main gold target at Clogau and the drilling of our high-grade Finnsbo copper-gold-rare earths prospect in Sweden in the coming days."

Acquisition Terms and Related Party Transaction

Certain changes have been negotiated to the terms of the transaction announced on 14 July 2025. While the total consideration for the acquisition by Alba of a 51% interest in the Project has not changed, the phasing of the acquisition has been modified, as follows:

- First Completion: the acquisition by Alba of an initial 25.5% interest in the Project, for £30,000 in cash and £426,930 in Alba shares at a deemed issue price of £0.0002414 (0.02414p) per share (unchanged from the announcement of 14 July 2025), a premium of approximately 20% above the last closing price of Alba shares of 0.020p on 27 October 2025 for a total of 1,768,560,480 Alba consideration shares. This acquisition has now been completed.

- Second Completion: the acquisition by Alba of a further 25.5% interest in the Project for £518,070 in Alba shares at the same deemed issue price of £0.0002414 (0.02414p) per share (unchanged from the announcement of 14 July 2025). Upon completion of the second stage of the transaction, a total of 2,146,103,977 consideration shares will be issued and Alba will move to a majority 51% interest in the Project.

In particular:

- Instead of Alba acquiring 49% of the Project at First Completion and another 2% at Second Completion, it has now acquired 25.5% at First Completion and will be acquiring a further 25.5% at Second Completion, thus ensuring a more even split in the consideration paid by Alba across the two phases of the transaction.

- Similarly, the repayment of loans and accrued fees will now be split more evenly between the two phases of the transaction.

- Alba's previous commitment to sole fund the Project up to an amount of £350k from First Completion will now be split so that the sole funding commitment from First Completion is reduced to £100k, with another £250k sole funding commitment only applying as from Second Completion, once Alba has moved to majority ownership of the Project.

- Instead of Alba having to reimburse 100% of the Motzfeldt 2025 field programme costs on First Completion, only 35% of those costs will have to be reimbursed at First Completion, with the balance of 65% being reimbursed on Second Completion, once Alba has moved to majority ownership.

The result of these changes is to substantially reduce both Alba's cash and share commitments at and following First Completion.

As previously stated, part of the consideration for the acquisition will be applied in the repayment of shareholder and third-party loans and accrued invoices through which the current operator and 100% owner of the Project, Elemental Rare Metals Ltd ("ERM") has funded the development of the Project in the past several years, amounting to approximately £375K in total across the two phases of the acquisition, with the balance of the consideration, approximately £600k in total, to be paid for the 51% controlling interest in the Project and distributed to ERM shareholders pro rata.

The completion of the second stage of the transaction will be subject to (1) Greenland Government approval to Alba acquiring a majority stake in the Project and (2) approval at a general meeting of Alba's acquisition of the second stake of 25.5% at Second Completion from an entity associated with Alba Chairman George Frangeskides. That entity did not participate in the sale of the initial stake of 25.5% to Alba which has completed.

Other terms announced on 14 July have not changed. As such:

- A joint venture will be established between Alba and ERM's existing shareholders.

- Once it has reached 51% ownership, Alba will have a right of first refusal over the remaining 49% interest, and the 49% owners will have a tag-along right in the event of a proposed sale by Alba of its 51% stake.

- Alba shares issued in the transaction will be subject to a total of 12 months of restrictions on sale, namely:

o an initial three-month lock-in from completion for 100% of the Alba consideration shares;

o a further three months during which 50% of the shares will be locked-in and 50% subject to orderly marketing provisions; and

o a further six-month orderly market period for 100% of the remaining shares.

In addition, the recipients of Alba consideration shares at First Completion have given certain undertakings to the Company, including irrevocable undertakings to vote in favour of the second stage of the acquisition at a forthcoming general meeting of the Company.

As previously reported, Alba Chairman George Frangeskides is a founder, significant shareholder and funder of ERM and therefore stands to receive part of the consideration from the transaction at Second Completion (see Table 1). Alba CFO Sarah Potter has, independently of her role with Alba, provided accounting services to ERM which will be paid from the transaction consideration as part of the settlement of accrued invoices referred to above at Second Completion, as set out in the table below. The independent directors of the Company, Michael Nott and Elizabeth Henson, consider, having consulted with SPARK Advisory Partners Ltd, the Company's nominated adviser, and having obtained independent valuation advice, that the terms of the revised transaction are fair and reasonable insofar as the Company's shareholders are concerned.

Interest of Related Parties in ERM/Project

| Related Party | Provision of Loans/Services to ERM | ERM/Project Interest | Total Consideration Shares | Percentage shareholding in Alba post Completion (includes pre-existing holdings) |

| George Frangeskides (and associated entities) | £153k | 50.1% | 1,814,703,811 | 10.58% |

| Sarah Potter | £15k | N/A | 62,137,531 | 0.34% |

NB: Immediately following the consummation of the transaction in full, no loan amounts or accrued invoices will be owing by ERM to George Frangeskides or his associated entities or to Sarah Potter, and George Frangeskides and his associated entities will have a 24.6% interest in the Project.

Admission of Alba Consideration Shares

Application will be made for the 1,768,560,480 Alba consideration shares to be issued on First Completion to be admitted to trading on AIM ("Admission"). It is expected that Admission of the new ordinary shares will become effective at 8.00 a.m. on or around 11 November 2025. The new ordinary shares will be issued credited as fully paid and will rank in full for all dividends and other distributions declared, made or paid after Admission and will otherwise rank on Admission pari passu in all respects with the existing ordinary shares.

Motzfeldt Technical Update

Work is progressing well at Motzfeldt, with the present focus being on the review of the airborne photogrammetric survey which is providing remarkable detail of both the Aries deposit and the Merino prospect down to the metre scale. Additionally, high-resolution drone photographs of the natural cross-sections of Merino provided by glacial erosion are aiding in target identification at depth, most notably in tracing subhorizontal structures bearing rare earth and niobium minerals such as bastnäsite and columbite (see Figure 1). These highly detailed photographs will allow for year-round structural and geological analysis of Merino to prepare for future fieldwork.

This data will be invaluable as the Company continues to develop both the deposit model at Merino and its development plans for Aries.

The Company's 300kg mini-bulk sample from the Aries deposit is in transit to the Company's specialist processing engineering consultants in South Africa and expected to arrive with them imminently.

Figure 1: Section of Merino cliff-face. Star marks the location of surface sample related to black structure from historic report with elevated REE-Nb-Zr (0.6% TREO). Yellow lines mark the horizontal black structures hypothesised to consist of the same material as the surface structure at depth.

Clogau Gold Mine

The Company's technical team and specialist contractors have now completed several underground safety upgrades, including:

· A full inspection and design check of ground support systems;

· Installation of new safety platforms between working levels; and

· Construction of a new emergency exit route.

Further mandated works currently in progress or due to commence shortly include:

· Final repairs and safety upgrades to Shaft 1;

· Installing a second winch and testing the lifting system in Shaft 2; and

· Completing a detailed underground survey and linking it to the new ventilation plan.

The specialist drilling and blasting contractor has been appointed.

The Company's protected species licence (EPSL) has been renewed by Natural Resources Wales.

Once all remaining work activities have been completed and signed off, the next phase of controlled blasting will be scheduled to start, marking a significant step forward in Alba's ongoing development of the Clogau Gold Mine.

Swedish Projects

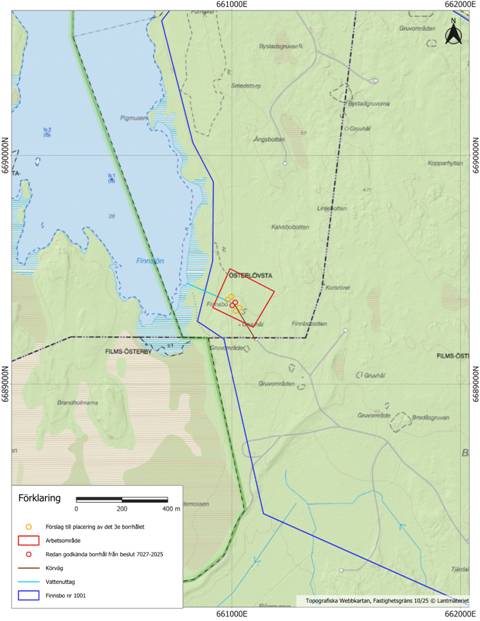

Drilling is scheduled to commence at the high-grade Finnsbo Project in the week commencing 4 November 2025 (Figure 2).

Figure 2: Location of planned drill holes at Finnsbo. First two holes marked in red, with optional third hole to be selected from the four holes marked in yellow.

The Company has decided not to take up its options over the Norrby and Glava licences in Sweden.

Share Placing

The Company is pleased to announce that it has raised £500k (before expenses) in a share placing involving the issue of 3,289,473,684 new ordinary shares at a price of 0.0152 pence per ordinary share (the "Issue Price") (the "Placing"), conditional on the admission of such new ordinary shares to trading on AIM. The placing price represents a discount of 20% to the last closing bid price of the Company's shares on 27 October 2025.

The proceeds from the Placing are intended to be used to continue the Company's activities across its projects, including:

- At Clogau, completing the blasting and bulk sampling programme at the Llechfraith Target, the primary gold development target at the Mine;

- Completing a drilling programme at Finnsbo;

- Completing the key Motzfeldt work streams in advance of next year's summer field programme;

- General working capital requirements.

Application will be made for the placing shares to be admitted to trading on AIM ("Admission"). It is expected that Admission of the new ordinary shares will become effective at 8.00 a.m. on or around 4 November 2025. The new ordinary shares will be issued credited as fully paid and will rank in full for all dividends and other distributions declared, made or paid after Admission and will otherwise rank on Admission pari passu in all respects with the existing ordinary shares.

Total Voting Rights

Following Admission of both the placing shares and the Alba consideration shares, the total number of ordinary shares in issue will be 19,835,050,231. The Company does not hold any ordinary shares in treasury. Therefore, the total number of ordinary shares with voting rights will be 19,835,050,231. This figure may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

This announcement contains inside information for the purposes of the UK Market Abuse Regulation and the Directors of the Company are responsible for the release of this announcement.

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market, financial and business conditions, competition for and availability of qualified staff and contractors, regulatory processes and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the timing and granting of regulatory and other third party consents and approvals, uncertainties regarding the Company's or any third party's ability to finance, execute and implement future plans and programmes, and the occurrence of unexpected events. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

**ENDS**

Engage with Alba by asking questions, watching video summaries and reading what other shareholders have to say. Navigate to our interactive Investor Hub here:

https://albamineralresources.com/link/yOOY0y

For further information, please visit the Alba Mineral Resources plc investor website (www.albamineralresources.com) and sign up to receive news and engage with the Alba management team. Subscribe to our news alert service (https://alba-l.investorhub.com/auth/signup) and visit @AlbaMinerals on X (formerly Twitter).

| Alba Mineral Resources plc George Frangeskides, Executive Chairman | +44 20 3950 0725

|

| SPARK Advisory Partners Limited (Nomad) Andrew Emmott | +44 20 3368 3555

|

| CMC Markets plc (Broker) Thomas Smith / Douglas Crippen | +44 20 3003 8632

|

| Alba's Projects & Investments

| ||

| Projects Operated by Alba | Location | Ownership |

| Clogau (gold) | Wales | 100% |

| Dolgellau Gold Exploration (gold) | Wales | 100% |

| Gwynfynydd (gold) | Wales | 100% |

| Investments Held by Alba | Location | Ownership |

| GreenRoc Strategic Materials Plc (graphite - anode) | Greenland | 25.78% |

| Elemental Rare Metals Limited (Motzfeldt Critical Metals Project) | Greenland | 25.5% |

| Horse Hill (oil) | England | 11.765% |

| Earn-in Projects | Location | Earn-in Rights |

| Finnsbo (rare earths, copper, gold) | Sweden | Up to 100% |

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.